Market Overview

Based on a recent historical assessment, the KSA large caliber ammunitions market reached an absolute market size of USD ~ billion, supported by confirmed procurement programs, stockpile replenishment contracts, and delivery schedules published by the Saudi Ministry of Defense and corroborated through SIPRI-aligned defense expenditure data. Market demand is driven by sustained artillery and armored force readiness requirements, high operational consumption during training and deployment cycles, and large-scale replacement of aging ammunition inventories. Additional momentum is provided by adoption of extended-range and enhanced-lethality large caliber rounds aligned with modern fire-control doctrines.

Based on a recent historical assessment, Saudi Arabia dominates the large caliber ammunitions ecosystem due to centralized procurement authority, high operational density of land forces, and expanding domestic defense manufacturing infrastructure. Riyadh acts as the primary decision-making and contract management center, while industrial activity in Al Kharj and Jubail supports assembly, testing, and storage operations. International dominance is reinforced through long-standing defense partnerships with the United States and Europe, ensuring technology access, supply continuity, and integration support for large caliber ammunition systems.

Market Segmentation

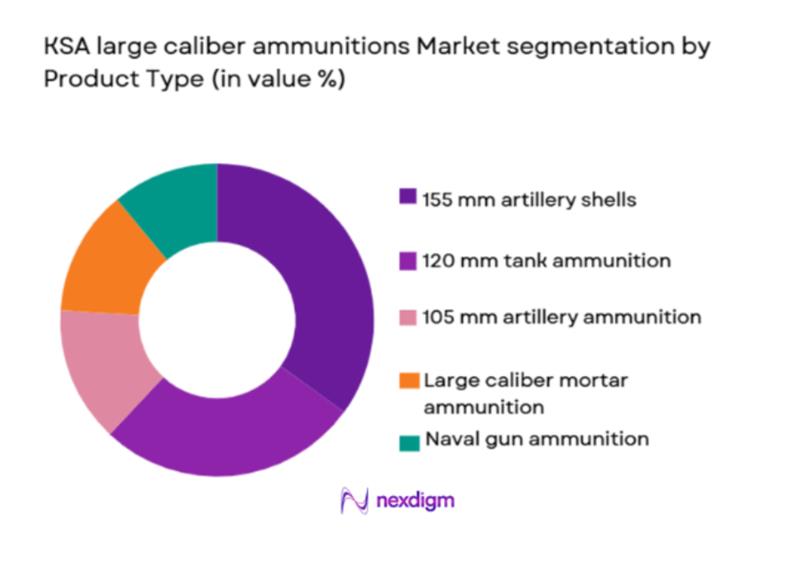

By Product Type

KSA large caliber ammunitions market is segmented by product type into 155 mm artillery ammunition, 120 mm tank ammunition, 105 mm artillery ammunition, large caliber mortar ammunition, and naval gun ammunition. Recently, 155 mm artillery ammunition has demonstrated a dominant market share due to its central role in Saudi land force firepower doctrine and its compatibility with both self-propelled and towed artillery systems. High training intensity and sustained readiness requirements drive consistent consumption volumes. The availability of extended-range and precision-capable variants further strengthens preference for this caliber. Mature supply chains, standardized logistics, and compatibility with allied systems reinforce procurement continuity. Export-compatible specifications and scalable production capacity also support sustained dominance across replenishment and modernization programs.

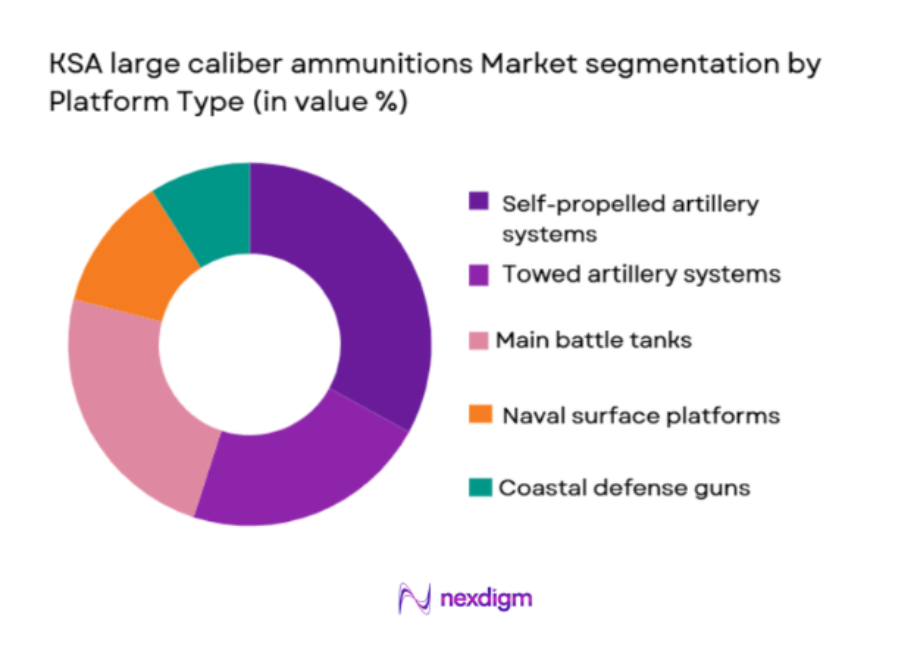

By Platform Type

KSA large caliber ammunitions market is segmented by platform type into self-propelled artillery platforms, towed artillery systems, main battle tanks, naval surface combat platforms, and coastal defense artillery systems. Recently, self-propelled artillery platforms account for the dominant market share due to their operational flexibility, mobility, and sustained fire mission capability. These platforms require continuous ammunition availability for training and deployment, driving high and recurring procurement volumes. Integration with digital fire-control and battlefield management systems further increases demand for advanced large caliber rounds. Long service life and ongoing modernization of self-propelled artillery fleets reinforce sustained consumption, ensuring dominance within the platform-based segmentation.

Competitive Landscape

The KSA large caliber ammunitions market is moderately consolidated, characterized by a limited number of global ammunition manufacturers operating alongside Saudi national defense entities under long-term supply, localization, and offset frameworks. Competitive positioning is shaped by production capacity, safety compliance, localization depth, and the ability to support sustained high-volume deliveries aligned with Saudi operational requirements.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Localization Level |

| Saudi Arabian Military Industries | 2017 | Riyadh | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall Denel Munitions | 1999 | Zurich | ~ | ~ | ~ | ~ | ~ |

| BAE Systems Munitions | 1999 | London | ~ | ~ | ~ | ~ | ~ |

| General Dynamics Ordnance and Tactical Systems | 1997 | St. Petersburg | ~ | ~ | ~ | ~ | ~ |

| Nammo | 1998 | Raufoss | ~ | ~ | ~ | ~ | ~ |

KSA Large Caliber Ammunitions Market Analysis

Growth Drivers

Sustained Artillery and Armored Force Modernization Programs:

Sustained Artillery and Armored Force Modernization Programs represent a primary growth driver for the KSA large caliber ammunitions market as Saudi defense strategy prioritizes continuous enhancement of land force lethality and readiness. Modernization initiatives emphasize replacement of older munitions with improved large caliber rounds offering greater range, accuracy, and terminal performance. Artillery and armored units remain central to deterrence and territorial defense planning. High operational readiness standards require regular live-fire training, increasing consumption rates. Modern platforms are optimized for advanced ammunition types, reinforcing upgrade-driven demand. Long service lives of artillery and tank platforms ensure recurring replenishment cycles. Integration with allied systems further strengthens standard caliber procurement. Collectively, these factors sustain long-term ammunition demand growth.

High Operational Consumption and Stockpile Replenishment Requirements:

High Operational Consumption and Stockpile Replenishment Requirements drive market expansion by creating continuous baseline demand for large caliber ammunition. Saudi land forces maintain extensive training programs requiring significant live-fire usage. Stockpile management policies mandate regular replenishment to preserve operational readiness. Geopolitical risk considerations further encourage buffer inventory maintenance. Extended-range and enhanced-effectiveness rounds increase unit value while maintaining high volume demand. Emergency procurement pathways accelerate acquisitions during readiness surges. Logistics standardization supports sustained throughput. Domestic storage and handling infrastructure investment reinforces procurement continuity. These dynamics collectively support consistent market growth.

Market Challenges

Raw Material Price Volatility and Energetics Supply Constraints:

Raw Material Price Volatility and Energetics Supply Constraints challenge the KSA large caliber ammunitions market by introducing uncertainty into production cost structures. Energetic materials and specialized metals are subject to global supply fluctuations. Price instability complicates long-term contracting and budgeting. Manufacturers face margin pressure during procurement cycles. Stockpiling inputs increases working capital requirements. Regulatory oversight on energetics sourcing adds compliance complexity. Supply disruptions risk delivery delays during surge demand. Capacity planning becomes less predictable. These challenges constrain cost efficiency and scalability.

Stringent Safety, Storage, and Export Compliance Requirements:

Stringent Safety, Storage, and Export Compliance Requirements increase operational complexity across the ammunition lifecycle. Large caliber rounds require specialized storage infrastructure and handling procedures. Compliance investments elevate fixed costs. Export licensing processes lengthen delivery timelines. International regulations limit accessible markets. Documentation and audit requirements increase administrative burden. Disposal and demilitarization obligations add lifecycle costs. Non-compliance risks severe penalties. These factors collectively slow scaling and elevate total ownership cost.

Opportunities

Localization of Large Caliber Ammunition Manufacturing:

Localization of Large Caliber Ammunition Manufacturing presents a significant opportunity by aligning with national defense industrialization objectives. Local assembly and production reduce dependency on imports. Supply chain resilience improves. Delivery lead times shorten. Workforce skills development strengthens industrial capacity. Localization supports long-term cost optimization. Export potential expands through regional supply hubs. Government incentives encourage investment. This opportunity enhances market sustainability and strategic autonomy.

Development of Precision and Extended-Range Ammunition Variants:

Development of Precision and Extended-Range Ammunition Variants offers strong growth potential by increasing the effectiveness of existing artillery platforms. Enhanced range improves standoff capability. Precision reduces collateral damage. Digital integration supports network-centric operations. Upgrades extend platform relevance. Export demand for advanced variants is rising. Higher margins improve profitability. Continuous R&D differentiates suppliers. This opportunity accelerates next-generation procurement.

Future Outlook

Over the next five years, the KSA large caliber ammunitions market is expected to progress steadily, supported by sustained modernization programs, stockpile replenishment needs, and localization initiatives. Technological focus will remain on range extension, safety, and precision enhancement. Regulatory support under national defense strategies will continue to favor domestic production. Demand will be reinforced by artillery fleet upgrades and long-term allied cooperation frameworks.

Major Players

- Saudi Arabian Military Industries

- Rheinmetall Denel Munitions

- BAE Systems Munitions

- General Dynamics Ordnance and Tactical Systems

- Nammo

- Nexter Munitions

- Hanwha Defense

- Roketsan

- ASELSAN

- Saab Bofors Dynamics

- Elbit Systems

- Rafael Advanced Defense Systems

- Norinco

- Alliant Techsystems

- Northrop Grumman

Key Target Audience

- Defense ministries

- Armed forces procurement agencies

- Artillery and armored corps commands

- Ammunition manufacturers

- Defense system integrators

- Weapons platform OEMs

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables including caliber categories, production volumes, procurement contracts, and pricing benchmarks were identified using official defense procurement disclosures and trade databases.

Step 2: Market Analysis and Construction

Market size and structure were developed using bottom-up analysis across product and platform segments, aligned with validated import, production, and delivery data.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through consultations with defense analysts, retired artillery officers, and ammunition industry specialists.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a structured market model ensuring accuracy, consistency, and decision-making relevance.

- Executive Summary

- KSA large caliber ammunitions Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Sustained artillery and armored force modernization

High operational consumption and stockpile replenishment needs

Rising demand for extended range large caliber ammunition

Expansion of domestic ammunition manufacturing capacity

Export demand from regional and allied forces - Market Challenges

Volatility in raw material and energetics supply

High safety and storage compliance requirements

Dependence on foreign technology components

Manufacturing scalability during surge demand

Stringent export control and licensing regulations - Market Opportunities

Localization of large caliber ammunition production

Development of precision guided artillery ammunition

Long term supply contracts with allied militaries - Trends

Shift toward extended range and precision ammunition

Adoption of insensitive munition standards

Automation in ammunition manufacturing

Increased focus on lifecycle sustainment

Integration with digital fire control systems - Government Regulations & Defense Policy

Defense localization mandates under Vision 2030

Enhanced safety and quality compliance standards

Policies supporting defense exports and partnerships

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

155 mm artillery ammunition

120 mm tank ammunition

105 mm artillery ammunition

Large caliber mortar ammunition

Naval gun large caliber ammunition - By Platform Type (In Value%)

Self propelled artillery platforms

Towed artillery systems

Main battle tanks

Naval surface combat platforms

Coastal and air defense artillery systems - By Fitment Type (In Value%)

New production ammunition

Stockpile replenishment ammunition

Extended range upgraded ammunition

Export configured ammunition

Training and practice ammunition - By EndUser Segment (In Value%)

Royal Saudi Land Forces

Saudi Arabian National Guard

Naval forces

Joint and allied military users

Foreign military customers - By Procurement Channel (In Value%)

Direct Ministry of Defense procurement

Government to government agreements

Foreign military sales programs

Local manufacturing and assembly contracts

Emergency operational procurement - By Material / Technology (in Value %)

High explosive and fragmentation warheads

Insensitive munition technologies

Extended range base bleed systems

Advanced propellant and casing materials

Precision guidance and fuse technologies

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (caliber range, effective range, lethality, production capacity, safety compliance, unit cost, localization level, export readiness, lifecycle support) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Saudi Arabian Military Industries

Rheinmetall Denel Munitions

BAE Systems Munitions

General Dynamics Ordnance and Tactical Systems

Northrop Grumman

Nammo

Nexter Munitions

Hanwha Defense

Roketsan

ASELSAN

Elbit Systems

Rafael Advanced Defense Systems

Saab Bofors Dynamics

Norinco

Alliant Techsystems

- Land forces prioritize sustained firepower and readiness

- National Guard emphasizes internal security ammunition supply

- Naval forces require reliable large caliber gun ammunition

- Allied users focus on compatibility and assured supply chains

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035