Market Overview

The KSA logistics & warehousing market is valued at approximately USD 37.8 billion in 2024, which is expected to grow at a CAGR of ~10%. This scale has been driven by Vision 2030–aligned infrastructure investment, accelerated ecommerce adoption, growth in FMCG, retail, healthcare and industrial demand, and expanding cold chain needs. Public investment exceeding SAR 100 billion in SEZs, dry ports, and transport corridors has further accelerated uptake

Riyadh and Jeddah serve as dominant logistics hubs due to their proximity to major ports (King Abdulaziz Port, Jeddah Islamic Port) and central industrial clusters; Riyadh benefits from inland transport infrastructure linking Dammam and NEOM corridor, while Jeddah draws international maritime flows and SEZ developments. Eastern Province hubs such as Jubail and Dammam dominate due to industrial activity and direct rail/port connectivity for petrochemical and trade flows.

Market Segmentation

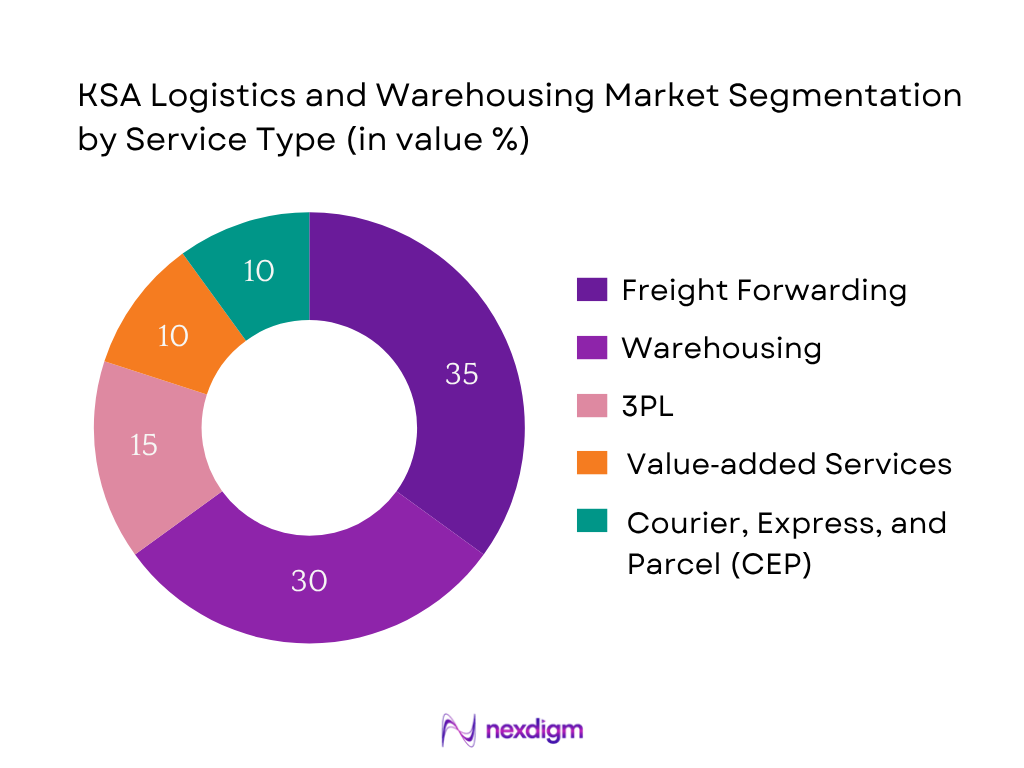

By Service Type

Freight Forwarding Services holds the dominant share (approx. 10 %) in 2024, owing to surging ecommerce demand, cold‑chain expansion, and growth in outsourced 3PL solutions. Firms across FMCG, retail, pharma, and industrial verticals increasingly prefer value‑added storage and distribution over transport-only options, boosting volume handled in modern warehouses and bonded storage.

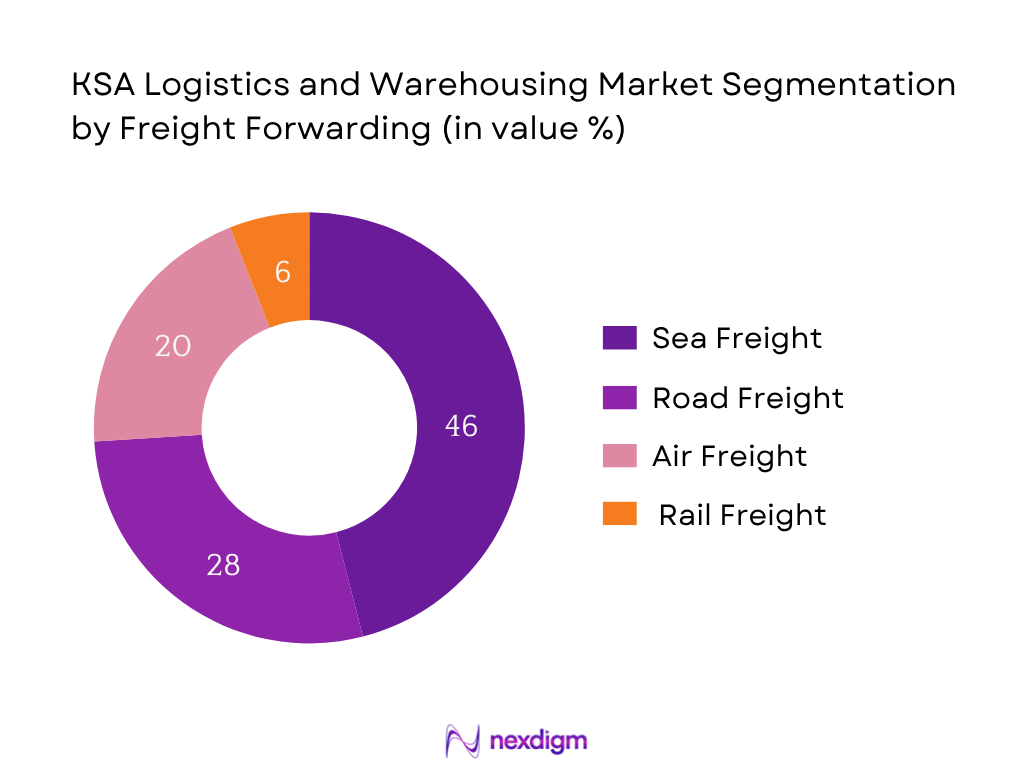

By Freight Forwarding

Sea Freight dominates the freight forwarding segment in Saudi Arabia in 2024, accounting for the largest share due to the country’s extensive coastline and deep-sea ports. Jeddah Islamic Port handled over 5.1 million TEUs of containerized cargo in 2023, while King Abdulaziz Port in Dammam processed more than 4.5 million tons of general cargo.

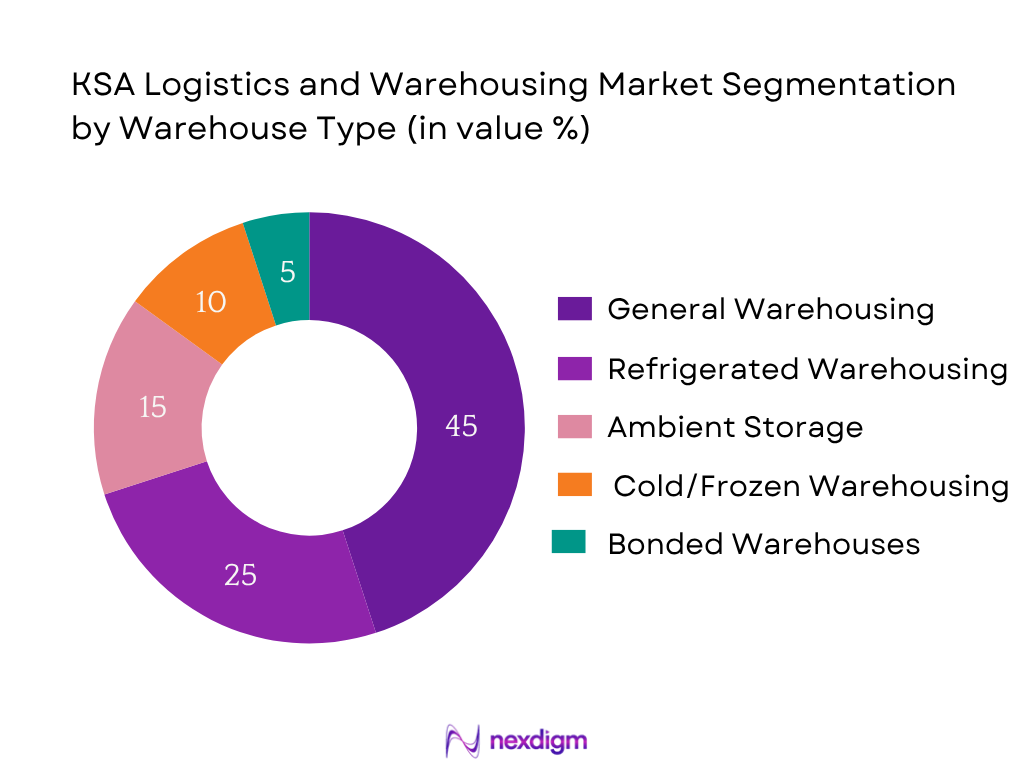

By Warehouse Type

General Warehousing leading due to high volumes of general merchandise, non-temperature sensitive goods and industrial inventory. However, Cold Storage is the fastest growing sub‑segment, reflecting rising perishable food and pharmaceutical logistics demand under SFDA regulation and consumer preference.

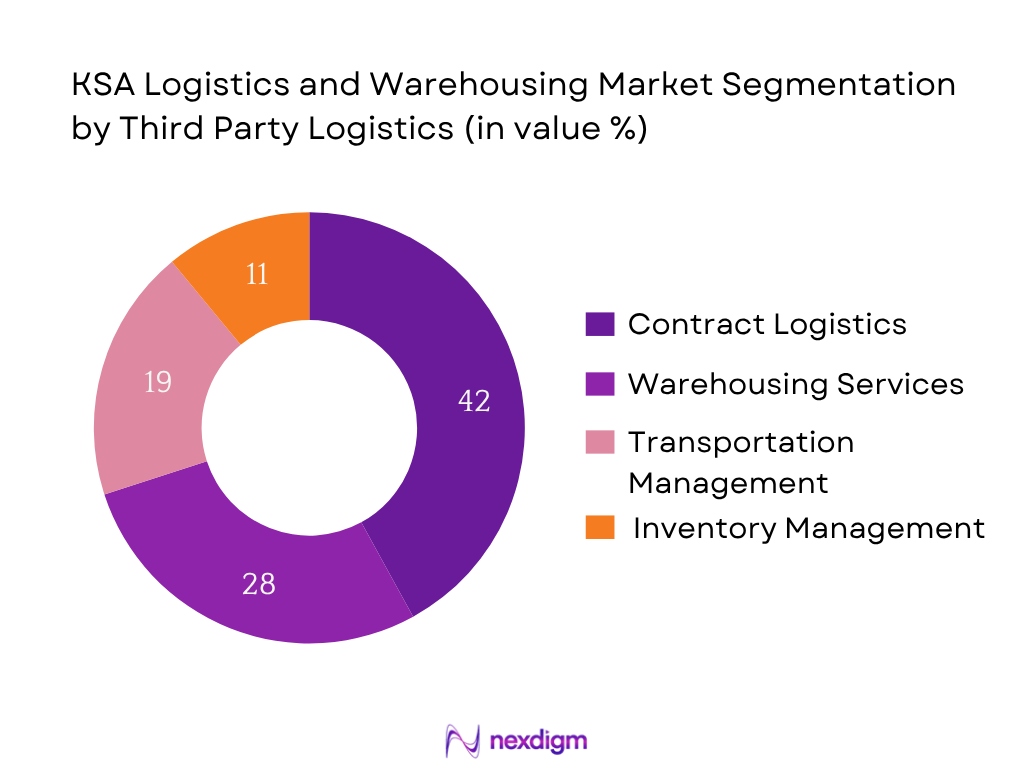

By Third-Party Logistics (3PL)

Contract Logistics holds the highest share among 3PL sub-segments in Saudi Arabia in 2024, driven by large-scale partnerships in FMCG, automotive, and healthcare sectors. In 2024, Saudi Arabia had over 20,000 registered logistics companies, with increasing private sector participation through long-term service contracts.

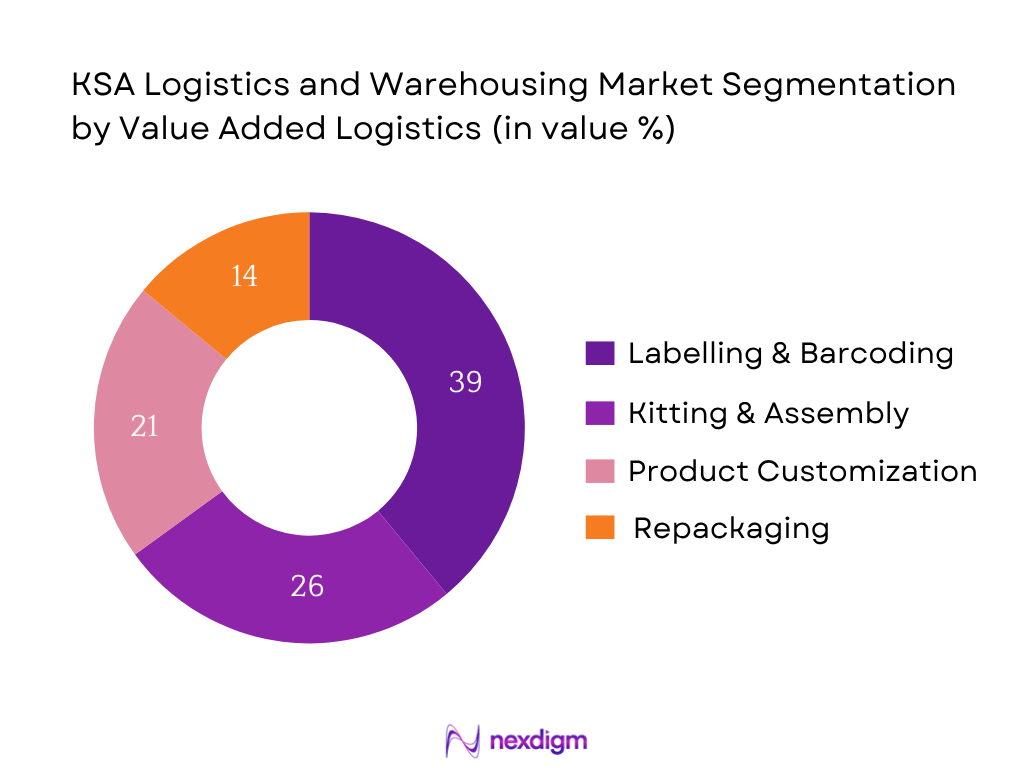

By Value-Added Logistics

Labelling & Barcoding is the leading sub-segment within value-added logistics in 2024, owing to SFDA regulations and retail compliance standards. Saudi Arabia imports large volumes of consumer electronics, cosmetics, and pharmaceuticals, which require precise localization and labeling for regulatory clearance.

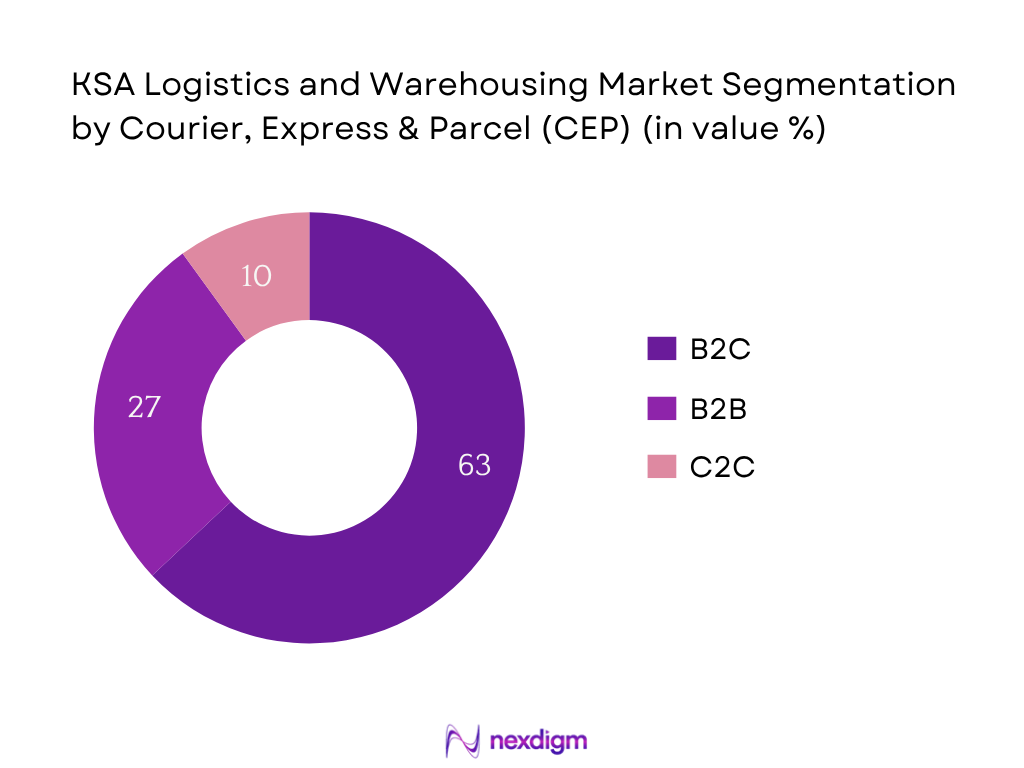

By Courier, Express & Parcel (CEP)

B2C (Business-to-Consumer) is the largest contributor to the CEP segment in 2024, accounting for the highest share due to the rapid growth of e-commerce and mobile delivery apps. In 2024, Saudi e-commerce transactions reached USD 52.6 billion, fueled by 32 million internet users and over 98% smartphone penetration.

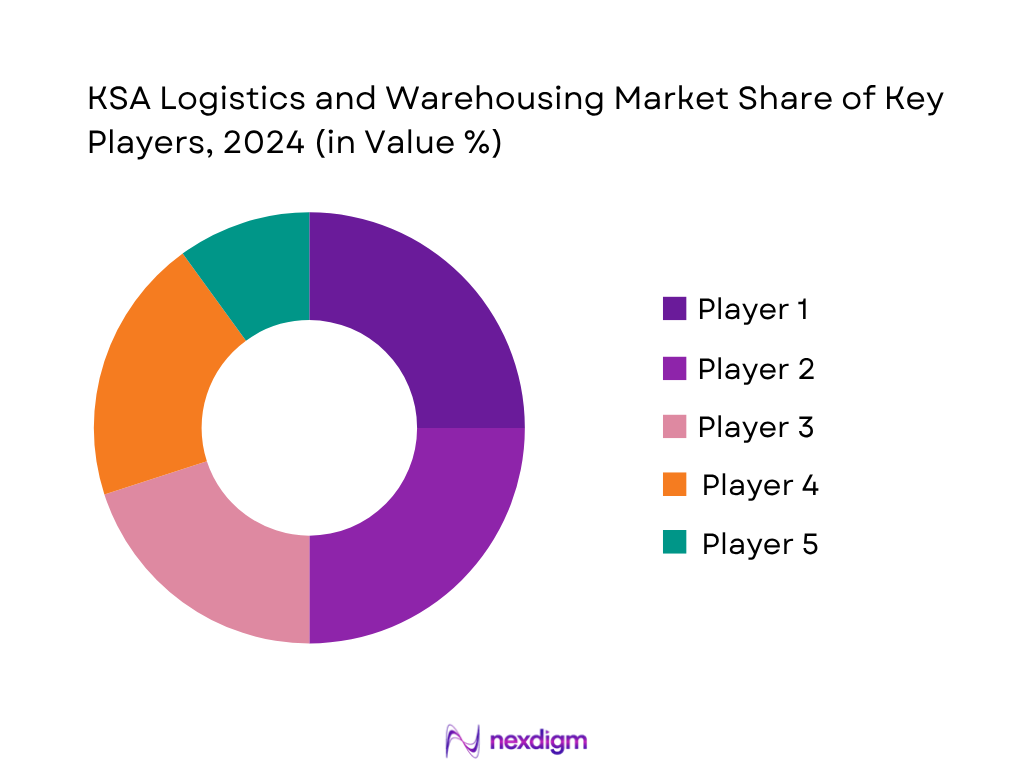

Competitive Landscape

The KSA logistics & warehousing market is led by a mix of international and domestic firms such as DHL, Bahri Logistics, Almajdouie, Agility, Aramex, Naqel Express, among others. This consolidation highlights how integrated, technology‑driven providers dominate physical storage, transport, and value‑added service delivery across SEZs, ports, and industrial zones.

| Company | Established | Headquarters | Network Coverage | Storage Capacity (sqm) | Cold‑Chain Share | Technology Adoption (WMS/IoT) | Service Mix (3PL, 4PL, JV, etc.) | SEZ/Dry‑Port Presence |

| DHL Saudi Arabia | 1969 | Bonn, Germany | – | – | – | – | – | – |

| Bahri Logistics | 1978 | Riyadh, KSA | – | – | – | – | – | – |

| Almajdouie Logistics | 1970s | Jeddah, KSA | – | – | – | – | – | – |

| Agility (KSA arm) | Global 1950s | Kuwait / Riyadh | – | – | – | – | – | – |

| Aramex (KSA operations) | 1982 | Dubai, UAE | – | – | – | – | – | – |

KSA Logistics and Warehousing Market Analysis

Growth Drivers

Strategic Position as Global Logistics Hub

Saudi Arabia’s strategic geography connects Red Sea and Gulf shipping lanes, reinforced by port handling capacities of over 130 million TEU at Jeddah Islamic Port and 105 million TEU at King Abdulaziz Port in Dammam. The country’s logistics upgrades helped it climb 17 places in the World Bank’s Logistics Performance Index to rank 38 in 2023. As of early 2024, infrastructure enhancements—including port modernization investments of 4.5 billion SAR—enabled handling of more than 25 million tons of cargo annually at key ports. These tangible enhancements improve shipment frequency and customs integration, solidifying Saudi Arabia’s role as a regional hub for transit flows between Asia, Europe, and Africa.

Vision 2030 Investments in Logistics Infrastructure

In 2023, the Saudi government allocated budget to expand freight railway capacity to 12.8 million tons and 800,000 TEU-equivalent units via railway upgrades and dry‑port development. Road networks totaling over 627,000 km include 151,000 km of major highways, facilitating inland connectivity across major cities. By mid‑2024, over 3,690 km of secondary roads were under improvement. Combined, these investments—backed by National Transport & Logistics Strategy funding—are driving logistic efficiencies and reducing transit times by significant margins. The rapid infrastructure build supports capacity utilization in logistics parks and dry‑port zones across central and eastern regions.

Market Challenges

High Initial Capital for Automated Warehousing

Automating warehouse operations in Saudi Arabia requires heavy upfront capital, particularly for robotics, Automated Storage and Retrieval Systems (AS/RS), and IoT-enabled inventory tracking. The cost of industrial robots alone averaged USD 27,000 per unit globally in 2023, and in KSA this is compounded by import duties on specialized machinery. Local financing constraints mean operators rely heavily on foreign equipment imports, with over SAR 12 billion worth of machinery and transport equipment imported in early 2024. This creates a high barrier for SMEs in logistics to adopt automation, slowing sector-wide productivity gains despite Vision 2030 incentives.

Skilled Workforce Shortage in Advanced Logistics Tech

The logistics sector’s shift toward WMS, RFID, and AI-powered routing requires highly trained technicians and IT specialists. Yet, in Q1 2024, Saudi Arabia’s unemployment rate for nationals was 7.6%, while foreign workers accounted for over 76% of transport and storage roles. Only a small portion of vocational graduates specialize in supply chain IT, resulting in a talent gap for operating advanced systems. This shortage increases reliance on expatriate specialists, which raises operating costs and creates compliance challenges with Saudization targets.

Opportunities

Growth in Multi‑Modal Logistics Corridors

Saudi Arabia’s Landbridge railway project, spanning 1,300 km to connect the Red Sea to the Arabian Gulf, is expected to carry up to 3 million TEUs annually upon completion. The current rail freight network already handles 12.8 million tons per year, with capacity expansions underway. These corridors will integrate with major ports and industrial cities, enabling faster inland cargo movement, reducing heavy truck dependency, and supporting the shift to environmentally sustainable freight. This multimodal integration will open significant opportunities for new inland container depots and cross-docking facilities.

Rising Demand for Last‑Mile Delivery Hubs

The Kingdom’s urban population reached 36.5 million in 2024, with over 84% living in cities. High smartphone penetration—98% of the population—has driven online retail, increasing the need for micro-fulfilment centers. The number of registered commercial delivery service licenses rose by 34% from 2022 to 2024, reflecting growing demand for last‑mile solutions. Strategic placement of small-scale warehouses near urban clusters reduces delivery times from 2–3 days to same-day service, especially critical for FMCG and perishables.

Future Outlook

Over the forecast window, the KSA logistics & warehousing market is expected to exhibit robust growth, driven by continued investment in transport and industrial corridors, expansion of specialized cold‑chain logistics, and transformative digitalization aligned with Vision 2030. New SEZ development, rail‑road Landbridge completion, and rising ecommerce demand are expected to accelerate modern warehousing adoption and service depth.

Major Players

- DHL Supply Chain (KSA)

- Bahri Logistics

- Almajdouie Logistics

- Agility Logistics (Saudi arm)

- Aramex (KSA operations)

- Naqel Express

- Wared Logistics

- BSL Logistics

- ATC Logistics

- Advanced Storage Co.

- LogiPoint

- Kuehne + Nagel Saudi Arabia

- GAC Logistics (KSA)

- P. Moller‑Maersk Saudi Logistics

- Aiduk Logistics

Key Target Audience

- Major Retailers & E‑commerce Operators

- FMCG & Food & Beverage Corporates

- Industrial & Manufacturing Enterprises

- Pharmaceutical & Cold‑Chain Importers

- Real Estate & Industrial Park Developers

- Investments & Venture Capitalist Firms

- Government & Regulatory Bodies (Ministry of Transport, Saudi Customs Authority, Modon Industrial Cities)

- Infrastructure Investors in SEZ and Logistics Hubs

Research Methodology

Step 1: Identification of Key Variables

We first constructed a supply‑chain ecosystem map, capturing major stakeholders including port authorities, 3PL operators, SEZ developers, industrial cities and cold‑storage providers. This was based on secondary data from governmental databases and proprietary logistics platforms.

Step 2: Market Analysis and Construction

Historical revenue and capacity data (2019–2023) were compiled for the logistics and warehousing sub‑markets. We analyzed transport versus storage value splits, capacity utilization, rental rates, and throughput volumes to derive accurate estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on growth drivers and constraints were validated with CATI interviews involving logistics executives, port operators, industrial city managers, and government officials to ensure operational context and quantitative accuracy.

Step 4: Research Synthesis and Final Output

Engagements with major operators such as DHL, Bahri Logistics, and Almajdouie were conducted to gather granular insight into segment-level performance, technology adoption, service mix, and future expansion plans to corroborate the bottom‑up market sizing.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In‑Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Infrastructure Developments

- Business Cycle

- Supply Chain and Value Chain Analysis

- By Value (SAR Million), 2019-2024

- By Volume (Million SQM Warehousing Capacity / TEU Throughput), 2019-2024

- By Average Rental Rate (SAR/SQM/Month, Ambient vs Cold Storage), 2019-2024

- By Service Type (In Value %)

Freight Forwarding

Warehousing

3PL

Value Added Logistics

Courier, Express, and Parcel (CEP) - By End‑Use Industry (In Value %)

E‑Commerce & Retail

FMCG & Food & Beverage

Industrial & Automotive

Healthcare & Pharmaceuticals

Chemicals & Energy - By Region (In Value %)

Central Region

Eastern Region

Western Region

Northern & NEOM Corridor

Southern Region (Jazan, Abha)

- Executive Summary

- KSA Warehousing Market Ecosystem

- Value Chain Analysis of Warehousing Industry

- Trends in KSA Warehousing (Automation, Cold Chain, Green Warehousing)

Commercial Models in Warehousing (Public, Private, SEZ-based, Contract Warehousing) - Technological Innovations (WMS, RFID, IoT-enabled Storage)

- Cold Chain and Specialized Warehousing Overview

- Business Models of Major Warehouse Operators

- Challenges in Warehousing (High Capex, Regional Disparities, Workforce Skills)

- Benefits of Modern Warehousing Practices

- Cross-Comparison – Major Warehouse Operators in KSA

- KSA Warehousing Market Size (USD Billion), 2019–2024

- Market Segmentation by Warehouse Type (General, Cold, Ambient, Bonded, Automated) and By End-Use (Retail, FMCG, Pharma, Industrial, Others), 2024

- Future Market Size (USD Billion), 2025–2030

- Executive Summary

- KSA Third-Party Logistics (3PL) Ecosystem

- Value Chain Analysis of 3PL Services

- Trends in KSA 3PL Industry (Integrated Services, Contract Logistics, E-commerce Fulfilment)

- Commercial Models in 3PL (Dedicated, Shared, Contract-based)

- Technological Adoption in 3PL (TMS, AI Route Optimization, IoT Tracking)

- Overview of Major 3PL Service Offerings (Transportation, Warehousing, Inventory, Reverse Logistics)

- Business Models of Leading 3PL Providers

- Challenges in 3PL (Cost Pressure, Compliance, Skill Shortages)

- Key Benefits of Outsourcing Logistics to 3PL Providers

- Cross-Comparison – Major 3PL Providers in KSA

- KSA 3PL Market Size (USD Billion), 2019–2024

- Market Segmentation by Service Type (Contract Logistics, Warehousing, Transportation Management, Inventory Management) and By End-User (Retail, FMCG, Healthcare, Industrial, Others), 2024

- Future Market Size (USD Billion), 2025–2030

- Executive Summary

- KSA Freight Forwarding Market Ecosystem

- Value Chain Analysis of Freight Forwarding Market

- Trends in KSA Freight Forwarding Industry

- Commercial Models in Freight Forwarding (Sea, Air, Road, Rail)

- Technological Advancements in Freight Forwarding (Digital Booking, IoT, Blockchain)

- Freight Forwarding Aggregator Platforms Overview

- Business Models of Leading Freight Forwarding Operators

- Major Challenges Impacting Freight Forwarding (Port Congestion, Customs Delays, Cost Volatility)

- Key Benefits of Digital Freight Forwarding Platforms

- Cross-Comparison – Major Freight Forwarding Companies in KSA

- KSA Freight Forwarding Market Size (USD Billion), 2019–2024

- Market Segmentation by Type of Cargo (Containerized, Bulk, Liquid, Perishable) and Mode (Sea, Air, Road, Rail), 2024

- Future Market Size (USD Billion), 2025–2030

- Executive Summary

- KSA Value-Added Logistics Services Ecosystem

- Value Chain Analysis of Value-Added Logistics (VAL)

- Trends in KSA VAL Market (E-commerce Customization, Last-mile Kitting)

- Commercial Models in VAL (Bundled with 3PL, Standalone Offerings)

- Technological Innovations (Automated Sorting, Barcode Systems, Cloud-based Tracking)

- Overview of Core VAL Offerings (Labelling, Kitting, Customization, Repackaging)

- Business Models of Major VAL Providers

- Challenges in VAL (Regulatory Compliance, Cost Control, Speed)

- Benefits of VAL for End-Users (Retailers, Manufacturers, Pharma)

- Cross-Comparison – Major VAL Providers in KSA

- KSA VAL Market Size (USD Billion), 2019–2024

- Market Segmentation by Service Type (Labelling, Kitting, Product Customization, Repackaging) and By End-User (Retail, FMCG, Healthcare, Industrial, Others), 2024

- Future Market Size (USD Billion), 2025–2030

- Executive Summary

- KSA CEP Market Ecosystem

- Value Chain Analysis of CEP Industry

- Trends in KSA CEP (E-commerce Growth, Same-day Delivery, Micro-fulfilment)

- Commercial Models in CEP (B2C, B2B, C2C)

- Technological Innovations (Route Optimization, Real-time Tracking, Automated Sorting)

- Overview of Domestic vs International CEP Services

- Business Models of Major CEP Operators

- Challenges in CEP (Last-mile Costs, Address Standardization, Delivery Speed)

- Benefits of Advanced CEP Services for E-commerce and Retail

- Cross-Comparison – Major CEP Operators in KSA

- KSA CEP Market Size (USD Billion), 2019–2024

- Market Segmentation by Service Type (B2C, B2B, C2C) and By Delivery Time (Same-day, Next-day, Standard), 2024

- Future Market Size (USD Billion), 2025–2030

- Growth Drivers

Strategic Position as Global Logistics Hub (Red Sea & Gulf Ports)

Vision 2030 Investments in Logistics Infrastructure

Rapid E‑Commerce Growth Driving Fulfilment Demand

SEZ Incentives and Customs Facilitation

Cold‑Chain Expansion for Food & Pharma - Market Challenges

High Initial Capital for Automated Warehousing

Skilled Workforce Shortage in Advanced Logistics Tech

Port Congestion and Customs Clearance Delays

Uneven Infrastructure Development Across Regions

Regulatory Compliance and Saudization Targets - Opportunities

Growth in Multi‑Modal Logistics Corridors

Rising Demand for Last‑Mile Delivery Hubs

Warehousing for Industrial Clusters (NEOM, Sudair, Ras Al‑Khair)

Metal & Commodity Storage Expansion (LME‑Listed Warehouses)

Renewable‑Energy‑Powered Warehousing - Trends

Green Warehousing and Sustainable Building Standards

AI‑Driven Inventory & Demand Forecasting - Government Regulation

SEZ Policy & Duty‑Free Incentives

Modon Industrial City Warehousing Guidelines - SWOT Analysis

- Stake Ecosystem (Ports, Customs, Transporters, 3PLs)

- Porter’s Five Forces Analysis

- Market Demand and Utilization (Pallet Positions, Throughput)

- Purchasing Power and Budget Allocations (End‑User Sectors)

- Regulatory and Compliance Requirements (Temperature Control, Safety Standards)

- Needs, Desires, and Pain Point Analysis (Visibility, Turnaround Time, Cost)

- Decision‑Making Process (Operator Selection Criteria)

- Market Share of Major Players on the Basis of Value/Volume

Market Share by Warehouse Type (Ambient, Cold‑Chain, Bonded) - Cross Comparison Parameters (Company Overview, Network Coverage, Warehouse Capacity, Technology Adoption Level, Cold‑Chain Portfolio Share, Operating Margins, Distribution Footprint, Service Mix, Strategic Partnerships)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs and Storage Type for Major Players

- Detailed Profiles of Major Companies

DHL Supply Chain (KSA)

Wared Logistics

Bahri Logistics

Almajdouie Logistics

A.P. Moller‑Maersk Saudi Logistics

ATC Logistics

BSL Logistics

Aiduk Logistics

Advanced Storage Co.

Arabian Logistics Solutions

LogiPoint

Zajil Express & Logistics

Agility (Saudi Arm)

GAC KSA Logistics

Kuehne + Nagel Saudi Arabia

- By Value, 2025-2030

- By Volume (Capacity in SQM / TEU), 2025-2030

- By Average Rental Rate, 2025-2030