Market Overview

The KSA Maritime Security market current size stands at around USD ~ million, shaped by sustained investments in coastal surveillance, port protection, and offshore asset security programs across national waterways. Demand is driven by modernization of maritime domain awareness, integration of digital command platforms, and expansion of perimeter protection systems for critical infrastructure. Procurement cycles favor integrated solutions covering monitoring, response coordination, and cyber-physical protection across ports, terminals, and offshore installations.

Demand concentration is highest across Jeddah, Dammam, Yanbu, Jubail, and emerging Red Sea development zones, where port expansion, logistics corridors, and offshore energy clusters intensify security requirements. Ecosystem maturity is supported by centralized procurement agencies, specialized integrators, and growing local service capacity. Policy alignment with national maritime safety frameworks, critical infrastructure protection mandates, and port digitalization initiatives accelerates adoption across commercial and government-operated maritime assets.

Market Segmentation

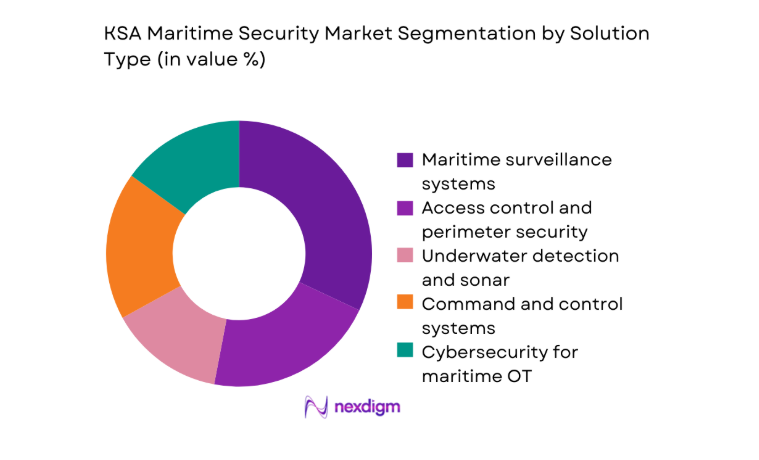

By Solution Type

Integrated surveillance and command platforms dominate adoption due to the need for unified maritime domain awareness across ports, coastal borders, and offshore assets. Buyers prioritize interoperable radar, electro-optical systems, vessel tracking, and command software to reduce response latency and improve cross-agency coordination. Cyber-physical security is increasingly embedded within solution stacks as port automation expands. Demand is strongest for modular architectures that scale across terminals and offshore installations while supporting centralized operations centers. Lifecycle services bundled with hardware and software gain preference as agencies seek operational continuity, uptime assurance, and local maintenance capacity aligned with evolving threat profiles.

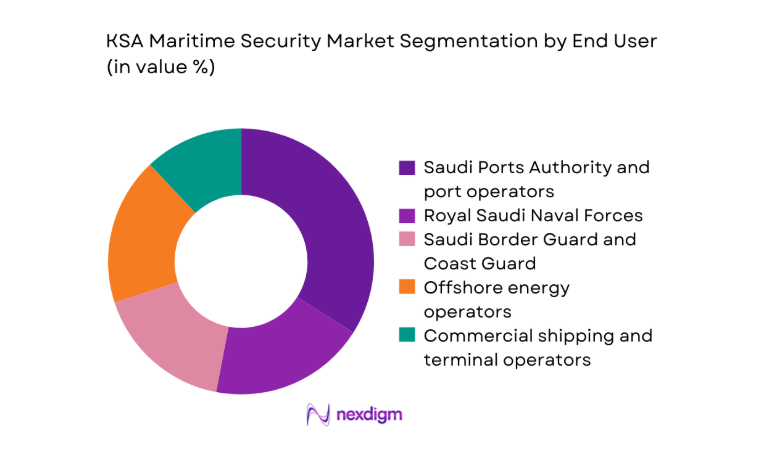

By End User

Government maritime authorities and port operators account for the largest demand concentration due to regulatory mandates, border security responsibilities, and port throughput growth. Offshore energy operators follow, driven by asset protection requirements for platforms, pipelines, and marine terminals. Commercial shipping and terminal operators adopt security platforms to meet compliance obligations and insurer expectations while safeguarding high-value cargo flows. Multi-agency coordination needs encourage standardized platforms across naval, border, and port authorities. Procurement favors vendors offering localized integration, training, and long-term service coverage to sustain mission-critical operations in high-traffic maritime corridors.

Competitive Landscape

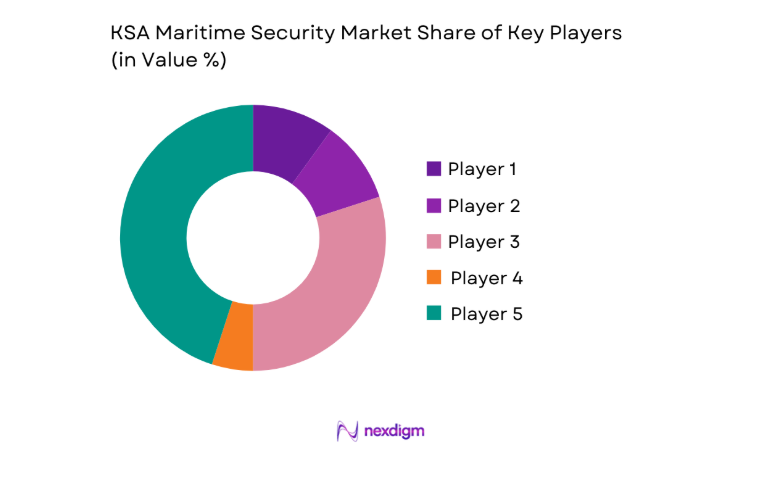

The competitive environment is characterized by system integrators and technology providers offering end-to-end maritime security stacks spanning sensors, analytics, and command platforms. Differentiation centers on integration depth, local service capacity, regulatory readiness, and the ability to deliver interoperable solutions across multi-agency maritime operations.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Maritime Security Market Analysis

Growth Drivers

Expansion of port infrastructure under Vision 2030

Port throughput capacity expanded across Red Sea and Gulf corridors as berth length additions exceeded 1200 meters during 2024, with terminal automation programs deployed at 6 major facilities. Container handling equipment deployments increased by 84 units, while coastal surveillance stations rose by 18 sites to support new logistics corridors. Vessel calls at upgraded terminals surpassed 14000 in 2025, raising perimeter and access control requirements. Shore power installations at 9 terminals drove digital monitoring integration with operations centers. Interagency command upgrades linked 4 regional centers to national maritime coordination hubs, reducing average response dispatch time by 27 minutes across high-traffic approaches.

Heightened threats from piracy and smuggling in Red Sea and Gulf

Reported interdictions along western maritime approaches reached 246 incidents during 2024, compared with 189 in 2022, prompting expanded patrol coverage across 2100 kilometers of coastline. Fast patrol craft deployments increased by 34 vessels across border units, while unmanned aerial sorties supporting maritime patrol exceeded 3800 flight hours in 2025. Seaborne cargo screening checkpoints rose by 27 installations at high-risk terminals. Coordination drills between naval and border units increased to 52 exercises annually, strengthening joint response readiness. Expanded maritime radar coverage extended by 190 kilometers of coastline, improving detection density across high-risk transit corridors.

Challenges

High capex for integrated maritime security platforms

Multi-sensor integration projects require procurement cycles spanning 18 to 24 months, with system commissioning across 5 to 8 operational nodes per port cluster. Hardware installation timelines averaged 210 days across coastal facilities during 2024 due to civil works dependencies and marine environment constraints. Maintenance backlogs reached 41 percent of installed coastal sensors after extended salt exposure periods exceeding 36 months. Skilled integrator availability averaged 1 certified team per 2 major terminals, creating deployment bottlenecks. Spare parts lead times extended to 120 days for specialized radar components, impacting uptime across 14 high-traffic monitoring sites.

Interoperability issues across legacy systems

Legacy vessel tracking platforms deployed before 2016 operate on 3 incompatible data protocols across 11 terminals, limiting real-time fusion. Integration middleware upgrades required refactoring across 47 interface endpoints during 2024. Data latency between coastal radars and operations centers averaged 9 seconds during peak traffic periods, constraining response coordination. Operator retraining cycles reached 64 hours per team to transition to unified dashboards. Cybersecurity hardening patches were applied across 128 endpoints to align legacy hardware with updated security baselines. Parallel maintenance windows across 7 agencies created scheduling conflicts affecting continuous coverage.

Opportunities

Smart port initiatives integrating AI-driven surveillance

Port automation programs expanded intelligent video analytics across 22 terminals during 2025, enabling anomaly detection across 14 operational zones per terminal. AI models trained on 9 million annotated frames improved intrusion recognition latency by 4 seconds in live operations. Sensor fusion pilots integrated radar, electro-optical, and AIS feeds across 3 regional command centers, enhancing situational awareness coverage by 180 kilometers of coastline. Workforce upskilling programs certified 260 operators in AI-assisted monitoring workflows. Edge processing deployments reduced data backhaul loads by 38 percent across congested networks, enabling scalable rollouts aligned with national smart port roadmaps.

Public-private partnerships for port security upgrades

Collaborative security modernization agreements covered 7 commercial terminals during 2024, enabling co-investment in perimeter hardening and surveillance integration. Joint operating frameworks established shared operations rooms across 4 port clusters, supporting coordinated incident management. Private terminal operators committed 26 months to phased security upgrades aligned with compliance milestones. Shared training programs delivered 480 operator certifications across partner facilities, improving response readiness. Contractual service-level commitments standardized maintenance intervals to 90 days for critical sensors. Data-sharing protocols harmonized 21 operational data streams between public authorities and terminal operators, improving cross-domain situational awareness.

Future Outlook

The market outlook through 2035 reflects continued alignment with national maritime safety priorities and port digitalization programs. Expansion of smart port initiatives and coastal surveillance networks will accelerate integrated platform adoption. Multi-agency interoperability and cyber-physical protection requirements are expected to shape procurement roadmaps. Local service capacity and lifecycle support will become key differentiators. Regional security cooperation will further strengthen maritime domain awareness across critical sea lanes.

Major Players

- Thales Group

- Leonardo S.p.A.

- Saab AB

- BAE Systems

- Lockheed Martin

- Raytheon Technologies

- Elbit Systems

- Rohde & Schwarz

- Kongsberg Gruppen

- Hensoldt

- L3Harris Technologies

- Honeywell

- Indra Sistemas

- ST Engineering

- Navantia

Key Target Audience

- Saudi Ports Authority

- Royal Saudi Naval Forces

- Saudi Border Guard

- Ministry of Interior maritime security directorates

- Offshore energy operators and terminal owners

- Port terminal operating companies

- Maritime infrastructure developers

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Operational threat vectors, asset exposure points, and surveillance coverage gaps were mapped across ports, coastal zones, and offshore installations. System interoperability requirements and service readiness factors were defined through structured stakeholder mapping and operational workflow analysis.

Step 2: Market Analysis and Construction

Solution architectures were decomposed into sensors, platforms, analytics, and services to structure demand assessment. Deployment models and procurement pathways were mapped across government and commercial end users to construct adoption scenarios.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions on technology adoption, interoperability constraints, and operational readiness were validated through expert consultations and scenario workshops with maritime operations stakeholders and technical integrators.

Step 4: Research Synthesis and Final Output

Findings were synthesized into actionable insights, aligning operational needs with technology roadmaps and policy priorities. Outputs were structured to support strategic planning, procurement sequencing, and capability development.

- Executive Summary

- Research Methodology (Market Definitions and threat taxonomy for KSA maritime domain, AIS and vessel traffic data analysis, Port security audit reviews and site interviews, Naval and coast guard procurement tracking, Offshore asset risk assessment modeling)

- Definition and Scope

- Market evolution

- Maritime threat landscape and protection pathways

- Ecosystem structure

- Supply chain and service delivery channels

- Growth Drivers

Expansion of port infrastructure under Vision 2030

Heightened threats from piracy and smuggling in Red Sea and Gulf

Protection needs for offshore oil and gas assets - Challenges

High capex for integrated maritime security platforms

Interoperability issues across legacy systems

Skills shortage in maritime cybersecurity and analytics - Opportunities

Smart port initiatives integrating AI-driven surveillance

Public-private partnerships for port security upgrades

Adoption of unmanned surface and aerial systems - Trends

AI-powered video analytics and anomaly detection

Fusion of AIS, radar, EO/IR, and satellite data

Growth of maritime cybersecurity solutions - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Revenue per Unit Economics, 2020–2025

- By Solution Type (in Value %)

Maritime surveillance systems

Access control and perimeter security

Underwater detection and sonar

Command and control systems

Cybersecurity for maritime OT

Unmanned systems and drones - By Platform (in Value %)

Ports and terminals

Offshore oil and gas installations

Commercial vessels and fleets

Naval and coast guard vessels

Coastal monitoring stations - By Application (in Value %)

Port and harbor security

Critical infrastructure protection

Border and coastal surveillance

Anti-piracy and smuggling prevention

Search and rescue enablement

Environmental and spill monitoring - By Deployment Model (in Value %)

Onshore fixed installations

Offshore fixed installations

Shipborne systems

Mobile and rapid-deploy units

Integrated networked platforms - By End User (in Value %)

Saudi Ports Authority and port operators

Royal Saudi Naval Forces

Saudi Border Guard and Coast Guard

- Market share of major players

- Cross Comparison Parameters (technology breadth, integration capability, local partnerships, compliance certifications, lifecycle services, deployment speed, total cost of ownership, cybersecurity maturity)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Thales Group

Leonardo S.p.A.

Saab AB

BAE Systems

Lockheed Martin

Raytheon Technologies

Elbit Systems

Rohde & Schwarz

Kongsberg Gruppen

Hensoldt

L3Harris Technologies

Honeywell

Indra Sistemas

ST Engineering

Navantia

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Revenue per Unit Economics, 2026–2035