Market Overview

Based on a recent historical assessment, the KSA land based smart weapons market reached an absolute value of USD ~ billion, supported by officially disclosed defense procurement allocations, signed land systems contracts, and delivery programs reported by the Saudi Ministry of Defense and corroborated by SIPRI-aligned expenditure disclosures. Demand is driven by large-scale ground force modernization, replacement of legacy unguided munitions, and integration of precision-guided, network-enabled land combat systems. Emphasis on accuracy, survivability, and interoperability across armored, artillery, and missile units continues to sustain procurement volumes.

Based on a recent historical assessment, Riyadh dominates the KSA land based smart weapons ecosystem due to centralized defense procurement, command headquarters presence, and proximity to national program management offices. Industrial activity in Al Kharj and Jubail supports assembly, testing, and sustainment of land weapon systems. International dominance is shaped by strategic partnerships with the United States, Western Europe, and selected Asian defense suppliers, driven by technology access, training alignment, and long-term sustainment agreements supporting complex smart weapon deployments.

Market Segmentation

By Product Type

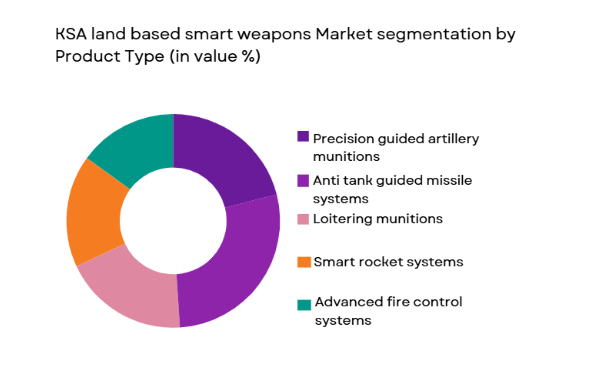

KSA land based smart weapons market is segmented by product type into precision guided artillery munitions, anti-tank guided missile systems, loitering munitions, smart rocket systems, and advanced fire control systems. Recently, anti tank guided missile systems have demonstrated a dominant market share due to sustained demand from armored brigades and border security formations. These systems are prioritized because of their proven effectiveness against modern armored threats and their compatibility with both legacy and upgraded platforms. Continuous procurement programs, coupled with training standardization and high readiness requirements, reinforce acquisition volumes. Integration with targeting sensors and battlefield networks further increases operational value. Long-term framework contracts and licensed local assembly also strengthen procurement continuity across multiple force commands.

By Platform Type

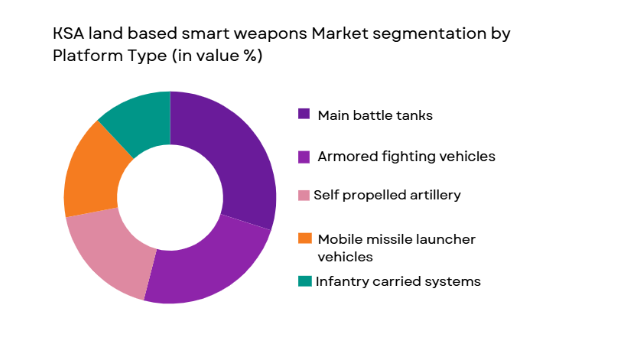

KSA land based smart weapons market is segmented by platform type into main battle tanks, armored fighting vehicles, self propelled artillery, mobile missile launcher vehicles, and infantry carried systems. Recently, main battle tanks have accounted for the dominant market share due to extensive fleet upgrade programs and high-value integration of smart weapon interfaces. These platforms serve as the backbone of heavy maneuver formations, driving sustained demand for advanced munitions and fire control upgrades. High survivability requirements and emphasis on combined arms operations further reinforce investment. Tank-centric modernization also benefits from standardized upgrade cycles and long operational lifespans, ensuring recurring procurement of compatible smart weapons.

Competitive Landscape

The KSA land based smart weapons market exhibits moderate consolidation, with procurement dominated by a limited number of global defense primes operating alongside Saudi national defense entities. Market influence is shaped by long-term government-to-government agreements, offset obligations, and localization mandates, while competition centers on technology transfer depth, integration capability, and lifecycle support strength.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Localization Capability |

| Saudi Arabian Military Industries | 2017 | Riyadh | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Düsseldorf | ~ | ~ | ~ | ~ | ~ |

KSA Land Based Smart Weapons Market Analysis

Growth Drivers

Ground Forces Modernization Under Vision 2030

Ground Forces Modernization Under Vision 2030 is a primary growth driver for the KSA land based smart weapons market as national defense priorities emphasize technological superiority and operational readiness. Large-scale recapitalization programs target replacement of legacy munitions with precision-guided alternatives. Smart weapons are increasingly integrated into armored, artillery, and missile units to enhance engagement accuracy. Doctrine evolution favors network-enabled firepower over massed fire. This shift directly increases demand for advanced guidance and targeting systems. Localization objectives further accelerate procurement cycles. Industrial partnerships enable sustained production. Training standardization reinforces system selection continuity. Together, these factors structurally expand market demand.

Rising Emphasis on Precision Strike and Force Protection

Rising Emphasis on Precision Strike and Force Protection drives adoption of land based smart weapons by prioritizing accuracy and survivability. Operational planning increasingly seeks to minimize collateral impact while maintaining decisive firepower. Smart weapons provide extended standoff capability, reducing exposure of ground forces. Integration with sensors enhances situational awareness. This operational benefit strengthens procurement justification. High-value asset protection reinforces investment. Interoperability with allied systems supports coalition readiness. Continuous technology refresh sustains replacement demand. These dynamics collectively reinforce long-term market growth.

Market Challenges

Dependence on Foreign Technology and Transfer Restrictions

Dependence on Foreign Technology and Transfer Restrictions presents a major challenge for the KSA land based smart weapons market due to reliance on imported guidance, propulsion, and sensor technologies. Export controls can delay deliveries and upgrades. Technology transfer limitations constrain local manufacturing depth. Compliance requirements increase procurement complexity. Customization timelines are extended. Cost escalation risks emerge from restricted supplier options. Workforce skill development is slowed by limited access. Program schedules face uncertainty. These constraints affect both cost efficiency and supply security.

High Lifecycle Costs and Sustainment Complexity

High Lifecycle Costs and Sustainment Complexity challenge procurement planning as smart weapons require continuous software updates, calibration, and specialized maintenance. Sustainment infrastructure investments are substantial. Training requirements elevate operational expenditure. Obsolescence risk shortens upgrade cycles. Inventory management becomes more complex. Budget prioritization may delay acquisitions. Long-term support agreements increase dependency. Cost visibility remains limited. These factors constrain procurement flexibility.

Opportunities

Expansion of Local Assembly and Co Production Programs

Expansion of Local Assembly and Co Production Programs represents a major opportunity as defense localization policies encourage in-country manufacturing. Joint ventures enable gradual technology absorption. Local assembly reduces delivery timelines. Sustainment capability improves operational availability. Workforce development strengthens industrial resilience. Export potential increases with localized production. Cost efficiencies improve over time. Policy incentives support investment. This opportunity enhances long-term market sustainability.

Adoption of AI Enabled Fire Control and Targeting Systems

Adoption of AI Enabled Fire Control and Targeting Systems offers significant opportunity by enhancing engagement efficiency and decision speed. AI improves target prioritization. Data fusion enhances accuracy. Operator workload is reduced. Systems adapt to dynamic threats. Software upgrades extend system relevance. Demand for autonomous features grows. Regulatory frameworks evolve to support controlled use. This opportunity drives next-generation procurement.

Future Outlook

Over the next five years, the KSA land based smart weapons market is expected to progress steadily through modernization-driven demand and localization initiatives. Precision strike capabilities, AI-enabled targeting, and network integration will shape system evolution. Regulatory support under national defense strategies will remain strong. Demand will be reinforced by armored fleet upgrades, border security requirements, and sustained investment in indigenous defense manufacturing capacity.

Major Players

- Saudi Arabian Military Industries

- Lockheed Martin

- Raytheon Technologies

- BAE Systems

- Rheinmetall AG

- Thales Group

- General Dynamics Land Systems

- MBDA

- L3Harris Technologies

- Hanwha Defense

- ASELSAN

- Roketsan

- Norinco

- Elbit Systems

- Rafael Advanced Defense Systems

Key Target Audience

- Defense ministries

- Armed forces procurement agencies

- Military modernization programs

- Defense system integrators

- Ammunition manufacturers

- Weapons platform OEMs

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables including product categories, platform integration levels, procurement volumes, and pricing structures were identified using official defense procurement disclosures and industry databases.

Step 2: Market Analysis and Construction

Data were structured using bottom-up assessment across segments, aligning domestic acquisitions with verified import and local production records.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through expert consultations with defense analysts, retired military officers, and industry specialists.

Step 4: Research Synthesis and Final Output

Validated findings were synthesized into a structured market model ensuring consistency, accuracy, and strategic relevance.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Ongoing modernization of Saudi ground forces

Rising demand for precision strike capabilities

Strategic focus on network centric land warfare

Expansion of indigenous defense manufacturing

Increased defense allocation for land systems - Market Challenges

High acquisition and lifecycle sustainment costs

Dependence on foreign technology transfer

Complex integration with legacy platforms

Regulatory and export control limitations

Skilled workforce and technical capability gaps - Market Opportunities

Localization of smart weapon production

Technology partnerships with global OEMs

Upgrades of existing armored and artillery fleets - Trends

Integration of AI and autonomy in ground weapons

Increased use of loitering munitions

Shift toward modular and upgradeable systems

Emphasis on interoperability with C4ISR networks

Growth of local assembly and testing facilities - Government Regulations & Defense Policy

Support for defense localization under Vision 2030

Stricter procurement and compliance frameworks

Incentives for foreign direct investment in defense - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Precision guided artillery munitions

Advanced anti-tank guided missile systems

Loitering munitions and ground launched UAVs

Smart rocket and missile systems

Integrated fire control and targeting systems - By Platform Type (In Value%)

Main battle tanks

Armored fighting vehicles

Self propelled and towed artillery platforms

Mobile missile launcher vehicles

Infantry carried land combat systems - By Fitment Type (In Value%)

New platform integration

Mid life upgrade and retrofit programs

Mission specific modular fitment

Indigenous platform customization

Export oriented configuration fitment - By EndUser Segment (In Value%)

Royal Saudi Land Forces

Saudi Arabian National Guard

Border security and internal security forces

Special operations units

Allied foreign military customers - By Procurement Channel (In Value%)

Direct government procurement

Intergovernmental defense agreements

Foreign military sales programs

Local defense industry contracts

Joint venture and offset based procurement - By Material / Technology (in Value %)

AI enabled guidance and targeting technologies

Electro optical and infrared sensor suites

Secure tactical communication and data links

Advanced propulsion and energetics

Lightweight composite and armored materials

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (system range, guidance accuracy, platform compatibility, mobility, survivability, unit cost, upgrade potential, localization level, lifecycle support)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Saudi Arabian Military Industries

Rafael Advanced Defense Systems

Elbit Systems

Lockheed Martin

Raytheon Technologies

BAE Systems

Thales Group

General Dynamics Land Systems

Rheinmetall AG

MBDA

L3Harris Technologies

Hanwha Defense

ASELSAN

Roketsan

Norinco

- Royal Saudi Land Forces prioritize precision and mobility

- National Guard focuses on internal security readiness

- Border forces emphasize surveillance strike integration

- Special forces demand lightweight and rapid response systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035