Market Overview

As of 2024, the KSA meat substitutes market is valued at USD 102.5 million, with a growing CAGR of 9.7% from 2024 to 2030. This market is witnessing rapid growth driven by shifting consumer preferences towards plant-based diets and an increasing awareness of health and sustainability. Factors driving this trend include higher disposable incomes and a significant portion of the population seeking healthier food alternatives, which has resulted in the rise of various meat substitute products available in the market.

Key cities like Riyadh, Jeddah, and Dammam dominate the KSA meat substitutes market due to their urbanization and consumer inclination towards alternative protein sources. Riyadh, as the capital, leads in innovation and market entry strategies, with diverse retail and distribution channels. Jeddah and Dammam also contribute significantly by hosting a mix of local and international brands that cater to shifting dietary patterns while promoting sustainability and health.

Market Segmentation

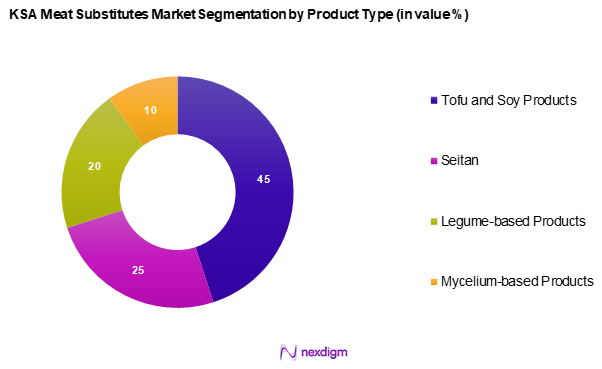

By Product Type

The KSA meat substitutes market is segmented into tofu and soy products, seitan, legume-based products, and mycelium-based products. The tofu and soy products segment dominates the KSA meat substitutes market due to their established presence and affordability, which appeals to a broad consumer base. Rich in protein and versatile in cooking applications, these products cater to both vegetarians and flexitarians seeking healthy alternatives. Brand recognition and familiarity further enhance consumer loyalty, making tofu and soy products a staple in many households. Additionally, increasing availability in retail outlets supports their market dominance as more consumers explore plant-based diets.

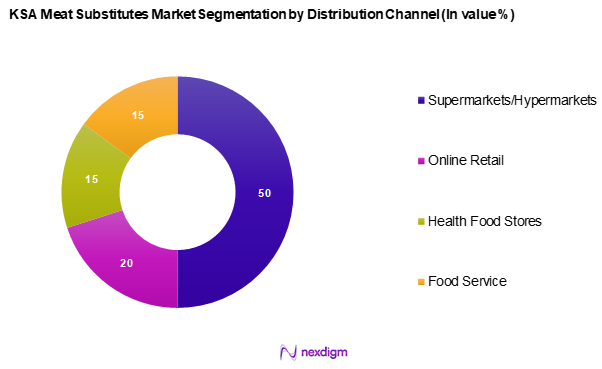

By Distribution Channel

The KSA meat substitutes market is also segmented into supermarkets / hypermarkets, online retail, health food stores, and food service. Supermarkets and hypermarkets account for a larger share of the market due to their extensive reach and consumer convenience. These retail platforms effectively showcase meat substitute products, facilitating customer engagement and ease of purchase. Moreover, the rise of health-conscious consumers is increasingly influencing supermarkets to branch out their organic and plant-based sections.

Competitive Landscape

The KSA meat substitutes market is characterized by the presence of several major players, including local manufacturers and strong international brands. Notable players include beyond meat, impossible foods, and local industry leaders which enhance competition within the space. This consolidation highlights the significant influence of established food producers driving innovation in product offerings and marketing strategies.

| Company | Establishment Year | Headquarters | Market Share | Product Range | Innovation Rate | Distribution Network |

| Beyond Meat | 2009 | El Segundo, CA | – | – | – | – |

| Impossible Foods | 2011 | Oakland, CA | – | – | – | – |

| Tofurky | 1980 | Hood River, OR | – | – | – | – |

| Quorn Foods | 1985 | Stokesley, UK | – | – | – | – |

| Gardein | 2003 | Richmond, Canada | – | – | – | – |

KSA Meat Substitutes Market Analysis

Growth Drivers

Rising Health Awareness

The increasing awareness of health and wellness among consumers plays a crucial role in the growth of the KSA meat substitutes market. According to the Global Nutrition Report, 2022 data indicates that approximately 43% of adults in Saudi Arabia are actively seeking healthier food alternatives, particularly those with lower fat and cholesterol levels. Additionally, the prevalence of lifestyle diseases such as obesity, which affects 35% of the adult population, is prompting a shift towards healthier eating patterns. The World Health Organization also emphasizes that health-conscious eating has been linked to a significant rise in consumers aligning their diets with better nutritional choices.

Increased Vegetarian and Vegan Trends

The shift towards vegetarianism and veganism is significantly influencing the KSA meat substitutes market. As of 2022, reports indicated that around 25% of the Saudi population is reducing their meat consumption due to growing awareness of plant-based diets. Furthermore, the number of vegan products available in local supermarkets has surged by 50% since 2021. A recent analysis notes that social media platforms are amplifying the visibility of plant-based eating, contributing to a lifestyle change among consumers, particularly the youth demographic, which constitutes about 70% of Saudi Arabia’s population.

Market Challenges

Price Sensitivity

Price sensitivity remains a significant barrier to the widespread adoption of meat substitutes in the KSA market. In the current economic landscape, inflation rates in Saudi Arabia reached a peak of 3.3% in 2023, leading to increasing prices of everyday goods, including food. As the average consumer spends roughly 40% of their monthly income on food, these rising costs make alternative protein sources seem expensive. Consequently, despite health benefits, many consumers still prioritize affordable and traditional meat products over premium-priced meat substitutes, inhibiting market growth.

Limited Product Awareness

Limited awareness of meat substitute products is another challenge the market faces. In a 2023 survey conducted by the Saudi Food and Drug Authority, over 50% of participants indicated that they had little to no knowledge of available meat alternative options. This lack of knowledge extends to aspects such as nutritional benefits, preparation methods, and product diversity. The growing presence of meat substitutes in stores is not sufficiently complemented by consumer education initiatives, which hampers the ability of these products to penetrate the traditional meat market more effectively.

Opportunities

Innovation in Product Development

Innovation in product development represents a substantial opportunity for the KSA meat substitutes market. Recent advancements in food technology have led to the creation of more palatable and versatile meat substitutes. For instance, 2023 saw the introduction of several new products such as plant-based chicken nuggets and ready-to-cook meals, which target traditional family-oriented dining habits. As consumer preferences evolve, the demand for flavour, texture, and cooking convenience has increased, positioning innovative products favourably within the expanding market. Engaging with culinary experts and food technologists can accelerate development in this sector, fostering growth in the meat substitutes market without the need for significant external investment.

Expansion into New Markets

The prospect of expanding into new markets presents a significant growth opportunity for the KSA meat substitutes market. Urbanization trends indicate an increasing population density in cities like Riyadh and Jeddah, which have seen population growth rates of approximately 3% annually. This rising urban population is becoming more exposed to global food trends, contributing to a surge in demand for diverse food options, including meat substitutes. Moreover, the government’s Vision 2030 initiative is facilitating trade and economic partnerships that can open new markets for local meat substitute products in neighbouring GCC countries. These factors collectively indicate a promising landscape for increased penetration of meat substitutes, especially in underserved markets.

Future Outlook

Over the next five years, the KSA meat substitutes market is expected to show significant growth driven by increased health consciousness, dietary shifts towards plant-based eating, and favourable government regulations promoting sustainability. The rise in local production capabilities and consumer acceptance of diverse plant-based options will further catalyse this growth, positioning the market to capitalize on emerging opportunities.

Major Players

- Beyond Meat Inc.

- Impossible Foods Inc.

- Tofurky

- Marlow Foods Ltd.

- Conagra, Inc.

- LightLife Foods Inc.

- MycoTechnology, Inc.

- LIVEKINDLY Collective

- Field Roast

- Kellanova

- Nutritional Growth Solutions

- Hooray Foods

- Redefine Meat Ltd.

- Eat Just, Inc.

- The Green Butcher

Key Target Audience

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Saudi Food and Drug Authority)

- Food Retail Chains

- Health and Wellness Businesses

- Restaurants and Food Service Providers

- Grocery Store Chains

- Food and Beverage Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The first step involves constructing a comprehensive ecosystem map that encompasses all pertinent stakeholders within the KSA meat substitutes market. This includes manufacturers, distributors, retailers, and consumers. Extensive desk research is employed, synthesizing information from industry reports, market studies, and databases to identify and define key variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we collect and analyse historical and current data pertaining to the KSA meat substitutes market. This includes assessing market penetration by evaluating the relationship between suppliers and retailers, revenue generation models, and consumption patterns. A thorough examination of existing product categories and service quality metrics is conducted to ensure our revenue estimates’ accuracy and reliability.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and validated through qualitative interviews and consultations with industry experts across various companies involved in the KSA meat substitutes market. These consultations provide valuable insights about operational practices, consumer preferences, and financial performance, which are crucial in refining and verifying market data.

Step 4: Research Synthesis and Final Output

The final stage involves direct engagement with several key players in the meat substitutes industry to gather in-depth insights on product offerings, sales performance, consumer decision-making processes, and emerging trends. This interaction validates and complements the quantitative data obtained from earlier phases, leading to a comprehensive analysis that supports informed business decisions.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Evolution

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Health Awareness

Increased Vegetarian and Vegan Trends - Market Challenges

Price Sensitivity

Limited Product Awareness - Opportunities

Innovation in Product Development

Expansion into New Markets - Trends

Surge in Plant-based Diets

Growth of Clean Label Products - Government Regulation

Labelling Requirements

Health and Safety Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Tofu and Soy Products

– Traditional Tofu

– Flavored/Smoked Tofu

– Textured Vegetable Protein (TVP)

– Soy Burgers and Mince

Seitan

– Seasoned Seitan Slices

– Seitan Sausages and Patties

– Ready-to-Cook Seitan Meals

Legume-Based Products

– Chickpea-Based Patties

– Lentil-Based Nuggets

– Black Bean Burgers

Mycelium-Based Products

– Fungi-Based Meat Replicates

– Mycoprotein Nuggets and Slices (e.g., Quorn-type)

– Blended Mycelium and Plant-Based Products - By Source (In Value %)

Plant-Based

– Soy-Based

– Wheat-Based

– Pea Protein-Based

– Mixed Plant Protein Formulations

Lab-Grown

– Cultured Chicken

– Cultured Beef

– Hybrid Lab-Grown with Plant Matrix - By Distribution Channel (In Value %)

Supermarkets/Hypermarkets

– Organized Retail Chains (e.g., Panda, Carrefour)

– In-Store Vegan/Organic Sections

Online Retail

– Brand-Specific E-commerce Stores

– Grocery Delivery Platforms (e.g., Nana, HungerStation)

Health Food Stores

– Organic/Natural Food Retailers

– Specialty Vegan Stores

Food Service

– Quick Service Restaurants (QSRs)

– Casual Dining Chains

– Hotel/Resort Menus Featuring Meat Alternatives - By Region (In Value %)

Riyadh

Jeddah

Dammam

Khobar

Makkah - By Consumer Type (In Value %)

Vegetarians

– Long-Term Plant-Based Consumers

– Health-Driven Dietary Choices

Flexitarians

– Meat Reducers

– Environmentally Conscious Shoppers

– Wellness and Weight Management Seekers

Meat Lovers

– Experimenters with Alt-Meat for Variety

– Consumers Seeking Protein Parity & Taste Mimicry

– Trial-Based Consumers in Premium Segments

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Product, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Beyond Meat Inc.

Impossible Foods Inc.

Tofurky

Marlow Foods Ltd.

Conagra, Inc.

LightLife Foods Inc.

MycoTechnology, Inc.

LIVEKINDLY Collective

Field Roast

Kellanova

Nutritional Growth Solutions

Hooray Foods

Redefine Meat Ltd.

Eat Just, Inc.

The Green Butcher

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Consumer Preferences and Motivations

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030