Market Overview

The Saudi Arabian military aircraft market is valued at USD ~ in 2025. This market is primarily driven by Saudi Arabia’s ongoing defense modernization plans, which are largely guided by the country’s Vision 2030 framework. The increasing focus on upgrading military capabilities, including the procurement of advanced fighter jets, transport aircraft, and UAVs, contributes significantly to this market. Additionally, defense spending by the Saudi government has consistently risen, with substantial investments in upgrading existing fleets and enhancing local aerospace manufacturing capabilities. The commitment to defense self-sufficiency through industrial partnerships and technology transfer further strengthens this growth trajectory.

Saudi Arabia’s military aircraft market is predominantly driven by the Kingdom’s capital, Riyadh, which houses major defense procurement bodies such as the Ministry of Defense and Military Production. Additionally, regional aerospace hubs like Jeddah and Dhahran play crucial roles in aircraft manufacturing, MRO (Maintenance, Repair, and Overhaul), and technology integration. Saudi Arabia remains a dominant force in the region due to its strategic geopolitical position and strong defense alliances with global powers such as the United States, which has resulted in a robust aircraft procurement pipeline, particularly for advanced platforms like the F-35 and F-15 fighters.

Market Segmentation

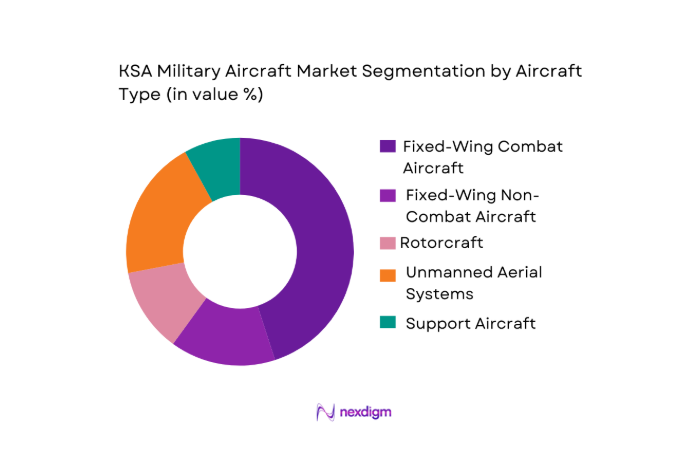

By Aircraft Type

The Saudi Arabian military aircraft market is segmented by aircraft type, which includes fixed-wing combat aircraft, fixed-wing non-combat aircraft, rotorcraft, unmanned aerial systems, and support aircraft. Among these, fixed-wing combat aircraft, including advanced fighters such as the F-15 and F-35, dominate the market. The growing need for superior air defense capabilities, coupled with escalating regional security threats, has led to significant investments in this segment. These aircraft serve critical roles in combat operations, surveillance, and strategic deterrence, contributing to their dominance. The strategic importance of having advanced air superiority, especially amid rising regional tensions, positions this sub-segment as a market leader.

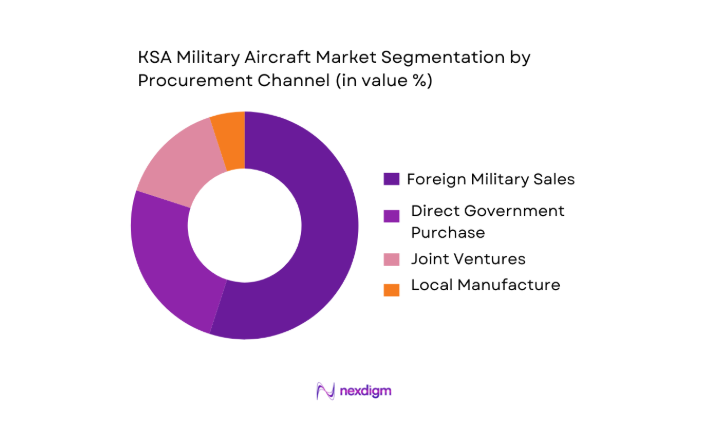

By Procurement Channel

The market is also segmented by procurement channel, which includes direct government purchase, foreign military sales (FMS), joint ventures, and local manufacture. The dominant procurement channel in Saudi Arabia’s military aircraft market is foreign military sales (FMS), primarily through established relationships with the United States. This procurement method allows for the acquisition of high-tech platforms with accompanying maintenance, training, and support packages. The U.S. has been a consistent supplier of advanced aircraft to Saudi Arabia, including the F-15, F-35, and other defense systems, which are critical to maintaining Saudi Arabia’s air superiority.

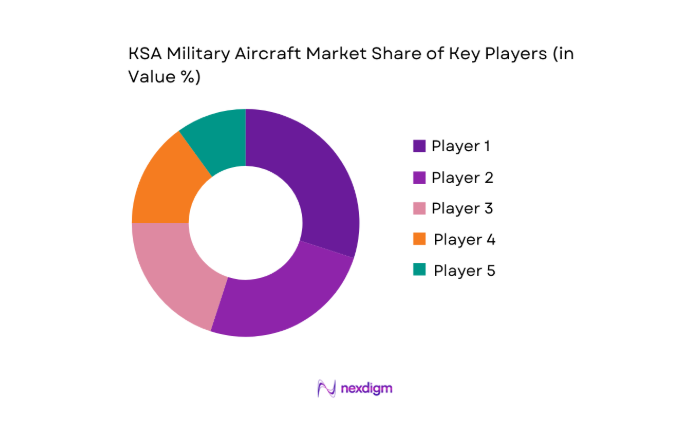

Competitive Landscape

The Saudi Arabian military aircraft market is dominated by several global players, reflecting the Kingdom’s reliance on international defense partnerships. These players include well-established firms such as Lockheed Martin, Boeing, Airbus, and Raytheon, among others. Lockheed Martin, for example, has been integral in supplying advanced fighter jets like the F-15 and F-35. Boeing has provided multi-role fighters and transport aircraft, while Airbus has supplied aerial refueling and surveillance platforms. The dominance of these players is fueled by their technological expertise, strong local partnerships, and the strategic importance of the Kingdom as a defense ally in the Middle East.

| Company | Establishment Year | Headquarters | Military Aircraft Portfolio | Technological Strengths | Local Manufacturing Partnerships | Key Contracts and Alliances |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ |

KSA Military Aircraft Market Analysis

Growth Drivers

Procurement Commitments

Saudi Arabia has committed substantial portions of its defense budget to military procurement in recent years. In 2025, Saudi Arabia allocated over USD ~ for defense expenditures, making it one of the top defense spenders globally. These commitments are aligned with the Kingdom’s Vision 2030, which emphasizes military modernization and self-sufficiency in defense production. The growing defense budget supports continued procurement of advanced aircraft, such as the F-35 and F-15 fighter jets. Saudi Arabia’s defense procurement strategy is backed by increasing regional security concerns and strategic defense partnerships, particularly with the United States and other NATO allies.

Modernization

Saudi Arabia is on a path to modernize its military infrastructure as part of its Vision 2030, which includes investing in the development and procurement of advanced military aircraft and systems. The country’s military budget for 2024 reflects this emphasis on modernization, with nearly 60% of defense spending earmarked for technology upgrades. Saudi Arabia’s aircraft fleet modernization includes the introduction of advanced platforms like the F-35, AH-64 Apache helicopters, and UAVs. This modernization effort is supported by military agreements with the U.S. and European countries, ensuring the Kingdom remains at the forefront of regional defense technologies.

Market Challenges

Localization Costs

Saudi Arabia’s goal of increasing its local defense manufacturing capacity through its Vision 2030 plan is facing significant challenges, particularly related to the high costs of localization. To meet its defense needs, the Kingdom has prioritized localizing military aircraft production and MRO activities. However, the capital and technological investment required to build local production capacity for complex military aircraft is substantial. The government has set aside nearly USD ~ for infrastructure development related to defense manufacturing in 2024, but the costs associated with developing a highly specialized workforce and building state-of-the-art production facilities are significant. This challenge underscores the difficulty in achieving full self-sufficiency in military production.

Regulatory & Export Controls

Saudi Arabia’s military aircraft procurement strategy is heavily influenced by international regulatory frameworks, particularly regarding the export of advanced military technologies. The Kingdom is subject to stringent regulations under the U.S. Arms Export Control Act and the European Union’s Common Position on Arms Exports. In 2025, these export controls impacted the pace of procurement for certain advanced aircraft and systems. The global nature of military aircraft trade introduces complexities in supply chain logistics and regulatory compliance, especially as Saudi Arabia seeks to balance local production with foreign procurement. Restrictions on technology transfers, as seen in the case of certain fighter jets and avionics systems, present barriers to seamless integration of modern technologies into the Saudi military.

Market Opportunities

Domestic Manufacturing

Saudi Arabia’s push toward domestic manufacturing of military aircraft is set to transform its aerospace sector. The Kingdom aims to generate ~ of its military equipment locally by 2030. As of 2024, the government has entered into several joint ventures with international defense firms to set up manufacturing plants within Saudi Arabia, focusing on assembling combat aircraft and UAVs. Local companies such as Saudi Arabian Military Industries (SAMI) are playing a key role in this shift. In 2024, SAMI was awarded contracts worth USD ~ for producing military systems, including components for fixed-wing and rotary aircraft. This move to strengthen local manufacturing capabilities will provide long-term growth opportunities for the Saudi military aircraft market, as the country seeks to reduce its reliance on foreign suppliers.

Technology Transfer

Saudi Arabia’s military aircraft market is benefiting from increasing opportunities for technology transfer, a key component of its Vision 2030 objectives. The Kingdom is engaging in partnerships with leading global aerospace companies to transfer advanced technologies, particularly in avionics, UAVs, and stealth technology. In 2024, Saudi Arabia signed agreements with Boeing and Lockheed Martin for technology transfers as part of their fighter jet procurement deals. These agreements will allow local firms to gain access to advanced defense technologies and significantly enhance the Kingdom’s manufacturing capabilities. This technological empowerment will drive further domestic production, making Saudi Arabia a more competitive player in the global defense market.

Future Outlook

Over the next decade, the Saudi Arabian military aircraft market is expected to experience consistent growth driven by ongoing investments in defense modernization and technological advancements. The Kingdom’s Vision 2030 initiative places a heavy emphasis on developing local defense capabilities, including military aviation. The forecasted increase in the procurement of advanced fighter jets, UAVs, and transport aircraft, along with significant investments in aerospace infrastructure, will fuel market growth. Moreover, the geopolitical landscape, including regional security dynamics and defense collaborations, will continue to shape the market’s trajectory. Saudi Arabia’s efforts to enhance its self-reliance in defense manufacturing through joint ventures and technology transfers are expected to lead to a more robust domestic aerospace sector by 2035.

Major Players

- Lockheed Martin

- Boeing

- Airbus

- Raytheon Technologies

- Northrop Grumman

- Leonardo S.p.A

- BAE Systems

- General Atomics Aeronautical Systems

- Textron Aviation

- Saab AB

- Embraer Defense

- Thales Group

- Rolls-Royce

- Dassault Aviation

- Honeywell International

Key Target Audience

- Ministry of Defense

- Royal Saudi Air Force

- National Guard of Saudi Arabia

- Aerospace & Defense Manufacturers

- Investment and Venture Capital Firms

- Government and Regulatory Bodies

- Procurement Officers

Research Methodology

Step 1: Identification of Key Variables

This step focuses on mapping the ecosystem of Saudi Arabia’s military aircraft market, involving key stakeholders like OEMs, government defense bodies, and contractors. Extensive secondary research is utilized to determine the critical variables that affect market dynamics, including procurement policies, defense budgets, and geopolitical factors.

Step 2: Market Analysis and Construction

In this phase, historical data related to aircraft procurement, fleet composition, and sustainment costs are analyzed. Data is drawn from primary sources including defense contracts and procurement records, and is supplemented by expert consultations to provide insights into market size, segment growth, and future trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert consultations with stakeholders in the Saudi Arabian defense sector. These consultations provide deeper insights into aircraft needs, emerging technologies, and procurement patterns, which help refine market predictions.

Step 4: Research Synthesis and Final Output

The final analysis involves synthesizing information from interviews, procurement records, and expert insights. The goal is to produce a comprehensive report that provides an accurate representation of the market’s current and future landscape, including growth drivers, challenges, and strategic recommendations.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Procurement commitments

modernization

regional threats

- Market Challenges

Localization costs

regulatory & export controls

- Market Opportunities

Domestic manufacturing

technology transfer

- Market Trends

Avionics upgrades

UAV proliferation

sustainment ecosystems

- Government Policies & Regulations

- SWOT Analysis

- Porter’s 5 Forces

- By Value, 2020–2025

- By Volume, 2020–2025

- By Average Price, 2020–2025

- By Aircraft Type (In Value %)

Fixed‑Wing Combat

Fixed‑Wing Non‑Combat

Rotorcraft - By Sub‑segments (In Value %)

Payload configuration

mission roles - By Procurement Channel (In Value %)

Direct government purchase

FMS

joint ventures - By Origin (In Value %)

Foreign OEMs

Localized manufacture - By End‑Use (In Value %)

Royal Saudi Air Force

National Guard, Border Security

- Market Share of Major Players

- Cross Comparison Parameters(Market share, Total contract backlog, Local content %, Delivery lead times, After‑sales support capability, Sustainment footprint (MRO), Avionics upgrade pipelines, Tech transfer commitments)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Players

Lockheed Martin

The Boeing Company

Airbus Defence & Space

Leonardo S.p.A

Raytheon Technologies

BAE Systems

Northrop Grumman

General Atomics Aeronautical Systems

Textron Aviation

Saab AB

Embraer Defense

Japan’s Mitsubishi Heavy Industries

Thales Group

Honeywell International

Rolls‑Royce

- Operational Requirements

- Budgetary Constraints

- Procurement Preferences

- Lifecycle Support Needs

- By Value, 2026–2035

- By Volume, 2026–2035

- By Average Price, 2026–2035