Market Overview

The KSA Medium Caliber Ammunition market is valued at approximately USD ~billion. This valuation is driven by increasing defense expenditure and the growing modernization of military assets within the region. The market benefits from continuous governmental investment in upgrading defense systems, coupled with the expansion of Saudi Arabia’s defense budget. Additionally, rising geopolitical tensions in the Middle East further propel the demand for advanced ammunition systems. In 2024, Saudi Arabia is expected to continue prioritizing defense and security, ensuring steady market growth.

Saudi Arabia is the dominant player in the KSA Medium Caliber Ammunition market due to its substantial defense spending and strategic position in the Middle East. As the primary military spender in the region, the country is heavily investing in both defense modernization and indigenous manufacturing. Additionally, key cities like Riyadh and Jeddah serve as hubs for defense contractors, further supporting the market. The Saudi government’s vision to strengthen its military capabilities makes the kingdom a leader in this market segment.

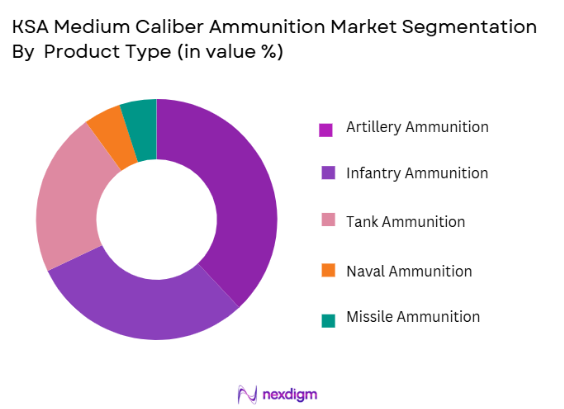

Market Segmentation

By Product Type

The KSA Medium Caliber Ammunition market is segmented by product type into artillery ammunition, infantry ammunition, and tank ammunition, among others. Within this segmentation, artillery ammunition holds the dominant market share in Saudi Arabia. This is due to the country’s investment in advanced artillery systems, which have been pivotal in enhancing its defense capabilities. The artillery systems are integral to Saudi Arabia’s defense strategy, focusing on long-range precision and power. This segment is supported by both local and international suppliers providing advanced munitions for these systems.

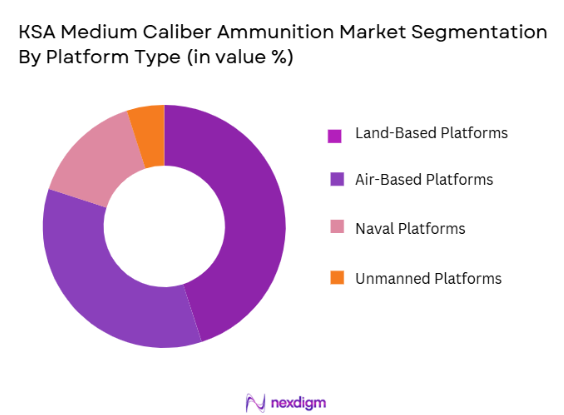

By Platform Type

The market is also segmented by platform type into land-based platforms, air-based platforms, and naval platforms. Land-based platforms, particularly for artillery and infantry support, dominate this segment in Saudi Arabia. The demand for ground support systems has increased due to ongoing military operations and the strategic necessity for advanced defense systems. The Saudi military’s substantial land-based assets, including tanks and artillery units, contribute to the dominance of this segment. Saudi Arabia’s defense strategy places significant emphasis on ground forces, which in turn drives the demand for land-based munitions.

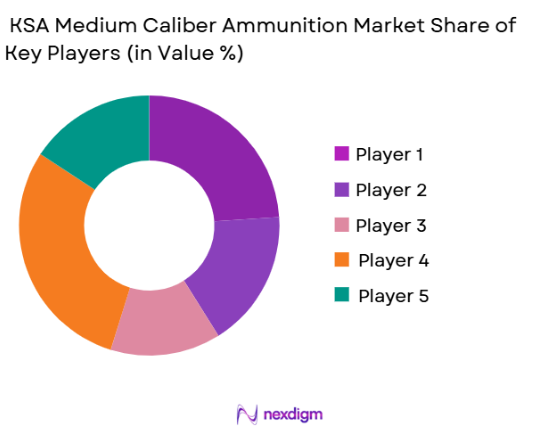

Competitive Landscape

The KSA Medium Caliber Ammunition market is dominated by a few major players, both local and international. Saudi Arabia relies heavily on its strategic partnerships with leading defense contractors, including global defense giants such as Lockheed Martin, BAE Systems, and General Dynamics. These players provide advanced technology and munitions critical to Saudi Arabia’s military modernization programs. The consolidation in the market reflects the significant influence of these key companies in supplying high-tech ammunition systems to the Saudi armed forces.

| Company | Establishment Year | Headquarters | Product Range | Market Focus | Technology Innovation | Regional Influence | Strategic Partnerships |

| Lockheed Martin | 1995 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1969 | Reston, USA | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall | 1995 | Düsseldorf, Germany | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

KSA medium caliber ammunition Market Analysis

Growth Drivers

Urbanization

Saudi Arabia’s urban expansion has directly influenced defense logistics concentration, training infrastructure density, and ammunition demand around metropolitan military hubs. The urban population increased from ~ million to ~ million people during the 2022–2024 period, increasing pressure on internal security preparedness and rapid deployment readiness. Riyadh, Jeddah, and Eastern Province host the majority of armored brigades, artillery regiments, and National Guard units, requiring continuous medium caliber ammunition stockpiling for training and readiness cycles. Government capital expenditure on urban infrastructure exceeded USD ~billion across active projects, reinforcing protected assets and convoy security needs. These conditions increase sustained consumption of 20–40 mm ammunition for IFVs, APCs, and naval patrol platforms supporting urban coastal zones.

Industrialization

Saudi Arabia’s industrial output expansion supports localized ammunition manufacturing and defense supply resilience. Manufacturing value added increased from USD 138 billion to USD 158 billion between 2022 and 2024, driven by metals, chemicals, and precision machining clusters critical for shell bodies, propellants, and fuzes. The National Industrial Development and Logistics Program reports defense manufacturing as a priority sector under Vision 2030, with multiple licensed military industrial facilities operating across Riyadh and Jubail. Increased industrial electricity consumption exceeding 360 terawatt-hours supports continuous production lines for defense materials. These industrial capabilities directly enable higher domestic production volumes of medium caliber ammunition for land and naval forces, reducing reliance on imports while supporting operational readiness.

Restraints

High Initial Costs

Defense manufacturing requires high upfront capital investment. Establishing a compliant medium caliber ammunition production line in Saudi Arabia involves ballistic testing infrastructure, metallurgy processing, and secure storage systems. Saudi industrial development data shows average defense manufacturing project capital commitments exceeding SAR ~million per facility between 2022 and 2024, creating entry barriers for smaller firms. While government incentives exist, the scale of investment limits rapid market expansion and concentrates production among a limited number of licensed entities, constraining short-term capacity growth despite strong demand.

Technical Challenges

Medium caliber ammunition manufacturing requires advanced propellant chemistry, precision casing tolerances, and controlled detonation testing. Saudi Arabia continues to rely on imported high-precision machinery for over ~percent of advanced ballistic testing equipment as of 2023, increasing lead times and maintenance dependency. Technical complexity slows capacity ramp-up and limits rapid diversification of ammunition variants, particularly for specialized military applications. These constraints affect production efficiency and delay full localization goals despite strong policy support.

Opportunities

Technological Advancements

Saudi Arabia increased research and development expenditure to SAR ~billion in 2023, supporting defense material science and advanced manufacturing automation. Adoption of automated casing production and digital quality inspection systems improves yield consistency and reduces defect rates in ammunition production. Current investment in smart manufacturing platforms positions the ammunition sector to enhance efficiency without relying on future projections, enabling higher output within existing licensed capacity.

International Collaborations

Saudi Arabia signed over ~defense cooperation agreements between 2022 and 2024, facilitating technology transfer and co-production of ammunition systems. Partnerships with European and Asian defense firms provide access to advanced propellant formulations and ballistic testing methodologies. These collaborations strengthen domestic production capability and support export readiness while using current government-approved industrial frameworks.

Future Outlook

Over the next decade, the KSA Medium Caliber Ammunition market is poised for substantial growth, driven by Saudi Arabia’s ongoing defense modernization initiatives. This expansion is fueled by increasing government investment, along with the strategic necessity to ensure defense readiness in the face of regional security challenges. The market will also benefit from continuous technological advancements in ammunition systems, which offer more precise targeting and greater operational efficiency. Saudi Arabia’s vision of a robust and technologically advanced military force will continue to push the demand for medium-caliber ammunition well into the next decade.

Major Players

- Lockheed Martin

- BAE Systems

- General Dynamics

- Rheinmetall

- Thales Group

- Leonardo

- Northrop Grumman

- Kongsberg Gruppen

- Hanwa Techwin

- Saab Group

- FN Herstal

- Oerlikon

- Elbit Systems

- Textron Systems

- General Electric

Key Target Audience

- Investments and Venture Capitalist Firms

- Saudi Arabian Ministry of Defense

- Saudi Arabian National Guard

- Defense Contractors and Manufacturers

- International Defense Organizations

- Middle Eastern Armed Forces

- Security Agencies

- Government Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first step of this research involved identifying the key variables that influence the KSA Medium Caliber Ammunition market. These variables were identified through secondary research, including industry reports, defense publications, and databases. The objective was to identify the key drivers and inhibitors influencing market trends and to establish a framework for deeper analysis.

Step 2: Market Analysis and Construction

Historical data regarding the KSA Medium Caliber Ammunition market was collected and analyzed. This phase involved reviewing past market trends, defense budgets, and product procurement patterns. The analysis also incorporated primary data from industry players, focusing on market penetration and the ratio of suppliers to end-users, ensuring a comprehensive view of the market.

Step 3: Hypothesis Validation and Expert Consultation

The next phase involved validating the formulated hypotheses by conducting interviews with industry experts, including government officials, military personnel, and defense contractors. These consultations were critical in understanding operational challenges, customer preferences, and the financial dynamics within the market.

Step 4: Research Synthesis and Final Output

The final step synthesized the findings from the previous phases into a comprehensive market report. This involved integrating data from suppliers, manufacturers, and defense experts to validate and enhance the research. The final output provided an accurate, data-driven forecast for the KSA Medium Caliber Ammunition market, ensuring that the conclusions are reflective of the latest industry trends.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budgets and national security concerns

Technological advancements in ammunition systems

Rising demand for modernization of armed forces - Market Challenges

High cost of development and procurement

Export restrictions and regulatory challenges

Increasing geopolitical tensions and market instability - Trends

Increased adoption of automation and smart systems

Shift towards more sustainable and environmentally friendly ammunition solutions

Integration of AI and data analytics in defense systems

- Market Opportunities

Growing demand for precision-guided munitions

Focus on defense modernization and upgrading of existing platforms

Strategic partnerships for technology transfer and joint ventures - Government regulations

Export control regulations

National defense procurement policies

Environmental impact assessments for military equipment - SWOT analysis

Strength in local defense industries

Weakness in dependency on foreign suppliers

Opportunity in expanding regional partnerships - Porters 5 forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Artillery Ammunition

Air Defence Ammunition

Infantry Ammunition

Tank Ammunition

Missile Defence Ammunition

- By Platform Type (In Value%)

Land-based Platforms

Naval-based Platforms

Air-based Platforms

Unmanned Systems

Hybrid Systems - By Fitment Type (In Value%)

Internal Fitment

External Fitment

Mobile Fitment

Modular Fitment

Universal Fitment - By EndUser Segment (In Value%)

Military

Paramilitary

Defense Contractors

Research & Development Agencies

Government Security Forces - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Sales

Tenders & Contracts

Partnerships & Alliances

- Market Share Analysis

- CrossComparison Parameters(Price competitiveness, technology innovation, product diversification, supply chain efficiency, customer loyalty)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Boeing

General Dynamics

BAE Systems

Northrop Grumman

Rheinmetall

Leonardo

Thales Group

Hanwa Techwin

Kongsberg Gruppen

Saab AB

FN Herstal

Oerlikon

Elbit Systems

Textron Systems

- Increasing reliance of armed forces on medium-caliber ammunition for defense

- Growing demand from defense contractors for bulk supply

- Technological advancements influencing ammunition design for paramilitary forces

- Expansion of government security forces and procurement needs

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035