Market Overview

The KSA Military 3D and 4D Printing market is valued at approximately USD ~ million in 2024, driven by increased defense spending and Saudi Arabia’s focus on modernizing its military infrastructure. With the growing adoption of advanced manufacturing technologies like 3D and 4D printing, the Saudi military can produce custom components on-demand, reducing dependency on foreign suppliers. The adoption is further bolstered by Saudi Arabia’s Vision 2030, which aims to boost local defense production and technological innovation. This increasing demand for localized, efficient, and cost-effective solutions is propelling the market.

Saudi Arabia is at the forefront of the 3D and 4D printing market in the Middle East due to its strategic investments in defense modernization and technological innovation. The Kingdom’s commitment to diversifying its economy and military capabilities under Vision 2030 has positioned it as a leader in adopting cutting-edge technologies like 3D and 4D printing. Riyadh, the capital, is the center of this development, with numerous defense contractors and research institutions focused on integrating advanced manufacturing technologies into military applications.

Market Segmentation

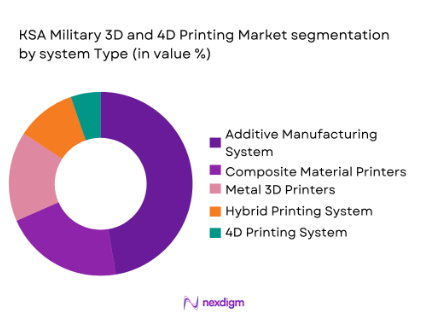

By System Type

The KSA Military 3D and 4D Printing market is segmented by system type into additive manufacturing systems, composite material printers, metal 3D printers, hybrid printing systems, and 4D printing systems. Additive manufacturing systems dominate the market due to their ability to produce complex geometries and customized parts on-demand. The Saudi Arabian military is increasingly utilizing these systems to manufacture high-performance components, including parts for drones, military vehicles, and aircraft. The flexibility to produce rapid prototypes and custom solutions tailored to military needs is key to the adoption of additive manufacturing systems.

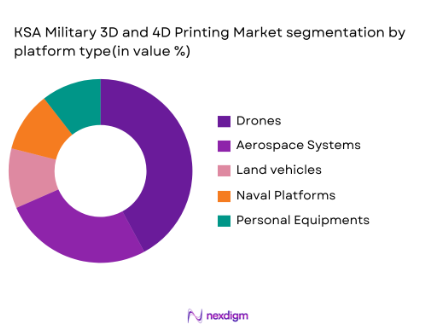

By Platform Type

The market is also segmented by platform type into land vehicles, aerospace systems, naval platforms, drones, and personal equipment. Drones are the dominant platform type in the KSA military market due to Saudi Arabia’s significant investment in unmanned aerial systems (UAS) for surveillance and defense operations. The growing use of drones for intelligence, surveillance, reconnaissance (ISR), and combat operations drives the demand for 3D and 4D printed components. These platforms require lightweight, high-durability parts that can be quickly manufactured to meet operational demands, further promoting the adoption of advanced printing technologies.

Competitive Landscape

The KSA Military 3D and 4D Printing market is dominated by a few key players, including major defense contractors and international firms collaborating with Saudi Arabia’s Ministry of Defense and local defense contractors. Companies like Lockheed Martin, Boeing, and Saudi Arabian Military Industries (SAMI) are heavily involved in the integration of 3D and 4D printing technologies within military applications. The market is also supported by local manufacturers and international technology providers offering cutting-edge solutions for rapid prototyping, customized parts, and manufacturing for the Saudi military’s specific needs.

| Company | Establishment Year | Headquarters | Technology Expertise | Product Range | Key Partnerships | Market Focus |

| Lockheed Martin | 1912 | USA | – | – | – | – |

| Boeing | 1916 | USA | – | – | – | – |

| Saudi Arabian Military Industries | 2017 | Saudi Arabia | – | – | – | – |

| Stratasys | 1989 | Israel | – | – | – | – |

| EOS GmbH | 1989 | Germany | – | – | – | – |

KSA Military 3D and 4D Printing Market Dynamics

Growth Drivers

Rising Defense Spending in KSA Fueling the Adoption of Advanced Manufacturing Technologies

Saudi Arabia’s defense spending continues to increase, with a projected allocation of approximately USD 30 billion for defense in 2024. This increase is part of the Kingdom’s broader strategy to modernize its military capabilities, underpinned by Saudi Vision 2030. A key aspect of this modernization is the adoption of advanced manufacturing technologies, including 3D and 4D printing. The Saudi government recognizes the potential of these technologies to enhance production flexibility, reduce supply chain dependence, and streamline the creation of complex military components. This funding boost is expected to drive further integration of these technologies within the military sector.

Technological Advancements in Additive Manufacturing for High-Performance Military Components

Advances in additive manufacturing technologies are driving the adoption of 3D and 4D printing in military applications. The production of high-performance components that were once difficult to manufacture is now possible, with the use of metal 3D printing and composite materials. The Saudi Arabian military is investing in these technologies to produce custom parts for drones, vehicles, and aircraft, aiming for higher performance and lighter components. As the technology evolves, its ability to produce complex geometries with specialized materials continues to enhance its appeal for military applications, including aerospace and defense.

Market Challenges

High Initial Cost of 3D and 4D Printing Systems

The adoption of 3D and 4D printing technologies in the Saudi military is hindered by the high upfront costs associated with acquiring advanced printing systems. For example, metal 3D printers required for military-grade parts can cost millions of dollars, a significant investment for the defense sector. These systems, while offering long-term cost efficiency, require substantial initial capital outlay, which is a barrier for some defense contractors and government agencies. Furthermore, the cost of training personnel to operate these systems adds another layer of expense, further slowing widespread adoption.

Technological Barriers in Integrating Advanced Printing Solutions with Legacy Military Systems

One of the significant challenges in integrating 3D and 4D printing technologies into the Saudi military lies in the compatibility with legacy systems. Many existing military platforms were designed before the rise of additive manufacturing, and integrating 3D and 4D printed components into these systems requires extensive modifications. For instance, updating legacy aircraft or armored vehicles to accommodate 3D printed parts may necessitate significant redesigns and testing to ensure compatibility and safety. This integration complexity increases the cost and time required to implement advanced printing solutions in older military systems.

Market Opportunities

Growing Demand for Customized Military Parts and On-Demand Manufacturing Solutions

The growing need for tailored military solutions in Saudi Arabia is driving demand for customized parts and on-demand manufacturing capabilities. The Saudi military is increasingly looking to 3D and 4D printing technologies to quickly produce specialized components that meet specific operational requirements. For example, in 2023, Saudi Arabian defense contractors began using additive manufacturing to create mission-specific parts for drones and unmanned aerial systems (UAS), reducing the time needed for supply chains to deliver custom components. This trend is expected to continue, enhancing the Saudi military’s flexibility in responding to changing defense needs.

KSA’s Position as a Global Leader in Defense Innovation Promoting Further 3D and 4D Printing Adoption

Saudi Arabia’s strategic focus on becoming a leader in defense innovation has positioned it as a key player in the development and adoption of cutting-edge technologies, including 3D and 4D printing. As part of Vision 2030, the Saudi government is investing heavily in defense modernization, with a particular emphasis on adopting disruptive technologies. The Kingdom’s efforts to diversify its defense capabilities and reduce dependence on foreign suppliers make the adoption of in-house, advanced manufacturing systems like 3D and 4D printing a critical opportunity. Saudi Arabia’s role as a global defense innovator will drive further growth in the market for military 3D and 4D printing technologies.

Future Outlook

Over the next decade, the KSA Military 3D and 4D Printing market is expected to grow significantly, driven by Saudi Arabia’s ongoing efforts to modernize its military capabilities as part of Vision 2030. The demand for 3D and 4D printed parts is set to rise as Saudi Arabia increasingly focuses on producing its own high-tech defense components domestically. The military’s focus on drones, lightweight systems, and on-demand manufacturing will further fuel the market, with technological advancements in 4D printing enhancing the adaptability and performance of printed components for military use. The integration of AI and machine learning in 3D printing systems will also contribute to the sector’s growth.

Major Players

- Lockheed Martin

- Boeing

- Saudi Arabian Military Industries

- Stratasys

- EOS GmbH

- Materialise

- 3D Systems

- GE Additive

- SABIC

- Arcam AB

- Renishaw

- HP Inc.

- Desktop Metal

- Dassault Systèmes

- HP Enterprise

Key Target Audience

- Defense Contractors

- Aerospace Manufacturers

- Saudi Arabian Ministry of Defense

- Saudi Arabian Military Industries (SAMI)

- Technology Providers

- Aerospace and Defense R&D Institutions

- Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key stakeholders, technological drivers, and market dynamics within the KSA Military 3D and 4D Printing market. Extensive desk research is conducted using secondary data sources, including government publications, defense reports, and industry analysis to map out the market’s structure.

Step 2: Market Analysis and Construction

In this phase, we will analyze historical data and trends within the military 3D and 4D printing market in KSA, focusing on defense budgets, technological advancements, and the adoption rate of 3D printing in defense manufacturing.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with industry experts from defense contractors, military forces, and technology providers. These consultations will offer valuable insights into the operational needs of Saudi Arabia’s military and help validate the research findings.

Step 4: Research Synthesis and Final Output

In the final phase, the data and insights gathered are synthesized into a comprehensive analysis of the KSA Military 3D and 4D Printing market. The findings will be validated through expert interviews and feedback from key stakeholders within the Saudi defense sector to ensure accuracy and relevance.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense spending in KSA fueling the adoption of advanced manufacturing technologies

Technological advancements in additive manufacturing for high-performance military components

Increasing need for rapid prototyping and on-demand manufacturing in military applications - Market Challenges

High initial cost of 3D and 4D printing systems

Technological barriers in integrating advanced printing solutions with legacy military systems

Security and intellectual property concerns with 3D and 4D printed military components - Market Opportunities

Growing demand for customized military parts and on-demand manufacturing solutions

KSA’s position as a global leader in defense innovation promoting further 3D and 4D printing adoption

Partnerships between defense companies and 3D printing firms to drive further technological advancements - Trends

Integration of AI and machine learning with 3D and 4D printing for smarter manufacturing solutions

Shift toward lightweight and durable 3D printed materials for military applications

Increased focus on sustainability and eco-friendly 3D and 4D printing materials in military production

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Additive Manufacturing Systems

Composite Material Printers

Metal 3D Printers

Hybrid Printing Systems

4D Printing Systems - By Platform Type (In Value%)

Land Vehicles

Aerospace Systems

Naval Platforms

Drones

Personal Equipment - By Fitment Type (In Value%)

Linefit

Retrofit

OEM Fitment

Maintenance Fitment

Aftermarket Fitment - By End User Segment (In Value%)

Defense Contractors

Military Forces

Aerospace and Defense Manufacturers

Technology Providers

MRO (Maintenance, Repair, and Overhaul) Providers - By Procurement Channel (In Value%)

Direct Procurement

Distributors & Resellers

OEM Procurement

Government Procurement

Defense Technology Contracts

- Market Share Analysis

- Cross Comparison Parameters (Technological Innovation, Cost Efficiency, Intellectual Property Security, Government Regulations, Supplier Network)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

- Lockheed MartinBoeing

Elbit Systems

Saudi Arabian Military Industries

Stratasys

Materialize

EOS GmbH

3D Systems

Desktop Metal

Arcam AB

GE Additive

SABIC

Renishaw

Hewlett Packard Enterprise

- Growing demand for advanced manufacturing in military aircraft and aerospace systems

- Increase in the use of 3D printing for military drones and unmanned systems

- Rapid adoption of 3D printing in vehicle maintenance and repair services for military platforms

- Technological advancements in personal military equipment, including body armor and weaponry

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035