Market Overview

The KSA Military Communications Market is valued at USD ~billion in 2023. This market is driven by the rapid advancements in military technology, including the adoption of secure communication systems, as well as the rising need for modernized defense infrastructure. The Saudi Arabian government has significantly increased its defense budget to enhance communication and surveillance capabilities. The market is also spurred by the increasing investments in cybersecurity and the growing demand for secure communications in military operations. The growing tensions in the Middle East further accelerate the demand for enhanced communication systems.Saudi Arabia, particularly Riyadh, is the dominant player in the KSA Military Communications Market due to its substantial defense expenditure and focus on modernization of military infrastructure. The country’s strategic location and its geopolitical role in the region have further amplified the importance of military communication systems. Riyadh hosts major defense-related conferences and is home to key military agencies, leading to consistent demand for advanced communication technologies. Other cities like Jeddah also contribute to the market, as they are hubs for defense contractors and operational military units.

Market Segmentation

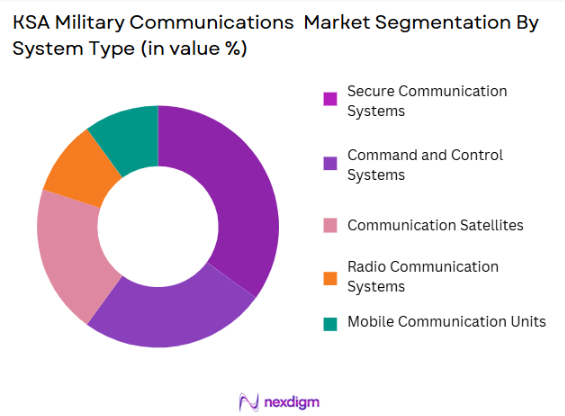

By System Type

The KSA Military Communications Market is segmented into system types such as command and control systems, communication satellites, radio communication systems, secure communication systems, and mobile communication units. Among these, secure communication systems dominate the market. The growing need for highly encrypted communication systems that ensure confidentiality and data integrity in military operations is the primary driver of this segment’s dominance. Additionally, advancements in secure mobile communications, as well as increasing threats from cyber-attacks, have intensified the need for secure communication systems.

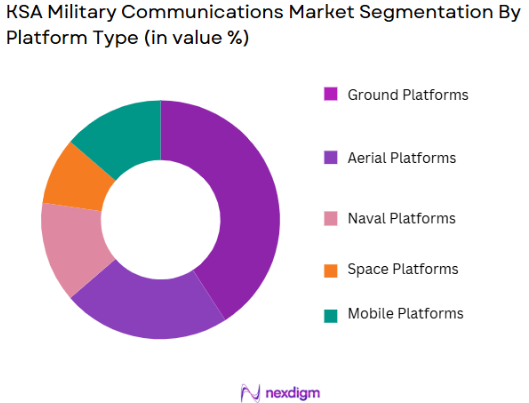

By Platform Type

The KSA Military Communications Market is segmented into platform types such as ground platforms, aerial platforms, naval platforms, space platforms, and mobile platforms. Among these, ground platforms have the dominant market share. This is due to the increasing emphasis on land-based military operations in Saudi Arabia, driven by the large-scale investments in defense capabilities. Ground communication platforms are critical for command, control, and coordination in military operations, making them a priority in the Saudi defense sector. The robust infrastructure and training for ground operations further solidify the dominance of this segment.

Competitive Landscape

The KSA Military Communications Market is dominated by a few major players, including local manufacturers and global defense companies. The competition is robust, with companies like Lockheed Martin, Raytheon Technologies, and Thales Group playing a key role in supplying advanced communication systems. These companies are well-established in the region due to their long-standing relationships with the Saudi government and defense forces. The market is also influenced by regional players, which are growing in prominence due to the increasing demand for locally developed military communication solutions.

| Company | Establishment Year | Headquarters | Market Penetration | Technology Leadership | Product Portfolio | Client Base | Defense Partnerships |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

KSA Military Communications Market Analysis

Growth Drivers

Urbanization

Urbanization plays a crucial role in driving the KSA Military Communications Market. As Saudi Arabia continues to urbanize, with more cities and urban areas being developed, the need for efficient, reliable, and advanced communication systems in these areas becomes increasingly important. Military communication systems are essential in supporting urban defense strategies, ensuring coordination, and maintaining security in densely populated areas. The growth of urban infrastructure leads to the expansion of defense networks that require robust communication platforms to monitor, manage, and protect cities. With rapid urbanization, the military must invest in cutting-edge communication systems to adapt to the evolving challenges in urban warfare, such as real-time data transmission, surveillance, and response coordination. Additionally, urbanization increases the need for effective communication between military forces and emergency services, further promoting the adoption of advanced military communication technologies in the region.

Industrialization

Industrialization in Saudi Arabia has also contributed significantly to the growth of the KSA Military Communications Market. The rise in defense production, the establishment of military manufacturing facilities, and the increased demand for industrial-scale communications infrastructure all require state-of-the-art systems to manage and operate effectively. As industrial activities expand, including the construction of defense technologies, secure communication systems are critical to the military’s operational efficiency. Additionally, the growing defense industry requires advanced communication solutions to manage logistics, coordinate supply chains, and ensure effective communication across military bases and operations. With industrialization, Saudi Arabia seeks to boost its defense capabilities by modernizing communication infrastructures, enabling improved collaboration between defense contractors, and providing enhanced communication security.

Restraints

High Initial Costs

One of the significant restraints affecting the KSA Military Communications Market is the high initial costs associated with developing and deploying military communication systems. The cost of procuring advanced equipment such as secure communication networks, command and control systems, and satellite-based communication platforms can be prohibitive. These systems require substantial investment in both infrastructure and technology, and the financial outlay may be a limiting factor for some defense agencies, especially when considering the long-term maintenance and operational costs. Despite the ongoing commitment from the Saudi government to modernize its defense capabilities, the significant upfront investment required for such projects may delay or hinder the pace of adoption of advanced military communication technologies.

Technical Challenges

Another challenge faced by the KSA Military Communications Market is overcoming technical difficulties related to the integration and interoperability of modern communication systems. The military must ensure that the latest communication technologies seamlessly integrate with existing legacy systems, which may be outdated or incompatible with newer infrastructure. This presents a challenge in maintaining operational continuity while upgrading systems. Additionally, ensuring the security of communication channels is a top priority, with the increasing sophistication of cyber threats targeting defense networks. The technical complexity involved in ensuring high-quality, secure communication over diverse platforms and geographic areas can slow down the implementation of advanced military communication systems.

Opportunities

Technological Advancements

Technological advancements represent a significant opportunity for growth in the KSA Military Communications Market. As the demand for more sophisticated, efficient, and secure communication systems increases, innovations in artificial intelligence (AI), 5G technology, and satellite communication systems offer exciting prospects. These technologies can enhance military capabilities by providing faster data transmission, more reliable communication channels, and greater operational efficiency. AI-driven systems can help automate critical tasks, improving decision-making and increasing the responsiveness of military units during operations. Furthermore, advancements in satellite communications allow for seamless global connectivity, which is crucial for military operations in remote and hostile environments. As technology continues to evolve, the Saudi military can adopt these cutting-edge solutions to improve its communication infrastructure and enhance national security.

International Collaborations

International collaborations present another promising opportunity for the KSA Military Communications Market. Saudi Arabia has been actively seeking partnerships with global defense companies to enhance its military capabilities, including communication technologies. Collaborating with foreign firms allows Saudi Arabia to access advanced military communication solutions and technology that may not be locally available. These partnerships often include knowledge transfer, joint ventures, and the development of locally produced systems, which contribute to Saudi Arabia’s long-term defense strategy. By forming strategic alliances with leading defense manufacturers from countries like the United States, France, and the UK, Saudi Arabia can modernize its defense communication systems more rapidly and effectively. These international collaborations not only boost technological capabilities but also strengthen the country’s position in the global defense market, enhancing its ability to address regional security challenges.

Future Outlook

Over the next decade, the KSA Military Communications Market is expected to experience significant growth. This growth will be driven by the continued investment in military infrastructure, the need for secure and advanced communication systems, and the increasing emphasis on modernizing the defense sector. As Saudi Arabia continues to expand its defense capabilities, the demand for cutting-edge communication technologies, including satellite-based systems, AI-driven communications, and cybersecurity measures, will intensify.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Thales Group

- BAE Systems

- General Dynamics

- Leonardo

- Harris Corporation

- Northrop Grumman

- L3 Technologies

- Cobham

- Elbit Systems

- Rockwell Collins

- Airbus Defence and Space

- Hensoldt

- Rohde & Schwarz

Key Target Audience

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

- Defense Contractors

- Military Procurement Agencies

- Armed Forces and Military Units

- OEMs in Military Communication Systems

- Telecommunication Companies

- Cybersecurity Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Military Communications Market. This step involves extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The goal is to define and identify critical market drivers and challenges that influence the market’s dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data will be compiled and analyzed for the KSA Military Communications Market. This includes assessing market penetration, customer preferences, and analyzing the demand across military platforms and system types. Additionally, revenue generation by product and service category will be evaluated to ensure accurate future projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through consultations with industry experts, including manufacturers, suppliers, and military personnel. These consultations will offer valuable insights and validate key assumptions regarding the performance of communication systems, including their reliability, security, and operational efficiency.

Step 4: Research Synthesis and Final Output

The final phase will involve direct engagement with key players in the military communications sector to acquire in-depth insights into their product offerings, market positioning, and business strategies. This step will ensure that the report reflects the most current and accurate market data.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations &

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government investments in defense infrastructure

Advancements in communication technologies

Increased demand for secure communication solutions - Market Challenges

High cost of deployment and maintenance

Interoperability issues with existing systems

Geopolitical tensions impacting market stability - Trends

Shift towards integrated defense communication networks

Increased focus on cybersecurity in military communication systems

Rise in demand for autonomous communication systems

- Market Opportunities

Emerging demand for 5G-based military communication

Growing adoption of AI and machine learning in defense communications

Expansion of defense spending in the Middle East - Government regulations

Military communication standards and certifications

Defense procurement regulations in Saudi Arabia

Cybersecurity and data protection laws in defense - SWOT analysis

Strength: Technological leadership in secure communication

Weakness: Dependence on foreign suppliers for advanced technologies

Opportunity: Expansion into regional defense market

Threat: Increasing geopolitical instability - Porters 5 forces

Threat of new entrants: Low due to high entry barriers

Bargaining power of suppliers: Moderate, limited by regional suppliers

Bargaining power of buyers: High, with growing demand for advanced systems

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and Control Systems

Communication Satellites

Radio Communication Systems

Secure Communication Systems

Mobile Communication Units - By Platform Type (In Value%)

Ground Platforms

Aerial Platforms

Naval Platforms

Space Platforms

Mobile Platforms - By Fitment Type (In Value%)

Integrated Systems

Standalone Systems

Mobile Systems

Modular Systems

Hybrid Systems - By EndUser Segment (In Value%)

Army

Navy

Air Force

Special Forces

Defense Contractors - By Procurement Channel (In Value%)

Direct Procurement

Defense Contractors

OEMs

Government Tenders

Public-Private Partnerships

- Market Share Analysis

- CrossComparison Parameters(Technology adoption rate, System complexity, Market penetration, Cost competitiveness, Regulatory compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Thales Group

BAE Systems

Leonardo

Harris Corporation

L3 Technologies

General Dynamics

Elbit Systems

Rockwell Collins

Harris Corporation

Airbus Defence and Space

Cobham

Hensoldt

- Rising demand from the Saudi Arabian military for modern communication systems

- Increasing collaboration between defense contractors and military agencies

- Adoption of advanced satellite communication systems by naval forces

- Demand for real-time communication solutions from air forces

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035