Market Overview

The KSA Military Actuators Market is valued at approximately USD ~ million in 2025, with a steady increase driven by rising defense spending in Saudi Arabia. As part of Vision 2030, the Kingdom is modernizing its military capabilities, focusing on advanced technologies including actuators. These components are critical for high-performance military applications such as drones, land vehicles, and aerospace systems. Saudi Arabia’s significant investments in defense technology and local production are driving the demand for sophisticated actuators in its military platforms.

Saudi Arabia dominates the military actuators market in the Middle East, particularly in Riyadh and Jeddah, where the primary defense contractors and manufacturers are located. The Kingdom’s dominance is attributed to its ambitious Vision 2030 plan, which emphasizes defense self-sufficiency and the integration of advanced technologies into military systems. Saudi Arabia’s strong relationships with global defense firms and its investment in local defense manufacturing, particularly in drones and unmanned vehicles, further solidify its position as a market leader.

Market Segmentation

By Actuator Type

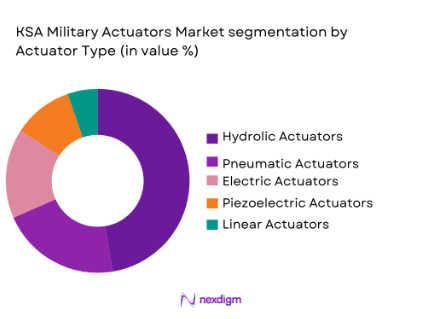

The KSA Military Actuators Market is segmented by actuator type into hydraulic actuators, pneumatic actuators, electric actuators, piezoelectric actuators, and linear actuators. Hydraulic actuators dominate the market, particularly for high-force applications in military land vehicles, aerospace, and naval platforms. These actuators are favored for their ability to generate high power and withstand harsh operating conditions. Saudi Arabia’s military modernization efforts, which focus on enhancing vehicle and aerospace capabilities, require the reliability and precision that hydraulic actuators offer, making them the preferred choice in the market.

By Platform Type

By Platform Type

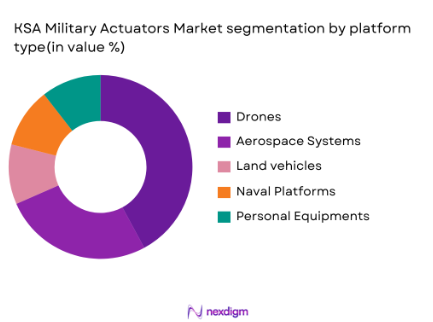

The KSA Military Actuators Market is also segmented by platform type into land vehicles, aerospace systems, naval platforms, drones, and personal equipment. Drones lead the market due to Saudi Arabia’s significant investments in unmanned aerial systems (UAS). These systems require actuators for precise movement and control of components such as flight surfaces, landing gear, and sensor mounts. The increased focus on drones for reconnaissance, surveillance, and combat operations drives demand for actuators that provide high precision, reliability, and lightweight properties, leading to their dominance in the market.

Competitive Landscape

The KSA Military Actuators Market is competitive, with a mix of local and international players driving technological innovation and supply. Leading companies like Lockheed Martin, Boeing, and Raytheon are key players in supplying actuators for military applications. Local defense manufacturers such as Saudi Arabian Military Industries (SAMI) are also emerging as significant contributors to the market, with a focus on developing domestic capabilities in high-tech components, including actuators, for use in Saudi Arabia’s military modernization efforts. The collaboration between global defense giants and local manufacturers is a key factor in the market’s development.

| Company | Establishment Year | Headquarters | Technology Expertise | Product Range | Key Partnerships | Market Focus |

| Lockheed Martin | 1912 | USA | – | – | – | – |

| Boeing | 1916 | USA | – | – | – | – |

| Saudi Arabian Military Industries | 2017 | Saudi Arabia | – | – | – | – |

| Stratasys | 1989 | Israel | – | – | – | – |

| EOS GmbH | 1989 | Germany | – | – | – | – |

KSA Military Actuators Market Dynamics

Growth Drivers

Rising Defense Spending in KSA Fueling the Adoption of Advanced Manufacturing Technologies

Saudi Arabia’s defense expenditure continues to increase, with an estimated budget of USD 30 billion allocated for defense in 2024. This substantial increase supports the adoption of advanced manufacturing technologies, including actuators, for high-performance military applications. The government’s strategic vision, aligned with Vision 2030, focuses on reducing dependency on foreign military supplies by strengthening the domestic defense sector. This increase in spending allows Saudi Arabia to invest in state-of-the-art technologies such as advanced actuators used in UAVs, military vehicles, and aerospace systems.

Technological Advancements in Actuator Systems for High-Performance Military Platforms

Technological progress in actuator systems, such as the development of lightweight, high-force actuators, is driving growth in Saudi Arabia’s military sector. The integration of these advanced systems into high-performance platforms like drones, aerospace vehicles, and ground combat units is essential for improving operational effectiveness. Saudi Arabia, with its focus on military innovation, has adopted more efficient actuator technologies, which play a critical role in enhancing the precision, control, and mobility of advanced military systems used in reconnaissance, surveillance, and combat missions.

Market Challenges

High Initial Cost of Advanced Actuator Systems

One of the primary barriers to the wider adoption of advanced actuators in Saudi Arabia’s military is the high initial cost associated with these systems. Military-grade actuators, which incorporate cutting-edge materials and technology, are expensive to develop and deploy. For instance, systems used in aerospace and unmanned systems can cost millions of dollars. This high cost limits the number of platforms that can be equipped with these advanced actuators, despite the long-term cost savings and performance improvements they provide

Technological Barriers in Integrating Advanced Actuators with Existing Military Systems

Integrating new actuator technologies into legacy military systems poses significant challenges for Saudi Arabia. Existing military platforms often lack the necessary infrastructure to support modern actuator systems, requiring expensive and time-consuming modifications. Additionally, the integration process involves extensive testing to ensure that new actuators do not interfere with the performance of legacy systems. These barriers to smooth integration slow down the process of modernizing Saudi Arabia’s military platforms with the latest actuator technologies.

Market Opportunities

Growing Demand for Customized Actuators for Military Vehicles and Drones

The demand for customized actuators tailored to specific military applications is increasing in Saudi Arabia. As the Kingdom enhances its capabilities in unmanned aerial systems (UAS) and military vehicles, the need for specialized actuators that meet precise performance requirements grows. Actuators play a crucial role in ensuring the functionality and control of complex systems, such as military drones used for reconnaissance and combat operations. The rise in demand for bespoke actuator solutions reflects Saudi Arabia’s commitment to enhancing its self-reliance in defense technology.

KSA’s Position as a Global Leader in Defense Innovation Promoting Further Actuator Adoption

Saudi Arabia’s position as a leader in regional and global defense innovation promotes the further adoption of advanced actuator systems. Under its Vision 2030, Saudi Arabia aims to diversify its defense industry and reduce reliance on foreign suppliers. This focus on domestic production and technological development, including the adoption of advanced actuators in military applications, helps Saudi Arabia maintain its competitive edge in the global defense market. These strategic initiatives drive the expansion of actuator technologies across the Kingdom’s defense sectors, from drones to land vehicles.

Future Outlook

Over the next decade, the KSA Military Actuators Market is expected to see robust growth, driven by the continued modernization of the Saudi military under the Vision 2030 plan. As the Kingdom expands its fleet of drones and unmanned systems, demand for high-performance actuators will increase. The Saudi military’s emphasis on self-sufficiency and reducing reliance on foreign suppliers will drive local manufacturing capabilities for actuators. Technological advancements in materials science, AI, and automation will further improve actuator performance, driving their adoption in a broader range of military systems, from vehicles to advanced aerospace platforms.

Major Players

- Lockheed Martin

- Boeing

- Saudi Arabian Military Industries

- Stratasys

- EOS GmbH

- Materialise

- 3D Systems

- GE Additive

- SABIC

- Arcam AB

- Renishaw

- HP Inc.

- Desktop Metal

- Dassault Systèmes

- HP Enterprise

Key Target Audience

- Defense Contractors

- Military Forces

- Saudi Arabian Ministry of Defense

- Saudi Arabian Military Industries (SAMI)

- Military Technology Providers

- Aerospace and Defense R&D Institutions

- Venture Capitalist Firms (focused on defense technologies)

- Government and Regulatory Bodies (e.g., Ministry of Defense, Defense Procurement Agencies)

Research Methodology

Step 1: Identification of Key Variables

In this phase, key stakeholders and market variables influencing the KSA Military Actuators Market are identified through secondary data collection, including reports from government bodies, defense organizations, and industry leaders.

Step 2: Market Analysis and Construction

Historical data regarding defense spending, military modernization, and actuator adoption trends are analyzed to build a comprehensive market model. Data regarding the integration of advanced technologies into military platforms is collected from multiple sources.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding growth drivers, market trends, and challenges are validated through consultations with industry experts from defense manufacturers, military organizations, and technology providers.

Step 4: Research Synthesis and Final Output

The data collected is synthesized into a comprehensive report detailing key market insights, growth forecasts, and competitive landscape. Feedback from experts in the field is incorporated to refine and verify the findings.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense spending in KSA fueling the adoption of advanced manufacturing technologies

Technological advancements in actuator systems for high-performance military platforms

Increasing need for precision and reliability in military systems - Market Challenges

High initial cost of advanced actuator systems

Technological barriers in integrating advanced actuators with existing military systems

Security and intellectual property concerns with advanced military actuators - Market Opportunities

Growing demand for customized actuators for military vehicles and drones

KSA’s position as a global leader in defense innovation promoting further actuator adoption

Partnerships between defense companies and actuator manufacturers to drive further technological advancements - Trends

Integration of AI and machine learning with actuators for smarter military systems

Shift towards lightweight actuators for enhanced performance in unmanned systems

Increased focus on sustainability and energy-efficient actuators in military production

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By Actuator Type (In Value%)

Hydraulic Actuators

Pneumatic Actuators

Electric Actuators

Piezoelectric Actuators

Linear Actuators - By Platform Type (In Value%)

Land Vehicles

Aerospace Systems

Naval Platforms

Drones

Personal Equipment - By Fitment Type (In Value%)

Linefit

Retrofit

OEM Fitment

Maintenance Fitment

Aftermarket Fitment - By End User Segment (In Value%)

Defense Contractors

Military Forces

Aerospace and Defense Manufacturers

Technology Providers

MRO (Maintenance, Repair, and Overhaul) Providers - By Procurement Channel (In Value%)

Direct Procurement

Distributors & Resellers

OEM Procurement

Government Procurement

Defense Technology Contracts

- Market Share Analysis

- Cross Comparison Parameters (Technological Innovation, Cost Efficiency, Intellectual Property Security, Government Regulations, Supplier Network)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Lockheed Martin

Boeing

Saudi Arabian Military Industries

Stratasys

EOS GmbH

Materialise

3D Systems

GE Additive

SABIC

Arcam AB

Renishaw

HP Inc.

Desktop Metal

Dassault Systèmes

HP Enterprise

- Growing demand for actuators in military drones and unmanned systems

- Rapid adoption of advanced actuators in land and aerospace military platforms

- Increase in the use of actuators for vehicle maintenance and repair services in military sectors

- Technological advancements in actuator systems for personal military equipment

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035