Market Overview

The KSA Light Tank Market is currently valued based on recent industry data and government reports. The market’s size is significantly influenced by the Kingdom’s strategic focus on modernizing its military capabilities, particularly in the area of armored vehicle technologies. In 2024, Saudi Arabia’s defense spending reached USD ~billion, one of the highest in the region. This investment is driven by regional security concerns and the government’s vision to enhance its military strength, especially in light of ongoing regional conflicts and tensions. The continuous modernization of the Saudi Arabian armed forces and investments in defense infrastructure further fuel the market for light tanks, as these vehicles play a crucial role in border security and national defense operations.

Saudi Arabia, with Riyadh as its capital, is the dominant market player in the region, driven by its robust defense policies and high military expenditure. Other cities such as Jeddah and Dhahran also play significant roles in the defense infrastructure, primarily due to their proximity to key military bases and the oil-rich eastern region, which is of strategic importance. The market dominance of Saudi Arabia stems from its pivotal role in the Middle East, where it acts as a regional power with considerable investments in defense technologies. The country’s alliance with Western defense manufacturers and local production capabilities further strengthen its position as the leading player in the light tank market.

Market Segmentation

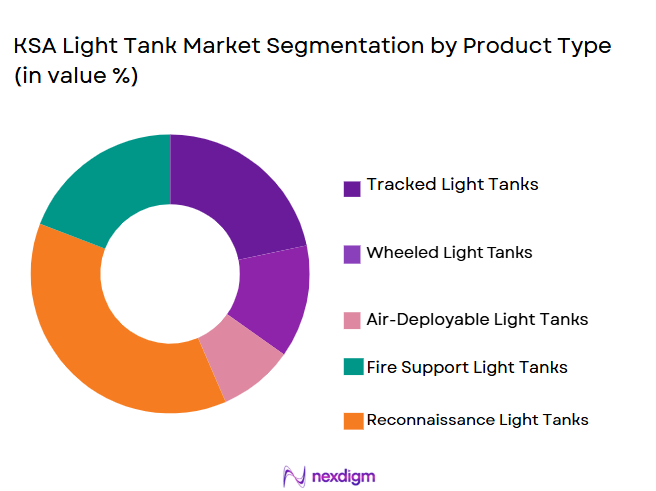

By Product Type

The KSA Light Tank Market is segmented into three main tank types: light wheeled tanks, light tracked tanks, and hybrid tanks. Among these, light wheeled tanks dominate the market due to their increased mobility, lower maintenance costs, and flexibility in varied terrain. These tanks are preferred for their speed and ease of transport, which are critical for rapid deployment in the desert environments and urban warfare scenarios commonly encountered by the Saudi military. The lightweight and maneuverability advantages of wheeled tanks make them more suitable for border security operations and quick-response military actions, ensuring their continued market dominance.

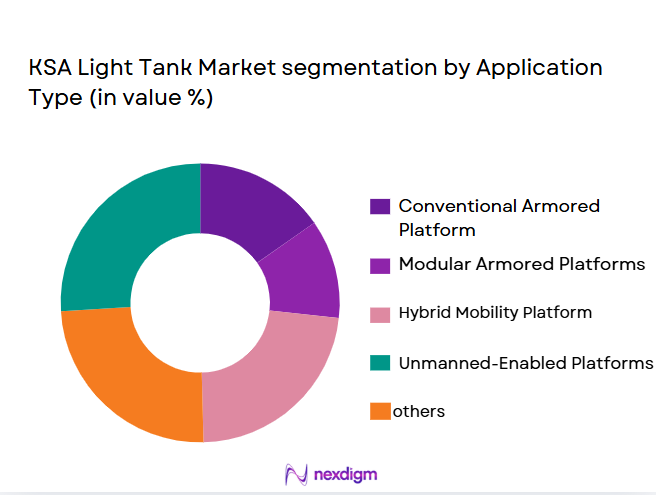

By Application

The KSA Light Tank Market is also segmented by application, including national defense forces, paramilitary forces, border security, and peacekeeping missions. National defense forces hold the largest share in the market, as Saudi Arabia continues to prioritize defense modernization and bolster its military forces. The demand for light tanks from national defense is propelled by their role in improving the mobility and firepower of the Kingdom’s military in high-intensity combat situations. Saudi Arabia’s defense strategies, including maintaining military preparedness and enhancing the operational efficiency of its ground forces, contribute significantly to the market share of light tanks in the national defense application.

Competitive Landscape

The KSA Light Tank Market is dominated by a few major players, including both local and international defense manufacturers. Companies like General Dynamics Land Systems, BAE Systems, and Rheinmetall are key global players providing advanced light tanks and military vehicles to Saudi Arabia. Local manufacturers, in collaboration with international firms, have also become a key part of the market, helping to drive local production and supply chains.

The competitive landscape in the market highlights the influence of these large corporations with established brand reputations, technological capabilities, and military expertise. Additionally, the strategic alliances between Saudi Arabia and these companies further reinforce the dominance of these players in the region, providing the country with state-of-the-art defense equipment.

| Company Name | Year Established | Headquarters | Technology Focus | Production Capacity | R&D Investment | Key Market Focus | Distribution Network |

| General Dynamics Land Systems | 1952 | USA | ~ | ~

|

~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ | ~ |

| Hanwha Defense | 1977 | South Korea | ~ | ~ | ~ | ~ | ~ |

KSA Light Tank Market Analysis

Growth Drivers

Increased Defense Budget Allocations by KSA Government

The Saudi Arabian government has consistently allocated a significant portion of its national budget to defense, with an estimated defense expenditure of approximately USD ~billion in 2024. This has been a consistent upward trend, driven by the need to modernize its military capabilities in response to regional security dynamics. The World Bank’s data on Saudi Arabia’s defense expenditure shows that defense allocations have been a central focus of the country’s economic planning, particularly in recent years. In addition to funding military operations, this budget supports the acquisition of advanced weaponry, including light tanks, to enhance the Kingdom’s defense capabilities. The ongoing defense budget increase is expected to continue fueling demand for modern military equipment, including light tanks, as part of Saudi Arabia’s broader defense strategy.

Ongoing Modernization of Armed Forces

Saudi Arabia is actively investing in the modernization of its armed forces, focusing on improving the mobility, precision, and efficiency of its military assets. The Kingdom’s Vision 2030 emphasizes the enhancement of national security through technological advancements in defense systems, including light armored vehicles. As part of this strategy, Saudi Arabia has significantly upgraded its defense infrastructure, with a portion of its defense budget allocated to procuring modern armored vehicles, including light tanks. In 2024, the Saudi Ministry of Defense prioritized the acquisition of new military technologies to strengthen its armed forces’ readiness. This shift towards modernization, coupled with its ongoing investments, will continue to drive the demand for advanced light tanks and other military vehicles.

Market Challenges

High Development and Maintenance Costs for Advanced Light Tanks

The production and maintenance of advanced light tanks are associated with high development costs, which can be a significant challenge for the Kingdom’s defense budget. The cost of advanced military technology, including sophisticated armor, weaponry, and electronic systems, continues to rise due to the integration of cutting-edge technologies. According to the International Monetary Fund (IMF), Saudi Arabia’s defense sector faces substantial operational and developmental challenges, particularly related to the procurement of high-tech systems. The IMF’s 2024 report highlights that while defense spending is increasing, the rising costs of technological advancements, maintenance, and parts replacements for military vehicles, including light tanks, pose long-term financial constraints.

Geopolitical Instabilities in the Middle East

Geopolitical instability in the Middle East, particularly the ongoing tensions with Iran and the situation in Yemen, poses a significant challenge for the KSA light tank market. Saudi Arabia’s strategic military investments are affected by shifting regional security needs and unpredictable political developments. The World Bank’s 2024 report on Middle East security highlights the economic and security risks posed by regional instability. These tensions often result in uncertain military procurement cycles and shifting defense priorities. The instability can delay procurement processes and complicate long-term military planning, which impacts the demand for specific military equipment, including light tanks.

Opportunities

Technological Advancements in Tank Design and Armor Systems

Technological advancements in tank design and armor systems present significant opportunities for the KSA light tank market. Saudi Arabia has been actively investing in new technologies that improve the survivability, mobility, and firepower of light tanks. The integration of advanced composite armor, active protection systems, and unmanned systems into light tank designs is one of the key opportunities in this market. As of 2024, the Saudi government has been working closely with international defense contractors to integrate state-of-the-art technology into its light tank fleet. This trend is expected to continue, as the demand for next-generation light tanks with enhanced operational capabilities remains high.

Domestic Production Initiatives

Saudi Arabia has been focusing on increasing its domestic production capabilities in the defense sector, including the manufacturing of light tanks. In line with Vision 2030, the Kingdom aims to reduce its dependence on foreign defense suppliers by building local manufacturing capacity. The Saudi Arabian Military Industries (SAMI), established in 2017, has been a key player in this initiative, driving the development of locally produced military vehicles, including light tanks. This push for domestic production is expected to foster greater innovation, cost efficiency, and supply chain security, providing significant opportunities for the market. The government’s strategic initiatives and support for local defense manufacturing are expected to continue fostering the growth of the KSA light tank market.

Future Outlook

Over the next five years, the KSA Light Tank Market is expected to experience steady growth, driven by continued government investments in defense, the ongoing modernization of the Saudi military, and an increasing focus on advanced technology in armored vehicles. The Kingdom’s strong alliances with global defense companies will facilitate the continued enhancement of its military capabilities, including the development and deployment of new light tank models. Additionally, the growing demand for advanced, mobile military solutions in border security and national defense will further fuel the market’s expansion. The collaboration between local manufacturers and international partners will play a crucial role in the evolution of the KSA light tank market, with increased localization of production expected to take place.

Major Players

- General Dynamics Land Systems

- BAE Systems

- Rheinmetall

- Lockheed Martin

- Hanwha Defense

- Oshkosh Defense

- Leonardo S.p.A

- Nexter Systems

- ST Engineering

- L3 Technologies

- Hyundai Rotem

- Elbit Systems

- Turkish Aerospace Industries

- Otokar

- Tatra Defence Vehicles

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory

- Military Contractors

- Defense Manufacturers

- National Defense Forces

- Paramilitary Organizations

- Procurement Managers in Defense Industry

- Armament Research and Development Institutes

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves gathering comprehensive information on the KSA Light Tank Market, including the identification of key variables such as market size, demand drivers, technological trends, and end-user preferences. This step combines secondary research from trusted databases and government reports, alongside primary research through interviews with industry experts.

Step 2: Market Analysis and Construction

We will analyze the historical data related to the KSA Light Tank Market, focusing on understanding the trends and demand fluctuations across the key sectors. This includes evaluating government defense expenditure, military modernization programs, and the application of light tanks in military strategies.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses regarding the growth and challenges in the light tank market will be validated through direct consultations with experts in military procurement and defense technology. The consultation will help refine assumptions and improve the accuracy of the market data.

Step 4: Research Synthesis and Final Output

Finally, the results from the bottom-up approach and expert consultations will be synthesized to produce a comprehensive analysis of the KSA Light Tank Market. This output will be

- Executive Summary

- KSA Light Tank Market Research Methodology

Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Modernization of ground forces under Vision 2030 defense initiatives

Operational requirements for high-mobility platforms in desert terrain

Increased focus on border security and rapid response capabilities - Market Challenges

High acquisition and lifecycle costs of advanced armored platforms

Dependence on foreign technology and subsystems

Integration complexity of modern protection and electronic systems - Market Opportunities

Localization of light tank manufacturing and assembly

Rising demand for wheeled and modular armored platforms

Potential exports to regional and allied defense forces - Trends

Emphasis on mobility and reduced combat weight

Adoption of advanced fire control and situational awareness systems

Integration of active protection systems on light armored vehicles

- By Market Value 2024–2029

- By Installed Units 2024–2029

- By Average System Price 2024–2029

- By System Complexity Tier 2024–2029

- By System Type (In Value%)

Tracked Light Tanks

Wheeled Light Tanks

Fire Support Light Tanks

Reconnaissance Light Tanks

Air-Transportable Light Tanks - By Platform Type (In Value%)

Conventional Armored Platforms

Modular Armored Platforms

Desert-Optimized Platforms

Network-Centric Combat Platforms

Unmanned-Enabled Support Platforms - By Fitment Type (In Value%)

New Production Platforms

Mid-Life Upgrade Fitment

Weapon and Turret Integration Fitment

Armor and Survivability Upgrade Fitment

C4ISR and Sensor Integration Fitment - By EndUser Segment (In Value%)

Royal Saudi Land Forces

Saudi Arabian National Guard

Border Guard Forces

Special Operations Forces

Export-Oriented Regional Customers - By Procurement Channel (In Value%)

Direct Government Procurement

Domestic Defense OEM Contracts

Joint Ventures and Localization Programs

Foreign Military Sales

Upgrade and Sustainment Contracts

- Market Share Analysis

- Cross Comparison Parameters

(Combat Weight, Mobility Range, Protection Level, Main Armament Caliber, System Integration Capability) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Saudi Arabian Military Industries

Elbit Systems

Rheinmetall

BAE Systems

General Dynamics Land Systems

Otokar

FNSS

Hanwha Defense

John Cockerill Defense

Nexter Systems

Krauss-Maffei Wegmann

ST Engineering

Denel Land Systems

ASELSAN

Rafael Advanced Defense Systems

- Land forces prioritize mobility, firepower, and desert survivability

- National Guard focuses on internal security and rapid deployment

- Special forces require compact and highly maneuverable platforms

- Regional customers seek cost-effective and proven combat solutions

- Forecast Market Value 2030–2035

- Forecast Installed Units 2030–2035

- Price Forecast by System Tier 2030–2035

- Future Demand by Platform 2030–2035