Market Overview

The KSA military aircraft avionics market, valued at USD ~ in 2025, is driven by increased defense spending, technological advancements, and a national focus on military modernization. The Saudi Arabian government continues to prioritize upgrading its fleet of aircraft to maintain a technological edge in defense capabilities. With an increasing emphasis on indigenous manufacturing through programs like Saudi Arabia’s Vision 2030, the market is poised for sustained growth. Additionally, the demand for avionics systems in fighter jets, transport aircraft, and surveillance systems boosts the market, with procurement contracts and defense collaborations driving the trajectory.

Saudi Arabia’s dominance in the KSA military aircraft avionics market is attributed to the country’s strategic positioning within the Middle East and its substantial defense budget. Riyadh, as the capital and primary hub for defense and aerospace activities, plays a central role in procurement and military aircraft operations. The government’s continued investment in defense infrastructure, including partnerships with global aviation leaders, and its efforts to localize avionics production, reinforce Saudi Arabia’s dominant position. Neighboring nations such as the UAE also influence regional trends but remain secondary to Saudi Arabia’s defense strategy.

Market Segmentation

By Subsystem Type

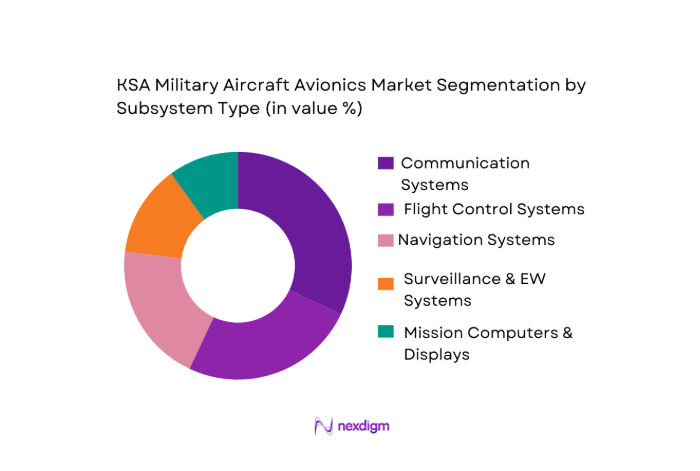

The KSA military aircraft avionics market is segmented by subsystem types such as flight control systems, communication systems, navigation systems, surveillance systems, and mission computers. Among these, communication systems dominate the market, particularly due to the integration of advanced secure communication technologies like SATCOM, Link-16, and digital radios. These systems are crucial in enhancing battlefield coordination, especially with evolving defense strategies focused on C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance). Moreover, with Saudi Arabia’s increasing focus on modernizing its fleet, communication systems are integrated extensively into both new aircraft platforms and retrofits.

By Aircraft Type

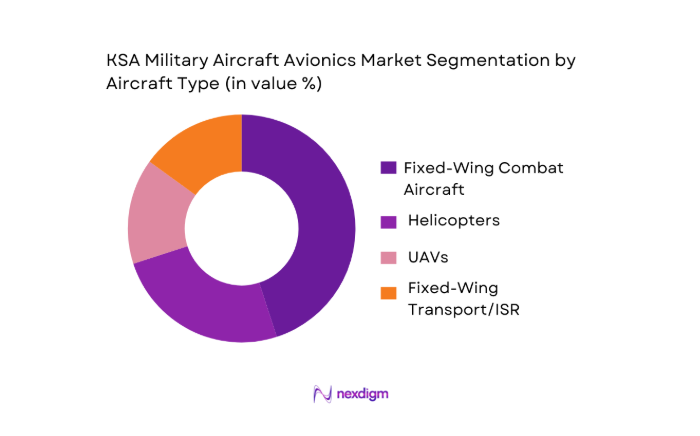

The military aircraft avionics market is segmented by aircraft type, including fixed-wing combat aircraft, helicopters, UAVs, and fixed-wing transport/ISR aircraft. Fixed-wing combat aircraft, particularly the F-15 and Eurofighter Typhoon, dominate this segment. These aircraft require advanced avionics for mission success, such as precision targeting systems and electronic warfare capabilities, which are essential for modern aerial combat. Saudi Arabia’s focus on modernizing its air force with technologically superior combat jets is a key factor driving the avionics demand in this segment.

Competitive Landscape

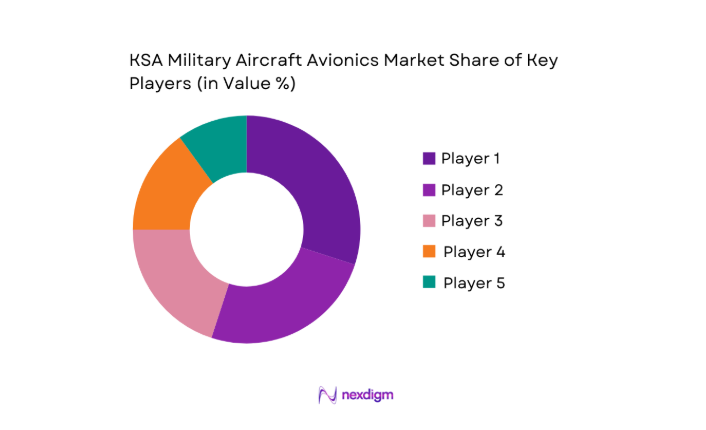

The KSA military aircraft avionics market is largely influenced by a few major global players, including industry giants like Lockheed Martin, Boeing, and Thales Group. These companies dominate due to their advanced technological capabilities, long-standing defense contracts with the Saudi government, and ongoing partnerships with local manufacturers. With the Saudi government’s strategic aim to diversify its defense supply chain and localize more production, these established players have also begun collaborating with local entities to meet the country’s offset and local content requirements.

| Company Name | Establishment Year | Headquarters | Subsystem Expertise | Market Presence in KSA | Local Manufacturing Support | Strategic Alliances |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ |

KSA Military Aircraft Avionics Market Analysis

Growth Drivers

Defense Modernization

Saudi Arabia is undergoing significant defense modernization, with a focus on enhancing technological capabilities, including avionics. The Saudi government has committed to spending approximately USD ~ on defense in 2024, marking a ~ increase from previous years. This expansion is driven by the increasing regional security concerns, particularly given tensions in the Middle East. As part of Saudi Arabia’s Vision 2030, the country aims to localize ~ of its defense industry by 2030, a strategic initiative to enhance its military capabilities, including avionics systems. The demand for advanced avionics systems like AI-based radar, communication systems, and flight controls will rise in alignment with this defense spending boost.

Regional Security Imperatives

The growing regional security concerns in the Middle East significantly contribute to the demand for advanced military aircraft avionics. Saudi Arabia’s defense expenditure is projected to increase, driven by the ongoing conflicts and military tensions with neighboring countries. Saudi Arabia’s military budget for 2024 stands at USD ~, and 2025 is expected to witness similar growth as the country continues to fortify its defense. Moreover, the demand for avionics systems is also driven by Saudi Arabia’s strategic need to improve defense preparedness and counter evolving threats such as cyber warfare, missile defense, and airspace security. As regional security dynamics evolve, Saudi Arabia’s air defense capabilities, including avionics, remain a top priority.

Market Challenges

Certification Cycles

Certification processes for military avionics systems are often lengthy and stringent due to the complexity and regulatory requirements. In Saudi Arabia, the need for compliance with international defense standards, such as NATO’s interoperability guidelines and MIL-STD certifications, adds to the challenges faced by avionics manufacturers. On average, the certification cycle for avionics systems can take anywhere from 18 to 24 months, depending on the complexity of the system. This delay in certification can hinder the rapid deployment of cutting-edge avionics solutions, making it crucial for manufacturers to navigate these regulatory hurdles efficiently.

Skills Gap

Saudi Arabia’s military aircraft avionics market faces a skills gap, especially in high-tech areas such as software engineering, AI integration, and cybersecurity within avionics systems. As the country seeks to localize production through its Vision 2030 initiative, there is a notable shortage of skilled labor, particularly in areas of avionics system development, maintenance, and upgrades. The government has introduced various training programs to bridge this gap, with the Saudi Arabian Military Industries (SAMI) investing in training 1,500 technicians annually. However, the local skill set still lags behind global standards, delaying the indigenous production of advanced avionics systems.

Strategic Opportunities

AI-Integrated Avionics

The integration of artificial intelligence (AI) into avionics systems presents a significant opportunity for growth in the Saudi Arabian market. AI technologies are already being incorporated into military avionics systems globally, and Saudi Arabia’s military is gradually adopting these advancements. In 2024, Saudi Arabia’s defense sector is focusing heavily on AI-driven systems, including AI-powered radar for threat detection, predictive maintenance systems, and autonomous flight control. By leveraging AI, Saudi Arabia can increase operational efficiency and enhance decision-making in real-time, improving the effectiveness of its defense systems. The country’s ongoing efforts to develop indigenous capabilities further emphasize the demand for AI-integrated avionics solutions.

Open Architecture

The open architecture approach in military avionics offers a significant opportunity for growth. By adopting open systems architecture (OSA), which allows for easier upgrades and integration with various platforms, Saudi Arabia can ensure its military aircraft remain at the forefront of technological advancements. Currently, more than ~ of Saudi Arabia’s military aircraft fleet is being upgraded with open architecture systems, allowing for smoother integration of new technologies, such as AI, radar, and communications. This move is crucial for enhancing the country’s air defense systems, ensuring they remain adaptable to future technological advancements.

Future Outlook

Over the next decade, the KSA military aircraft avionics market is expected to witness a substantial growth trajectory. Continued government investments in defense modernization, along with evolving requirements for next-generation avionics such as AI-driven systems, cybersecurity, and sensor fusion, will contribute to market expansion. Saudi Arabia’s Vision 2030 program will further propel local content development, creating opportunities for domestic manufacturers and integration partners. In addition, rising regional security concerns will encourage further avionics advancements to maintain a competitive advantage in the Middle East.

Major Players

- Lockheed Martin

- Boeing

- Thales Group

- Raytheon Technologies

- BAE Systems

- Airbus

- Honeywell Aerospace

- Northrop Grumman

- Leonardo

- Elbit Systems

- General Dynamics

- L3Harris Technologies

- SAMI – Advanced Electronics Company

- Alsalam Aerospace Industries

- Saab AB

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace and Defense Contractors

- Local Manufacturing Partners

- International Defense OEMs

- Military Procurement Officers

- Research and Development Institutions in Aerospace

Research Methodology

Step 1: Identification of Key Variables

The research begins with identifying all significant players and variables that affect the KSA military aircraft avionics market. This includes studying defense budgets, avionics demand from military sectors, and key geopolitical dynamics. Extensive secondary research through government documents, military whitepapers, and defense procurement records forms the foundation for this phase.

Step 2: Market Analysis and Construction

Following the identification of key variables, a comprehensive analysis of historical data is conducted, focusing on defense contracts, procurement figures, and technological adoption in Saudi military aircraft. The market is divided into categories based on product segments and aircraft types, with specific emphasis on avionics systems and associated technologies.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through direct interviews with industry experts, including aviation engineers, government procurement officers, and senior executives from defense manufacturers. This validation process helps to refine the data and provides deeper insights into the operational aspects of the Saudi defense sector.

Step 4: Research Synthesis and Final Output

The final report synthesizes all research and expert consultation results, presenting a complete picture of the KSA military aircraft avionics market. Data collected is corroborated by on-ground sources and manufacturer insights, ensuring that all findings reflect the latest market dynamics.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Defense modernization

regional security imperatives - Market Challenges

Certification cycles

skills gap

tech transfer - Strategic Opportunities

AI‑integrated avionics

open architecture - Market Trends

Cyber‑resilient avionics

sensor fusion

SWaP optimization - Government Regulations & Policy

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020‑2025

- By Volume , 2020‑2025

- Average Price Trends, 2020‑2025

- By Subsystem (In Value %)

Flight Control Systems

Communication Systems

Navigation Systems - By Aircraft Type (In Value %)

Fixed‑Wing Combat

Helicopters/Rotary

UAV / UCAV Platforms

- By Fit Type (In Value %)

Line‑fit

Retrofit / Upgrade

- By End‑User (In Value %)

RSAF Operational Units

Defense Training Command

Government Test & Evaluation - By Deployment Mode (In Value %)

Domestic Manufacture

OEM Imported

- Market Share of Major Players

- Cross Comparison Parameters (Subsystem Technology Maturity, Compliance to MIL‑STD / DO‑178C / DO‑178D Certification Levels, Local Content / Offset Compliance Percentage, Supply Chain Resilience / Dual‑Source Capabilities, Cybersecurity & EW Capability Rating, SWaP Efficiency)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Competitive Benchmarking by Technical Metrics

- Detailed Profiles of Major Players

Lockheed Martin

Boeing

Airbus

Raytheon Technologies

Northrop Grumman

Thales Group

BAE Systems

Honeywell Aerospace

Leonardo

Saab AB

Elbit Systems

General Dynamics

L3Harris Technologies

SAMI

- Defense procurement criteria

- Operational readiness drivers

- Life‑cycle maintenance cost factors

- User performance metrics

- By Value, 2026‑2035

- By Volume , 2026‑2035

- Average Price Trends, 2026‑2035