Market Overview

The KSA Military Exoskeleton Market is experiencing robust growth, with the market valued at USD ~ million in 2025 and projected to grow significantly in the coming years. The increasing demand for advanced military technologies that enhance the performance, mobility, and endurance of soldiers is a primary driver for this growth. Exoskeletons enable soldiers to carry heavy loads for extended periods, reducing fatigue and injury, which is critical for military operations. Additionally, substantial government investment in defense innovation and modernization, particularly under the Vision 2035 initiative, supports the market’s expansion.

Saudi Arabia is the dominant player in the KSA Military Exoskeleton Market due to its focus on defense innovation and the growing demand for exoskeleton technology within the military sector. Key cities like Riyadh and Jeddah lead in military infrastructure, where most defense contracts are secured and executed. Additionally, Saudi Arabia’s strategic alliances with global defense contractors, such as Lockheed Martin and Raytheon Technologies, facilitate the incorporation of cutting-edge technologies like exoskeletons into their military systems. Government-funded projects further bolster the market’s growth, especially in regions focused on technological advancements.

Market Segmentation

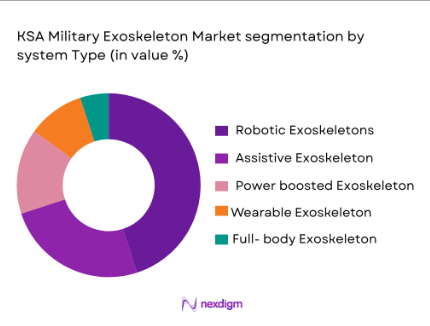

By System Type

The KSA Military Exoskeleton Market is segmented by system type, and it is primarily dominated by robotic exoskeletons. These systems are increasingly favored by defense forces because they enhance a soldier’s physical abilities, providing greater mobility, strength, and endurance during operations. Robotic exoskeletons are designed for heavy-duty tasks and are typically used in combat scenarios to support military personnel in carrying heavy loads. The demand for robotic exoskeletons has surged due to their high efficiency in reducing fatigue and preventing injuries, which is particularly essential for troops involved in prolonged missions.

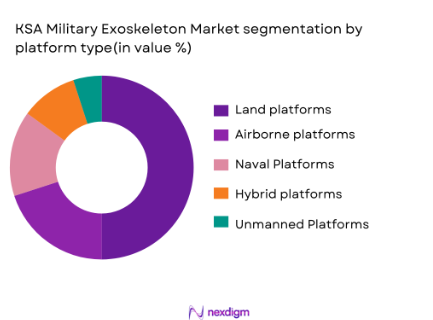

By Platform Type

The KSA Military Exoskeleton Market is also segmented by platform type, with land platforms leading the market share. Military exoskeletons used for land platforms are crucial for enhancing mobility during ground combat. These exoskeletons are designed to support soldiers in rough terrains and are essential for increasing soldier effectiveness and endurance on the battlefield. Given Saudi Arabia’s terrain and focus on land-based military operations, the demand for land platform exoskeletons has outpaced that of other platforms, such as air and naval systems.

Competitive Landscape

The KSA Military Exoskeleton Market is highly competitive, with key players including both local and global defense contractors. The market is dominated by leading companies that specialize in military robotics and wearable technologies. These companies are continuously innovating to enhance the functionality and efficiency of their exoskeleton systems. The consolidation of these players reflects their significant influence in shaping the future of exoskeleton technology in defense sectors.

| Company Name | Establishment Year | Headquarters | R&D Focus | Key Products | Market Reach | Partnerships |

| Lockheed Martin | 1912 | USA | – | – | – | – |

| Raytheon Technologies | 1922 | USA | – | – | – | – |

| Ekso Bionics | 2005 | USA | – | – | – | – |

| Sarcos Robotics | 2005 | USA | – | – | – | – |

| Bae Systems | 1999 | UK | – | – | – | – |

KSA Military Exoskeleton Market Dynamics

Growth Drivers

Increase in Military Personnel Mobility Requirements

The increasing need for mobility and operational efficiency in military personnel is one of the major drivers behind the growth of the KSA Military Exoskeleton Market. The Saudi Arabian military, like many other global defense forces, is emphasizing enhancing soldier performance and endurance, especially during long-duration missions. The country’s focus on modernizing its armed forces and integrating advanced technologies has intensified the need for tools that improve physical mobility. The Kingdom’s defense spending for 2024 is forecasted to increase to USD 61.8 billion, which directly supports procurement of advanced defense technologies, including exoskeleton systems to enhance soldier mobility. According to the Saudi Ministry of Defense, the Kingdom’s efforts to improve the operational capacity of its armed forces are aligned with Vision 2030, which aims to enhance technological integration in military operations.

Advancements in Exoskeleton Technologies

Advancements in exoskeleton technologies, including increased capabilities for load-bearing, mobility, and injury prevention, are significantly driving market growth in Saudi Arabia. As technology evolves, modern exoskeletons are increasingly becoming lighter, more flexible, and more efficient at supporting soldiers in high-stress environments. In 2023, the global defense sector saw a rise in the number of military contracts for robotic exoskeletons due to improvements in materials and design. This trend is mirrored in Saudi Arabia, where defense contractors are actively pursuing exoskeleton integration into military operations to reduce fatigue and prevent musculoskeletal injuries, particularly for soldiers carrying heavy combat gear. Additionally, Saudi Arabia’s collaboration with international defense tech companies to advance the research and development of these systems has accelerated their adoption. The KSA Ministry of Defense’s strategic investment in technological defense solutions plays a significant role in driving these advancements.

Market Challenges

High Production Costs for Advanced Exoskeleton Systems

One of the significant challenges hindering the broader adoption of military exoskeletons in Saudi Arabia is the high production cost of these advanced systems. Exoskeletons, particularly robotic and powered versions, require sophisticated materials, research, and development efforts, all contributing to their high manufacturing costs. These systems are also costly to maintain due to the specialized workforce required for maintenance and repair. For example, advanced robotic exoskeletons can cost upwards of USD 100,000 per unit, which places a considerable financial burden on defense budgets. Given that Saudi Arabia has been increasing its defense spending, the allocation for high-cost systems like exoskeletons still competes with other priorities such as fighter jets, tanks, and naval systems. The Saudi government’s defense spending in 2024 reflects a broader challenge in balancing advanced technological investments with budget constraints.

Integration Complexity with Existing Military Equipment

Another significant challenge for the KSA Military Exoskeleton Market is the complexity involved in integrating exoskeleton systems with existing military equipment and infrastructure. As military forces rely on highly specialized vehicles, weapons, and technologies, the integration of exoskeletons requires substantial system compatibility and interoperability with a wide range of military hardware. This technical complexity can lead to delays in deployment and higher costs for customization and retrofitting. Additionally, Saudi Arabia’s heavy reliance on foreign military systems further complicates this integration process, as exoskeleton systems need to be compatible with diverse, often legacy, military equipment. The complexity of this integration poses a challenge for the seamless adoption of exoskeletons within the defense forces.

Market Opportunities

Growing Demand for Exoskeletons in Combat Scenarios

There is a significant and growing demand for military exoskeletons in combat scenarios within Saudi Arabia’s defense sector. As Saudi Arabia strengthens its military readiness and combat capabilities, the need for technologies that support soldiers during high-stress combat situations is becoming more apparent. Military exoskeletons can assist soldiers in carrying heavy loads, improve endurance, and provide enhanced protection from physical strain, which is essential in combat scenarios. This demand aligns with Saudi Arabia’s broader goal to modernize its military capabilities under Vision 2030, a strategic initiative to transition the armed forces into a more advanced, technology-driven sector. The Royal Saudi Land Forces have been exploring the use of exoskeletons to ensure better combat performance in extreme environments. Furthermore, the increasing emphasis on improving soldier health and reducing the risk of injury further accelerates the adoption of exoskeleton technology in combat.

Potential for Dual-Use Technologies in Both Military and Civilian Markets

Another promising opportunity lies in the dual-use potential of exoskeleton technologies, which can cater to both military and civilian sectors. The demand for exoskeletons is not confined solely to defense applications but also extends to the healthcare and industrial sectors. In Saudi Arabia, there is growing interest in using exoskeletons for rehabilitation, elderly care, and workforce assistance, areas where the Kingdom is actively investing to improve quality of life and healthcare services. This trend presents an opportunity for the defense sector to leverage technological advancements for broader applications. The KSA government’s commitment to supporting both military and civilian technological integration, as part of its Vision 2030, ensures that exoskeletons designed for military use will likely see a crossover into civilian markets. In the healthcare sector, for instance, exoskeletons are seen as beneficial for patients with mobility impairments, creating a secondary market for the same technologies.

Future Outlook

The KSA Military Exoskeleton Market is poised for significant growth over the next decade. Continued advancements in exoskeleton technology, government investments in defense infrastructure, and the increasing need for soldier mobility and performance enhancement are expected to drive the market forward. The Saudi Arabian government’s Vision 2030 initiative, which includes strengthening the defense sector, will likely continue to boost the adoption of cutting-edge technologies like military exoskeletons. As the technology becomes more refined and cost-effective, the market is set to expand further, especially in land-based platforms where demand is highest.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Ekso Bionics

- Sarcos Robotics

- Bae Systems

- ExoAtlet

- Honda Motor Co.

- Parker Hannifin

- NeuroMetrix

- ReWalk Robotics

- Omni Motion

- SuitX

- Army Technology

- Noonee

- Trexo Robotics

Key Target Audience

- Military and Defense Agencies

- Government and regulatory bodies

- Investment and venture capitalist firms

- Military Contractors

- National Research and Development Institutions

- Exoskeleton Manufacturers

- Technology Integrators in Defense

- Aerospace and Defense Equipment Suppliers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables that influence the KSA Military Exoskeleton Market. This is accomplished through desk research, reviewing industry reports, and conducting consultations with defense experts to identify drivers, challenges, and opportunities. The goal is to map the complete ecosystem of the market and pinpoint the main drivers of growth and key segments.

Step 2: Market Analysis and Construction

In this phase, we compile historical market data to evaluate market penetration, segment shares, and the historical growth rate of the exoskeleton market in the defense sector. We also analyze the value proposition of different platforms, including land, airborne, and naval systems, to assess the evolving needs of the market.

Step 3: Hypothesis Validation and Expert Consultation

The formulated hypotheses are validated through in-depth consultations with industry experts, including representatives from military technology providers and government defense bodies. This process involves one-on-one interviews and computer-assisted telephone interviews (CATIs) to collect actionable insights from real-world practitioners.

Step 4: Research Synthesis and Final Output

In the final phase, we compile the findings from the primary research and cross-check the data with secondary research sources. Detailed company interviews with manufacturers and procurement agencies provide insights into the actual use cases and challenges faced in adopting military exoskeletons. These findings are integrated into the final report, ensuring a comprehensive analysis of the market.

- Executive Summary

- KSA Military Exoskeleton Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in military personnel mobility requirements

Advancements in exoskeleton technologies

Government investments in defense innovation - Market Challenges

High production costs for advanced exoskeleton systems

Integration complexity with existing military equipment

Limited availability of skilled workforce for exoskeleton maintenance - Market Opportunities

Growing demand for exoskeletons in combat scenarios

Potential for dual-use technologies in both military and civilian markets

Strategic alliances with international defense agencies - Trends

Rising integration of AI in exoskeletons for enhanced performance

Focus on lightweight and durable materials

Increased focus on wearable exoskeletons for enhanced soldier endurance

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Assistive Exoskeletons

Robotic Exoskeletons

Wearable Exoskeletons

Power-Boosted Exoskeletons

Full-Body Exoskeletons - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Hybrid Platforms

Unmanned Platforms - By Fitment Type (In Value%)

Upper Body Fitment

Lower Body Fitment

Full Body Fitment

Partial Body Fitment

Modular Fitment - By End User Segment (In Value%)

Military Defense

Research & Development Organizations

Government Defense Contractors

Special Operations Units

Army Personnel - By Procurement Channel (In Value%)

Direct Purchase from Manufacturer

Government Procurement Programs

Third-Party Distributors

Military Contractors

B2B Partnerships

- Market Share Analysis

- Cross Comparison Parameters (System Complexity, Platform Integration, Fitment Options, Procurement Channels, End-User Segments)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Lockheed Martin

Raytheon Technologies

Bae Systems

Ekso Bionics

ReWalk Robotics

Sarcos Robotics

SuitX

Honda Motor Co.

ExoAtlet

Parker Hannifin

Noonee

Army Technology

Trexo Robotics

NeuroMetrix

Omni Motion - K

- Increased demand from elite special operations forces

- Integration with current military vehicles and robotics

- Expansion of exoskeletons for rehabilitation and injury prevention

- Growing importance in defense research and technological advancement

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035