Market Overview

The KSA Man Portable Military Electronics market is valued at USD ~ billion, supported by increasing military expenditure and advanced technological innovation in defense systems. The market is driven by Saudi Arabia’s rising defense budget, focused modernization programs, and the adoption of cutting-edge technologies for enhanced operational capabilities. The market’s growth trajectory can also be attributed to the growing need for enhanced mobility, surveillance, and communication systems in military operations. In the past few years, investments from both the public and private sectors have further bolstered market development, while strong local and international demand for portable military electronics continues to grow.

Saudi Arabia remains the dominant player in the KSA Man Portable Military Electronics market due to its significant defense budget, ongoing modernization programs, and its strategic location within the Middle East. Riyadh, the capital city, is central to the defense and security sector in the kingdom, hosting key military procurement offices and defense agencies. The government has made substantial investments in developing state-of-the-art technologies in surveillance, communication, and weapons systems, making Saudi Arabia a key market driver in the region. Additionally, the country’s strategic defense alliances and military collaborations with global defense contractors strengthen its position as a leader in the market.

Market Segmentation

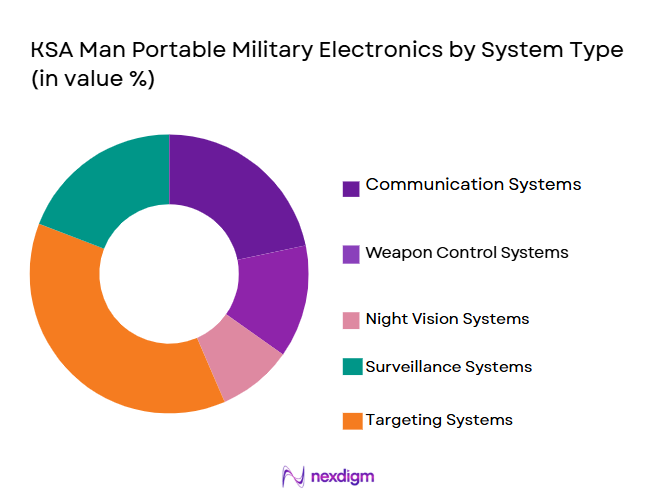

By System Type

The KSA Man Portable Military Electronics market is segmented by system type into communication systems, weapon control systems, night vision systems, surveillance systems, and targeting systems. Among these, communication systems hold the largest market share, driven by the increasing demand for real-time communication and secure data transmission in military operations. The need for continuous, reliable communication in battlefield scenarios has pushed forward technological advancements in portable communication devices. Companies are investing in secure, encrypted communication systems that cater to the need for military-grade solutions in remote and mobile environments. The development of compact and durable communication devices ensures that Saudi forces maintain operational readiness, contributing to the dominance of this sub-segment.

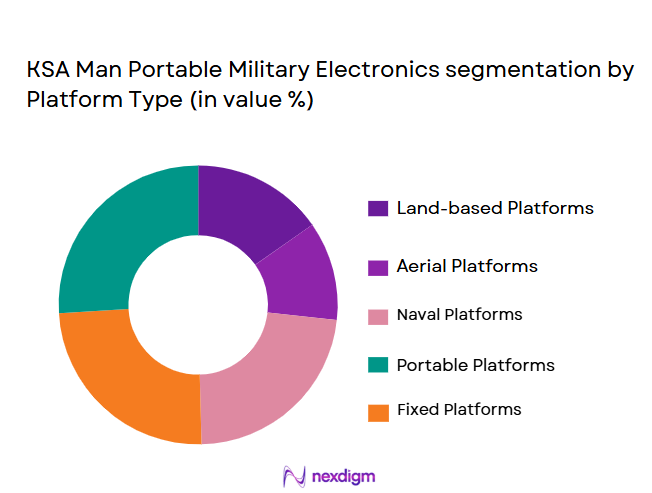

By Platform Type

The market is also segmented by platform type into land-based platforms, aerial platforms, naval platforms, portable platforms, and fixed platforms. Among these, portable platforms dominate the market, driven by the increasing demand for lightweight, highly mobile military equipment. These systems are essential for soldiers in the field, allowing them to maintain operational capabilities in dynamic environments. The demand for portable systems is particularly high due to their versatility and ease of deployment, making them suitable for a range of military applications from communications to surveillance and targeting. The shift towards more agile, mobile defense operations continues to propel this segment forward.

Competitive Landscape

The KSA Man Portable Military Electronics market is dominated by both local and international defense contractors. The competition is fierce, with companies offering cutting-edge technologies designed to meet the specific needs of military forces in the region. Notable players include global giants such as Lockheed Martin, Raytheon Technologies, and Thales Group, alongside regional leaders like Al Salam Aircraft Company. These companies are focusing on technological innovation, including the development of compact, durable, and multi-functional portable military systems.

The competitive landscape reflects a blend of established players with long-standing relationships in the defense sector and newer, innovative firms specializing in niche military technologies. This concentration of market power in a few major firms is indicative of the substantial barriers to entry in the defense electronics industry, particularly in a highly regulated and security-conscious market like Saudi Arabia.

| Company | Establishment Year | Headquarters | Product Innovation | Geographical Reach | R&D Investment | Pricing Strategy | Customer Support | Brand Reputation | Supply Chain |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Al Salam Aircraft Co. | 1980 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

KSA man portable military electronics Market Dynamics

Growth Drivers

Rising defense budgets in KSA

The increasing defense budget in Saudi Arabia plays a crucial role in driving the market for man portable military electronics. As the government prioritizes defense modernization and bolsters its military capabilities, the demand for advanced and portable military systems continues to rise, supporting market growth.

Advancements in man portable military electronics technology

Continuous advancements in portable military electronics technology enable the development of more efficient, reliable, and compact systems. Innovations in communication, surveillance, and targeting systems are enhancing operational efficiency and mobility, which boosts demand across various sectors of the military.

Market Challenges

High research and development costs

The development of advanced man portable military electronics requires significant research and development investments. These high costs can limit market growth, particularly for smaller players without the capital to compete with larger defense contractors that can afford extensive R&D programs.

Regulatory hurdles and compliance with international standards

The defense industry faces stringent regulations, especially when dealing with international arms treaties and certifications. Ensuring compliance with these global standards can delay product development and increase costs, presenting a challenge for companies entering the market.

Market Opportunities

Growing demand for portable military systems

There is an increasing demand for portable military systems due to the growing need for mobility in modern military operations. Portable systems offer enhanced flexibility, making them ideal for special operations, quick deployment, and diverse military applications, providing substantial growth potential in the market.

Technological advancements in miniaturization

Miniaturization of military electronics is a key opportunity in the market. Advances in microelectronics allow for the creation of more compact, lightweight, and efficient systems that maintain high performance. This makes portable systems more accessible for a broader range of applications and enhances their attractiveness for military forces.

Future Outlook

Over the next decade, the KSA Man Portable Military Electronics market is expected to experience significant growth. This growth will be driven by continued investment in defense modernization, technological advancements, and the strategic need for highly mobile and reliable military systems. The increasing demand for portable electronics, especially in communication, surveillance, and targeting, will fuel further innovation in this space. Additionally, Saudi Arabia’s defense initiatives, including its Vision 2030 program, will support the growth of domestic military technology providers, thereby contributing to the expansion of the market.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Thales Group

- Al Salam Aircraft Company

- BAE Systems

- Leonardo S.p.A.

- L3Harris Technologies

- General Dynamics

- Northrop Grumman

- Rheinmetall AG

- Elbit Systems

- Saab AB

- Meggitt PLC

- Oshkosh Corporation

- Textron Inc.

Key Target Audience

- Government Defense Agencies

- Military Forces

- Security Agencies (e.g., Saudi Arabian National Guard)

- Private Defense Contractors

- Investments and Venture Capitalist Firms

- Regulatory Bodies (e.g., Saudi Arabian General Authority for Military Industries)

- Defense Equipment Manufacturers

- Armed Forces Logistics and Procurement Officers

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying the critical variables that influence the KSA Man Portable Military Electronics market. Through extensive desk research and secondary data collection from proprietary industry databases, we identify key stakeholders, including manufacturers, government agencies, and defense contractors, alongside market drivers and challenges.

Step 2: Market Analysis and Construction

In this phase, historical market data for the KSA Man Portable Military Electronics market is compiled, focusing on aspects like market size, trends, and key drivers. By examining data on sales performance, demand for specific product types, and regional military expenditure, a comprehensive market analysis is conducted.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses related to future trends, drivers, and challenges will be validated through interviews with industry experts. These include professionals from key market players, as well as military procurement officers and strategic consultants specializing in defense technology.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing insights from both secondary data and expert interviews. Engaging with manufacturers of portable military electronics allows for a detailed analysis of product segments, market penetration, and consumer preferences, thus ensuring the accuracy of the forecast and analysis.

- Executive Summary

- KSA Man Portable Military Electronics Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense budgets in KSA

Advancements in man portable military electronics technology

Increasing security threats and demand for advanced military systems - Market Challenges

High research and development costs

Regulatory hurdles and compliance with international standards

Dependency on global supply chains for components - Market Opportunities

Growing demand for portable military systems

Technological advancements in miniaturization

Government initiatives for strengthening national defense capabilities - Trends

Shift towards more autonomous and AI-driven military systems

Integration of IoT in military electronics

Increasing demand for integrated systems for multiple defense applications

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Communication Systems

Weapon Control Systems

Night Vision Systems

Surveillance Systems

Targeting Systems - By Platform Type (In Value%)

Land-based Platforms

Aerial Platforms

Naval Platforms

Portable Platforms

Fixed Platforms - By Fitment Type (In Value%)

Integrated Systems

Standalone Systems

Modular Systems

Portable Systems

Hybrid Systems - By EndUser Segment (In Value%)

Military Forces

Government Defense Agencies

Private Defense Contractors

Security Agencies

Research & Development Institutions - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Procurement via Government Contracts

Third-Party Distributors

Online Procurement

Through Defense Partnerships

- Market Share Analysis

- Cross Comparison Parameters

(Product Innovation, Price Sensitivity, Geographical Reach, Customer Support Services, Technology Integration) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Thales Group

L3Harris Technologies

BAE Systems

Leonardo S.p.A.

General Dynamics

Elbit Systems

Rheinmetall AG

Saab AB

Meggitt PLC

Harris Corporation

BAE Systems

Oshkosh Corporation

Textron Inc.

- Government defense agencies focusing on upgrading military technology

- Increasing reliance on specialized military systems for enhanced performance

- Private contractors playing a major role in research and development

- Growing importance of security agencies in homeland defense

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035