Market Overview

The KSA Machine Learning in Healthcare market is valued at USD ~ million, reflecting accelerating institutional spend on advanced analytics, clinical AI, and automated decision-support systems across the healthcare continuum. Demand is structurally anchored in the need to improve diagnostic throughput, manage rising chronic disease complexity, and optimize operational efficiency across hospitals, diagnostic chains, and payer systems. Machine learning applications are increasingly embedded into imaging workflows, risk stratification engines, and administrative automation, making the market strategically critical to national healthcare performance, cost containment, and quality-of-care objectives.

Within KSA, Riyadh dominates adoption due to its concentration of national healthcare authorities, tertiary hospitals, digital health command centers, and centralized procurement programs that drive enterprise-scale deployments. Jeddah follows as a major hub supported by large referral hospitals, diagnostic networks, and cross-regional patient flows that benefit from imaging and predictive analytics. Globally, the United States and select European countries influence technology supply through leadership in cloud infrastructure, medical imaging AI platforms, and enterprise health IT ecosystems, which form the backbone of most machine learning deployments implemented within KSA healthcare institutions.

Market Segmentation

By Application Area

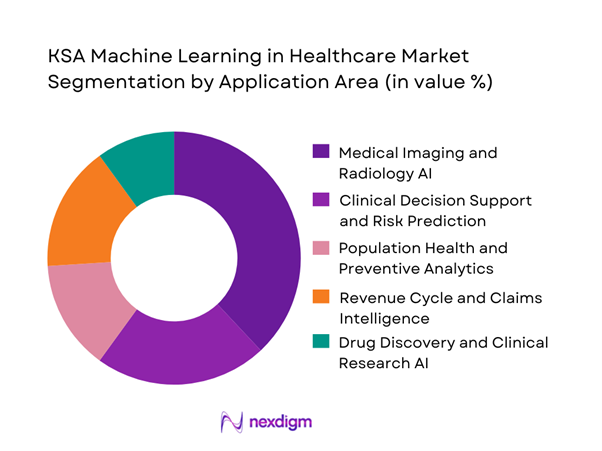

The KSA Machine Learning in Healthcare market is segmented by application area into medical imaging and radiology AI, clinical decision support and risk prediction, population health and preventive analytics, revenue cycle and claims intelligence, and drug discovery and clinical research AI. Medical imaging and radiology AI dominates this segmentation due to its direct and measurable impact on provider productivity and clinical turnaround times. Imaging workflows generate large volumes of structured data that are well-suited for machine learning, enabling faster validation and safer integration into clinical operations. Hospitals prioritize imaging AI to address radiologist shortages, reduce reporting backlogs, and improve diagnostic consistency. The ability to deploy imaging AI without disrupting core care pathways further strengthens its dominance, making it the most commercially scalable and institutionally accepted application segment in the market.

By End-Use Customer Type

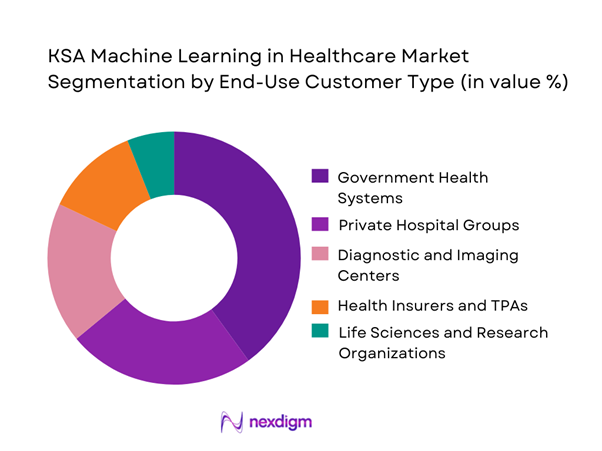

The KSA Machine Learning in Healthcare market is also segmented by end-use customer type into government health systems, private hospital groups, diagnostic and imaging centers, health insurers and TPAs, and life sciences and research organizations. Government health systems hold the dominant position in this segmentation due to their scale, centralized governance, and ability to mandate standardized digital and AI adoption across multiple facilities. These entities operate the largest integrated care networks and population health programs, making them natural adopters of predictive analytics and enterprise ML platforms. Government-backed deployments also benefit from coordinated funding, regulatory alignment, and national data initiatives, allowing machine learning solutions to be rolled out across regions with higher utilization intensity compared to fragmented private-sector adoption.

Competitive Landscape

The KSA Machine Learning in Healthcare market is dominated by a few major players, including Saudi Company for Artificial Intelligence and global or regional brands like Microsoft, Oracle Health, and Siemens Healthineers. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | KSA Delivery Model | Core ML-in-Healthcare Focus | Primary Buyer Segment | Integration Strength (EHR/PACS/LIS) | Data Residency & Privacy Posture | Security & Compliance Readiness | Typical Deployment Pattern |

| Lean Business Services | 2019 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| solutions by stc | 1998 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Saudi Company for Artificial Intelligence (SCAI) | 2021 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Microsoft (Azure) | 1975 | Redmond, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Oracle Health (Cerner) | 1977 | Austin, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Machine Learning in Healthcare Market Analysis

Growth Drivers

Rising Diagnostic and Imaging Workload

The increasing diagnostic burden across Saudi Arabia’s healthcare system is placing sustained pressure on radiology, pathology, and imaging departments. Higher patient inflow in emergency care, oncology screening programs, cardiovascular diagnostics, and trauma services has led to significant growth in imaging volumes and case complexity. This has intensified turnaround time expectations while radiologist availability remains constrained. Machine learning solutions are increasingly adopted to automate image triage, flag high-risk findings, prioritize worklists, and support preliminary interpretation. These tools allow clinicians to focus on complex cases while routine assessments are streamlined. From an operational standpoint, ML improves reporting consistency, reduces manual review fatigue, and strengthens quality assurance processes. As diagnostic demand continues to rise across public and private providers, imaging-focused ML deployments are viewed as a critical lever for sustaining service levels, clinician productivity, and patient safety.

Healthcare Digital Transformation Programs

Healthcare digital transformation initiatives across Saudi Arabia are acting as a structural enabler for machine learning adoption. Large-scale modernization of electronic health records, imaging archives, hospital information systems, and data exchange platforms is creating standardized digital foundations required for advanced analytics. As healthcare organizations migrate from siloed systems to interoperable architectures, machine learning can be embedded directly into clinical and administrative workflows rather than operating as standalone tools. These programs also improve data availability, data governance, and system integration capabilities, which are essential for reliable ML performance. Additionally, digital transformation has elevated leadership awareness of data-driven decision making, accelerating executive sponsorship for AI initiatives. As a result, machine learning is increasingly positioned not as an experimental technology, but as a core capability supporting efficiency, quality, and system-wide performance improvement.

Challenges

Data Quality and Interoperability Gaps

Despite progress in digitalization, data quality and interoperability challenges remain a major constraint on machine learning effectiveness in healthcare. Clinical data is often distributed across multiple legacy systems, with variations in data formats, coding standards, and documentation practices. Imaging metadata, clinical notes, lab results, and administrative records are not always harmonized, limiting the completeness and reliability of training datasets. In multi-facility provider networks, inconsistencies in workflows and system configurations further complicate data aggregation. These issues increase preprocessing effort, reduce model accuracy, and slow deployment timelines. Additionally, incomplete or biased datasets raise concerns around model generalizability and clinical safety. Until interoperability improves and data governance frameworks mature, organizations may struggle to scale machine learning solutions beyond isolated departments or pilot projects.

Clinical Adoption and Workflow Resistance

Clinical adoption remains a non-technical barrier that significantly affects machine learning utilization. Many clinicians are cautious about incorporating algorithm-driven outputs into diagnostic and treatment decisions, particularly when model logic is not transparent or easily explainable. Concerns related to accountability, medico-legal risk, and over-reliance on automated recommendations can lead to hesitancy. Workflow disruption is another challenge, as tools that require additional clicks, separate dashboards, or parallel processes often face resistance in high-pressure clinical environments. If machine learning outputs are not seamlessly integrated into existing systems and aligned with clinical decision pathways, adoption tends to remain superficial. Overcoming this challenge requires strong clinical engagement, training, explainability features, and workflow-native deployment models that support clinicians rather than compete with established practices.

Opportunities

Enterprise-Scale Imaging AI Rollouts

Large hospital groups and integrated care networks in Saudi Arabia present significant opportunities for enterprise-scale imaging AI deployment. Once an imaging ML solution is clinically validated and operationally approved, it can be standardized across multiple hospitals, diagnostic centers, and outpatient facilities. This creates efficiencies in deployment, governance, and training while ensuring consistent diagnostic support across the network. Centralized PACS environments and shared reporting frameworks further support scalable rollouts. From a commercial perspective, enterprise implementations favor long-term licensing, platform subscriptions, and managed services, rather than one-off installations. Providers also benefit from centralized performance monitoring and continuous model improvement. As imaging volumes continue to grow, standardized AI deployment becomes a strategic approach to capacity management and service quality enhancement.

Predictive Population Health Programs

Machine learning offers strong opportunities in predictive population health management by enabling early identification of high-risk individuals and groups. By analyzing longitudinal clinical records, utilization patterns, and demographic indicators, ML models can support risk stratification for chronic diseases, hospital readmissions, and preventive screening programs. These capabilities are particularly relevant for national and regional health initiatives focused on improving long-term outcomes and optimizing resource allocation. Predictive insights allow healthcare systems to shift from reactive treatment models toward proactive intervention strategies. Additionally, population-level analytics support planning decisions related to workforce allocation, facility utilization, and preventive care prioritization. As healthcare stakeholders increasingly focus on value-based outcomes and system sustainability, predictive population health use cases are expected to gain strategic importance.

Future Outlook

The KSA Machine Learning in Healthcare market is positioned for sustained expansion as institutions shift from experimentation to full-scale operationalization. Strategic focus will move toward governance-ready platforms, clinically validated models, and integration-centric deployments that deliver measurable outcomes across care delivery, administration, and population health management.

Major Players

- Saudi Company for Artificial Intelligence

- solutions by stc

- Lean Business Services

- Elm Company

- Saudi Aramco Digital

- Microsoft

- Google Cloud

- Amazon Web Services

- Oracle Health

- IBM

- Siemens Healthineers

- GE HealthCare

- Philips

- NVIDIA

- SAS

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Public healthcare system administrators

- Private hospital group leadership

- Diagnostic and imaging network operators

- Health insurers and third-party administrators

- Healthcare IT and digital platform operators

- Cloud and AI infrastructure providers serving healthcare

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping stakeholders across providers, payers, regulators, and technology vendors. Key variables influencing adoption, spend behavior, and deployment readiness are identified through structured desk research.

Step 2: Market Analysis and Construction

Historical adoption patterns, deployment models, and solution mix are analyzed to construct the market framework. Emphasis is placed on understanding demand concentration across applications and end users.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through structured expert discussions with healthcare executives, IT leaders, and solution providers to assess real-world adoption dynamics and constraints.

Step 4: Research Synthesis and Final Output

Insights are synthesized into a consolidated market model, ensuring consistency across sizing, segmentation, and competitive analysis for a validated client-ready output.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Healthcare AI Usage and Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- KSA Healthcare Delivery and Digital Architecture

- Growth Drivers

Rising Diagnostic and Imaging Workload

Chronic Disease Management Complexity

Healthcare Digital Transformation Programs

Operational Efficiency and Cost Optimization

Data Availability and Interoperability Expansion - Challenges

Data Quality and Interoperability Gaps

Clinical Adoption and Workflow Resistance

Regulatory and Compliance Complexity

AI Talent and Skill Shortages

Cybersecurity and Data Privacy Risks - Opportunities

Enterprise-Scale Imaging AI Rollouts

Predictive Population Health Programs

Claims Automation and Utilization Management

Virtual Care and Remote Monitoring AI

Arabic Clinical NLP Solutions - Trends

- Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Solution Revenues vs Services Revenues, 2019–2024

- By Buyer Spend Split, 2019–2024

- By Application Area (in Value %)

Medical Imaging and Radiology AI

Clinical Decision Support and Risk Prediction

Population Health and Preventive Analytics

Revenue Cycle and Claims Intelligence

Drug Discovery and Clinical Research AI - By Data Modality (in Value %)

Medical Imaging Data

Structured EHR Data

Clinical Text and NLP

Physiological Waveform Data

Multi-Source Integrated Data - By Technology / Platform Type (in Value %)

Supervised Learning Models

Deep Learning and Neural Networks

Natural Language Processing Platforms

Computer Vision Platforms

Federated and Privacy-Preserving ML - By Deployment Model (in Value %)

On-Premise

Public Cloud

Hybrid Cloud

Embedded Device-Level AI - By End-Use Customer Type (in Value %)

Government Health Systems

Private Hospital Groups

Diagnostic and Imaging Centers

Health Insurers and TPAs

Life Sciences and Research Organizations - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Competition ecosystem overview

- Cross Comparison Parameters (SFDA readiness, PDPL compliance, EHR/PACS integration depth, Arabic NLP capability, deployment scalability, cybersecurity posture, MLOps maturity, clinical validation breadth)

- SWOT analysis of major players

Pricing and commercial model benchmarking - Detailed Profiles of Major Companies

Saudi Company for Artificial Intelligence

solutions by stc

Lean Business Services

Elm Company

Saudi Aramco Digital

Microsoft

Google Cloud

Amazon Web Services

Oracle Health

IBM

Siemens Healthineers

GE HealthCare

Philips

NVIDIA

SAS

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Solution Revenues vs Services Revenues, 2025–2030

- By Buyer Spend Split, 2025–2030