Market Overview

The KSA lipid profiles testing market is valued at USD ~, reflecting its role as a foundational diagnostic service within the national healthcare ecosystem. Demand is structurally driven by the rising clinical focus on cardiovascular risk stratification, long-term diabetes management, and preventive screening mandates across public and private care settings. Lipid testing has become embedded in routine care pathways, from primary clinics to tertiary hospitals, making it a high-frequency, high-volume diagnostic category that underpins chronic disease programs, insurance-backed health packages, and corporate wellness initiatives across the healthcare value chain.

Within the country, demand is concentrated in Riyadh, Jeddah, and Dammam due to their dense clusters of tertiary hospitals, reference laboratories, and corporate healthcare providers. Riyadh dominates through centralized government healthcare operations and national specialty institutes, while Jeddah benefits from its strong private hospital ecosystem and medical tourism activity. Dammam is driven by occupational health demand from industrial sectors. On the supply side, the market is shaped by global diagnostics technology leaders and multinational manufacturing hubs that influence analyzer standards, reagent innovation, and automation frameworks, setting the performance benchmarks adopted by laboratories nationwide.

Market Segmentation

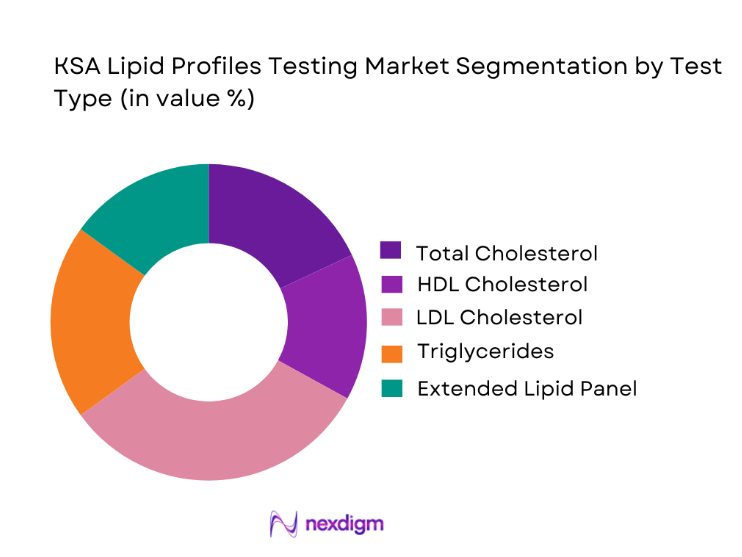

By Test Type

The KSA lipid profiles testing market by test type is led by LDL cholesterol testing, which has emerged as the dominant sub-segment due to its central role in cardiovascular risk management and therapeutic decision-making. Clinicians increasingly rely on LDL values to guide statin initiation, dosage adjustments, and long-term patient monitoring, making it the most clinically actionable lipid parameter. National guidelines emphasizing early detection of dyslipidemia and aggressive management of high-risk populations have further elevated the importance of LDL testing. In addition, the shift from calculated to direct LDL assays in complex cases has increased both test frequency and value realization. As preventive cardiology gains momentum and chronic disease management programs expand, LDL testing continues to anchor lipid profile demand across hospitals, diagnostic laboratories, and primary care networks.

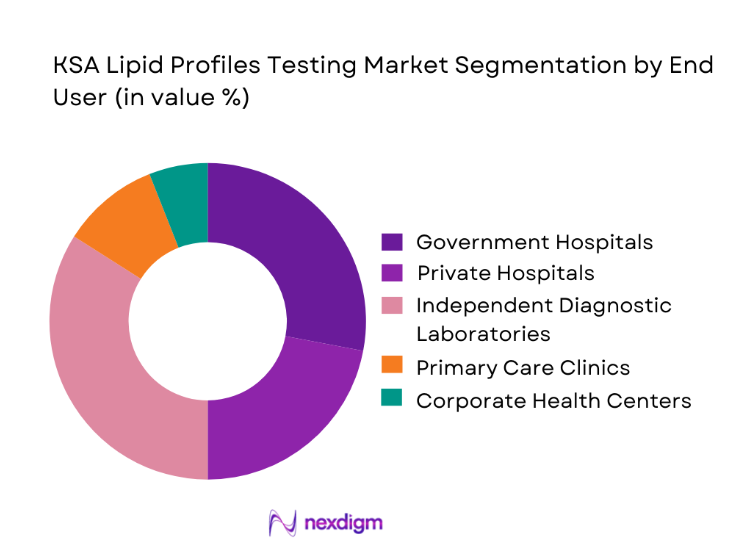

By End-Use

Among end-use customer types, independent diagnostic laboratories dominate the KSA lipid profiles testing market due to their expanding footprint, operational efficiency, and central role in outsourced diagnostics. These laboratories have invested heavily in high-throughput analyzers, automation lines, and digital reporting systems, enabling them to process large volumes of lipid tests at competitive cost structures. Their strong positioning in preventive health packages and corporate wellness programs has further amplified routine lipid testing demand outside hospital settings. Additionally, partnerships with insurance providers and government screening initiatives have increased test inflow consistency. As healthcare delivery shifts toward decentralized and patient-centric models, independent laboratories continue to strengthen their leadership by offering faster turnaround times, broader geographic access, and integrated home collection services that support sustained growth in lipid profile testing volumes.

Competitive Landscape

The KSA Lipid Profiles Testing market is dominated by a few major players, including Roche Diagnostics and global or regional brands like Abbott Diagnostics, Siemens Healthineers, and Beckman Coulter. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | Installed Base in KSA | Reagent Rental Penetration | SFDA Registered Products | Local Service Network | Key End-User Focus | Technology Strength |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott Diagnostics | 1888 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Beckman Coulter | 1935 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Mindray Medical | 1991 | China | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Lipid Profiles Testing Market Analysis

Growth Drivers

Rising cardiovascular disease burden

The increasing prevalence of heart disease and metabolic disorders is fundamentally reshaping diagnostic priorities across the healthcare system. As clinicians focus on early risk identification and long-term disease management, lipid profiling has become a standard component of routine patient assessment. This shift drives consistent test volumes across hospitals and clinics while also strengthening demand from preventive health programs. The outcome is a structurally resilient market where lipid testing is no longer episodic but embedded in continuous care pathways.

Expansion of preventive screening programs

Government-led and private sector preventive health initiatives are expanding the scope of routine diagnostics beyond symptomatic care. Large-scale screening programs targeting high-risk populations have elevated lipid profiling as a first-line diagnostic tool. This approach increases testing frequency among asymptomatic individuals, broadening the market base and reinforcing the role of diagnostics in population health management.

Challenges

Pricing pressure from centralized procurement

Centralized purchasing frameworks have intensified competition among suppliers, leading to sustained pressure on reagent pricing and service margins. While this improves cost efficiency for healthcare providers, it constrains revenue growth for diagnostics companies and limits their flexibility in investing in innovation and localized support infrastructure. Over time, this dynamic may affect service quality and technology refresh cycles across laboratories.

Shortage of specialized laboratory workforce

The rapid expansion of diagnostic services has outpaced the availability of trained laboratory professionals, particularly in secondary cities and remote regions. Workforce gaps affect turnaround times, quality assurance, and the adoption of advanced automation platforms. Without parallel investments in training and professional development, operational bottlenecks may limit the full growth potential of lipid testing services nationwide.

Opportunities

Automation-led laboratory efficiency gains

The adoption of fully automated analyzers and integrated laboratory lines presents a major opportunity to enhance throughput, reduce manual errors, and optimize cost per test. As laboratories scale operations, automation enables them to handle rising lipid test volumes without proportional increases in staffing, improving both profitability and service consistency. This technological shift also supports faster reporting, which is critical for time-sensitive clinical decision-making.

Expansion of decentralized testing models

Growing demand for patient convenience is accelerating the adoption of decentralized diagnostics, including community-based laboratories and home collection services. Lipid profiling, being a high-frequency and low-complexity test category, is well suited to this model. Expanding access beyond hospital settings opens new revenue streams while improving early detection rates across underserved populations.

Future Outlook

The KSA lipid profiles testing market is positioned for steady expansion as preventive healthcare becomes a central pillar of national health strategy. Continued investment in laboratory automation, digital health integration, and decentralized service delivery will enhance accessibility and operational efficiency. At the same time, the alignment of insurance coverage with routine diagnostics and the growth of corporate wellness programs will sustain long-term demand, reinforcing lipid testing as a core component of chronic disease management and population health initiatives.

Major Players

- Roche Diagnostics

- Abbott Diagnostics

- Siemens Healthineers

- Beckman Coulter

- Thermo Fisher Scientific

- Randox Laboratories

- Ortho Clinical Diagnostics

- Mindray Medical

- Bio-Rad Laboratories

- DiaSys Diagnostic Systems

- Sekisui Diagnostics

- ARKRAY

- Sysmex Corporation

- Fujifilm Healthcare

- Elitech Group

Key Target Audience

- Hospital groups and healthcare networks

- Independent diagnostic laboratory chains

- Corporate healthcare and occupational health providers

- Medical device and diagnostics distributors

- Investments and venture capitalist firms

- Government and regulatory bodies

- Health insurance companies and third-party administrators

- Healthcare infrastructure developers and hospital project investors

Research Methodology

Step 1: Identification of Key Variables

The research began with mapping the diagnostic ecosystem across public and private healthcare segments to identify key demand and supply variables. Secondary data from procurement systems, hospital utilization records, and diagnostics company disclosures were analyzed to define market boundaries and revenue drivers. This phase established the foundational assumptions guiding the study.

Step 2: Market Analysis and Construction

Historical testing volumes and revenue flows were assessed using a bottom-up approach, aggregating data from laboratory networks and supplier sales channels. Market structure was validated through analysis of service delivery models and pricing frameworks to ensure realistic representation of competitive dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary market insights were validated through structured discussions with laboratory directors, procurement leaders, and distributor executives. These consultations refined assumptions around technology adoption, purchasing behavior, and service-level expectations, strengthening the credibility of the market model.

Step 4: Research Synthesis and Final Output

The final phase integrated qualitative insights with quantitative modeling to produce a coherent market narrative. Cross-verification across multiple data streams ensured consistency, while expert feedback helped align findings with operational realities in the diagnostics landscape.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, lipid testing taxonomy and care pathway mapping, market sizing logic by test volume and analyzer installed base, revenue attribution across reagents calibrators controls and service, primary interview program with hospitals labs distributors and payers, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Evolution of Lipid Testing in KSA

- Cardiometabolic Burden and Preventive Screening Drivers

- Care Pathway Mapping Across Primary Care Hospitals and Diagnostic Centers

- Public Procurement and Private Lab Network Dynamics

- Import Dependence and Distributor Managed Supply Ecosystem

- Growth Drivers

High prevalence of obesity diabetes and cardiovascular risk factors

Expansion of preventive screening and chronic disease programs

Growth of private diagnostics and lab network capacity

Greater focus on early risk stratification and treatment optimization

Employer led screening initiatives and wellness programs - Challenges

Tender driven pricing compression for routine chemistry reagents

Preanalytical variability and fasting compliance issues

Limited reimbursement coverage for advanced lipid biomarkers

Standardization gaps across decentralized testing sites

Supply continuity risk for imported reagents and calibrators - Opportunities

Advanced lipid testing growth for high risk patient stratification

POCT lipid testing expansion in primary care and remote sites

Bundled reagent and analyzer contracting models for lab networks

Integration of lipid results into cardiometabolic registries and analytics

Clinical education programs for familial hypercholesterolemia screening - Trends

Shift toward non fasting lipid testing protocols in routine care

Growing adoption of lipoprotein a and apolipoprotein testing

Greater use of reflex testing for high risk lipid abnormalities

Expansion of automated lab lines and higher throughput platforms

Increasing emphasis on QC analytics and accreditation readiness - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Test Volume, 2019–2024

- By Hospital vs Independent Lab Revenue Split, 2019–2024

- By Routine Lipid Panel vs Advanced Lipid Testing Split, 2019–2024

- By Fleet Type (in Value %)

Government hospitals and medical cities

Primary healthcare centers

Private hospital networks

Independent diagnostic laboratories

Corporate and occupational health providers - By Application (in Value %)

Cardiovascular risk screening and prevention

Diabetes and metabolic syndrome monitoring

Statin therapy initiation and follow up monitoring

Pediatric lipid screening and familial hypercholesterolemia workup

Preoperative and inpatient risk assessment testing - By Technology Architecture (in Value %)

Automated clinical chemistry analyzers and reagent systems

Point of care lipid testing devices

Direct LDL and non HDL testing workflows

Apolipoprotein and lipoprotein a testing platforms

Advanced lipid particle analysis and specialty assays - By Connectivity Type (in Value %)

Standalone analyzers with local reporting

LIS integrated laboratory workflows

EHR integrated primary care ordering pathways

Cloud enabled QC analytics and inventory management

Remote service monitoring and uptime support - By End-Use Industry (in Value %)

Clinical laboratories and pathology networks

Primary care and family medicine clinics

Cardiology and endocrinology specialty centers

Hospitals inpatient care programs

Public health screening and wellness providers - By Region (in Value %)

Riyadh Region

Makkah Region

Eastern Province

Madinah Region

Asir and Southern Regions

- Competitive ecosystem structure across clinical chemistry majors specialty assay providers and distributors

- Positioning driven by throughput assay performance and service footprint

- Partnership models between OEMs hospital groups and lab networks

- Cross Comparison Parameters (analytical accuracy and traceability alignment, throughput capacity and automation fit, direct LDL assay performance, reagent stability and storage requirements, LIS and EHR connectivity readiness, QC and calibration burden, advanced lipid menu breadth, cost per reportable result)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Roche Diagnostics

Abbott

Siemens Healthineers

Beckman Coulter

Ortho Clinical Diagnostics

Mindray

Horiba Medical

Thermo Fisher Scientific

DiaSorin

Randox Laboratories

Sekisui Diagnostics

Sysmex

QuidelOrtho

Bio Rad Laboratories

BD

- Primary care ordering behavior and screening pathway design

- Lab director priorities for throughput reagent stability and QC burden

- Procurement models in public hospitals and private networks

- Decision criteria for central lab versus POCT deployments

- Total cost of ownership drivers across reagents service and uptime

- By Value, 2025–2030

- By Test Volume, 2025–2030

- By Hospital vs Independent Lab Revenue Split, 2025–2030

- By Routine Lipid Panel vs Advanced Lipid Testing Split, 2025–2030