Market Overview

The KSA Military Aviation Maintenance, Repair, and Overhaul (MRO) market is a vital segment of the country’s defense industry. Valued at approximately USD ~ billion in 2025, the market size is propelled by the Kingdom’s ongoing efforts to enhance its defense infrastructure under Vision 2030. This is further driven by the increasing demand for advanced MRO services to maintain Saudi Arabia’s growing military fleet, including fighter jets, transport aircraft, and helicopters. The local defense manufacturing push, through the Saudi Arabian Military Industries (SAMI), as well as the focus on long-term strategic alliances with global players, plays a significant role in expanding this market.

The KSA Military Aviation MRO market is predominantly driven by major military hubs such as Riyadh, Jeddah, and Dammam. Riyadh remains a key hub for aircraft fleet management, with its proximity to military command centers and key airbases. Jeddah is essential for logistical support, particularly for naval and maritime aviation MRO operations. Dammam, with its specialized facilities, caters to both air force and commercial aviation MRO, which contributes to its dominant role. Saudi Arabia’s strategic geographical location in the Middle East further facilitates its role as a key player in the regional defense market.

Market Segmentation

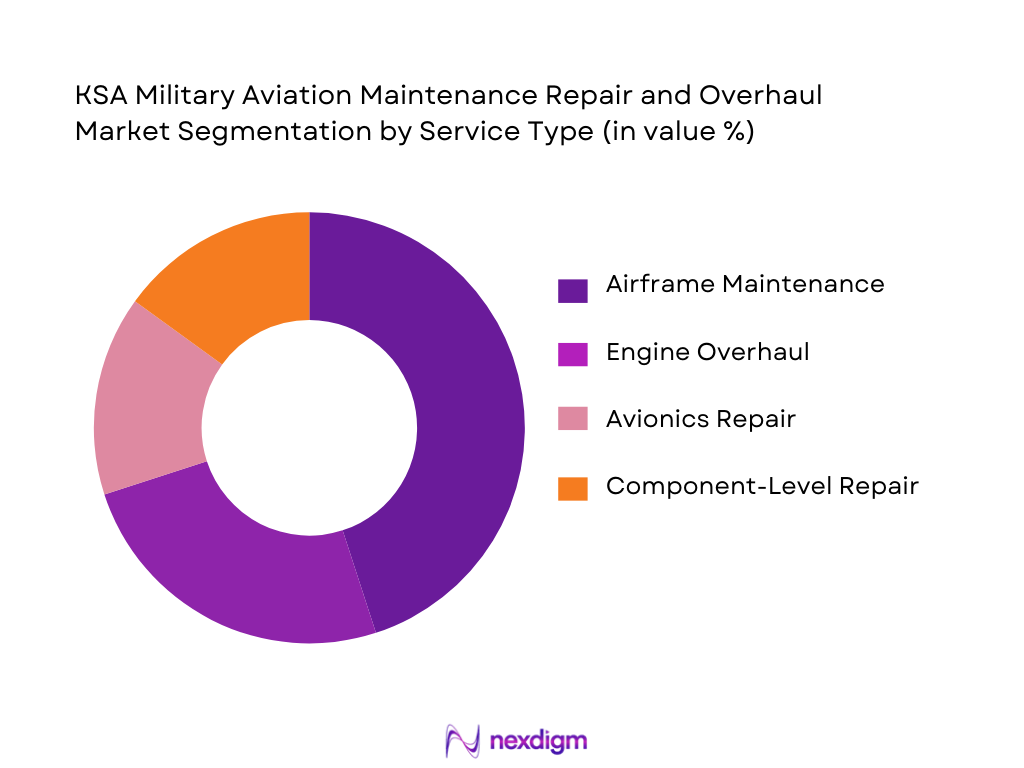

By Service Type

The market for Military Aviation MRO services in KSA is segmented into airframe maintenance, engine overhaul, avionics repair, and component-level repairs. Among these, airframe maintenance dominates the segment, as it is crucial for the operational readiness of combat and transport aircraft. This segment benefits from a constant need to ensure aircraft safety and readiness, aligning with Saudi Arabia’s defense strategy to maintain high mission-capable rates for its air fleet. Airframe maintenance requires specialized facilities and skilled labor, contributing to its large share in the market.

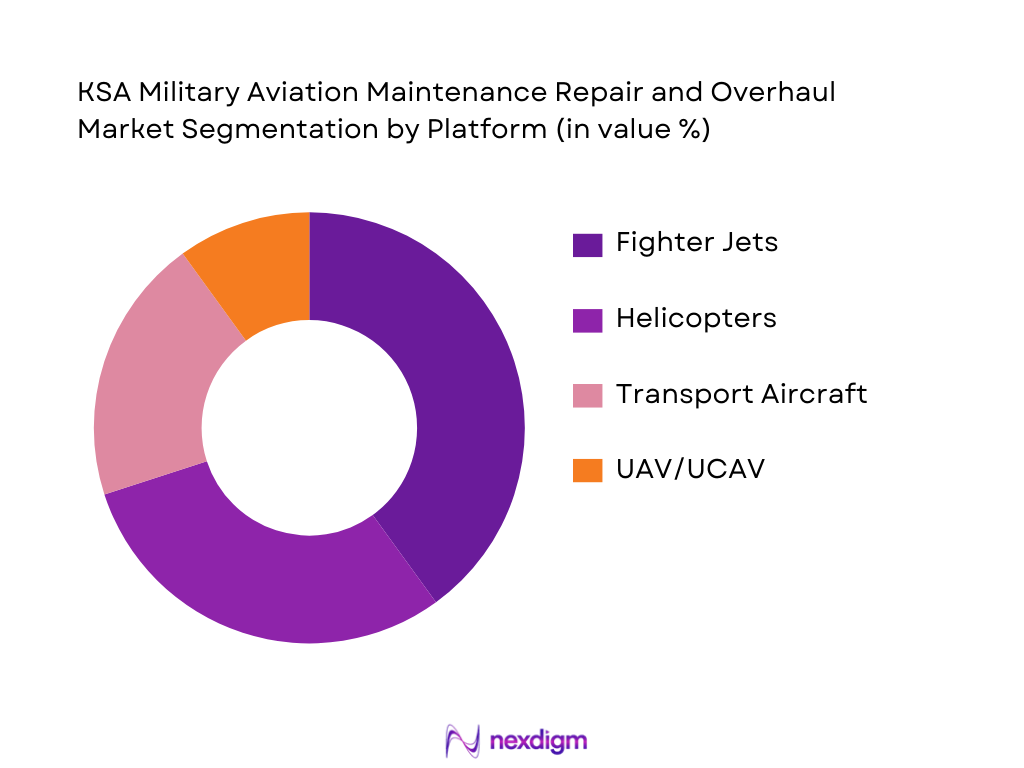

By Platform

The KSA Military Aviation MRO market is further segmented by platform type, with fighter jets, helicopters, and transport aircraft being the most significant contributors. Fighter jets, including the F-15 and Eurofighter Typhoon, dominate the platform segment due to their advanced technology and high operational demands. Given Saudi Arabia’s focus on enhancing its air force capabilities to maintain regional defense stability, fighter jet MRO services constitute the largest share. The increasing number of rotary-wing aircraft, especially for defense and search-and-rescue operations, also bolsters the market for helicopter MRO services.

Competitive Landscape

The KSA Military Aviation MRO market is marked by a few dominant global and local players who have established strong footholds in this segment. Companies such as Saudia Aerospace Engineering Industries (SAEI) and Alsalam Aerospace Industries lead the market, benefiting from strategic government contracts, strong local expertise, and comprehensive MRO capabilities. These players are complemented by global defense giants like Boeing and Lockheed Martin, whose MRO services support the advanced technologies within the Kingdom’s military fleet.

| Company Name | Establishment Year | Headquarters | Service Type | Fleet Size (No. of Aircraft) | Regional Presence | Technological Capability |

| Saudia Aerospace Engineering (SAEI) | 1982 | Riyadh | ~ | ~ | ~ | ~ |

| Alsalam Aerospace Industries | 1988 | Riyadh | ~ | ~ | ~ | ~ |

| Boeing Global Services | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

| Lockheed Martin Sustainment | 1995 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Rolls-Royce MRO Services | 1904 | Derby, UK | ~ | ~ | ~ | ~ |

KSA Military Aviation Maintenance, Repair & Overhaul Market Analysis

Growth Drivers

Defense Budget Expansion & Fleet Modernization Demand (Military MRO Density)

The Kingdom of Saudi Arabia has significantly increased its defense budget in recent years as part of its Vision 2030 strategy to modernize its military capabilities. This increase in funding has led to a growing demand for Military Aviation Maintenance, Repair, and Overhaul (MRO) services. As Saudi Arabia modernizes its fleet of combat aircraft, helicopters, and transport aircraft, there is a higher requirement for ongoing, specialized MRO services to ensure operational readiness and mission success. The expansion of the fleet, along with a focus on advanced and high-tech military aircraft, has led to an increase in MRO density — the frequency and complexity of maintenance activities. This demand for MRO services supports growth within the local defense sector, ensuring that the Kingdom’s military assets remain serviceable and fully operational.

Defense Industrial Localization Policies & Incentives

Saudi Arabia’s Vision 2030 is heavily focused on reducing dependency on foreign defense suppliers and increasing local capabilities in manufacturing and MRO services. The government has introduced various policies and incentives, including the establishment of Saudi Arabian Military Industries (SAMI), to encourage local businesses to invest in defense technology and infrastructure. This push towards defense industrial localization is driving the growth of the MRO sector, as the government seeks to develop domestic expertise, build robust local supply chains, and create sustainable jobs. These policies include financial incentives, public-private partnerships, and technological support for companies looking to expand MRO capabilities within the Kingdom.

Market Challenges

Skilled Workforce Gaps (Technician Certification, Training Bottlenecks)

A significant challenge in the KSA Military Aviation MRO market is the lack of a sufficiently skilled workforce to meet the growing demand for specialized maintenance and overhaul services. The shortage of certified aviation technicians is a critical bottleneck, as many MRO activities require highly trained and experienced personnel to handle complex aircraft systems. While the Kingdom is investing in technical education and training programs, the pace of workforce development has not kept up with the rising demand for MRO services. This shortage can lead to increased operational costs, delays in aircraft turnaround times, and reliance on foreign expertise, which undermines the goal of defense self-sufficiency.

Supply Chain & Spare Parts Accessibility

Another key challenge is the supply chain and spare parts accessibility for military aircraft. Despite efforts to localize the defense sector, many critical parts for advanced aircraft are still imported from foreign suppliers. This reliance on global suppliers can create delays in maintenance, especially during times of geopolitical tensions or supply chain disruptions. Additionally, the complexity of maintaining a wide variety of aircraft platforms requires a diverse inventory of spare parts, and ensuring timely delivery from international suppliers can be problematic. Such issues could result in extended downtime for aircraft and impact mission readiness.

Opportunities

Expansion of Local MRO Hubs (JV Facilities, Export‑oriented Services)

As part of its defense industrialization goals, Saudi Arabia is focusing on the expansion of local MRO hubs. Joint ventures (JVs) with international Original Equipment Manufacturers (OEMs) and private sector players are becoming increasingly common. These partnerships enable Saudi Arabia to develop advanced MRO facilities with cutting-edge technologies. Additionally, there is a growing opportunity for Saudi Arabia to become a regional hub for MRO services, offering its services to neighboring countries in the Middle East and North Africa (MENA) region. By positioning itself as an export-oriented MRO service provider, the Kingdom can attract regional contracts, further bolstering its economic growth and military self-sufficiency.

Defense OEM Partnerships & License Manufacturing

Another significant opportunity lies in forming partnerships with defense Original Equipment Manufacturers (OEMs) for MRO services and license manufacturing. By collaborating with global defense giants like Boeing, Lockheed Martin, and Airbus, Saudi Arabia can secure technology transfers and expertise in aircraft maintenance. These partnerships not only provide technical support for the Kingdom’s existing fleet but also open the door for localized manufacturing of spare parts, reducing dependency on foreign suppliers. Furthermore, licensing agreements could pave the way for manufacturing critical components domestically, contributing to the local economy and further supporting the government’s goal of defense industrialization and self-reliance.

Future Outlook

Over the next five years, the KSA Military Aviation MRO market is poised for continued growth driven by government investment in defense and military modernization. The Kingdom’s Vision 2030 aims to reduce reliance on foreign defense contractors, with significant investments in local MRO facilities. Additionally, technological advancements, such as predictive maintenance and digital twin systems, will enhance operational efficiency and reduce maintenance costs. These factors are expected to contribute to a robust and sustainable growth trajectory for the market, ensuring its strategic importance in Saudi Arabia’s defense ecosystem.

Major Players in the Market

- Saudia Aerospace Engineering Industries (SAEI)

- Alsalam Aerospace Industries

- Boeing Global Services

- Lockheed Martin Sustainment

- Rolls-Royce MRO Services

- General Electric Aviation

- Thales Group

- Northrop Grumman Logistics

- AAR Corp

- Airbus Defence and Space

- BAE Systems

- Leonardo S.p.A.

- Safran Aircraft Engines

- Standard Aero

- Dallah Avco

Key Target Audience

- Military & Defense Ministries (e.g., Ministry of Defense – Saudi Arabia)

- Aviation Regulatory Bodies (e.g., General Authority of Civil Aviation – KSA)

- Defense Contractors & OEMs

- Aircraft Operators & Airlines

- Military Aviation MRO Contractors

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Saudi Arabian Military Industries – SAMI)

- Aircraft Maintenance Service Providers

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identify and define the critical market variables that drive the KSA Military Aviation MRO market. This step includes gathering secondary data from authoritative defense agencies, military budgets, and industry reports to create a comprehensive understanding of the market landscape.

Step 2: Market Analysis and Construction

We analyze historical data related to military fleet utilization, MRO service demand, and regional deployment patterns. This analysis forms the basis of understanding the demand-supply dynamics, examining the correlation between fleet size, military spending, and MRO requirements.

Step 3: Hypothesis Validation and Expert Consultation

This step involves validating the gathered data through expert consultations with stakeholders from military aviation units, defense OEMs, and MRO service providers. In-depth interviews and surveys will help refine the assumptions and gather real-time insights into market trends.

Step 4: Research Synthesis and Final Output

The final phase includes synthesizing the findings and presenting them in the report format. This phase also involves conducting additional consultations with industry players to verify data accuracy and ensure the reliability of the final market report.

- Executive Summary

- Research Methodology (Definitions & Market Boundaries, Abbreviations, Data Collection Framework (Primary & Secondary), Defense Procurement Mapping (SAMIs, GAMI, MOD), MRO Revenue Estimation Approach, Forecasting & Validation Techniques, Assumptions & Limitations)

- Definition and Detailed Scope

- Evolution of Military Aviation MRO in KSA

- Strategic Role of MRO

- Defense Policy & Military Procurement Framework (GAMI, MoD Regulation)

- Stakeholder Value Chain & Ecosystem Mapping

- Aviation MRO Service Lifecycle

- Operational Readiness & Mission Capability Metrics

- Growth Drivers

Defense Budget Expansion & Fleet Modernization Demand

Defense Industrial Localization Policies & Incentives

Technological Modernization (AI, IoT, Predictive Maintenance)

Increased Helicopter & UAV Operations Requiring Specialized MRO - Market Challenges

Skilled Workforce Gaps (Technician Certification, Training Bottlenecks)

Supply Chain & Spare Parts Accessibility

High CapEx Requirements for MRO Infrastructure

Regulatory & Compliance Complexity (SAMA, GAMI, Environmental) - Opportunities

Expansion of Local MRO Hubs (JV Facilities, Export‑oriented Services)

Defense OEM Partnerships & License Manufacturing

AI/ML Predictive Maintenance Revenue Models

Defense Logistics Support Services Scaling - Key Market Trends

Shift from Break‑Fix to Predictive Maintenance Contracts

Adoption of Condition‑Based Maintenance KPIs

Integration of Additive Manufacturing in MRO - Government Regulation & Policy Impact

Defense Procurement Policies (SAMA, GAMI Guidelines)

Quality & Safety Standards (ISO, Military Aviation Standards)

Export Control & ITAR Implications

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Service Type (In Value %)

Airframe Maintenance (Scheduled vs Unscheduled)

Engine Overhaul & Life Extension

Avionics & Electrical Systems Repair

Component Repair & Logistics Support

Depot Level Heavy Maintenance

- By Platform (In Value %)

Fighter & Combat Aircraft

Transport & Tactical Aircraft

Rotary Wing (Helicopters)

Unmanned Aerial Systems (UAV & UCAV)

Trainer & Support Platforms

- By Contract Model (In Value %)

Direct Military (In‑House MoD Facilities)

OEM / Tier‑1 Prime MRO Contracts

Third‑Party Defense Contractors

Public‑Private Partnership (PPP) MRO Models

- By Technology Adoption (In Value %)

Predictive & AI‑Driven Maintenance

Digital Twin & IoT Asset Monitoring

Robotic & Automated Repair Systems

Advanced NDT & 3D Part Fabrication

- By Geographic Deployment (In Value %)

Central Region (Riyadh / King Khalid)

Western Region (Jeddah / KAIA)

Eastern Region (Dammam / KFIA)

Northern & Southern Defense Hubs

- Market Share Analysis (Value & Volume)

- Competitive Positioning Matrix (Service Breadth vs Tech Capability)

- Cross Comparison Parameters (Service Portfolio Breadth, Global Footprint, OEM Certifications, Depot Capacity, Asset Turnaround Time, Local Workforce Level, Strategic Alliances, Digital Capability Adoption)

- Detailed Profiles of Key Players

Saudia Aerospace Engineering Industries (SAEI) (Airframe & Military MRO)

StandardAero (Military MRO Services Provider)

Middle East Propulsion Company (Engine MRO)

Alsalam Aerospace Industries (Component & Repair)

Saudi Arabian Military Industries (SAMI) (Defense OEM & MRO Integration)

Al Tadrea (TMC) (Specialty MRO)

Dallah Avco (Aviation Services with Defense Contracts)

Lufthansa Technik (Global OEM MRO Partner)

Rolls‑Royce MRO Services (Engine Overhaul Segment)

GE Aviation MRO (Military Engine Support)

AAR Corp (Integrated MRO)

Boeing Global Services (Defense MRO Contracts)

Lockheed Martin Sustainment Services

Airbus Defense & Space MRO

Northrop Grumman Logistics & MRO

- Military Operational Readiness Requirements (Aircraft Availability Targets)

- Defense Budget Allocation & MRO Procurement Cycles

- Maintenance Decision‑Making Process (Military vs Contractor Choice)

- Pain Points & Capability Gaps (Skills, Turnaround, Tech Stack)

- Cost Drivers in Military Aviation MRO (Man‑Hours, Parts, Dock Costs)

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035