Market Overview

The KSA main battle tank market is valued at approximately USD ~ billion, driven primarily by the significant defense budgets allocated by the Kingdom. The market is influenced by increased geopolitical tensions in the Middle East, pushing for enhanced military capabilities. Moreover, the ongoing modernization of the Saudi Armed Forces has resulted in a surge in demand for advanced tanks and armored vehicles, including the development of local manufacturing capabilities in the region. By 2026, the market is expected to reach USD ~ billion based on current assessments.

Dominating countries in the KSA main battle tank market include Saudi Arabia, a key player in regional defense spending, and the United Arab Emirates. These countries have consistently increased their military expenditure due to security concerns, positioning them as strong markets for defense systems. The Kingdom’s strategic initiatives to boost domestic manufacturing capabilities and increase the number of locally-produced tanks are key factors behind the market’s expected growth. Saudi Arabia’s partnerships with global defense manufacturers are further enhancing its market dominance.

Market Segmentation

By Product Type

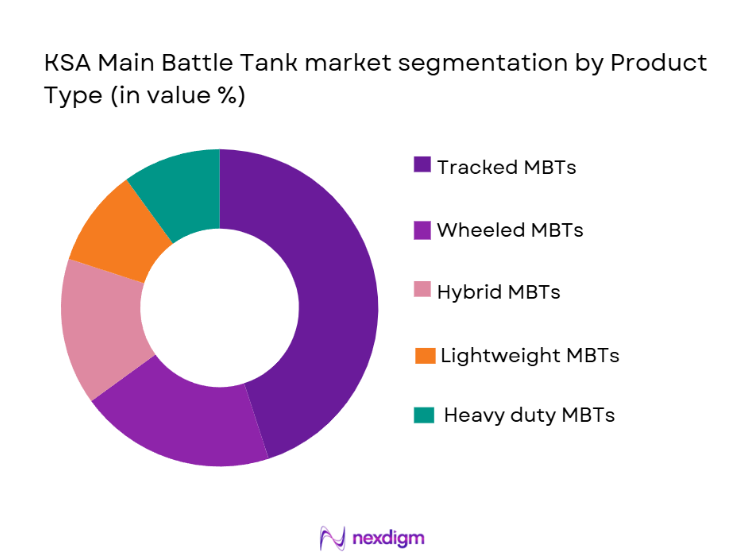

The KSA main battle tank market is segmented by product type into tracked main battle tanks, wheeled main battle tanks, hybrid main battle tanks, lightweight main battle tanks, and heavy-duty main battle tanks. Recently, tracked main battle tanks have a dominant market share due to factors such as their enhanced mobility, superior firepower, and proven durability in various combat scenarios. These tanks are increasingly preferred by the Saudi Armed Forces for their adaptability to both open terrain and urban warfare environments, making them a primary choice in military procurements.

By Platform Type

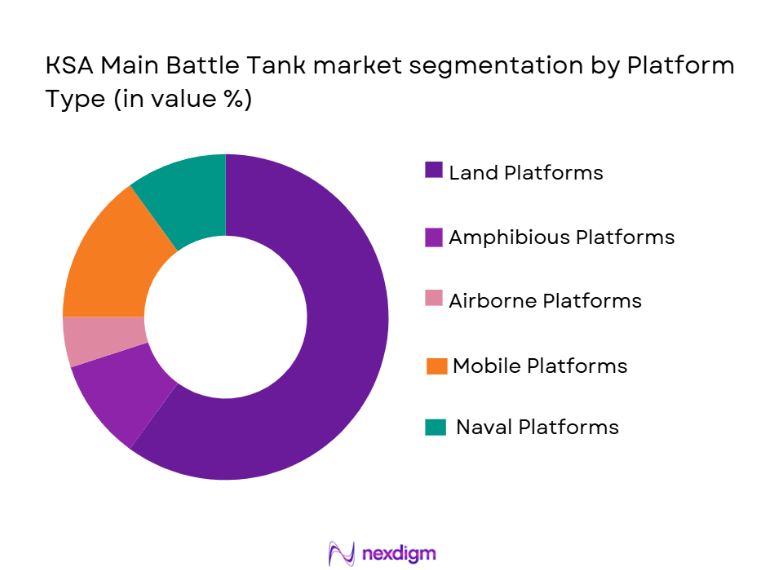

The KSA main battle tank market is segmented by platform type into land platforms, amphibious platforms, airborne platforms, mobile platforms, and naval platforms. Land platforms dominate the market, attributed to their extensive use in desert warfare scenarios that are prominent in the region. These platforms are designed to operate effectively in harsh environments, with features like sand-resistant systems and high mobility. As Saudi Arabia continues to invest in upgrading its land-based defense infrastructure, land platforms remain the most sought-after solution for military operations.

Competitive Landscape

The competitive landscape of the KSA main battle tank market is highly concentrated, with a few dominant players leading the industry. These companies engage in strategic collaborations, technological innovations, and long-term partnerships with the government to consolidate their position in the market. The influence of major defense manufacturers, both domestic and international, continues to shape the competitive dynamics, and regional players are also leveraging local production to meet military needs. As the market experiences steady growth, it is expected that consolidation among these players will intensify.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Saudi Arabian Military Industries (SAMI) | 2017 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall | 1889 | Düsseldorf, Germany | ~ | ~ | ~ | ~ | ~ |

KSA Main Battle Tank Market Analysis

Growth Drivers

Increased Defense Spending

The KSA main battle tank market is driven by significant increases in defense spending, especially as the Kingdom aims to modernize its armed forces. With Saudi Arabia’s defense budget expanding, the need for advanced military equipment, such as main battle tanks, is expected to rise. This trend is propelled by the strategic need to enhance the Kingdom’s military capabilities amid regional instability and security threats. Additionally, investments in local defense production are pushing the market further, with an increasing focus on self-reliance in defense technology.

Technological Advancements in Armored Vehicles

The continuous evolution of tank technology is a significant growth driver for the KSA market. Technological innovations such as enhanced armor, advanced fire control systems, and improved mobility have made main battle tanks more efficient and cost-effective. As global defense manufacturers introduce cutting-edge solutions to meet the demands of modern warfare, Saudi Arabia continues to integrate the latest technologies into its fleet, further fueling market growth. Technological advancements ensure that the Kingdom’s military capabilities remain competitive and robust in the face of emerging threats.

Market Challenges

High Operational and Maintenance Costs

A significant challenge for the KSA main battle tank market is the high operational and maintenance costs associated with these advanced military vehicles. The complex nature of modern main battle tanks, combined with the need for highly specialized training for military personnel, leads to increased expenditure. Moreover, these tanks require ongoing maintenance to ensure optimal performance, especially in challenging environments like the desert. The costs of spare parts, repairs, and upgrades further complicate budget allocation for defense procurement.

Geopolitical Instability and Political Barriers

The geopolitical instability in the Middle East presents a challenge for the KSA main battle tank market. While the Kingdom’sdefenseexpenditure continues to rise, the ongoing regional conflicts and political tensions complicate the implementation of large-scale defense programs. International trade agreements, sanctions, and political hurdles can also delay procurement decisions and the execution of military contracts, impacting the market’s overall growth. This unpredictability in the political environment presents a significant barrier to continuous market growth.

Opportunities

Collaborations with International Defense Manufacturers

One of the key opportunities in the KSA main battle tank market is the potential for partnerships and collaborations with leading global defense manufacturers. Saudi Arabia’s initiatives to localize production and reduce reliance on foreign imports open doors for joint ventures and technology transfer agreements with major players. Such collaborations are expected to not only enhance Saudi Arabia’s defense capabilities but also improve the technological sophistication of the Kingdom’s main battle tanks, allowing for cost-effective and state-of-the-art systems.

Focus on Exporting to Other Middle Eastern Countries

The KSA main battle tank market presents significant export opportunities, particularly within the Middle Eastern region. Asneighboringcountries increase their defense spending, Saudi Arabia’s advanced military vehicles, including main battle tanks, are poised to meet the growing demand for armored combat vehicles. Exporting to other countries in the region provides Saudi manufacturers with an opportunity to expand their market reach, diversify revenue sources, and establish themselves as key defense suppliers for the broader Middle Eastern market.

Future Outlook

The future outlook for the KSA main battle tank market looks promising, with steady growth expected over the next several years. The market is projected to benefit from technological advancements in tank design, including improved armor, mobility, and firepower. Furthermore, Saudi Arabia’s focus on local manufacturing and self-sufficiency in defense equipment is likely to strengthen the market’s position. Regulatory support, increasing defense budgets, and rising demand for advanced military equipment are expected to drive sustained growth, with the market becoming more competitive in the coming years.

Major Players

- Saudi Arabian Military Industries (SAMI)

- General Dynamics

- BAE Systems

- Lockheed Martin

- Rheinmetall

- Thales Group

- Kongsberg Defence & Aerospace

- Northrop Grumman

- Rostec

- Leonardo

- Denel

- AM General

- Oshkosh Defense

- Elbit Systems

- KMW (Krauss-Maffei Wegmann)

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Security agencies

- Defense technology suppliers

- International defense investors

- Export-focused defense firms

Research Methodology

Step 1: Identification of Key Variables

In this step, we identified the key variables impacting the KSA main battle tank market, including technological developments, defense spending, geopolitical factors, and regional security dynamics. These variables were considered crucial for analyzing the market trends and future outlook.

Step 2: Market Analysis and Construction

We conducted a detailed analysis of the KSA main battle tank market, constructing a model based on historical data, market segmentation, and current trends. The analysis also involved gathering data from credible sources, including government reports and industry research.

Step 3: Hypothesis Validation and Expert Consultation

To validate our findings, we consulted with defense industry experts, military officials, and market analysts. Their insights helped refine our understanding of market drivers, challenges, and opportunities, ensuring a comprehensive and accurate report.

Step 4: Research Synthesis and Final Output

In this final step, we synthesized all research data and expert inputs to prepare the report’s conclusions. The data was then formatted into a cohesive structure, ensuring all relevant aspects of the market were covered.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Defense Budgets

Technological Advancements in Armament

Rising Geopolitical Tensions in the Middle East - Market Challenges

High Maintenance Costs

Geopolitical Instability Impacting Defense Expenditures

Limited Domestic Production Capacity - Market Opportunities

Advancements in Tank Armor and Protection

Strategic Alliances with International Defense Corporations

Export Opportunities for Local Manufacturers - Trends

Increased Adoption of Autonomous Features

Shift Towards Modular Design for Flexibility

Growth of Urban Warfare Strategies Impacting Tank Designs - Government Regulations

International Export Regulations

Local Manufacturing Incentives

Environmental Impact and Compliance Regulations

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Tracked Main Battle Tanks

Wheeled Main Battle Tanks

Hybrid Main Battle Tanks

Lightweight Main Battle Tanks

Heavy Duty Main Battle Tanks - By Platform Type (In Value%)

Land Platforms

Amphibious Platforms

Airborne Platforms

Mobile Platforms

Naval Platforms - By Fitment Type (In Value%)

Combat Fitment

Logistical Fitment

Training Fitment

Support Fitment

Upgrades Fitment - By EndUser Segment (In Value%)

Defense Forces

Paramilitary Forces

Government & Law Enforcement

Private Security Firms

Foreign Military Sales - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Resellers

Government Contracts

International Bidding

Military Auctions

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, Fitment Type, EndUser Segment, Procurement Channel)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Saudi Arabian Military Industries (SAMI)

General Dynamics

BAE Systems

Lockheed Martin

Kuwait Military Industries

Thales Group

Rheinmetall

Kongsberg Defence & Aerospace

Northrop Grumman

Rostec

Leonardo

Denel

AM General

Oshkosh Defense

Elbit Systems

- Defense Forces Budget Allocation

- Demand for Modernization of Existing Fleet

- Private Security Firms Increasing Adoption

- Shift in Tactical Needs of End Users

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035