Market Overview

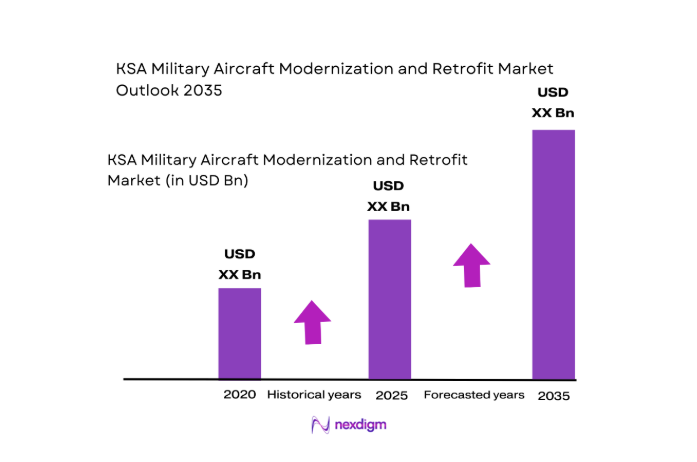

The KSA military aircraft modernization and retrofit market is valued at approximately USD ~. This market is primarily driven by Saudi Arabia’s continuous focus on modernizing its air force to maintain regional superiority and meet evolving defense needs. The Saudi Arabian government’s commitment to defense modernization, particularly through its Vision 2030 objectives, plays a pivotal role. Retrofit programs for older platforms such as the F‑15SA, the C‑130 Hercules, and AH‑64 Apache have further accelerated demand. Additionally, the increasing defense budget allocation, coupled with foreign partnerships and local industrial capabilities, has fueled market growth.

Saudi Arabia dominates the Middle Eastern military aircraft modernization and retrofit market due to its strategic location and military aspirations. Major cities such as Riyadh and Jeddah are key centers for defense operations and procurement. The Kingdom’s heavy reliance on advanced Western and Russian platforms, combined with efforts to build indigenous defense capabilities, makes it a primary market in the region. The government’s significant defense expenditure and investments in air force capabilities ensure continued dominance in this sector, aligning with the broader goals of Vision 2030 for national security and defense autonomy.

Market Segmentation

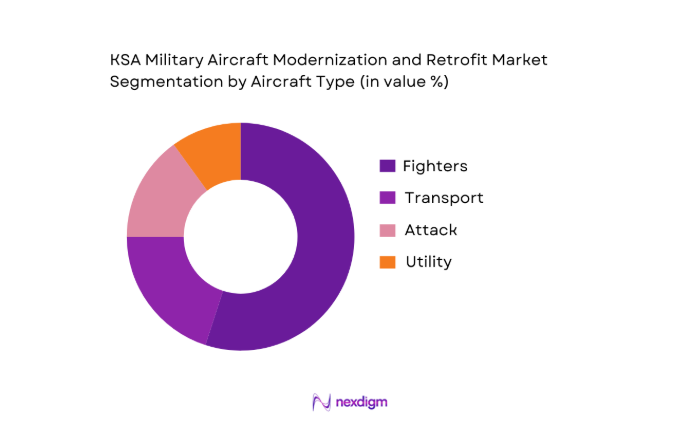

By Aircraft Type

The KSA military aircraft modernization and retrofit market is segmented by aircraft type into fixed-wing and rotary-wing platforms. Recently, fixed-wing aircraft have dominated the market, specifically fighter jets like the F‑15SA, which undergo significant retrofitting to enhance avionics, propulsion, and weapons systems. The strategic importance of these fighter jets, coupled with the Saudi Air Force’s operational needs to maintain air superiority, has led to this dominance. The extensive fleet of F‑15s and Eurofighters requires continuous upgrades to stay technologically competitive. Modernization efforts, including engine overhauls, radar upgrades, and advanced avionics integration, are primary contributors to the segment’s market share.

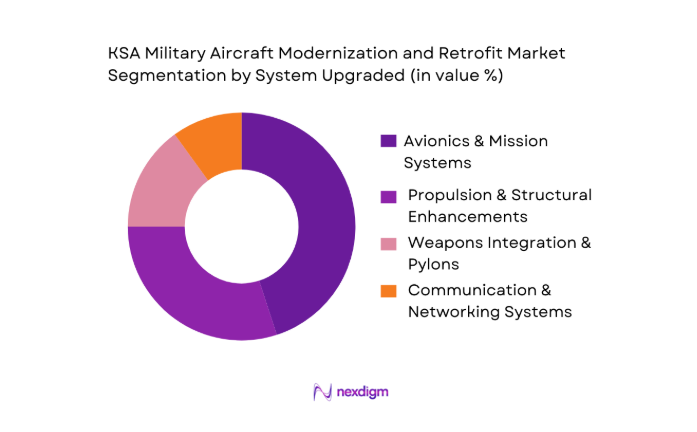

By System Upgraded

The market is segmented based on the systems being upgraded, including avionics, propulsion, and weapons systems. Avionics upgrades are dominating the market, driven by the need to enhance communication, navigation, and surveillance systems for modern warfare. The integration of advanced radar systems, electronic warfare systems, and C4ISR systems into existing platforms has driven a significant portion of the retrofit demand. These upgrades are essential for maintaining operational capabilities in complex and evolving combat scenarios, ensuring that Saudi Arabia’s aircraft remain competitive on the global stage.

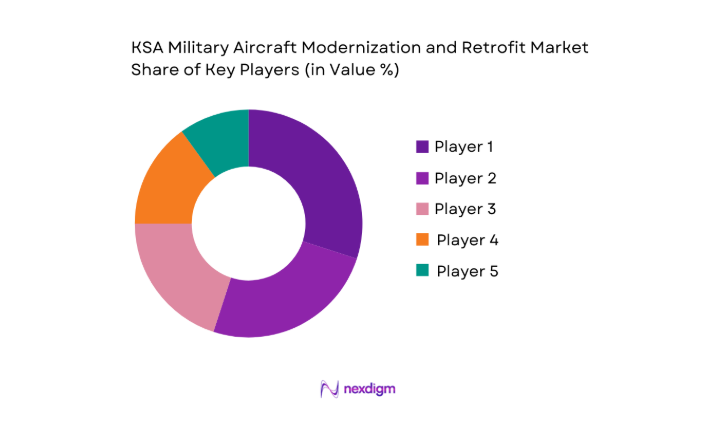

Competitive Landscape

The KSA military aircraft modernization and retrofit market is dominated by a few major players, with significant contributions from both global OEMs and local defense contractors. The consolidation of these players highlights their crucial role in meeting the air force’s strategic requirements. Key players in the market include defense giants such as Lockheed Martin, Boeing, and Raytheon Technologies, which provide advanced avionics, propulsion, and weapons system upgrades. Local contractors, in collaboration with foreign partners, are increasingly being engaged to provide support services, maintenance, and sustainment solutions.

| Company Name | Establishment Year | Headquarters | Key Offering | Technology Capabilities | Major Contracts | Strategic Partnership | Localization Level |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

KSA Military Aircraft Modernization and Retrofit Market Analysis

Growth Drivers

Geopolitical Tensions

Geopolitical tensions in the Middle East have significantly impacted defense spending, especially in Saudi Arabia. The Kingdom is a key player in the region’s security dynamics, facing security threats from neighboring conflicts and regional instability. The defense budget for Saudi Arabia has consistently increased, with an estimated defense expenditure of USD ~ in 2025. This underscores the importance of maintaining military superiority, particularly through aircraft modernization, to enhance defensive and offensive capabilities in response to emerging threats. The Kingdom’s air force modernization programs are integral to securing air dominance amid these tensions.

Strategic Airpower Goals

Saudi Arabia’s strategic airpower goals are focused on maintaining a modern and capable air force. The Kingdom’s air defense priorities include reinforcing its fleet of fighter jets and advanced surveillance systems to ensure its ability to project power in the region. As part of Vision 2030, the government aims to upgrade platforms like the F‑15 and Eurofighters to bolster regional deterrence. This modernization is backed by defense budgets of around ~ for air defense systems alone in 2024, reflecting a commitment to enhancing the country’s air force capabilities.

Market Challenges

Budget Volatility

Budget volatility is a significant challenge in defense procurement, particularly in the context of fluctuating oil prices, which are a primary source of revenue for Saudi Arabia. Although the Saudi government allocates substantial funds to its military, defense budgets are susceptible to global oil price changes. For instance, when global oil prices dropped to USD ~ in 2025, this impacted the government’s fiscal outlook, causing delays in procurement decisions. This volatility affects the continuity of long-term modernization contracts, complicating the planning and execution of retrofit programs.

Complex Certification Protocols

The certification process for military aircraft retrofitting is complex and requires strict adherence to international and local regulations. In 2024, the Saudi General Authority for Military Industries (GAMI) introduced more stringent requirements for airworthiness certification of retrofitted aircraft, with additional compliance checks for electronic warfare and avionics systems. The process involves rigorous testing and quality checks that can delay retrofit programs. These certifications must meet both local and international standards, increasing the costs and time involved in completing upgrades, further straining the defense budget.

Opportunities

Localization via GAMI

One of the most promising opportunities for the KSA military aircraft modernization market is the ongoing efforts to localize defense manufacturing through the General Authority for Military Industries. Saudi Arabia is focused on reducing dependency on foreign suppliers by developing local capabilities in aircraft maintenance, repair, and overhaul . The Vision 2030 initiative sets ambitious goals for local production, including a target to produce ~ of military systems locally by 2030. With this, the domestic defense industry is expected to experience substantial growth, driven by joint ventures between international and local manufacturers.

Tech Transfer

Tech transfer opportunities are pivotal in advancing the Kingdom’s aircraft modernization capabilities. As Saudi Arabia enters more partnerships with global OEMs for aircraft retrofitting, technology transfer agreements are a growing trend. The government aims to enhance local capabilities by incorporating advanced technologies in avionics, propulsion systems, and military communications. In 2024, Saudi Arabia signed multiple tech transfer agreements with companies like Boeing and Lockheed Martin, which will ensure the Kingdom benefits from cutting-edge technologies while promoting local innovation. This shift toward self-sufficiency in military technology offers a significant opportunity for future market growth.

Future Outlook

Over the next decade, the KSA military aircraft modernization and retrofit market is poised for substantial growth. The Kingdom’s increasing focus on strengthening its military infrastructure, underpinned by the Vision 2030 framework, will drive continued demand for retrofit programs. This growth will be propelled by advancements in avionics technology, sustainability goals for aging fleets, and the need for interoperability between old and new defense platforms. Additionally, rising geopolitical tensions and Saudi Arabia’s efforts to assert regional dominance will require continued investment in air combat superiority.

Major Players

- Lockheed Martin

- Boeing

- Raytheon Technologies

- BAE Systems

- Airbus Defence & Space

- Northrop Grumman

- SAAB

- Leonardo

- Elbit Systems

- Thales Group

- Honeywell Aerospace

- Collins Aerospace

- Textron Systems

- L3Harris Technologies

- Rafael Advanced Defense Systems

Key Target Audience

- Ministry of Defense, Saudi Arabia

- Royal Saudi Air Force

- Defense Contractors

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

- Private Sector Defense Solution Providers

- Military Equipment Suppliers

- Aerospace and Defense Investment Firms

Research Methodology

Step 1: Identification of Key Variables

The first phase of the research involves identifying key variables such as aircraft types, upgrade systems, and market dynamics. The data is gathered through secondary sources, including industry reports, defense budgets, and government procurement policies, to develop a comprehensive ecosystem map of stakeholders within the KSA military aircraft modernization market.

Step 2: Market Analysis and Construction

Market construction focuses on understanding the historical context of the KSA retrofit programs. We analyze data regarding fleet age, procurement trends, and technological upgrades, alongside revenue generation models. Historical data from defense reports is examined to map out past investments in modernization efforts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding the market drivers and trends will be validated via consultations with military experts, government officials, and key OEM representatives. These discussions provide deeper insights into the operational demands and future direction of KSA’s air force capabilities, ensuring a well-rounded market analysis.

Step 4: Research Synthesis and Final Output

The final phase entails synthesizing the data collected from multiple sources to refine the analysis. Insights gathered from expert consultations are cross-checked with secondary data to finalize projections for the market’s future outlook, providing a comprehensive report backed by accurate, validated figures.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Geopolitical Tensions

Strategic Airpower Goals

Fleet Aging Index - Market Challenges

Budget Volatility

Complex Certification Protocols - Opportunities

Localization via GAMI

Tech Transfer

Regional Retrofit Hub Potential - Key Trends

Stealth & EW Retrofitting

AI‑Enabled Avionics - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By Volume, 2020-2025

- Average Retrofit Price, 2020-2025

- By Aircraft Type (In Value %)

Fixed Wing

Rotary Wing - By System Upgraded (In Value %)

Avionics & Mission Systems

Propulsion & Structural Enhancements

Weapons Integration & Pylons - By Retrofit Depth (In Value %)

Life Extension Programs

Capability Enhancement Programs

Sustainment Services - By End User (In Value %)

RSAF Combat Units

Royal Saudi Land Forces Aviation Corps

National Guard Aviation - By Procurement Mode (In Value %)

Direct Government Contract

Foreign OEM Partnership

Offset/Industrial Cooperation

- Market Share of Major Players

- Cross Comparison Parameters (Platform Retrofit Depth, Local Content %, Tech Transfer Index, Delivery Lead Time, Warranty & Support Term, Integration Capability, Aftermarket Analytics Capability, Regulatory Compliance Level)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profile of Major Players

Lockheed Martin

Boeing Defence

Airbus Defence & Space

Raytheon Technologies

Northrop Grumman

BAE Systems

SAAB

Leonardo S.p.A

Elbit Systems

Thales Group

Honeywell Aerospace

Collins Aerospace

Textron Systems

L3Harris Technologies

Rafael Advanced Defense Systems

- Mission Performance Requirements

- Platform Life Cycle Management Metrics

- Cost of Ownership & Sustainment Budget Impacts

- Doctrine & Tactics Shaping Retrofit Priorities

- By Value, 2026-2035

- By Volume, 2026-2035

- Average Retrofit Price, 2026-2035