Market Overview

The global land-based remote weapon stations market was valued at USD ~ billion based on a recent historical assessment, supported by consolidated defense procurement data published by internationally recognized defense intelligence sources. Market expansion has been driven by rising investments in force protection systems, modernization of armored and tactical ground vehicles, and increasing adoption of remotely operated combat solutions to reduce soldier exposure in hostile environments. Additional momentum has come from ongoing border security programs, urban warfare preparedness initiatives, and sustained military spending across major defense-spending nations.

Market dominance is concentrated in the United States, Saudi Arabia, Israel, South Korea, and several Western European countries due to their advanced defense manufacturing ecosystems and continuous land force modernization programs. Cities such as Riyadh, Tel Aviv, Washington D.C., Seoul, and Paris play a central role because they host defense ministries, system integrators, and key testing facilities. Strong domestic procurement pipelines, active export programs, and established military-industrial partnerships have reinforced leadership in these regions.

Market Segmentation

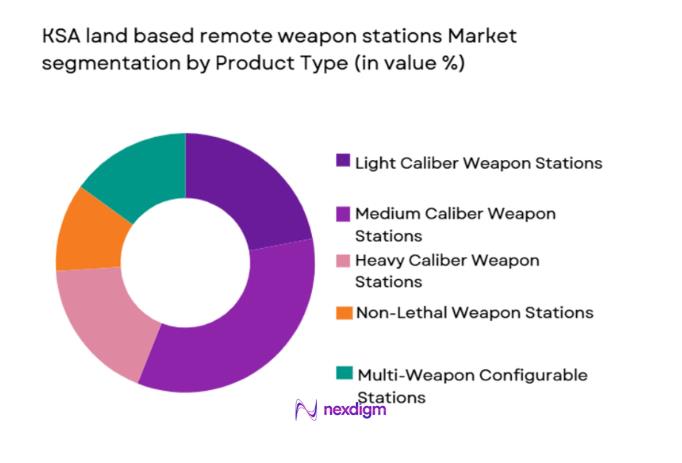

By Product Type

Land based remote weapon stations market is segmented by product type into light caliber weapon stations, medium caliber weapon stations, heavy caliber weapon stations, non-lethal weapon stations, and multi-weapon configurable stations. Recently, medium caliber weapon stations have held a dominant market share due to their balanced firepower, compatibility with armored vehicles, and suitability for both conventional and asymmetric warfare environments. These systems support automatic cannons and advanced targeting optics, making them preferred for border security, convoy protection, and urban combat operations. Their widespread integration into new-generation infantry fighting vehicles and armored personnel carriers has strengthened demand. In addition, medium caliber systems offer modularity for sensor upgrades, network-centric warfare compatibility, and improved stabilization, which aligns with evolving battlefield requirements. Procurement programs across the Middle East and Europe have further reinforced adoption due to their operational flexibility and proven reliability in diverse combat scenarios.

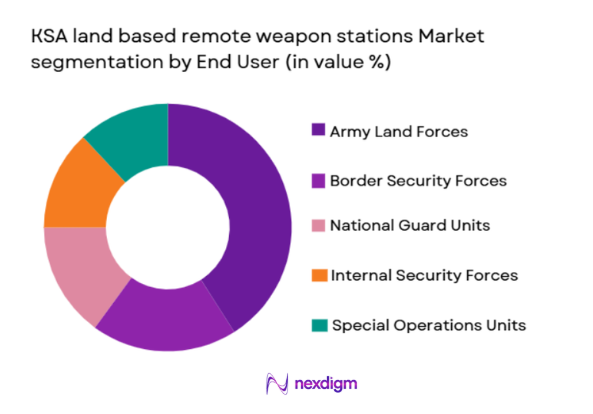

By End User

Land based remote weapon stations market is segmented by end user into army land forces, border security forces, national guard units, internal security forces, and special operations units. Recently, army land forces have accounted for the dominant market share due to large-scale vehicle modernization programs and continuous investments in armored mobility and survivability. Army procurement cycles typically involve high-volume contracts for combat vehicles equipped with integrated weapon stations, supporting sustained demand. These forces prioritize systems offering enhanced lethality, precision targeting, and integration with battlefield management systems. The increasing emphasis on mechanized infantry formations and expeditionary readiness has also driven adoption. Additionally, long-term replacement of manually operated turrets and increased focus on crew safety have positioned army land forces as the primary demand driver globally.

Competitive Landscape

The land-based remote weapon stations market is moderately consolidated, with a limited number of global defense contractors holding strong technological and contractual positions. Major players influence market direction through long-term government contracts, platform integration capabilities, and continuous investment in sensor fusion and automation technologies. Strategic partnerships, localized manufacturing agreements, and defense offset programs further strengthen competitive positioning.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Platform Integration Capability |

| Kongsberg Defence & Aerospace | 1814 | Norway | ~

|

~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Italy | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

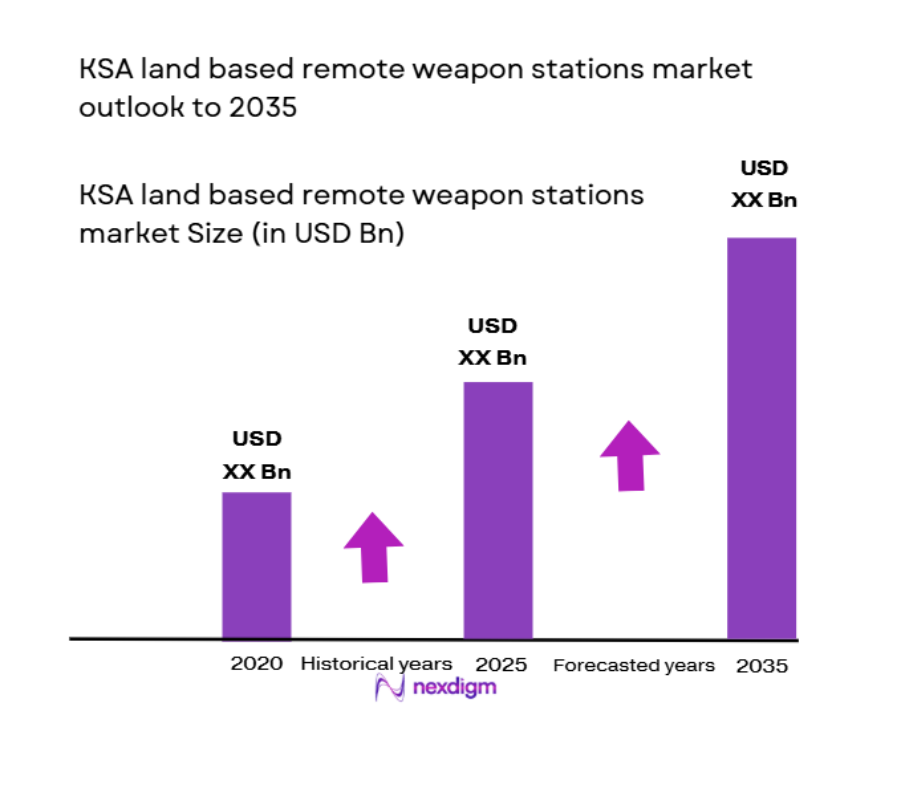

KSA Land Based Remote Weapon Stations Market Analysis

Growth Drivers

Modernization of Armored and Tactical Ground Vehicles:

Modernization of armored and tactical ground vehicles has become a central growth driver for the land-based remote weapon stations market as military forces replace legacy platforms with digitally enabled systems. Defense ministries are prioritizing survivability enhancements, which has accelerated the integration of remotely operated weapon stations into infantry fighting vehicles, armored personnel carriers, and tactical patrol vehicles. These systems allow crews to operate weapons from protected environments, significantly reducing exposure to direct fire and improvised explosive threats. Vehicle upgrade programs increasingly specify remote weapon stations as standard rather than optional equipment. Integration with advanced sensors, stabilized mounts, and fire control software has expanded operational effectiveness across diverse terrains. Global land forces are also focusing on interoperability, which favors standardized remote weapon platforms. As mechanized units expand and expeditionary operations increase, procurement volumes for integrated systems continue to rise. This sustained modernization cycle underpins long-term market growth.

Rising Emphasis on Force Protection and Crew Survivability:

Rising emphasis on force protection and crew survivability has strongly influenced procurement strategies within the land-based remote weapon stations market. Modern combat environments expose personnel to asymmetric threats, including ambushes and sniper attacks, increasing demand for protected engagement capabilities. Remote weapon stations enable soldiers to detect, track, and neutralize threats without direct physical exposure. Defense doctrines increasingly prioritize minimizing casualties while maintaining combat effectiveness. Advances in thermal imaging, laser rangefinding, and automated tracking further enhance survivability outcomes. Military planners also value reduced fatigue and improved accuracy enabled by stabilized systems. As casualty reduction becomes a strategic objective, investment in remote weapon technologies continues to accelerate. This focus ensures sustained demand across both conventional and internal security operations.

Market Challenges

High System Integration and Lifecycle Costs:

High system integration and lifecycle costs present a significant challenge for the land-based remote weapon stations market, particularly for budget-constrained defense forces. These systems require advanced sensors, stabilization units, software integration, and hardened electronics, increasing upfront acquisition costs. Integration with existing vehicle platforms often demands structural modifications and additional testing. Long-term maintenance, software updates, and spare parts further elevate total ownership costs. Smaller defense organizations may delay adoption due to budget prioritization toward manpower or mobility. Cost pressures are amplified when systems rely on imported components subject to currency and supply chain risks. Procurement delays and phased acquisition strategies can slow market expansion. Managing affordability while maintaining performance remains a persistent challenge.

Dependence on Advanced Electronics and Secure Supply Chains:

Dependence on advanced electronics and secure supply chains poses another challenge for the land-based remote weapon stations market. These systems rely on high-precision sensors, processors, and communication modules that are vulnerable to supply disruptions. Export controls and technology transfer restrictions can limit access to critical components. Geopolitical tensions may further complicate sourcing strategies for defense manufacturers. Cybersecurity requirements add complexity to system design and certification. Ensuring resilience against electronic warfare and cyber intrusion demands continuous upgrades. These factors increase development timelines and compliance costs. Supply chain vulnerability therefore constrains scalability and deployment speed.

Opportunities

Expansion of Indigenous Defense Manufacturing Programs:

Expansion of indigenous defense manufacturing programs presents a major opportunity for the land-based remote weapon stations market, particularly in emerging defense economies. Governments are encouraging local production to enhance self-reliance and reduce import dependence. Local assembly and licensed manufacturing arrangements increase procurement volumes and long-term support contracts. Domestic production also supports customization for specific operational requirements. Technology transfer agreements facilitate skill development and industrial capacity building. These initiatives create new revenue streams for original equipment manufacturers through partnerships. As localization policies strengthen, demand for adaptable remote weapon platforms will expand. This trend supports sustainable market growth.

Integration of Artificial Intelligence and Autonomous Targeting:

Integration of artificial intelligence and autonomous targeting technologies offers substantial growth opportunities within the land-based remote weapon stations market. AI-enabled systems improve target recognition, threat prioritization, and engagement accuracy. Automated tracking reduces operator workload and response time. Defense forces increasingly value decision-support capabilities embedded within weapon systems. AI integration also enhances interoperability with network-centric battlefield architectures. Continuous software upgrades extend system relevance and performance. These technological advancements attract new procurement interest. The shift toward intelligent weapon stations positions the market for long-term innovation-driven expansion.

Future Outlook

Over the next five years, the land-based remote weapon stations market is expected to experience sustained growth driven by ongoing vehicle modernization programs and rising demand for protected combat solutions. Technological advancements in sensors, automation, and AI integration will continue to enhance system capabilities. Supportive defense procurement policies and localization initiatives are likely to strengthen supply chains. Demand will remain strong across conventional military and internal security applications.

Major Players

- Kongsberg Defence & Aerospace

- Elbit Systems

- Rheinmetall AG

- Leonardo S.p.A.

- Thales Group

- BAE Systems

- Saab AB

- ASELSAN

- Hanwha Defense

- General Dynamics Land Systems

- Rafael Advanced Defense Systems

- FN Herstal

- Moog Inc.

- Electro Optic Systems

- IMI Systems

Key Target Audience

- Defense ministries

- Armed forces procurement agencies

- Border security organizations

- Internal security agencies

- Vehicle OEMs

- System integrators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Core demand drivers, procurement trends, technology adoption, and regulatory factors were identified through structured secondary research. Data points were cross-verified with defense publications.

Step 2: Market Analysis and Construction

Market structure and segmentation were developed using validated industry frameworks. Supply-side and demand-side factors were analyzed to construct the market model.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were reviewed against expert opinions and defense sector insights. Assumptions were refined to ensure consistency and accuracy.

Step 4: Research Synthesis and Final Output

All validated inputs were synthesized into a cohesive report. Data integrity checks were conducted before final presentation.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising border security requirements

Modernization of land combat platforms

Increased focus on force protection

Growth in asymmetric warfare threats

Localization and domestic defense manufacturing - Market Challenges

High system integration complexity

Dependence on imported subsystems

Cybersecurity risks in networked systems

Budget prioritization across defense programs

Maintenance and lifecycle cost pressures - Market Opportunities

Expansion of indigenous manufacturing capabilities

Integration of advanced AI and autonomy features

Upgrades of legacy vehicle fleets - Trends

Increased adoption of remotely operated weaponry

Shift toward modular and scalable systems

Integration with battlefield management systems

Emphasis on reduced crew exposure

Growth in sensor fusion capabilities - Government Regulations & Defense Policy

Defense localization and offset mandates

Import control and technology transfer regulations

National military modernization initiatives

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Light caliber remote weapon stations

Medium caliber remote weapon stations

Heavy caliber remote weapon stations

Non lethal remote weapon stations

Multi weapon configurable stations - By Platform Type (In Value%)

Armored ground vehicles

Unarmored tactical vehicles

Fixed border installations

Mobile patrol platforms

Critical infrastructure defense platforms - By Fitment Type (In Value%)

New vehicle integration

Retrofit on legacy vehicles

Fixed mount installations

Trailer mounted systems

Modular deployable systems - By EndUser Segment (In Value%)

Army land forces

National guard units

Border security forces

Internal security forces

Special operations units - By Procurement Channel (In Value%)

Direct government procurement

Defense offset agreements

Local manufacturing partnerships

Licensed foreign procurement

Upgrade and lifecycle contracts - By Material / Technology (in Value %)

Electro optical and infrared sensors

AI based target recognition

Stabilized fire control systems

Composite and lightweight materials

Network enabled weapon integration

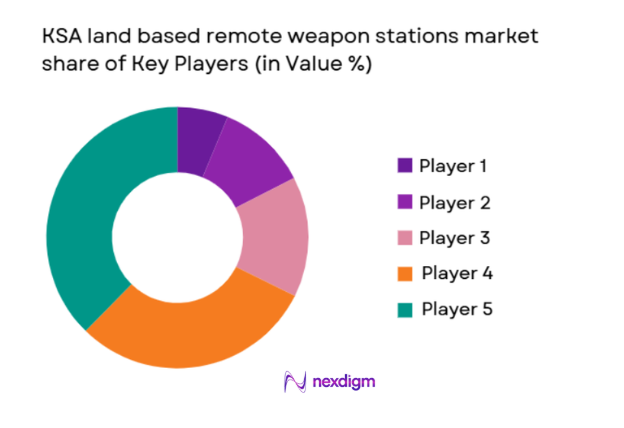

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (system lethality, stabilization accuracy, sensor range, integration compatibility, weight profile, mobility suitability, automation level, lifecycle support, local content compliance) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Saudi Arabian Military Industries

Advanced Electronics Company

MilDef Arabia

Rheinmetall Denel Munitions Saudi Arabia

BAE Systems Saudi Arabia

Lockheed Martin Saudi Arabia

Raytheon Saudi Arabia

Aselsan Middle East

Elbit Systems Arabia

Thales Saudi Arabia

Leonardo Saudi Arabia

General Dynamics Land Systems Arabia

Kongsberg Defence Saudi Programs

Hanwha Defense Middle East

EDGE Group Regional Operations

- Army focus on survivability and lethality enhancement

- Border forces emphasis on persistent surveillance and response

- Internal security demand for non lethal and flexible systems

- Special forces requirement for lightweight and rapid deployment solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035