Market Overview

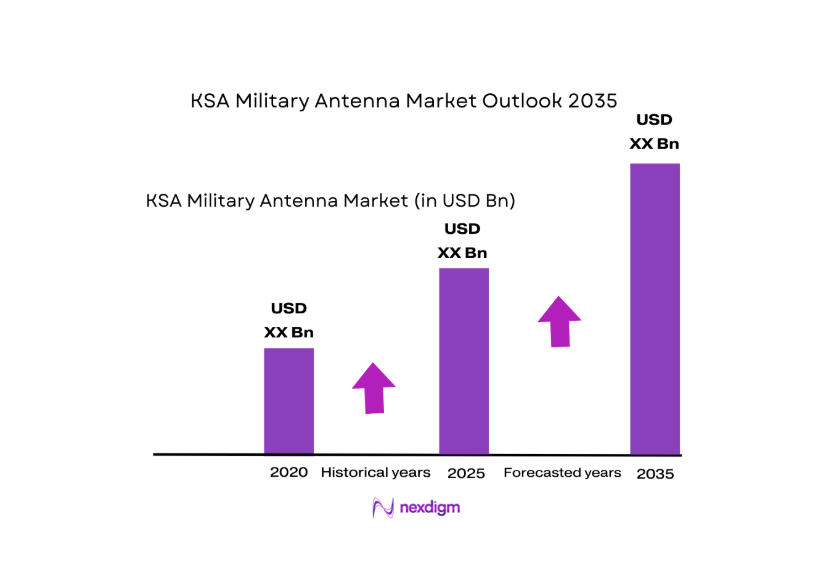

The KSA military antenna market has been steadily growing due to increasing defense budgets and military modernization efforts. The market is driven by a surge in demand for advanced communication technologies, including military-grade antennas, which are critical for tactical communication systems. The KSA government’s ongoing investments in defense infrastructure, technological advancements in antenna systems, and rising geopolitical tensions have further catalyzed this growth. In recent years, the market reached a valuation of approximately USD ~ in 2025 and is expected to grow significantly in the coming years, with a focus on advanced technologies such as multi-functional and multi-band antennas.

KSA, being a regional leader in defense, is the dominant force in the Middle East’s military antenna market. The country’s strategic military alliances and robust defense budget are key drivers behind this dominance. Riyadh, being the political and defense hub, along with key military bases and technological centers spread across the country, forms the backbone of the market. Other regions such as Jeddah and Dammam also contribute due to their proximity to major ports and airbases, further strengthening the overall demand for military communication systems.

Market Segmentation

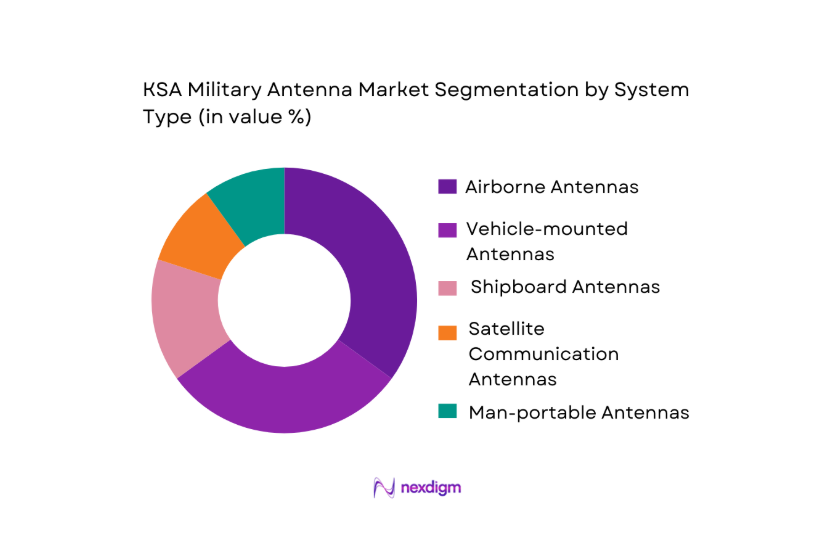

By System Type

The KSA military antenna market is primarily segmented by system type into man-portable antennas, vehicle-mounted antennas, airborne antennas, shipboard antennas, and satellite communication antennas. Among these, airborne antennas hold a dominant market share, largely driven by the country’s military focus on enhancing its air force capabilities. Airborne systems are integral to communication between aircraft and ground stations, enabling critical operations in both combat and surveillance missions. The continuous upgrading of Saudi Arabia’s air defense systems, along with the demand for enhanced performance in military aircraft, further fuels the dominance of this segment.

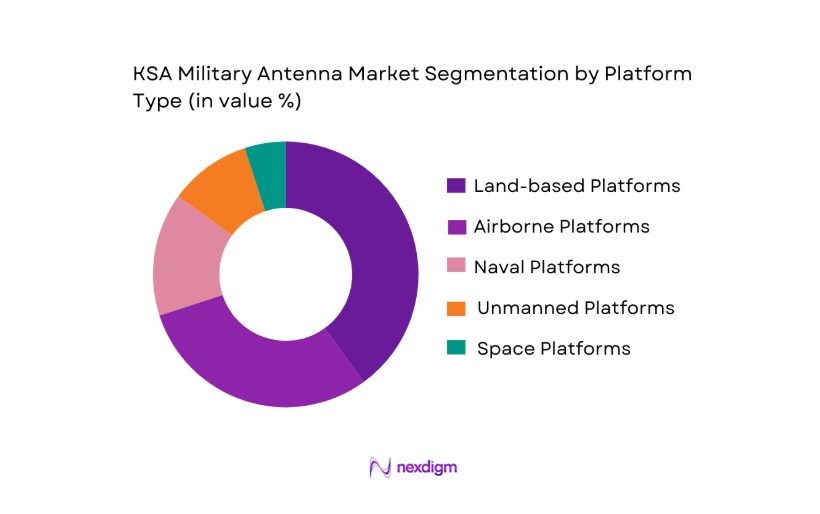

By Platform Type

The market is also segmented based on platform type, with key sub-segments being land-based platforms, airborne platforms, naval platforms, space platforms, and unmanned platforms. Land-based platforms dominate this segment due to the vast landmass of Saudi Arabia and the strategic importance of ground communication systems in defense operations. These platforms are crucial for securing military bases, ensuring real-time communication with ground forces, and providing network support during defense operations. The integration of land-based communication platforms in military operations remains critical, driving the demand for specialized antennas for communication.

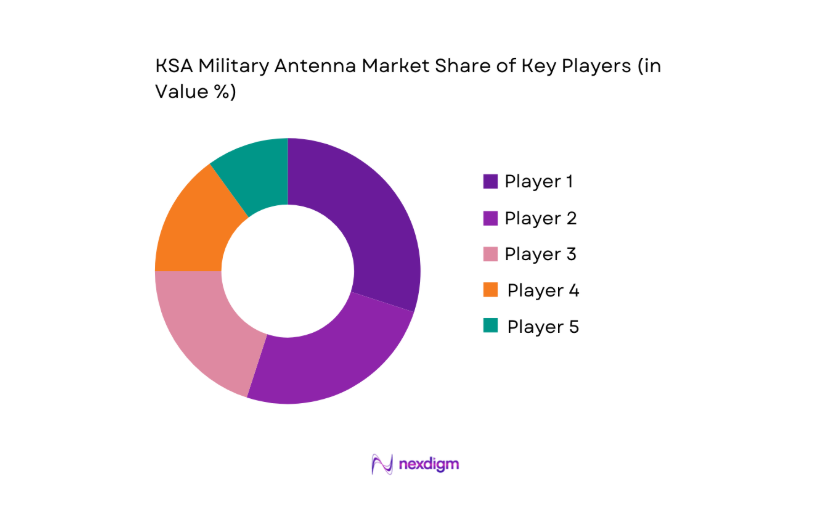

Competitive Landscape

The KSA military antenna market is characterized by the presence of both established global players and local manufacturers. This competitive landscape is dominated by large multinational defense companies, such as Thales Group, Northrop Grumman, and L3 Technologies, which supply state-of-the-art military-grade antennas. In addition, several regional firms, backed by strong ties to government defense initiatives, contribute to the competition. The competitive nature is further influenced by the high demand for cutting-edge technology, such as multi-functional antennas, which combine several communication functions into one platform, offering more efficiency and lower operational costs.

| Company Name | Establishment Year | Headquarters | Key Technology Focus | Product Portfolio | Market Reach | Strategic Partnerships | R&D Investment |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman Corporation | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| L3 Technologies | 1997 | USA | ~ | ~ | ~ | ~ | ~ |

| Leonardo DRS | 1958 | Italy | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence and Space | 2000 | Germany/France | ~ | ~ | ~ | ~ | ~ |

KSA Military Antenna Market Dynamics

Growth Drivers

Increased Military Budget Allocations in the KSA

Saudi Arabia’s military expenditure continues to be one of the highest in the world, reflecting its strategic defense priorities. In 2024, the country’s defense spending is projected to surpass USD 60 billion, as the government continues to enhance its defense capabilities amid regional security concerns. According to the International Monetary Fund (IMF), Saudi Arabia’s defense budget accounts for over ~ of its GDP, a substantial increase compared to the global average of approximately ~. This sustained investment in defense not only drives the demand for military systems but also supports the development of advanced communication technologies like military antennas, which are essential for modernizing defense infrastructure.

Expansion of Defense Communication Networks

Saudi Arabia’s ongoing commitment to strengthening its defense communication networks is evident in the nation’s continued infrastructure investments. In 2024, the government is expected to allocate a significant portion of its defense budget to upgrading its communication systems, with a focus on satellite and tactical communication technologies. With an increase in border security concerns and regional tensions, Saudi Arabia has prioritized the modernization of its communication networks to ensure secure and reliable military operations. The World Bank’s 2024 analysis highlights a notable surge in investment in high-tech communication systems across the Middle East, which supports the KSA’s push for cutting-edge military antennas and communications technology.

Market Challenges

Geopolitical Tensions and Defense Budget Constraints

While Saudi Arabia continues to prioritize defense, it faces challenges in managing geopolitical tensions with neighboring countries, which has resulted in fluctuating defense budgets. The 2024 budget allocation of USD ~ reflects the government’s focus on ensuring national security amidst instability in the Middle East. However, the fluctuating global oil prices, which constitute a major portion of Saudi Arabia’s revenue, create budgetary pressures, making it difficult to maintain sustained defense spending. As per the IMF, global oil prices are expected to stabilize at around USD ~ in 2024, which could impact the available funding for military projects. This constraint can slow down investments in new antenna technologies and their integration.

High R&D Costs for Advanced Antenna Systems

The development of advanced military antenna systems, especially those integrating multi-functional capabilities, involves significant R&D investments. In 2024, the cost of R&D for these systems is projected to exceed USD ~ globally, with a considerable portion of this expenditure coming from Saudi defense contractors. This high R&D cost is a major challenge for the KSA military antenna market as the country strives to keep pace with global technological trends. Given that the local production of military antennas is still in a developing phase, reliance on foreign imports, coupled with these high R&D expenses, can delay the widespread adoption of advanced systems. The Saudi government’s commitment to reducing dependency on imports by promoting local defense industry growth is a long-term strategy that may alleviate this challenge over time.

Market Opportunities

Growth in Military Modernization Programs

Saudi Arabia’s military modernization programs are a key opportunity for the military antenna market. As part of the Vision 2030 initiative, the Kingdom has committed to upgrading its defense capabilities, which includes bolstering communication infrastructure. The government’s investment in new defense technologies has been steadily rising, with the Kingdom focusing on advanced command and control systems, radar, and satellite communications. A significant portion of this modernization effort is focused on enhancing military communication networks, which directly translates to increased demand for advanced antennas. The Saudi Ministry of Defense, through its partnership with global defense firms, continues to develop and implement new technologies to enhance its military infrastructure, creating long-term growth prospects for the antenna sector.

Rise in Demand for Tactical Communication Systems

As regional security challenges continue to evolve, Saudi Arabia is increasingly investing in tactical communication systems for its military operations. The growing threat from regional instability has prompted the need for more reliable and secure communication networks that can withstand electronic warfare and cyber-attacks. In 2024, Saudi Arabia is expected to significantly increase its procurement of tactical communication systems for use by its armed forces. This includes expanding satellite communication capabilities and implementing highly secure systems that ensure uninterrupted communication during missions. With this heightened demand, the military antenna market is well-positioned to benefit from the ongoing military preparedness strategies.

Future Outlook

Over the next decade, the KSA military antenna market is expected to continue its growth trajectory, driven by technological advancements in communication systems, coupled with Saudi Arabia’s aggressive military modernization programs. The rise in military spending and increasing defense cooperation with international powers are key factors contributing to this forecasted growth. Furthermore, the evolving security landscape in the Middle East and the demand for high-performance antennas capable of multi-band and multi-functional communications will further fuel the market’s expansion.

Major Players

- Thales Group

- Northrop Grumman Corporation

- L3 Technologies

- Leonardo DRS

- Airbus Defence and Space

- General Dynamics Mission Systems

- Viasat Inc.

- Cobham PLC

- Rohde & Schwarz

- Harris Corporation

- Rockwell Collins

- Lockheed Martin

- Raytheon Technologies

- Elbit Systems

- Boeing

Key Target Audience

- Government and Regulatory Bodies

- Military Contractors and Defense Solution Providers

- Investments and Venture Capitalist Firms

- Defense Research & Development Organizations

- Aerospace and Defense Equipment Manufacturers

- National Defense Agencies

- International Defense Agencies

- Security and Surveillance Companies

Research Methodology

Step 1: Identification of Key Variables

The first step in this research process involves identifying critical market variables. This phase includes extensive desk research, using proprietary databases and secondary sources to collect data on major stakeholders in the KSA military antenna market. The aim is to define all significant factors affecting the market dynamics, such as technological trends, geopolitical influences, and defense infrastructure.

Step 2: Market Analysis and Construction

In this phase, historical data on the KSA military antenna market is compiled and analyzed. This includes reviewing past market performances, identifying growth trends, and understanding the proportion of different sub-segments. A detailed market analysis is conducted to map the penetration rates of various platforms and technologies, providing a comprehensive view of the market’s evolution.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated based on the collected data, which are then validated through interviews with industry experts. These consultations involve military contractors, defense analysts, and technology providers, offering critical insights into the market’s challenges and opportunities. The goal is to ensure the accuracy and relevance of the market data, reinforcing the research findings.

Step 4: Research Synthesis and Final Output

In the final step, detailed information from military manufacturers and technology providers is gathered to supplement the research findings. This interaction helps to verify the data collected and ensures that the final market report includes validated statistics and comprehensive market insights, offering a complete picture of the KSA military antenna market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Military Budget Allocations in the KSA

Expansion of Defense Communication Networks

Technological Advancements in Antenna Systems - Market Challenges

Geopolitical Tensions and Defense Budget Constraints

High R&D Costs for Advanced Antenna Systems

Integration Challenges with Existing Infrastructure - Market Opportunities

Growth in Military Modernization Programs

Rise in Demand for Tactical Communication Systems

Increase in Strategic Military Alliances and Joint Ventures - Trends

Shift Towards Multi-band and Multi-functional Antennas

Integration of AI and Automation in Antenna Systems

Growing Demand for Space-based Military Communication Solutions

- Government Regulations

- Porter’s Five Forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Man-portable Antennas

Vehicle-mounted Antennas

Airborne Antennas

Shipboard Antennas

Satellite Communication Antennas - By Platform Type (In Value%)

Land-based Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Unmanned Platforms - By Fitment Type (In Value%)

Fixed Fitment

Mobile Fitment

Remotely Operated Fitment

Modular Fitment

Integrated Fitment - By EndUser Segment (In Value%)

Defense Ministry

Military Contractors

Defense Research & Development

Private Military Contractors

Aerospace & Defense Equipment Manufacturers - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Third-Party Procurement

Private Auctions

Online Bidding Platforms

- Market Share Analysis

- CrossComparison Parameters (Technology Innovation, Geographic Reach, System Integration, Cost Efficiency, Product Customization)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus Defence and Space

Thales Group

General Dynamics Mission Systems

Northrop Grumman Corporation

L3 Technologies

Leonardo DRS

Harris Corporation

Cobham plc

Rohde & Schwarz GmbH

Viasat, Inc.

Lockheed Martin

Boeing

Rockwell Collins

ITT Exelis

Elbit Systems

- Growing Defense Budget Impacting Antenna Demand

- Increased Usage of Antennas in Tactical Military Operations

- Rising Demand from Aerospace and Satellite Communication Sectors

- Shift Towards Highly Customizable Antenna Solutions for Specific Needs

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035