Market Overview

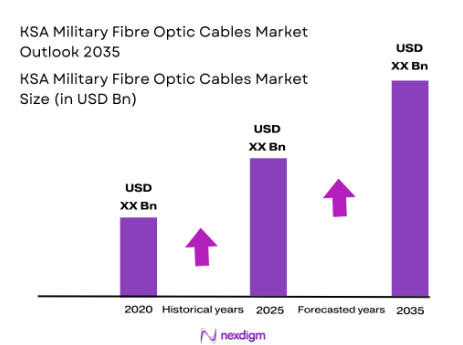

The KSA Military Fibre Optic Cables market is valued at approximately USD ~ million, driven by the country’s ongoing efforts to modernize and enhance its defense infrastructure. The growth of the market is propelled by the increasing need for high-performance communication networks to support critical military operations. In particular, the Saudi government’s heavy investments in national defense initiatives, along with the increasing demand for secure and fast communication systems, fuels the market. The growing need for reliable, high-speed data transmission in military operations, as well as the shift towards fiber optics for superior security and capacity, are significant contributors to the market’s expansion.

The Kingdom of Saudi Arabia (KSA) is the dominant player in the Military Fibre Optic Cables market due to its strategic investments in defense and security sectors. As part of the Vision 2030 program, KSA is significantly upgrading its military communication infrastructure, leading to a surge in demand for military-grade fiber optic cables. Additionally, cities such as Riyadh, Jeddah, and Dammam act as key hubs due to their centrality in defense operations and military activities. These cities are home to major military bases, and their proximity to ports and logistical centers further boosts demand for military communication solutions. This concentration of military activity and infrastructure development supports the dominance of KSA in the market.

Market Segmentation

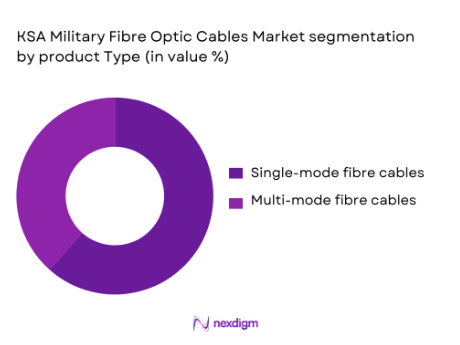

By Product Type

The KSA Military Fibre Optic Cables market is segmented by product type into single-mode and multi-mode fiber optic cables. Single-mode fiber cables hold the dominant market share in the KSA military sector, primarily due to their ability to transmit data over long distances without significant loss of signal. These cables are crucial for military operations that require robust and secure communications over expansive geographic areas. Single-mode fiber optic cables are particularly preferred for military installations, remote base connections, and large-scale defense communication networks. With increasing military base expansions and modernization programs, the demand for single-mode fiber cables is expected to continue its dominance.

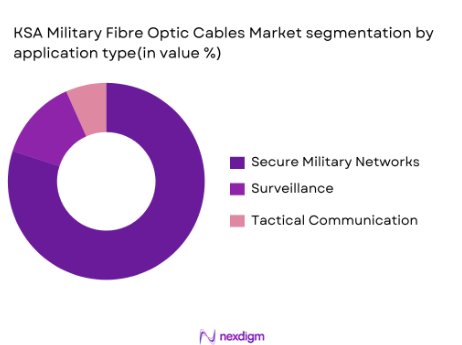

By Application

The market is also segmented by application into tactical communication, surveillance, and secure military networks. Among these, secure military networks have the largest share in the KSA Military Fibre Optic Cables market. The demand for high-security communication networks, which are essential for encryption and secure data transmission, is driving the growth in this segment. The increasing emphasis on national security, as well as the need for secure command and control communications, is pushing the demand for fiber optic cables tailored to military security applications. As military operations increasingly rely on secure and uninterrupted communication channels, this segment is poised for continued growth.

Competitive Landscape

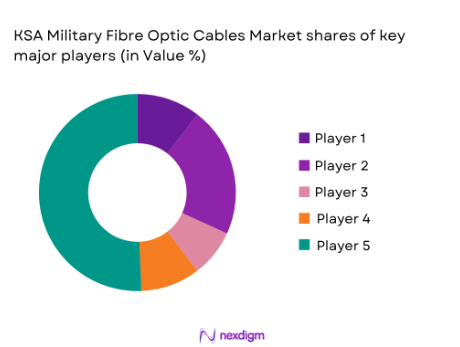

The KSA Military Fibre Optic Cables market is dominated by a few major players, including both international and local manufacturers. These companies are contributing significantly to the growth of the market by providing high-quality fiber optic cables for military applications. Their strategic partnerships with government defense agencies, as well as their investments in cutting-edge technology, position them as key players in the market. Global companies with strong technological capabilities are establishing a solid foothold in KSA, where large defense infrastructure projects are driving demand for their products.

| Company Name | Year Established | Headquarters | Product Focus | Revenue (2023) | Technology Innovation | Key Contracts |

| Nexans | 1897 | Paris, France | – | – | – | – |

| Furukawa Electric | 1884 | Tokyo, Japan | – | – | – | – |

| Prysmian Group | 2005 | Milan, Italy | – | – | – | – |

| Leoni AG | 1997 | Nuremberg, Germany | – | – | – | – |

| OFS (Furukawa) | 2001 | Norcross, USA | – | – | – | – |

KSA Military Fibre Optic Cables Market Dynamics

Growth Drivers

Growing demand for secure communication systems in military operations

The Kingdom of Saudi Arabia has significantly increased its defense budget, allocating approximately USD 61.4 billion to its national defense in 2024, marking an increase of 4.5% compared to previous years. This growth in defense expenditure is primarily focused on enhancing military communication systems, including secure fiber optic cables that are crucial for real-time data transmission in defense operations. The growing geopolitical tensions in the region, coupled with the rise in cybersecurity threats, have further amplified the need for secure communication infrastructures. With this allocation, the KSA aims to modernize its defense systems and strengthen its military communication networks. As a result, the demand for advanced fiber optic cables that offer high security and reliability is expected to continue rising, further fueling market growth.

Technological advancements in fibre optic cable systems for military applications

Technological advancements in fiber optic cable systems have led to significant improvements in data transmission speeds and security, making them more suitable for military applications. The global defense sector’s shift towards high-bandwidth systems is supported by the increasing use of data-centric warfare and advanced surveillance tools. In Saudi Arabia, the defense sector is transitioning from legacy communication systems to more advanced solutions, investing in fiber optics for secure, high-speed connections. Additionally, advancements in military-grade fiber optic cables, such as high-strength coatings and laser-driven systems, are making them more robust, durable, and adaptable for use in harsh environments, which is crucial for military operations.

Market Challenges

High cost of fibre optic cable systems and their installation

The initial capital investment required for installing fiber optic cables remains a significant challenge in the KSA Military Fibre Optic Cables market. The costs associated with fiber optic systems, including procurement, installation, and ongoing maintenance, are substantially higher than those of traditional communication systems. According to the World Bank, the cost of infrastructure projects in the Middle East has been increasing due to inflationary pressures and supply chain disruptions. In Saudi Arabia, the installation of military-grade fiber optic cables involves highly specialized labor and advanced technology, leading to high upfront costs. This factor has led to slower adoption in some areas, despite the long-term operational benefits of fiber optic systems.

Challenges in integrating new fibre optic systems with legacy military infrastructure

The integration of new fiber optic cable systems with existing legacy military infrastructure is a considerable challenge for the KSA defense sector. Saudi Arabia’s military infrastructure is primarily built on older communication systems, and the process of upgrading or replacing these systems to accommodate fiber optic technology is complex and resource-intensive. Moreover, the lack of standardization in legacy systems can result in compatibility issues when integrating new technologies. In 2023, a report from the Saudi Arabian Ministry of Defense highlighted delays in ongoing infrastructure upgrades due to the incompatibility between existing infrastructure and advanced communication technologies. The need for seamless integration continues to be a barrier to faster implementation of fiber optic solutions.

Market Opportunities

Potential for growth in fibre optic cable applications in unmanned platforms

With the increasing use of unmanned aerial vehicles (UAVs) and unmanned ground vehicles (UGVs) in military operations, there is a growing demand for reliable communication systems that can withstand harsh environments and provide real-time data transmission. Fiber optic cables, known for their durability and high bandwidth, are being increasingly incorporated into these unmanned platforms. In Saudi Arabia, the Ministry of Defense has launched initiatives to incorporate UAVs for surveillance and reconnaissance, and these platforms require advanced communication systems. As of 2024, UAVs are widely deployed for military surveillance, with over 200 UAVs currently in use by the Saudi armed forces. Fiber optic cables are being integrated into these platforms to provide uninterrupted, secure communication.

Expanding demand for fibre optic cables in military research and development

The Saudi Arabian government has been increasingly investing in defense research and development, with a specific focus on advanced technologies, including military communication systems. In 2024, the Saudi government allocated USD 2.4 billion towards military research and development projects aimed at improving the country’s defense capabilities. This includes the enhancement of communication infrastructure, with a growing emphasis on fiber optic cables for military R&D applications. Fiber optic technology plays a critical role in the development of advanced military communication systems, including satellite communications and secure data links. As military R&D continues to expand, the demand for fiber optic cables in this sector is poised for significant growth.

Future Outlook

The KSA Military Fibre Optic Cables market is poised for steady growth through 2035, fueled by continuous government investments in military infrastructure and the rising need for high-speed, secure communications. The increasing focus on enhancing national security, alongside the development of advanced defense systems, is expected to drive the demand for military-grade fiber optic cables. Further, the ongoing modernization of the Kingdom’s military forces, including the integration of advanced technology into communication systems, will support the demand for more reliable and efficient fiber optic networks. With Vision 2030 and enhanced defense strategies, the market outlook remains positive, showcasing substantial growth prospects in the coming years.

Major Players

- Nexans

- Furukawa Electric

- Prysmian Group

- Leoni AG

- OFS (Furukawa)

- Corning Inc.

- Sumitomo Electric Industries

- CommScope

- Tratos

- Optical Cable Corporation (OCC)

- Belden Inc.

- Huber + Suhner

- General Cable

- LS Cable & System

- Sterlite Technologies

Key Target Audience

- Defense Contractors and Suppliers

- Military and Defense Agencies

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

- Telecommunications Companies

- Fiber Optic Cable Manufacturers

- Security Technology Providers

- Military Logistics Providers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the major drivers and constraints in the KSA Military Fibre Optic Cables market. This phase focuses on understanding key market dynamics through secondary research, including reports, company websites, and industry publications, to develop an ecosystem map of stakeholders and determine relevant market variables.

Step 2: Market Analysis and Construction

Here, historical data related to the market’s performance is analyzed, including trends in defense expenditure and fiber optic cable demand. This phase assesses the influence of geopolitical factors, defense budgets, and technological innovations that shape the market’s evolution.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, we engage with industry experts via interviews and surveys to validate the initial hypotheses regarding market size, growth, and trends. The expert insights help refine the data and ensure that assumptions are in line with real-world market conditions.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data into comprehensive market reports. This includes verifying data accuracy through engagements with key stakeholders like defense manufacturers, government agencies, and fiber optic technology providers to ensure a fully validated market analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing demand for secure communication systems in military operations

Technological advancements in fibre optic cable systems for military applications

Increased defense budget allocations by the Saudi Arabian government - Market Challenges

High cost of fibre optic cable systems and their installation

Challenges in integrating new fibre optic systems with legacy military infrastructure

Vulnerabilities in cable security during deployment in conflict zones - Market Opportunities

Potential for growth in fibre optic cable applications in unmanned platforms

Expanding demand for fibre optic cables in military research and development

Opportunities for collaboration between defense tech companies and telecom providers - Trends

Growing adoption of fibre optic cables for secure military communication

Shift towards modular and flexible cable systems in defense networks

Increasing use of fibre optic cables for cyber defense and surveillance

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Single-Mode Fibre Optic Cables

Multi-Mode Fibre Optic Cables

Armoured Fibre Optic Cables

Loose Tube Fibre Optic Cables

Hybrid Fibre Optic Cables - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Airborne Platforms

Space Platforms

Command & Control Centres - By Fitment Type (In Value%)

Internal Systems

External Systems

Modular Systems

Portable Systems

Integrated Systems - By End User Segment (In Value%)

Military Communication Networks

Defense Contractors

Government Research Institutions

Military Logistics & Supply Chains

Combat & Tactical Units - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Government Defense Programs

Third-Party Distributors

Military Contractors

B2B Partnerships

- Market Share Analysis

- Cross Comparison Parameters (System Complexity, Integration with Existing Infrastructure, Fitment Options, Procurement Channels, End-User Segments)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Optical Cable Corporation

TAT Technologies

Bezeq International

Mellanox Technologies

Mitsubishi Electric

Marmon Utility

Ciena Corporation

General Electric

Siemens AG

Huawei Technologies

Cisco Systems

Northrop Grumman

- Growing integration of fibre optic cables in military UAV systems

- Adoption of advanced fibre optic networks for secure battlefield communication

- Increased focus on resilient and durable fibre optic systems for combat units

- Demand for real-time data transfer in military logistics and command centers

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035