Market Overview

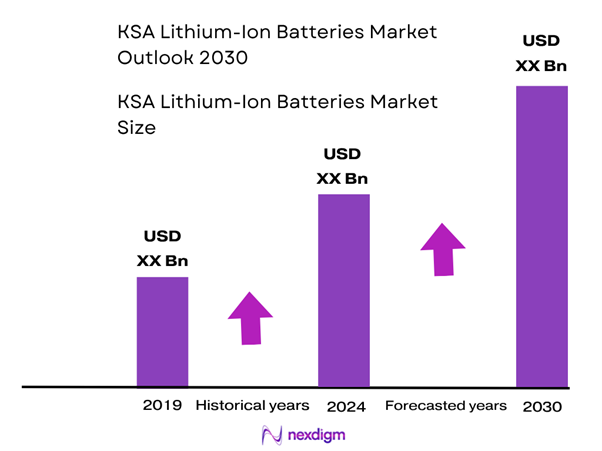

The KSA lithium-ion batteries market is valued at USD ~ million in the base year, based on recent industry research. The market growth is driven by accelerating adoption of electric vehicles (EVs) and large-scale renewable energy projects in the Kingdom, along with the need for energy storage systems to stabilise grid supply and support the country’s energy transition strategy.

Major cities such as Riyadh and Jeddah dominate the market due to their high levels of industrial development, major automotive and infrastructure investments, and established logistics and assembly networks for battery modules, which makes them hubs within Saudi Arabia’s battery value chain.

Market Segmentation

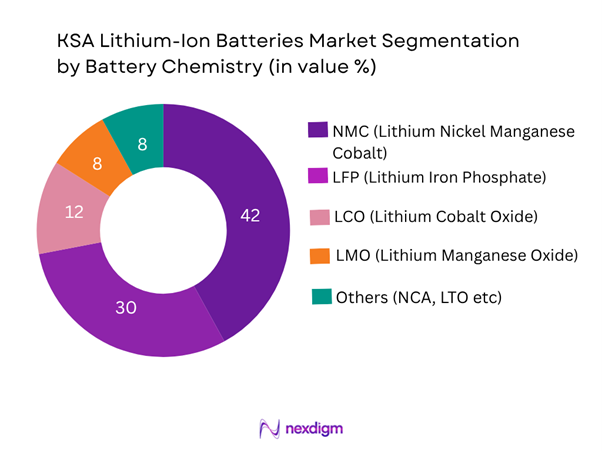

By Battery Chemistry

This segment classifies the market by the chemistry of the lithium-ion cell and pack. Typical sub-segments include NMC (Lithium Nickel Manganese Cobalt), LFP (Lithium Iron Phosphate), LCO (Lithium Cobalt Oxide), LMO (Lithium Manganese Oxide), and “Others” (including NCA, LTO etc).

In the KSA context, the NMC chemistry sub-segment is dominating the market because it offers a favourable balance of energy density, cost and cycle life which suits both automotive and stationary energy-storage applications in the Kingdom’s infrastructure-driven growth environment. Manufacturers and system integrators prefer NMC packs for EVs and grid installations, contributing to its dominant share.

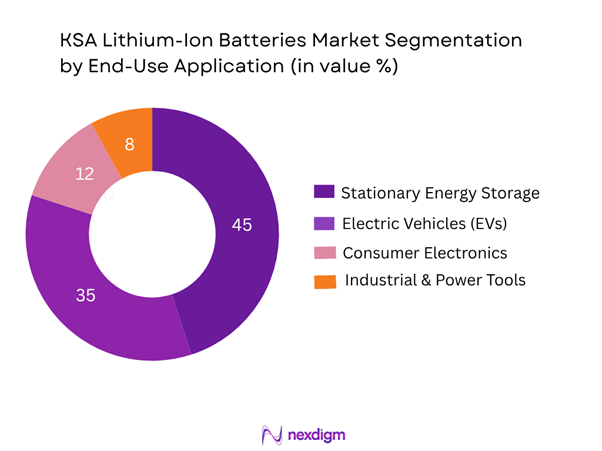

By End-Use Application

This segment divides the market by the key applications where lithium-ion batteries are used: EVs (electric vehicles), Stationary Energy Storage Systems (ESS) (grid/utility/residential), Consumer Electronics, and Industrial/Power Tools.

In the KSA market, the stationary energy storage systems (ESS) sub-segment holds the dominant share owing to the Kingdom’s major renewable-energy expansion, grid modernisation and the drive for large-scale battery installations. Utility-scale solar and wind projects increasingly incorporate lithium-ion battery storage, making ESS the leading application.

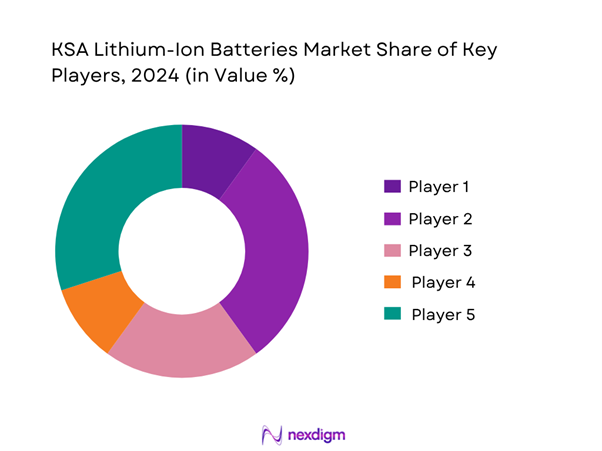

Competitive Landscape

The KSA lithium-ion batteries market is characterised by a mix of global and regional players, with international cell/pack manufacturers entering via partnerships or localisation efforts and energy-system integrators targeting Saudi utility and infrastructure customers. This consolidation highlights the significant influence of key companies in driving scale, technological capability and local manufacturing presence within the Kingdom.

| Company | Establishment Year | Headquarters | Local Manufacturing/Assembly Presence in KSA | Product Portfolio (Cells / Packs / Systems) | Key Strategic Focus in KSA | Partnership / JV Activity |

| BYD Co. Ltd | 1995 | China | – | – | – | – |

| LG Energy Solution | 2011 | South Korea | – | – | – | – |

| Panasonic Holdings Corp | 1918 | Japan | – | – | – | – |

| Samsung SDI Co Ltd | 1970 | South Korea | – | – | – | – |

| Saft Group S.A. | 1918 | France | – | – | – | – |

KSA Lithium-Ion Batteries Market Analysis

Growth Drivers

Rising EV adoption

In the Kingdom of Saudi Arabia, annual electric-vehicle sales increased from around 779 units in 2023 to approximately 24,092 units in 2024. Such considerable growth in EV uptake drives demand for lithium-ion battery packs, modules and related components across transport and mobility sectors. The growing number of vehicles utilising these batteries heightens the need for sustainable supply chains, local assembly and system integration, thereby propelling the battery market within the country.

Renewable energy integration

By the end of 2024, Saudi Arabia’s total renewable-energy capacity across all stages of development had reached 44.1 gigawatts (GW). This substantial build-out of solar and wind capacities increases the need for grid-scale energy storage systems using lithium-ion batteries to manage intermittency, frequency regulation and load-shifting. As the utility and infrastructure segments invest to stabilise renewables, demand for large capacity battery installations rises accordingly.

Market Challenges

Raw-material import dependency

Despite ambitions to localise battery material production, Saudi Arabia remains heavily dependent on imports for critical raw-materials like lithium and cobalt. The downstream battery-pack manufacturing value chain is constrained by upstream material supply. In addition, global supply-chain disruptions or price volatility in raw-materials could affect local battery manufacturing cost structure and competitiveness in the Kingdom.

Recycling infrastructure

The battery-recycling market in Saudi Arabia was valued at about USD 155.92 million in 2024. While this shows emerging activity in recycling end-of-life batteries, the infrastructure (collection networks, processing capacity, technology) remains nascent relative to projected volumes of spent lithium-ion cells from EVs and large-scale storage. The gap in recycling capability means inefficiencies and supply-chain risks persist for the battery ecosystem.

Market Opportunities

Local battery manufacturing

Saudi Arabia is actively planning to establish a domestic lithium-ion battery-cell and pack manufacturing hub, targeting both mobility and stationary-storage applications. With the country leveraging its industrial policy and energy-transition goals, a local manufacturing base offers opportunities to reduce imports, shorten supply-chains and enable value-capture in battery production. For firms, this opens localized production, development of battery-ecosystem partnerships and first-mover advantage in the Kingdom’s battery market.

Lithium/brine extraction & second-life batteries

Saudi Arabia has initiated pilot-projects for extracting lithium from oil-field brines and seawater, signalling potential upstream localisation of raw materials. Reuters+1 Concurrently, the growth of EV and stationary-storage deployments implies future volumes of used battery packs suitable for second-life applications (such as grid storage, backup systems). These dynamics create opportunities for battery-material recycling, repurposing (second-life), and vertical integration in the battery value-chain within the KSA market context

Future Outlook

Over the next five years, the KSA lithium-ion batteries market is expected to show significant growth driven by strong government initiatives, increased renewable-energy deployment, and rising adoption of electric mobility solutions. Infrastructure build-out, localisation of battery manufacturing, and integration of grid-scale storage systems will further underpin market expansion.

Major Players

- BYD Co. Ltd

- LG Energy Solution

- Panasonic Holdings Corp

- Samsung SDI Co Ltd

- Saft Group S.A.

- CATL (Contemporary Amperex Technology Co.)

- Tesla, Inc.

- GS Yuasa Corporation

- VARTA AG

- Hitachi Ltd

- Toshiba Corporation

- A123 Systems LLC

- Yinlong Energy (China) Ltd.

- Obeikan Investment Group (Saudi Arabia)

- Saudi Arabian Mining Company (Ma’aden)

Key Target Audience

- Battery cell and pack manufacturers looking to enter or expand in the Kingdom of Saudi Arabia

- Automotive OEMs and Tier-1 suppliers planning EV battery sourcing or localisation in KSA

- Utility companies and grid-operators investing in large-scale battery energy storage systems

- Renewable energy project developers (solar, wind) seeking ESS integration in KSA

- Investments and venture capitalist firms evaluating financing or M&A opportunities in KSA battery value chain

- Government and regulatory bodies (e.g., Saudi Arabia’s Ministry of Industry & Mineral Resources, Saudi Arabia’s Ministry of Energy) formulating battery manufacturing and energy-storage policies

- Industrial equipment and power-tool manufacturers exploring battery-pack partnerships in KSA

- Recycling and second-life battery companies assessing opportunities in KSA’s battery ecosystem

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map encompassing all major stakeholders within the KSA lithium-ion batteries market (cell/pack manufacturers, ESS integrators, EV OEMs, policy/regulatory bodies). Extensive desk research using published reports and industry databases formed the basis for defining critical variables influencing market size and growth.

Step 2: Market Analysis and Construction

In this phase, historical and current data for the KSA market were compiled, including revenue estimates, volume shipments, and average selling prices for lithium-ion batteries (by chemistry and application). Market-penetration trends, cost trajectories, and deployment data for energy-storage systems were analysed to build the bottom-up model for 2024 and forecast to 2030.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed around key drivers (EV adoption, renewable-energy storage) and then validated through discussions with industry experts—battery manufacturers, system integrators, utilities in the Kingdom of Saudi Arabia—to ensure realism and relevance of assumptions used in the forecast.

Step 4: Research Synthesis and Final Output

The final phase involved synthesising the validated data, segmentation breakdowns, competitive landscape assessments and growth-scenarios into the report. This ensured alignment between the bottom-up sizing and forecast and enables a credible market outlook for the KSA lithium-ion battery sector.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Abbreviations, Market Sizing Approach (value, volume, average price), Data Sources & Triangulation, Primary Research Approach (industry interviews in KSA), Secondary Research Approach, Consolidated Research Approach, Limitations & Future Outlook)

- Definition and Scope

- Market Genesis and Evolution in KSA

- Timeline of Major Milestones & Government Initiatives in KSA

- Lithium-Ion Battery Value Chain & Supply Chain in KSA

- Regulatory Framework & Energy Transition Strategy in KSA

- Business Cycle & Market Maturity Profile

- Growth Drivers

Rising EV adoption

Renewable energy integration

Grid-scale storage

KSA Vision 2030 decarbonisation - Market Challenges

Raw material import dependency

Recycling infrastructure

Manufacturing skills gap - Market Opportunities

Local battery manufacturing

Lithium/brine extraction, second-life batteries - Market Trends

Shift to LFP

Battery as a service

Vertical integration

Localisation of supply chain - Government Regulation & Incentives

Policy Support

Localisation Mandates

Import Duties

Sustainability standards - SWOT Analysis

- Stakeholder Ecosystem (Raw-material suppliers, cell/pack manufacturers, system integrators, end-users, recyclers)

- Porter’s Five Forces Analysis

- By Value (USD millions) – KSA, 2019-2024

- By Volume (MWh or number of units) – KSA, 2019-2024

- By Average Selling Price (ASP) per kWh or per battery pack – KSA, 2019-2024

- Current Installed Capacity / Shipment Trends – KSA, 2019-2024

- By Product Chemistry (In Value %)

Lithium Nickel Manganese Cobalt (NMC)

Lithium Iron Phosphate (LFP)

Lithium Cobalt Oxide (LCO)

Lithium Manganese Oxide (LMO)

Other emerging chemistries (e.g., Solid-state, Lithium Titanate) - By Cell Form Factor (In Value %)

Cylindrical

Prismatic

Pouch - By Application / End-Use (In Value %)

Electric Vehicles (EVs)

Stationary Energy Storage Systems

Consumer Electronics & Portable Devices

Industrial Equipment & Power Tools - By Battery Pack Power Capacity Range (In Value %)

<10 kWh

10 kWh to 100 kWh

>100 kWh - By Region / Geography within KSA (In Value %)

Central Region

Eastern Region

Western Region

Northern & Southern Regions - By Manufacturing & Localisation Status (In Value %)

Imported cells/packs

Local assembly of imported components

Fully domestic manufacturing in KSA

- Market Share of Major Players (By Value/Volume) – latest available year

- Cross-Comparison Parameters (Company Overview, Business Strategy , Recent Developments & Investments, Strengths, Weaknesses, Manufacturing/Assembly Capacity in KSA, Revenue & Revenue by Product Type, Distribution & Channel Network in KSA, Local Content Level, R&D/Innovation Capability, Margins & Cost Structure, Partnerships & Joint Ventures)

- Detailed Profiles of Major Companies

BYD Co Ltd – China

LG Chem Ltd – South Korea

Samsung SDI Co Ltd – South Korea

Panasonic Holdings Corp – Japan

CATL (Contemporary Amperex Technology Co.) – China

Saft Group S.A. – France

Tesla Inc. – USA

GS Yuasa Corp – Japan

VARTA AG – Germany

Hitachi Ltd – Japan

Toshiba Corp – Japan

Systems LLC – USA

Yinlong Energy China Ltd. – China

Obeikan Investment Group – Saudi Arabia (local investor)

Saudi Arabian Mining Company (Ma’aden) – Saudi Arabia

- Demand-Side Landscape by End–Sector

- Buyer Behaviour & Procurement Patterns

- Cost Structure & Pricing Dynamics

- Total Cost of Ownership (TCO) and Return on Investment (ROI) for major applications

- Decision-Making Framework & Buying Criteria

- By Value (USD millions), 2025-2030

- By Volume (MWh or units), 2025-2030

- By Average Selling Price (ASP), 2025-2030