Market Overview

The KSA loitering munition market is experiencing significant growth, with an estimated market size reaching USD ~ billion. The market is primarily driven by the increasing demand for advanced defense systems, including autonomous precision strike capabilities. Technological advancements in loitering munitions and growing defense budgets have been key contributors to market growth. The increasing adoption of loitering munitions in military operations, particularly for surveillance and targeted strikes, is expected to further fuel the market’s expansion.

Based on a recent historical assessment, the Kingdom of Saudi Arabia (KSA) continues to be a dominant player in the loitering munition market due to its strategic military advancements and geopolitical importance in the Middle East. Key cities such as Riyadh and Dhahran have been at the forefront of defense innovation, supported by strong government investments in defense modernization programs. These cities serve as hubs for defense technology development, contributing significantly to the market’s dominance in the region.

Market Segmentation

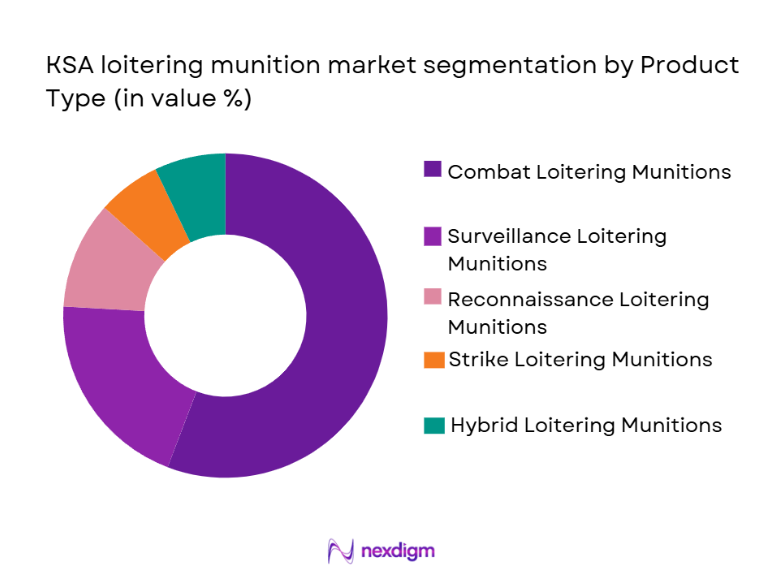

By Product Type

The KSA loitering munition market is segmented by product type into combat loitering munitions, surveillance loitering munitions, reconnaissance loitering munitions, strike loitering munitions, and hybrid loitering munitions. Recently, combat loitering munitions have dominated the market share due to their widespread use in precision strike missions and military operations. These systems provide effective on-the-ground support, helping military forces conduct surgical strikes with minimal collateral damage, which is a key factor in their popularity among military units. The demand for these systems is expected to increase, driven by their adaptability and effectiveness in modern warfare environments.

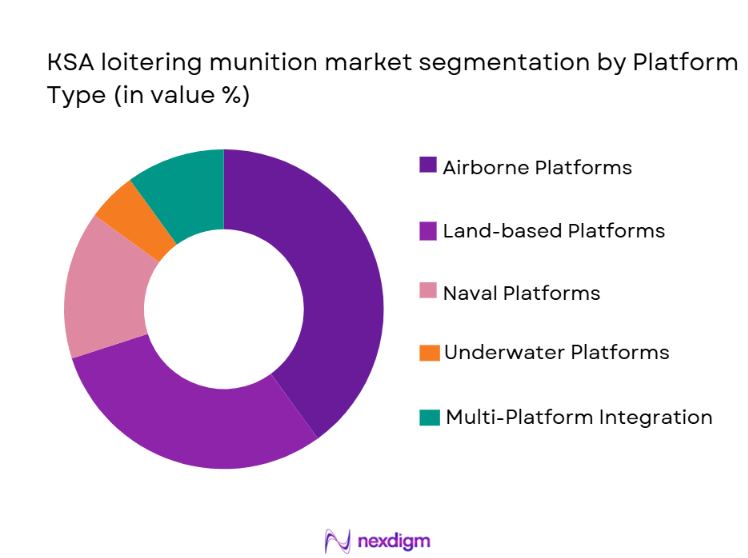

By Platform Type

The market is also segmented by platform type into land-based platforms, airborne platforms, naval platforms, underwater platforms, and multi-platform integration. Airborne platforms are the dominant segment due to their unmatched mobility, long-range capabilities, and efficiency in conducting operations over extended areas. Airborne loitering munitions have become increasingly popular due to their ability to cover a wide area and provide real-time intelligence for military forces. Their integration with other advanced technologies, including autonomous systems, further boosts their demand and market share.

Competitive Landscape

The KSA loitering munition market is highly competitive, with several major players holding a significant market share. Key companies focus on innovation and technology to maintain their position in the market. Consolidation is likely in the coming years as companies merge or form strategic alliances to enhance their technological capabilities. This competitive environment fosters rapid innovation and technological advancements, particularly in autonomous loitering munition systems. The involvement of global defense giants and regional players ensures that the market remains dynamic and evolving.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Rheinmetall Defence | 1889 | Düsseldorf, Germany | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | Farnborough, UK | ~ | ~ | ~ | ~ | ~ |

KSA Loitering Munition Market Analysis

Growth Drivers

Technological Advancements

The continuous evolution of technology, particularly in artificial intelligence (AI), machine learning, and autonomous systems, is a major growth driver in the KSA loitering munition market. These advancements allow loitering munitions to operate with greater precision, autonomy, and efficiency. AI integration enables these munitions to autonomously detect, track, and engage targets in real time, reducing the dependency on human operators. This capability significantly enhances operational efficiency, reduces collateral damage, and improves overall mission success. As these systems become more advanced, they are increasingly adopted by military forces, thereby fueling the growth of the market. Additionally, advancements in battery life, sensor technology, and flight control systems have enhanced the operational capabilities of loitering munitions, allowing them to cover wider areas and perform more complex tasks. This technological shift is expected to drive the continued adoption of loitering munitions in defense operations, further accelerating the market’s growth.

Increased Defense Budgets

The growing defense budgets, particularly in KSA, are another key factor driving the market. As the region faces increasing geopolitical tensions and security threats, defense spending has become a priority for the government. These higher budgets enable investments in advanced weaponry, including loitering munitions, as part of the broader defense modernization programs. This financial commitment to improving military capabilities, coupled with a push for advanced technology solutions, is expected to significantly contribute to the expansion of the loitering munition market in the coming years.

Market Challenges

High Development Costs

A significant challenge facing the KSA loitering munition market is the high development costs associated with producing advanced systems. The integration of cutting-edge technologies, including AI, autonomous systems, and real-time surveillance, increases manufacturing expenses. These costs can hinder widespread adoption, particularly for countries or smaller defense agencies with limited budgets. Additionally, the continuous need for upgrades and maintenance of these high-tech systems adds to the overall cost, making it difficult for some players to keep up with innovation. While larger defense contractors may absorb these costs, smaller organizations face barriers to entry, limiting competition in the market. The high initial costs may also discourage potential buyers who are unable to justify the investment, slowing the pace of market growth in certain regions.

Geopolitical Tensions and Export Restrictions

Geopolitical tensions in the Middle East represent another challenge in the loitering munition market. As regional instability continues, there are concerns regarding the potential misuse of advanced weaponry, leading to increased scrutiny and export restrictions. KSA, in particular, faces challenges in sourcing components or full systems from certain international suppliers due to political issues. These export restrictions can affect the timely delivery of loitering munitions and may create bottlenecks in market growth. Moreover, diplomatic relations and military alliances play a significant role in the availability of advanced defense technology. These challenges have the potential to limit the growth and expansion of the loitering munition market, particularly in the Middle East.

Opportunities

Growing Counter-Terrorism Demand

One of the most significant opportunities in the KSA loitering munition market is the rising demand for advanced solutions in counter-terrorism operations. Loitering munitions offer unparalleled advantages in targeting precision, reducing collateral damage, and providing real-time surveillance in complex, urban combat situations. These systems can be deployed in diverse scenarios, including counterinsurgency and border patrol missions, which are crucial for KSA and neighboring countries that are battling terrorism and extremism. With the increasing prevalence of asymmetric warfare, loitering munitions have emerged as an ideal solution for military forces looking for effective counter-terrorism tools. As the demand for such systems grows, manufacturers are likely to develop more specialized models, further enhancing the market’s expansion in the region.

Defense Collaborations and Alliances

Another lucrative opportunity lies in the formation of defense collaborations and international alliances. KSA has been actively seeking partnerships with global powers and neighboring nations to strengthen its defense capabilities, particularly with the rise of regional conflicts. Collaborative defense programs and joint ventures can provide access to cutting-edge technology, allowing KSA to enhance its loitering munition systems while reducing costs through shared resources. These alliances also present opportunities for technology transfer, enabling KSA to develop indigenous systems that meet its specific operational requirements. Furthermore, the growing number of defense collaborations globally enhances the overall demand for loitering munitions, creating new avenues for growth in the market. As countries continue to prioritize defense and security, opportunities for international partnerships will continue to drive the market forward.

Future Outlook

The future outlook for the KSA loitering munition market is highly promising, with continued growth expected over the next several years. Advancements in technology, particularly in AI and autonomous systems, will play a key role in shaping the market. Increased defense spending, coupled with rising geopolitical tensions, will further fuel the demand for loitering munitions. Additionally, regulatory support for defense innovation and modernization programs will provide further impetus for market growth. Manufacturers will continue to develop next-generation systems with enhanced capabilities, ensuring that the market remains dynamic and responsive to emerging defense needs.

Major Players

- Rheinmetall Defence

- Israel Aerospace Industries

- Northrop Grumman

- General Dynamics

- BAE Systems

- Thales Group

- Lockheed Martin

- Raytheon Technologies

- Leonardo S.p.A.

- L3 Technologies

- MBDA

- Kongsberg Gruppen

- Dynetics

- Saab Group

- Elbit Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military agencies

- Armed forces procurement officers

- Homeland security organizations

- International defense collaborations

- Military equipment distributors

Research Methodology

Step 1: Identification of Key Variables

The first step in our research methodology involves identifying the key variables that affect the loitering munition market. This includes understanding technological advancements, defense budgets, market drivers, and geopolitical factors that influence the demand for loitering munitions.

Step 2: Market Analysis and Construction

We then conduct a comprehensive analysis of the market, constructing a detailed framework for segmentation, growth drivers, challenges, and opportunities. This step involves gathering both primary and secondary data to ensure accuracy and depth in our market insights.

Step 3: Hypothesis Validation and Expert Consultation

Next, we validate the hypotheses through expert consultations, gathering insights from key industry players, military officials, and defense analysts. This ensures the data is relevant, accurate, and reflective of real-world market conditions.

Step 4: Research Synthesis and Final Output

In the final step, all the research findings are synthesized into a comprehensive market report. This includes analyzing the data, identifying trends, and providing actionable insights to help stakeholders make informed decisions regarding the loitering munition market.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense budgets and modernization efforts

Increased demand for precision strike capabilities

Technological advancements in loitering munition systems - Market Challenges

High cost of development and procurement

Complexities in integration with existing defense systems

Geopolitical tensions and export restrictions - Market Opportunities

Growing defense expenditure in the Middle East

Expanding use in counter-terrorism and counter-insurgency operations

Collaboration opportunities with international defense organizations - Trends

Shift towards autonomous loitering munitions

Integration of AI and machine learning for target identification

Emerging interest in loitering munitions for homeland security applications - Government Regulations

International arms trade regulations

Export control laws

Standards for unmanned systems and autonomous weapons

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Combat Loitering Munitions

Surveillance Loitering Munitions

Reconnaissance Loitering Munitions

Strike Loitering Munitions

Hybrid Loitering Munitions - By Platform Type (In Value%)

Land-based Platforms

Airborne Platforms

Naval Platforms

Underwater Platforms

Multi-platform Integration - By Fitment Type (In Value%)

Man-Portable Systems

Vehicle-mounted Systems

Aircraft-mounted Systems

Naval-based Fitments

Integrated Systems - By EndUser Segment (In Value%)

Military

Defense Contractors

Government Agencies

Private Sector Security

Research Institutions - By Procurement Channel (In Value%)

Direct Procurement by Government

Defense Contractors’ Procurement

Third-Party Distributors

Military Alliances

Private Security Firms

- Market Share Analysis

- CrossComparison Parameters (Market Share, Growth Rate, Technological Advancements, Pricing Strategies, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Rheinmetall Defence

Israel Aerospace Industries (IAI)

Northrop Grumman

General Dynamics

BAE Systems

Thales Group

Lockheed Martin

Raytheon Technologies

Leonardo S.p.A.

L3 Technologies

MBDA

Kongsberg Gruppen

Dynetics

Saab Group

Elbit Systems

- Military Forces

- Private Military Contractors

- Government and Law Enforcement Agencies

- Research and Development Institutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035