Market Overview

The KSA Military Fitness Training Equipment market is valued at approximately USD ~ million, driven by the Kingdom’s substantial defense budget, which is expected to reach USD 61.4 billion in 2024. The demand for fitness training equipment is primarily fueled by the Saudi government’s focus on enhancing military readiness through physical fitness programs. The Saudi Arabian military has increasingly incorporated advanced fitness training technologies to improve soldiers’ overall performance, which includes cardiovascular and strength training systems. As a result, the market is projected to grow steadily as these investments continue to rise.

Riyadh, Jeddah, and Dammam dominate the KSA Military Fitness Training Equipment market due to their centrality in the Kingdom’s defense infrastructure. Riyadh, being the capital, houses major military bases, academies, and training facilities, while Jeddah serves as a key logistics and defense hub due to its proximity to the Red Sea. Dammam plays a vital role with its strategic position in the Eastern Province, hosting multiple military installations. These cities are the focal points of Saudi Arabia’s defense and military development strategies, which contribute to their dominance in the market.

Market Segmentation

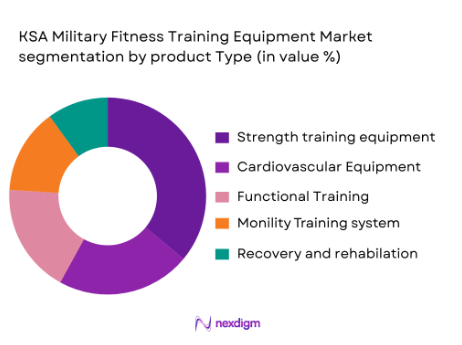

By Product Type

The KSA Military Fitness Training Equipment market is segmented by product type into strength training equipment, cardiovascular equipment, functional training systems, mobility training systems, and recovery and rehabilitation equipment. Recently, strength training equipment has dominated the market under the segmentation by product type, due to its strong presence in military fitness regimens. Strength training equipment is essential for building endurance, strength, and agility in soldiers, which directly contributes to combat readiness. The Saudi Armed Forces have increasingly focused on resistance-based training to ensure soldiers are well-prepared for physically demanding operations, thus driving the dominance of this segment.

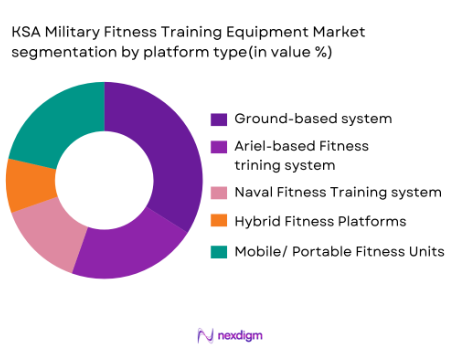

By Platform Type

The market is also segmented by platform type, including ground-based systems, aerial-based fitness systems, naval fitness training systems, hybrid fitness platforms, and mobile/portable fitness units. Ground-based systems currently dominate the market due to their long-established role in military training programs. These systems, which include weight machines, resistance training equipment, and other functional training setups, are integral to comprehensive soldier fitness regimes. The Saudi military heavily invests in these systems to meet the diverse training needs of its personnel, making ground-based platforms the dominant subsegment.

Competitive Landscape

The KSA Military Fitness Training Equipment market is characterized by the presence of several major players, both local and international, who provide innovative fitness solutions tailored to military needs. These players include global fitness equipment manufacturers and specialized defense contractors who have established strong relationships with the Saudi government and military. This consolidation of major brands highlights the significant influence of these key companies, which supply the majority of fitness systems to military bases and training centers.

| Company Name | Year Established | Headquarters | Product Focus | Revenue (2023) | Technology Innovation | Key Contracts |

| Technogym | 1983 | Cesena, Italy | – | – | – | – |

| Life Fitness | 1997 | Rosemont, USA | – | – | – | – |

| Precor | 1980 | Woodinville, USA | – | – | – | – |

| Escape Fitness | 2001 | London, UK | – | – | – | – |

| Cybex | 1970 | Medway, USA | – | – | – | – |

KSA Military Fitness Training Equipment Market Dynamics

Growth Drivers

Increase in military personnel fitness programs to boost operational readiness

Saudi Arabia’s Ministry of Defense continues to allocate significant resources towards enhancing the physical fitness of its military personnel. As of 2024, the defense budget has reached approximately USD 61.4 billion, with a portion dedicated to improving fitness infrastructure and training programs. The Kingdom has recognized that physical fitness is essential for combat readiness and minimizing injury rates among soldiers. In response to increasing security concerns in the region, the Saudi Armed Forces have focused on modernizing fitness facilities to ensure soldiers remain in peak physical condition. This focus on fitness has driven investments in advanced training equipment designed to improve strength, endurance, and overall physical performance.

Technological advancements in fitness equipment for military applications

Advancements in fitness technology are a key driver of the KSA Military Fitness Training Equipment market. With the integration of AI, real-time performance tracking, and personalized fitness solutions, military fitness programs in Saudi Arabia have become more efficient and targeted. The Saudi military is investing in next-gen fitness equipment, including smart resistance training systems and wearable devices that provide performance analytics to soldiers. These technological innovations enhance training effectiveness and improve operational readiness. Additionally, the Ministry of Defense has been working to incorporate digital platforms that track physical performance data, ensuring that soldiers’ fitness regimens are optimized for peak performance.

Market Challenges

High cost of advanced fitness training systems for military applications

The adoption of high-tech fitness equipment for military training faces the significant challenge of high costs associated with procurement, installation, and maintenance. The advanced fitness systems used by Saudi Arabia’s military are often customized to meet the specific needs of soldiers. This customization requires substantial investment in both equipment and installation, leading to higher upfront costs. In 2024, the continued global inflation and disruptions in supply chains have resulted in increased prices for fitness training systems and equipment, making it challenging for smaller units and specialized programs to access advanced fitness solutions. This issue has been exacerbated by the high cost of importing military-grade fitness equipment from global suppliers.

Challenges in adapting commercial fitness technology to military specifications

One of the key challenges in the KSA Military Fitness Training Equipment market is the difficulty in adapting commercial fitness technology to meet military specifications. Military fitness programs require equipment that can withstand extreme conditions, such as harsh weather and physical wear and tear. Additionally, systems must be easily portable and versatile to support training in remote areas. Many commercial fitness technologies do not meet these military requirements, necessitating costly modifications. The Saudi Ministry of Defense continues to invest in research to retrofit commercial fitness equipment to make it suitable for military training, but this process is complex and time-consuming.

Market Opportunities

Growth of specialized fitness equipment for injury recovery and rehabilitation

As physical fitness becomes increasingly prioritized in the Saudi military, the demand for specialized fitness equipment for injury recovery and rehabilitation has grown. Musculoskeletal injuries are common among soldiers, and the Saudi Armed Forces have invested in rehabilitation centers equipped with advanced recovery systems. The Ministry of Defense is particularly focused on reducing the long-term effects of injuries and improving recovery times. This has led to the widespread adoption of equipment such as cryotherapy machines, hydrotherapy stations, and electrical muscle stimulators. The increasing focus on injury prevention and recovery solutions is expected to continue driving the demand for specialized fitness equipment in Saudi Arabia’s military sector.

Demand for integrated fitness systems to improve physical readiness of military units

With a continued emphasis on enhancing operational readiness, the demand for integrated fitness systems in the Saudi military is increasing. Integrated systems, which combine strength, endurance, and flexibility training with real-time monitoring and data analytics, are becoming essential for military training programs. These systems help track soldiers’ progress and provide personalized fitness regimens tailored to individual needs. The Ministry of Defense is increasingly investing in these advanced systems to improve overall physical fitness and reduce the risk of injuries. As of 2024, Saudi Arabia is modernizing military training facilities with these integrated solutions, and this trend is expected to grow as military readiness remains a top priority.

Future Outlook

Over the next decade, the KSA Military Fitness Training Equipment market is expected to show steady growth, driven by increasing government investments in defense infrastructure and soldier readiness. The Saudi government continues to prioritize the physical fitness of its military personnel, with substantial funding allocated to upgrading training facilities and introducing advanced fitness technologies. The market is also expected to benefit from technological advancements in fitness equipment, including AI-driven performance tracking systems and integrated fitness platforms. With the government’s Vision 2030 program, there will be continued emphasis on military modernization, which will further drive demand for cutting-edge fitness training solutions.

Major Players

- Technogym

- Life Fitness

- Precor

- Escape Fitness

- Cybex

- Keiser Corporation

- Rogue Fitness

- Hammer Strength

- Strength Systems

- Nautilus

- Matrix Fitness

- TRX Training

- Body-Solid

- Eleiko

- Power Systems

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Saudi Ministry of Defense)

- Saudi Armed Forces

- Private Military Contractors

- Military Academies and Training Institutes

- Fitness Centers for Military Personnel

- Defense Contractors and Suppliers

- Fitness Equipment Distributors

Research Methodology

%3

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in military personnel fitness programs to boost operational readiness

Technological advancements in fitness equipment for military applications

Expansion of military training centers and defense infrastructure - Market Challenges

High cost of advanced fitness training systems for military applications

Challenges in adapting commercial fitness technology to military specifications

Logistical challenges in deploying fitness systems in remote military bases - Market Opportunities

Growth of specialized fitness equipment for injury recovery and rehabilitation

Demand for integrated fitness systems to improve physical readiness of military units

Increasing adoption of mobile and portable fitness units for on-the-go training - Trends

Rise in adoption of virtual fitness training and gamified fitness solutions

Increased focus on military fitness for overall health and stress management

Integration of AI and IoT in fitness equipment for real-time performance tracking

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Strength Training Equipment

Cardiovascular Equipment

Functional Training Systems

Mobility Training Systems

Recovery and Rehabilitation Equipment - By Platform Type (In Value%)

Ground-Based Systems

Aerial-Based Fitness Systems

Naval Fitness Training Systems

Hybrid Fitness Platforms

Mobile/Portable Fitness Units - By Fitment Type (In Value%)

Fixed Installations

Portable Units

Modular Systems

Integrated Solutions

Customizable Fitments - By End User Segment (In Value%)

Saudi Armed Forces

Private Military Contractors

Government Security Agencies

Military Academies and Training Institutes

Fitness Centers for Military Personnel - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Government Procurement Programs

Distributor Networks

Online Marketplaces

Third-Party Procurement via Contractors

- Market Share Analysis

- Cross Comparison Parameters (Market share, System innovation, Technology adoption, Government contracts, Pricing strategies)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

Detailed Company Profiles

Technogym

Life Fitness

TriActive USA

Rally Fitness LLC

MoveStrong

Rogue Fitness

Gtech Fitness

American Fitness

Keiser Corporation

Outdoor‑Fit Exercise Systems

Greenfields Outdoor Fitness

BeaverFit North America LLC

ProMaxima Strength & Conditioning

TRXperience, LLC

Octane Fitness

- Saudi Armed Forces focusing on physical fitness as a key performance metric

- Private contractors adapting fitness systems for special forces training

Military academies upgrading fitness equipment to meet modern training needs - Government security agencies investing in long-term physical fitness solutions for personnel

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035