Market Overview

The Saudi Arabia military amphibious vehicle market is valued at USD ~ as of 2024, driven primarily by increasing defense budgets and the ongoing modernization of the Saudi Armed Forces, particularly the Royal Saudi Navy and Land Forces. The growth of this market is fueled by the Kingdom’s strategic military plans under Vision 2030, which includes enhancing amphibious warfare capabilities and establishing a powerful defense infrastructure for its coastal regions. Amphibious vehicles are key to bolstering Saudi Arabia’s operational flexibility in both desert and coastal environments, with an emphasis on amphibious assault and logistics support in maritime operations.

Saudi Arabia, particularly Riyadh and Dhahran, dominates the military amphibious vehicle market in the region due to its central role in defense procurement and military strategy. The Kingdom’s large-scale defense investments, coupled with its strategic positioning along the Arabian Gulf and the Red Sea, necessitate an advanced amphibious force capable of projecting power in littoral and contested environments.

Market Segmentation

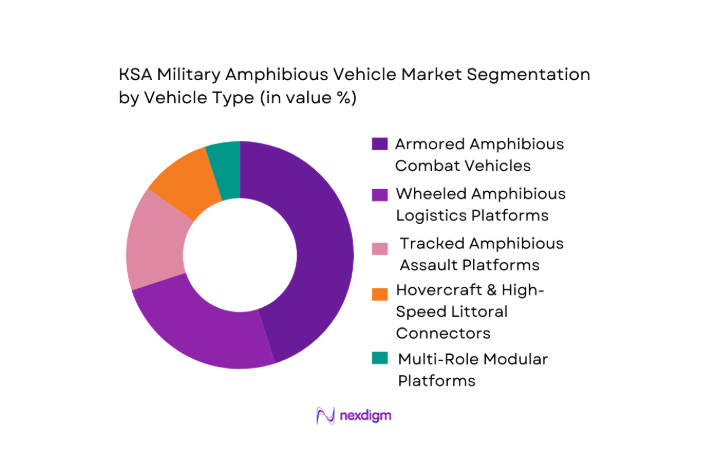

By Vehicle Type

The Saudi Arabian military amphibious vehicle market is segmented by vehicle type into Armored Amphibious Combat Vehicles (AACV), Wheeled Amphibious Logistics Platforms, Tracked Amphibious Assault Platforms, Hovercraft & High-Speed Littoral Connectors, and Multi-Role Modular Platforms. Armored Amphibious Combat Vehicles (AACVs) dominate the market within this segmentation. AACVs are particularly significant due to their critical role in amphibious assaults and troop transport in hostile environments. These vehicles combine protection with mobility, which is crucial for Saudi Arabia’s need to project military power across various terrains, including coastal and desert regions. They are integrated with advanced technologies such as C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance), enabling efficient battlefield management and tactical operations.

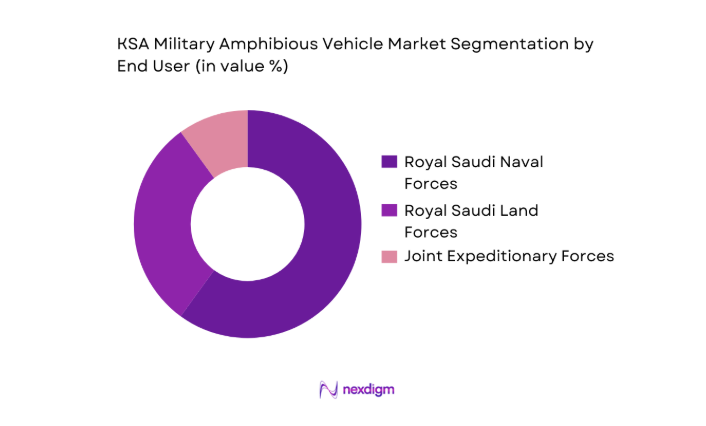

By End User

This market is also segmented by end users, including the Royal Saudi Naval Forces (RSNF), Royal Saudi Land Forces (RSLF), and joint expeditionary forces. Royal Saudi Naval Forces (RSNF) dominate the end-user segment. The RSNF’s responsibility to ensure maritime security and protect the Kingdom’s vast coastal borders makes amphibious vehicles critical for their operations. These vehicles are used for naval landings, humanitarian missions, and amphibious defense strategies. The RSNF has consistently increased its investment in modern amphibious technologies to maintain a superior naval defense posture, especially in the face of regional tensions and ongoing defense modernization efforts.

Competitive Landscape

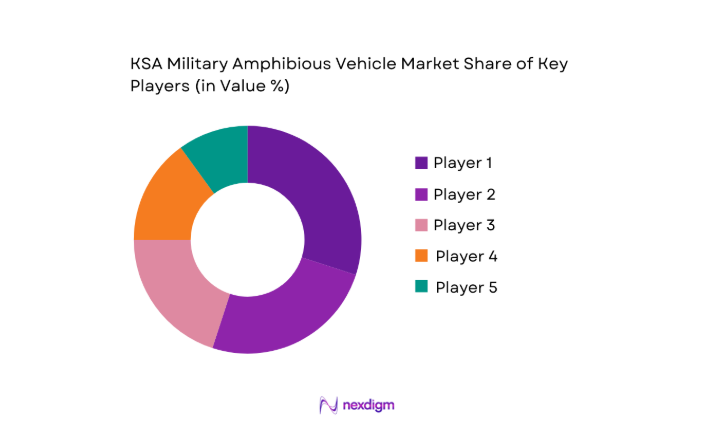

The Saudi Arabian military amphibious vehicle market is highly competitive and dominated by global defense giants alongside regional players. These companies provide a variety of amphibious platforms tailored to the needs of the Saudi Armed Forces, which includes a mix of armored vehicles, wheeled platforms, and high-speed connectors. Major players include BAE Systems, Lockheed Martin, and Rheinmetall, among others. These companies continue to innovate, offering advanced amphibious solutions that integrate with Saudi Arabia’s growing defense modernization strategy.

| Company | Establishment Year | Headquarters | Armored Amphibious Combat Vehicles | Wheeled Amphibious Logistics | Tracked Amphibious Assault Platforms | Hovercraft & High-Speed Connectors | Local Assembly/Offset Participation | Export Approvals & Compliance |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall | 1889 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| FNSS Defence Systems | 1988 | Turkey | ~ | ~ | ~ | ~ | ~ | ~ |

| Hanwha Defense | 1977 | South Korea | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Military Amphibious Vehicle Market Analysis

Growth Drivers

Strategic Modernization & Vision-Driven Defense Procurement

Saudi Arabia’s defense spending remains one of the highest in the Middle East, driven by its Vision 2030 plan to diversify the economy and enhance military capabilities. In 2024, Saudi Arabia’s defense budget is projected to reach approximately USD~, underscoring the Kingdom’s commitment to modernizing its military infrastructure. This defense modernization includes the procurement of advanced amphibious vehicles to strengthen the Royal Saudi Navy’s capabilities. The modernization efforts are supported by the Kingdom’s growing defense industry, which is expected to reach a local production value of over USD ~ by 2026. These initiatives are part of a broader effort to reduce reliance on foreign defense suppliers and foster self-sufficiency in key military assets. The growth in defense spending, coupled with strategic defense procurement, drives the demand for advanced military platforms such as amphibious vehicles.

Coastal Defense and Expeditionary Maneuver Requirements

Saudi Arabia’s geopolitical positioning along the Arabian Gulf and Red Sea necessitates robust coastal defense capabilities. The Kingdom’s expanding maritime borders and strategic interest in securing key shipping lanes, especially in the context of regional instability, require advanced amphibious vehicles to facilitate rapid deployment and coastal defense operations. The Saudi navy continues to modernize its fleet, with a significant portion allocated to strengthening amphibious operations. As part of this, the country has been investing heavily in surveillance, interdiction, and rapid response capabilities. In 2024, the Saudi government plans to allocate USD ~ to coastal defense systems, reinforcing the need for amphibious platforms. This reflects a growing focus on defending critical maritime assets and projecting power across regional waters.

Market Challenges

Supply Chain Constraints & Geopolitical Sourcing Risks

One of the key challenges faced by Saudi Arabia’s defense procurement is the reliance on global supply chains for critical military components, which can be disrupted by geopolitical tensions. The defense industry is highly dependent on suppliers from the U.S., Europe, and Asia, creating vulnerabilities in times of international conflict or sanctions. The disruption caused by the COVID-19 pandemic in 2020 highlighted how fragile the defense supply chain can be, particularly for specialized platforms like amphibious vehicles. In 2024, global defense manufacturers are facing supply chain delays due to material shortages, particularly for armored vehicle components and advanced electronics. These disruptions could affect the timely delivery of amphibious vehicles, which are critical to Saudi Arabia’s defense strategy. Additionally, sanctions on specific countries and regional conflicts can create uncertainties for the Kingdom’s procurement strategy.

Lifecycle Sustainment Costs & Interoperability Barriers

Amphibious vehicles have long operational lifecycles, often exceeding 30 years, and maintaining them involves significant costs. In Saudi Arabia, the challenge lies in the costs of both procurement and ongoing maintenance. As of 2024, the Kingdom allocates a substantial portion of its defense budget to sustain existing military platforms, including amphibious vehicles. The Royal Saudi Navy, for instance, has spent over USD 3.2 billion in the past five years on maintenance and upgrades for existing fleets. Moreover, interoperability with other regional and international forces remains a key concern. While the Saudi Armed Forces invest in advanced platforms, challenges arise from integrating these systems with NATO-aligned forces and GCC partners, which operate different types of amphibious platforms and technologies. The cost burden of integration and interoperability is likely to continue as the Kingdom modernizes its defense infrastructure.

Market Opportunities

Indigenous Production & Offset Partnerships

Saudi Arabia is making significant strides in building its domestic defense industry, supported by the Vision 2030 initiative. The Kingdom is focusing on indigenous production of advanced military platforms, including amphibious vehicles, as part of a broader strategy to enhance local defense capabilities and reduce reliance on foreign suppliers. In 2024, Saudi Arabia’s military production sector is expected to grow to USD 8 billion, with a significant portion directed towards local manufacturing of amphibious vehicles. To facilitate this, the government has entered into offset agreements with major defense contractors like Lockheed Martin and BAE Systems, enabling the Kingdom to develop the necessary technical expertise and supply chains for amphibious vehicle production. These efforts are expected to boost the local defense industry and create new market opportunities, providing long-term benefits for both the Saudi economy and its military capabilities.

Aftermarket Services & Sustainment Contracts

The expansion of Saudi Arabia’s military vehicle fleet, including amphibious platforms, presents significant opportunities for aftermarket services and sustainment contracts. As the Kingdom invests in long-term fleet development, the need for ongoing support services such as repairs, upgrades, and training will grow. In 2024, Saudi Arabia’s defense procurement plan includes a focus on lifecycle sustainment, with plans to allocate USD ~ for long-term support contracts for military vehicles, including amphibious platforms. This presents lucrative opportunities for global defense contractors and local companies specializing in maintenance and technical support. Furthermore, the government’s push for enhancing domestic defense services opens the door for local suppliers to enter the aftermarket service space, providing significant growth potential in the sector.

Future Outlook

Over the next 5 years, the Saudi Arabia military amphibious vehicle market is projected to experience sustained growth. This growth will be driven by the Saudi government’s ongoing defense modernization efforts, which align with Vision 2030. Increasing defense budgets, advancements in amphibious vehicle technology, and the need for multi-role, high-mobility platforms will continue to fuel demand. Additionally, Saudi Arabia’s strategic focus on enhancing its coastal defense and military interoperability within the GCC region will ensure a robust market outlook.

Major Players

- BAE Systems

- Lockheed Martin

- Rheinmetall AG

- FNSS Defence Systems

- Hanwha Defense

- General Dynamics Corporation

- Textron Systems

- Otokar

- Norinco Group

- Gibbs Amphibians

- Grifon Hoverwork

- EIK Engineering Sdn Bhd

- Wetland Equipment Company

- Amphibious Marine Inc.

- Navistar Defense

Key Target Audience

- Ministry of Defense, Saudi Arabia

- Royal Saudi Navy

- Royal Saudi Land Forces

- Defense Procurement Authorities

- Defense Contractors and Manufacturers

- Investment and Venture Capitalist Firms

- Aerospace and Defense Technology Innovators

- Defense Industry Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

This step involves gathering comprehensive data from secondary sources, including defense procurement databases, industry reports, and government publications, to identify the key variables that influence the market, such as defense budget allocations, procurement cycles, and platform specifications.

Step 2: Market Analysis and Construction

Historical data from defense industry reports and governmental defense spending archives will be analyzed. Market penetration and growth drivers such as amphibious technology adoption, procurement trends, and strategic military needs will be evaluated to assess the current market situation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding the impact of Saudi defense strategies and regional security threats will be validated through interviews with key experts in military defense technology, procurement specialists, and senior officials from defense contractors operating in Saudi Arabia.

Step 4: Research Synthesis and Final Output

The final phase includes synthesizing data from expert consultations and real-time market intelligence gathered through industry sources, validating assumptions, and providing the final market forecast, segmentation analysis, and insights into future trends and strategic opportunities.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In‑Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Strategic modernization & Vision‑driven defense procurement

Coastal defense and expeditionary maneuver requirements - Market Challenges

Supply chain constraints & geopolitical sourcing risks

Lifecycle sustainment costs & interoperability barriers

Anti‑access/area denial environment adaptation - Opportunities

Indigenous production & offset partnerships

Aftermarket services & sustainment contracts

Export synergies within GCC cooperation frameworks - Trends

Autonomy & unmanned amphibious solutions

Network‑centric command integration

Modular mission payload architectures - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020‑2025

- By Volume , 2020‑2025

- By Average Unit Cost, 2020‑2025

- By Vehicle Type (In Value %)

Armored Amphibious Combat Vehicles

Wheeled Amphibious Logistics Platforms

Tracked Amphibious Assault Platforms - By Propulsion / Mobility Technologies (In Value %)

Track

wheel

water‑jet - By End User (In Value %)

Royal Saudi Naval Forces

Royal Saudi Land Forces Amphibious Brigades

Joint Expeditionary Units - By Application (In Value %)

Naval landing & littoral projection

Logistic sustainment

- Market Share of Major Players

- Cross Comparison Parameters (Platform survivability ratings, Maritime operational range, Payload / troop capacity, Maintenance & integrated logistics support cost, Sensor & C2 integration maturity, Local assembly/offset participation rate)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profile of Major Players

BAE Systems plc

General Dynamics Corporation

Lockheed Martin Corporation

FNSS Defence Systems

Rheinmetall AG

Textron Systems

Hanwha Defense

Otokar

Norinco Group

Gibbs Amphibians

H20 Amphibious Inc.

Griffon Hoverwork

EIK Engineering Sdn Bhd

- Operational Doctrine Imperatives

- Procurement & Budgeting Cycles

- Interoperability Requirements

- Lifecycle Sustainment & Field Support Economics

- By Value, 2026‑2035

- By Volume , 2026‑2035

- By Average Unit Cost, 2026‑2035