Market Overview

The KSA military electro-optical and infrared systems market has witnessed significant growth, primarily driven by increasing defense budgets and the demand for advanced surveillance technologies. Based on a recent historical assessment, the market is valued at approximately USD ~ billion in 2024, with growth fueled by national security concerns and ongoing defense modernization efforts. The systems are highly sought after for military operations, surveillance, reconnaissance, and target acquisition, contributing to a strong demand for these technologies.

Saudi Arabia remains a dominant player in the Middle East, with its military modernization programs pushing the demand for electro-optical and infrared systems. The country is investing heavily in defense infrastructure, seeking to enhance its capabilities in areas such as border security, counter-terrorism, and regional defense. The strategic geopolitical position of Saudi Arabia and its alliances with global powers further bolster its position in the market, ensuring sustained demand for high-tech military systems.

Market Segmentation

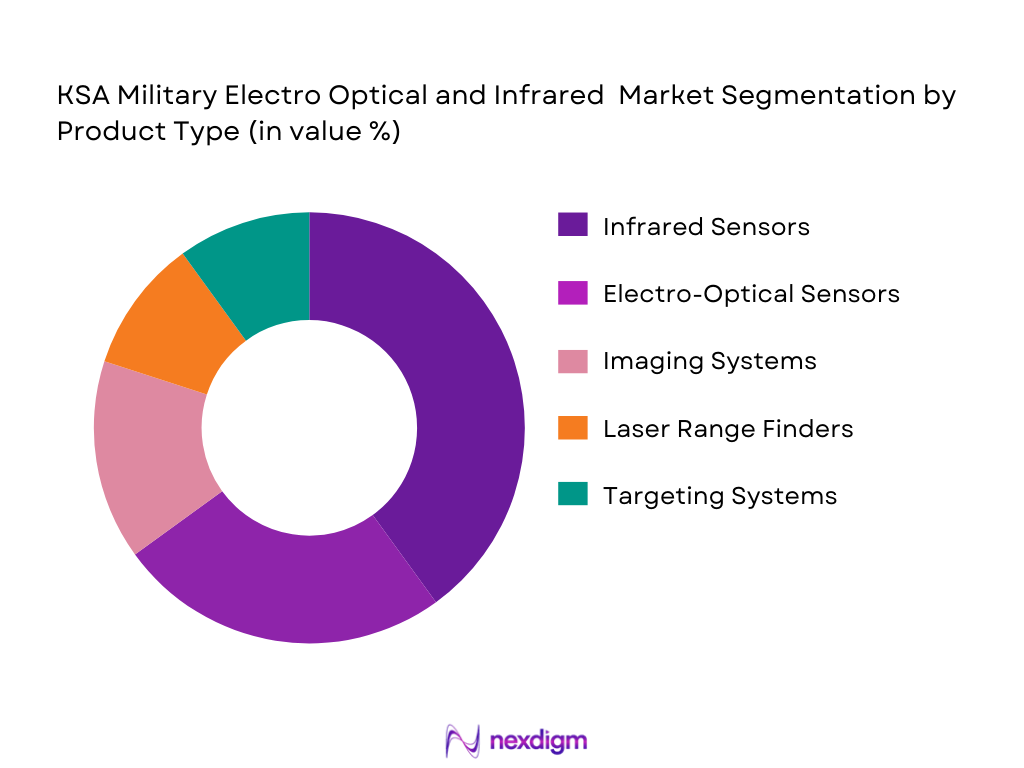

By Product Type

The KSA military electro-optical and infrared systems market is segmented by product type into infrared sensors, electro-optical sensors, imaging systems, laser range finders, and targeting systems. Among these, infrared sensors have a dominant market share due to their superior capability in detecting heat signatures, even in low visibility conditions. The rising need for enhanced surveillance and detection systems, especially in desert and urban warfare, has made infrared sensors a critical component in military operations. Their ability to function effectively across varying terrains and weather conditions drives their market leadership.

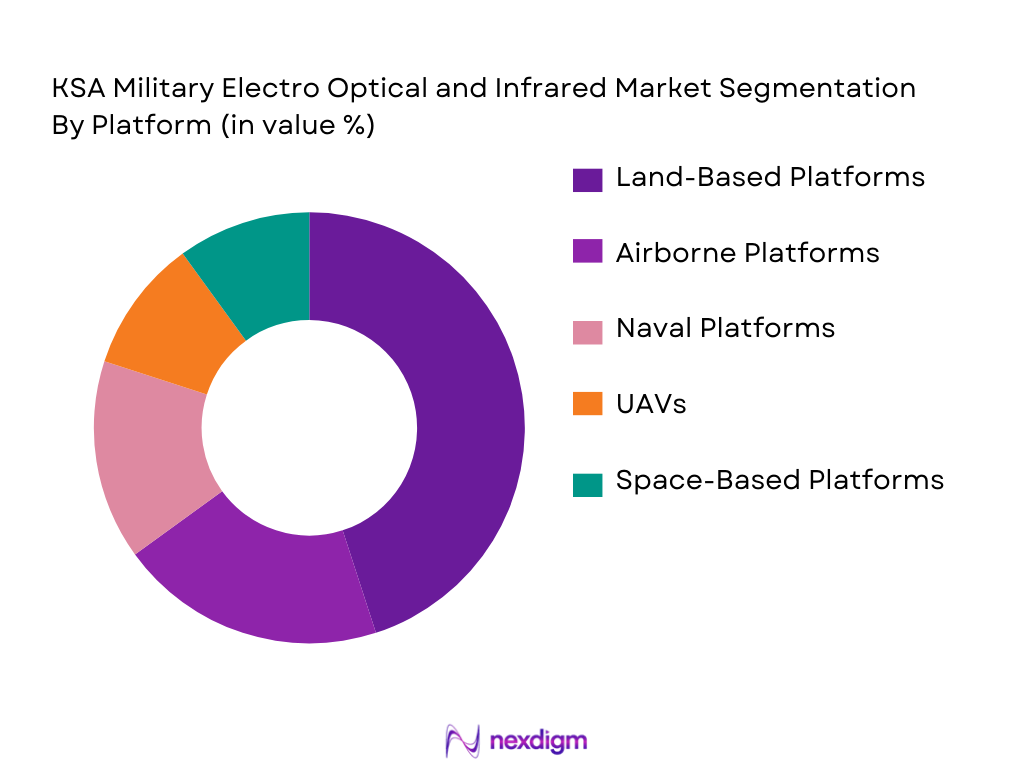

By Platform Type

The market is segmented by platform type into land-based platforms, airborne platforms, naval platforms, unmanned aerial vehicles (UAVs), and space-based platforms. Among these, land-based platforms have a dominant share due to the increasing demand for border security and surveillance along the extensive Saudi borders. These platforms offer a high degree of mobility and are equipped with the necessary electro-optical and infrared systems to monitor ground movements effectively. The growth of internal defense initiatives also contributes to the growing use of these systems in land-based applications.

Competitive Landscape

The KSA military electro-optical and infrared systems market is highly competitive, with several key players establishing a strong foothold. Major international defense contractors, along with local firms, drive market consolidation through strategic partnerships and technological advancements. Companies are focusing on enhancing product performance and providing tailored solutions to meet the specific requirements of the Saudi military. Technological innovations, such as AI integration and multi-sensor systems, have become central to staying competitive in this growing market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

Market Analysis

Growth Drivers

Technological Advancements in Sensor Technology

The rapid advancements in sensor technology have played a crucial role in driving the market for electro-optical and infrared systems. These technologies enable enhanced image resolution, greater detection range, and the ability to operate in challenging environments. As defense forces seek superior capabilities for surveillance, reconnaissance, and targeting, the demand for high-performance electro-optical and infrared sensors continues to rise. This growth driver is supported by the continuous evolution of sensor miniaturization, which allows for more compact and efficient systems. Additionally, innovations such as the integration of artificial intelligence (AI) into sensor systems have further increased the market appeal, as they offer improved autonomy and decision-making capabilities. As military operations become increasingly complex and data-driven, the need for more advanced sensor systems becomes even more critical. The ongoing research and development efforts by leading defense companies also contribute to enhancing system capabilities and expanding market reach, driving further demand. Moreover, advancements in materials science, such as the use of new infrared detectors, have improved performance and reliability, making electro-optical and infrared systems indispensable for modern military operations.

Increased Geopolitical Tensions and National Security Focus

Geopolitical instability in the Middle East has amplified the need for robust defense systems in the region, with Saudi Arabia being one of the primary stakeholders. With its strategic location and involvement in various regional conflicts, Saudi Arabia is investing heavily in advanced surveillance and reconnaissance systems to safeguard its borders and assets. The growing regional security concerns, including terrorism and border security challenges, are driving the demand for sophisticated military technologies, including electro-optical and infrared systems. These systems are critical for monitoring cross-border movements, identifying potential threats, and maintaining real-time situational awareness. As the country seeks to strengthen its defense capabilities, the adoption of cutting-edge military technologies like electro-optical and infrared systems has become a key focus. Furthermore, the Saudi military’s emphasis on modernization and alignment with global defense standards has resulted in the procurement of advanced systems that enhance its operational effectiveness. As security concerns intensify, the importance of these systems in ensuring national defense and maintaining peace and stability within the region becomes paramount.

Market Challenges

High Cost of Development and Maintenance

One of the most significant challenges faced by the KSA military electro-optical and infrared systems market is the high cost of both development and maintenance. The complex nature of these systems requires significant investment in research and development, as well as the use of high-quality materials and technologies. The need for continuous innovation to maintain system performance and integrate the latest advancements in AI and sensor technologies further adds to the costs. Moreover, maintaining these sophisticated systems involves high operational expenses, including the training of personnel, system upgrades, and support services. For many defense forces, the long-term financial commitments associated with these systems pose a challenge, especially in the face of competing budgetary priorities. This challenge is compounded by the need to regularly upgrade systems to keep up with rapidly evolving technological advancements. While the benefits of these systems are undeniable, the high costs associated with their development and maintenance remain a significant barrier to widespread adoption, especially for smaller defense budgets.

Integration with Existing Military Systems

Another key challenge in the market is the complexity of integrating electro-optical and infrared systems with existing military infrastructure. The Saudi military, like many other defense forces, operates a variety of legacy systems that may not be fully compatible with newer technologies. Integrating these advanced systems into the existing network of defense platforms often requires significant modifications, which can be costly and time-consuming. Furthermore, the integration process may face technical difficulties, as different systems may use incompatible protocols or require specialized interfaces. The lack of seamless interoperability between legacy and modern systems can hinder operational efficiency and reduce the effectiveness of the overall defense infrastructure. Additionally, the technical expertise required for successful integration is often in short supply, leading to potential delays and increased costs. Overcoming these challenges requires careful planning, advanced engineering solutions, and collaboration between defense contractors and military organizations.

Opportunities

Adoption of Artificial Intelligence (AI) and Machine Learning (ML) in Electro-Optical and Infrared Systems

One of the most significant opportunities for the KSA military electro-optical and infrared systems market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. These technologies can dramatically enhance the performance of electro-optical and infrared systems, enabling more autonomous decision-making and improved situational awareness. AI and ML algorithms can process vast amounts of data in real-time, allowing for faster and more accurate target identification and threat detection. As military operations become more complex and data-driven, the need for intelligent systems that can process and analyze information autonomously is becoming more apparent. By leveraging AI and ML, Saudi Arabia can enhance the capabilities of its defense forces, making them more efficient and effective in responding to evolving threats. This technological advancement presents a significant growth opportunity for companies operating in the electro-optical and infrared systems market, as it offers a way to provide cutting-edge solutions that meet the increasing demand for sophisticated defense technologies. Furthermore, the integration of AI and ML aligns with Saudi Arabia’s broader efforts to modernize its military and align with the latest global defense standards.

Collaborations with Global Defense Contractors for Technological Advancements

Another key opportunity lies in strategic collaborations between Saudi Arabia and leading global defense contractors. By partnering with established international firms, Saudi Arabia can gain access to the latest technologies and innovations in electro-optical and infrared systems. These partnerships enable the country to acquire state-of-the-art systems, which may not be available through domestic suppliers. Furthermore, collaborations with global contractors can help accelerate the development and deployment of advanced systems, allowing Saudi Arabia to stay at the forefront of defense technology. Such partnerships also provide opportunities for technology transfer, where local firms can learn from their international counterparts and enhance their own capabilities. This, in turn, can help boost the local defense industry and contribute to economic growth. The increasing trend of defense collaboration between nations also strengthens diplomatic ties and positions Saudi Arabia as a key player in the global defense market.

Future Outlook

Over the next five years, the KSA military electro-optical and infrared systems market is expected to experience sustained growth, driven by continuous technological advancements and increasing defense expenditures. Technological innovations such as AI integration and enhanced sensor capabilities will shape the future of these systems, offering improved performance and greater autonomy. With the continued focus on military modernization, regulatory support from the government, and a rising demand for advanced surveillance technologies, the market is poised to expand significantly. Additionally, the strategic partnerships between Saudi Arabia and global defense contractors will further support the growth of the market, ensuring access to cutting-edge technologies. The increasing need for border security and surveillance in the region will remain a key driver of market growth, alongside the broader geopolitical dynamics that shape defense priorities in the Middle East.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Israel Aerospace Industries

- Thales Group

- Northrop Grumman

- General Dynamics

- BAE Systems

- Leonardo

- L3 Technologies

- SAAB

- Elbit Systems

- Rockwell Collins

- Harris Corporation

- Textron Systems

- Kongsberg Gruppen

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military decision-makers

- Armed forces procurement officers

- Technology integration specialists

- International defense alliances

- Security agencies

Research Methodology

Step 1: Identification of Key Variables

The first step in the research process involves identifying key variables that influence the market, such as technological trends, regulatory impacts, and economic factors.

Step 2: Market Analysis and Construction

This step involves conducting a detailed market analysis using both primary and secondary data sources to construct an accurate picture of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Experts in the field are consulted to validate hypotheses and ensure the data is aligned with real-world market conditions and technological developments.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the collected data into a comprehensive report that offers actionable insights and forecasts for market growth.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Sensors

Increasing Defense Budgets

Rising Geopolitical Tensions

- Market Challenges

High Costs of Development and Maintenance

Complex Integration with Existing Systems

Security Concerns and Cyber Vulnerabilities

- Market Opportunities

Adoption of AI and Machine Learning in EO/IR Systems

Collaborations with International Defense Contractors

Expanding Defense Exports

- Trends

Miniaturization of Sensors

Integration of Multi-Function Systems

Shift Toward Autonomous Systems

- Government Regulations

Compliance with International Standards

National Security Regulations

Defense Export Controls

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Infrared Sensors

Electro-Optical Sensors

Imaging Systems

Laser Range Finders

Targeting Systems - By Platform Type (In Value%)

Land-Based Platforms

Airborne Platforms

Naval Platforms

Unmanned Aerial Vehicles (UAVs)

Space-Based Platforms - By Fitment Type (In Value%)

OEM Fitment

Retrofit

Upgrades

Modular Fitment

Integrated Systems - By End –User Segment (In Value%)

Military Applications

Defense Contractors

Government & Homeland Security

Private Security Firms

Research & Development Agencies - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Purchases

Third-Party Intermediaries

Defense Alliances

- Market Share Analysis

- Cross Comparison Parameter (Technology, Platform Compatibility, Market Reach, Production Capacity, Customer Support, Innovation Rate, Product Customization, Supply Chain Efficiency, Regulatory Compliance, Pricing Strategy, Partnerships and Alliances, R&D Investment, Geographic Presence)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Raytheon Technologies

Israel Aerospace Industries

Thales Group

Northrop Grumman

General Dynamics

BAE Systems

Leonardo

L3 Technologies

SAAB

Elbit Systems

Rockwell Collins

Harris Corporation

Textron Systems

Kongsberg Gruppen

- Military Forces

- Private Defense Contractors

- Government Agencies

- Security Services

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035