Market Overview

The KSA Military Battery Market is expected to experience significant growth due to rising defense modernization initiatives and the increasing reliance on advanced battery technologies for military operations. The market size is driven by the need for high-performance, energy-dense power solutions for various military applications such as armored vehicles, unmanned systems, and soldier-worn devices. Additionally, the demand for reliable and long-lasting battery systems in extreme environments, along with the transition to electric-powered military platforms, is enhancing the market growth. In 2024, the market is projected to be valued at approximately USD ~ million, driven by substantial investments in defense electrification programs and UAV technology.

Saudi Arabia remains a dominant player in the region, with the government’s focus on advancing its military capabilities under Vision 2030. The country is investing in developing indigenous defense technologies, including advanced battery solutions for various platforms. Additionally, major cities like Riyadh and Jeddah, with their well-established defense hubs and proximity to key military installations, are pivotal in driving demand. Saudi Arabia’s collaboration with international defense manufacturers and local production incentives also solidify its position in the market, making it a key player in the broader Middle East defense sector.

Market Segmentation

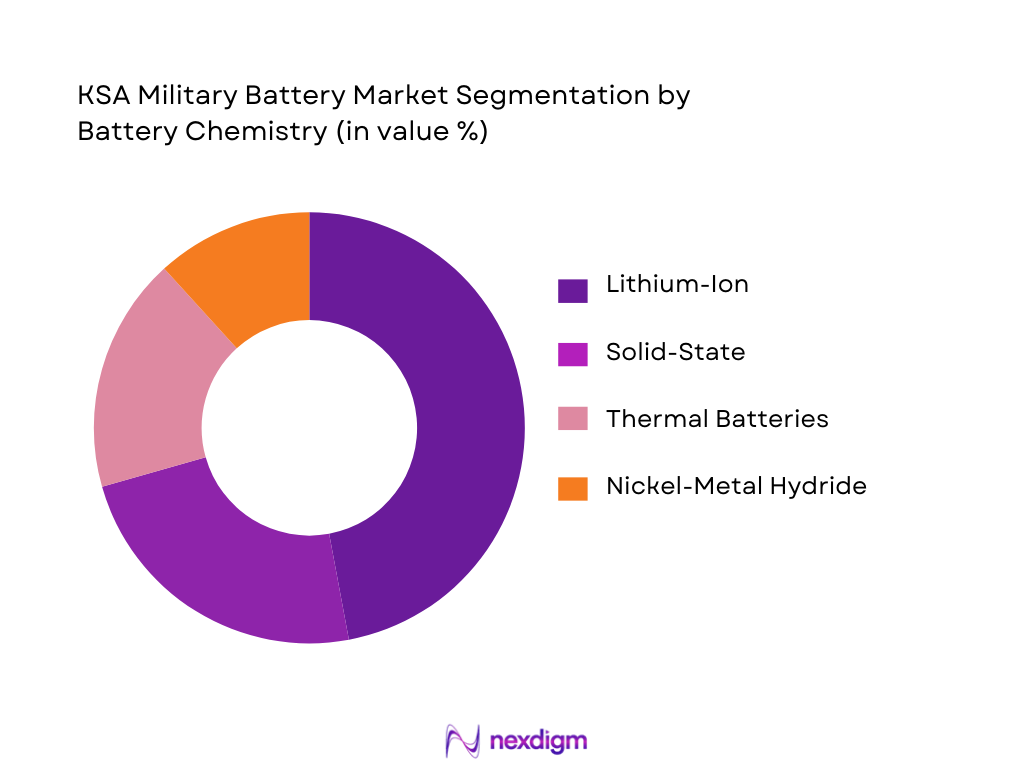

By Battery Chemistry

The KSA Military Battery Market is segmented by battery chemistry into lithium-ion, solid-state, thermal batteries, nickel-metal hydride, and lead-acid. Among these, lithium-ion batteries dominate the market, primarily due to their superior energy density, long cycle life, and light weight, making them ideal for mobile military applications. The Saudi armed forces increasingly rely on lithium-ion batteries for powering tactical vehicles, communication devices, and UAVs due to their efficiency and extended operational endurance. Solid-state batteries are gradually gaining traction due to their enhanced safety and thermal tolerance, though they are still in the developmental phase for military applications.

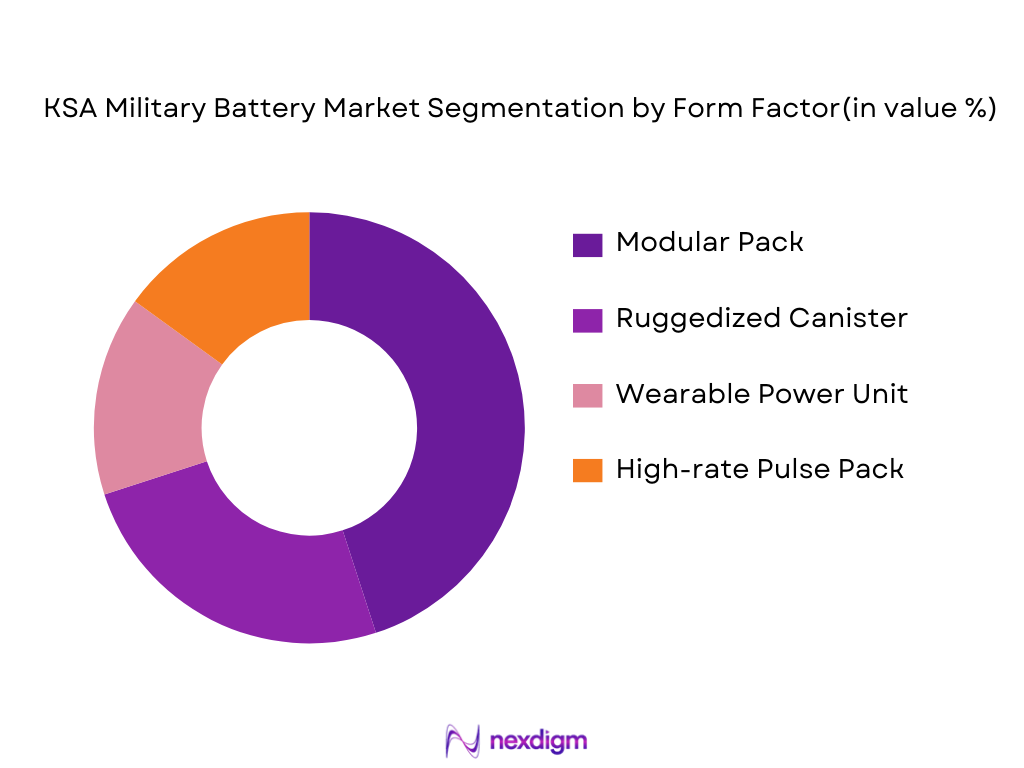

By Form Factor

The KSA Military Battery Market is segmented by form factor into modular packs, ruggedized canisters, wearable power units, and high-rate pulse packs. Modular packs dominate the market due to their flexibility and adaptability across various military platforms such as armored vehicles, UAVs, and communication systems. These packs can be customized for specific operational requirements, offering scalability and ease of integration into different platforms. Additionally, the ruggedized canister segment is gaining traction for its durability and reliability in harsh military environments, where resistance to shock, vibration, and temperature extremes is critical.

Competitive Landscape

The KSA Military Battery Market is dominated by several major players who specialize in providing advanced battery technologies for military applications. Companies such as Saft Groupe S.A., EnerSys, and EaglePicher Technologies are leading the charge with their state-of-the-art energy storage solutions designed for defense use. These players focus on offering high-performance, durable batteries that can withstand extreme conditions. Their success in the market is attributed to their strong technological expertise, compliance with military standards, and ability to meet the complex demands of the defense sector. Furthermore, local players are emerging as key competitors, driven by Saudi Arabia’s push for defense localization and the Vision 2030 initiative, which encourages domestic production and R&D.

| Company Name | Establishment Year | Headquarters | Product Specialization | Military Partnerships | R&D Investment | Local Production Footprint | Battery Technology Focus | Compliance Standards |

| Saft Groupe S.A. | 1918 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| EnerSys | 1999 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| EaglePicher Technologies | 1945 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| BYD | 1995 | China | ~ | ~ | ~ | ~ | ~ | ~ |

| Duracell | 1920 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Military Battery Market Analysis

Growth Drivers

Defense Electrification Programs

The Kingdom of Saudi Arabia (KSA) is increasingly focused on enhancing its military capabilities, particularly through electrification initiatives. These programs are a part of the broader Vision 2030 defense transformation strategy, which aims to modernize the Saudi military and reduce dependency on traditional fuel sources. As military platforms, such as armored vehicles, UAVs, and communication systems, shift toward electric power, there is a growing demand for advanced batteries that provide greater efficiency, higher energy densities, and long-duration performance. The push for more sustainable energy solutions for military platforms not only reduces operational costs but also strengthens the country’s defense posture by making it less reliant on external fuel supplies. This shift in military power needs is expected to drive substantial growth in the military battery market, as more complex systems requiring high-performance batteries are integrated into the armed forces.

Portable Soldier Power Needs

With the increasing complexity of military operations, soldiers in the field need portable, reliable, and high-performance power sources. The demand for wearable power solutions, such as batteries for communication devices, soldier sensors, and powered body armor, is growing rapidly. The KSA military is investing heavily in portable energy solutions that can sustain troops in remote locations with minimal logistical support. Lightweight and durable batteries are required to power devices that enable real-time data transmission, GPS systems, and situational awareness tools. These soldier-worn power units are critical to enhancing operational effectiveness and soldier safety. As the need for efficient and long-lasting portable power sources increases, the market for military batteries that can meet these demands will continue to expand.

Market Challenges

Safety Standards & Hazardous Materials Compliance

One of the key challenges in the KSA Military Battery Market is ensuring compliance with stringent safety standards and environmental regulations. Military batteries are required to meet high safety specifications due to the extreme conditions they endure, including heat, shock, and vibration. Batteries used in military applications also face strict guidelines concerning hazardous materials such as lithium, cadmium, and lead, which require proper handling and disposal. The need to comply with international safety standards, including MIL-STD specifications, creates additional hurdles for manufacturers and defense agencies. Moreover, as battery technologies evolve, ensuring that these advanced power systems remain safe and reliable under various operational conditions remains a top priority. The regulatory landscape and continuous updates to safety standards further complicate the market, as manufacturers must invest in compliance strategies and innovations to address these challenges.

Supply Chain Dependence

The KSA Military Battery Market is highly dependent on a robust global supply chain, especially for advanced battery chemistries like lithium-ion and solid-state batteries. The supply chain for raw materials like lithium, cobalt, and nickel, which are critical for producing high-performance military batteries, is often vulnerable to global market fluctuations, geopolitical tensions, and trade policies. This dependence creates risks for KSA, as delays or shortages in the supply of key materials can affect battery production timelines and operational readiness. Additionally, external supply chain disruptions—such as those caused by the COVID-19 pandemic or regional instability—can cause delays in procurement and increase costs. To mitigate these risks, KSA may need to consider diversifying its supply sources or developing more localized production capabilities. A secure and sustainable supply chain is essential for ensuring that military operations are not hindered by battery shortages.

Market Opportunities

Local Production Incentives

Saudi Arabia’s Vision 2030 initiative emphasizes the importance of local manufacturing and reducing reliance on imports. The government is keen to develop its domestic defense industry, including military battery production, by offering incentives for local manufacturing. These incentives include tax breaks, subsidies, and funding for research and development. With a strong focus on boosting the defense sector’s local capabilities, KSA has created a favorable environment for companies to establish manufacturing plants within the country. By promoting local production of military batteries, the government aims to strengthen its defense infrastructure, reduce supply chain risks, and create jobs within the local economy. Furthermore, local production aligns with national security interests by ensuring that critical defense technologies, including energy storage systems, are developed and manufactured within the country.

Tech Transfer Programs

Another significant opportunity for the KSA Military Battery Market lies in technology transfer programs. These programs involve the exchange of knowledge and expertise between local and foreign companies, enabling Saudi Arabia to develop its indigenous battery technologies. By engaging with international defense contractors and technology providers, KSA can acquire advanced battery technologies, such as solid-state batteries, which have higher energy densities and safer performance than conventional lithium-ion batteries. These technology transfer agreements can also help Saudi companies build expertise in battery production, testing, and integration, thereby reducing the country’s dependence on foreign suppliers. As KSA looks to diversify its defense industry and invest in cutting-edge technologies, these programs will play a pivotal role in advancing the local military battery market. The resulting innovations could further enhance the performance and reliability of military power systems, supporting Saudi Arabia’s long-term defense objectives.

Future Outlook

Over the next six years, the KSA Military Battery Market is poised for significant growth, driven by the Saudi Arabian government’s increased investment in defense modernization. With the country’s Vision 2030 agenda emphasizing self-reliance in defense technology, there is a clear push towards the development of advanced power systems for military platforms. Advancements in battery chemistries, such as solid-state batteries, and increased integration of renewable energy sources in military operations will play a crucial role in shaping the market’s future. The increasing demand for electric vehicles in the military sector, coupled with the growing need for energy storage in remote military outposts and forward operating bases, will further fuel the market expansion.

Major Players

- Saft Groupe S.A.

- EnerSys

- EaglePicher Technologies

- BYD

- Duracell

- Panasonic Defense & Industrial Batteries

- Arotech Corporation

- Ultium Cells / GM Defense

- Thales Power & Battery Divisions

- Tenergy Defense Products

- Northrop Grumman Mission Systems

- L3Harris Technologies

- Cargill

- Exide Technologies

- MK Battery

Key Target Audience

- Defense Contractors and OEMs (Original Equipment Manufacturers)

- Ministry of Defense (Saudi Arabia)

- Saudi Arabian National Guard

- Military Procurement Agencies (Royal Saudi Air Force, Royal Saudi Navy)

- Energy Storage Technology Providers

- Military Battery Integration Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Defense Procurement Authority, Saudi Arabian Standards Organization)

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out all the key stakeholders in the KSA Military Battery Market, including OEMs, government agencies, and military procurement officers. Extensive desk research and secondary data are used to identify the critical variables that impact market dynamics.

Step 2: Market Analysis and Construction

In this phase, we assess historical data on military battery deployment across various platforms such as armored vehicles, UAVs, and wearable systems. We analyze market penetration and revenue generation across different segments to establish a baseline for future projections.

Step 3: Hypothesis Validation and Expert Consultation

Our research hypotheses are validated through direct consultations with industry experts, including defense contractors, military officials, and battery manufacturers. This step ensures that the data gathered aligns with real-world operations and market needs.

Step 4: Research Synthesis and Final Output

We conduct thorough consultations with top manufacturers and defense agencies to finalize the data gathered from previous steps. This ensures a comprehensive analysis of the market, confirming our findings with input from key industry leaders.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, KSA Defense Battery Standards and Classifications, Military Procurement Protocols, Data Modeling for Operational Demand, Primary Data Sources – Defense OEMs & Armed Forces, Limitations and Opportunities)

- Definition and Scope

- Overview Genesis and Strategic Importance (Defense Modernization, Vision 2030 Military Electrification)

- Military Power Needs and Battlefield Energy Demand

- Global Defense Battery Trends vs KSA Specific Dynamics

- Military Battery Supply Chain and Defense Industrial Base Mapping

- Growth Drivers

Defense Electrification Programs

Portable Soldier Power Needs

UAV Extended Mission Endurance

- Market Challenges

Safety Standards & Hazardous Materials Compliance

Supply Chain Dependence

Heat & Environmental Resilience

- Market Opportunities

Local Production Incentives

Tech Transfer Programs

Hybrid Power Systems Integration

- Trends

Adoption of Solid-State Batteries

Smart Battery Management Systems

Rechargeable vs Primary Preference

- Policy & Regulatory Landscape

Military Battery Standards (MIL-STD Compliance)

Defense Procurement Regulations

Import/Export Control Policies

Environmental Regulations on Battery Disposal

Local Content and Sourcing Requirements

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Battery Chemistries (In Value %)

Lithium-Ion

Solid-State

Thermal Batteries

Nickel-Metal Hydride

Lead Acid - By Form Factor (In Value %)

Modular Pack

Ruggedized Canister

Wearable Power Unit

High-rate Pulse Pack - By End Use (In Value %)

Tactical Vehicles

Unmanned Systems (UAV/UUV)

Soldier Worn Systems

Communication Relays

Forward Operating Bases - By Power Ratings (In Value %)

Low power (<100 Wh/kg)

Mid-power (100-200 Wh/kg)

High-power (>200 Wh/kg) - By Platform Integration (In Value %)

Land Platforms

Airborne Platforms

Naval Platforms

Remote Outposts

- Market Share of Key Players (by Value & Deployments)

- Cross‑Comparison Parameters (Company Overview, Defense Portfolio Breadth, Battery Chemistry Focus, Compliance to Military Standards, R&D Investment, Local Production Footprint, Govt Contracts Won, Battery Performance Specs, After‑Sales Support, Integration Partnerships, Supply Chain Dependence, Customization Capability, Pricing Structure, Warranty & Reliability Data)

- Detailed Competitive Profiles

Saft Groupe S.A.

EnerSys

EaglePicher Technologies

Northrop Grumman Mission Systems (Battery Divisions)

L3Harris Technologies (Power Solutions)

Ultium Cells / GM Defense Battery Units

Panasonic Defense & Industrial Batteries

Arotech Corporation

BYD (Defense Power Solutions)

Lithium Werks Defense Tech

Duracell Military Grade Units

Exide Technologies (Defense Line)

Tenergy Defense Products

MK Battery (Military Grade)

Thales Power & Battery Divisions

- Royal Saudi Land Forces Requirements

- Royal Saudi Air Defense Forces Power Units

- Naval Battery Needs (Shipboard & Submarine Support)

- Defense R&D Labs and Research Institutes Battery Needs

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035