Market Overview

The KSA Military Gas Mask market is valued at approximately USD ~ million in 2025. This market is primarily driven by Saudi Arabia’s increasing defense expenditure, with the kingdom’s defense budget reaching USD 61.3 billion in 2023, representing a significant portion of its overall spending. As a strategic player in the Middle East, Saudi Arabia continues to invest heavily in CBRN (Chemical, Biological, Radiological, and Nuclear) defense capabilities to protect its armed forces. The government’s strong commitment to defense modernization and regional security enhances demand for military-grade gas masks and other protective equipment, as these systems are integral to defense readiness in volatile geopolitical situations.

Saudi Arabia leads the KSA Military Gas Mask market due to its robust defense infrastructure and ongoing military modernization efforts. The kingdom has been the focal point of defense procurement in the region, driven by its strategic position in the Middle East and its leadership role within the Gulf Cooperation Council (GCC). Major cities like Riyadh and Jeddah are key centers for military procurement activities. Additionally, partnerships with international defense contractors further bolster the market, with Saudi Arabia continuing to increase its defense imports, particularly in the areas of advanced personal protective equipment like gas masks, driven by its high security concerns and commitment to preparedness for potential CBRN threats.

Market Segmentation

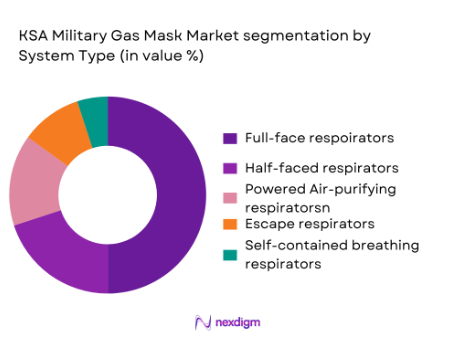

By System Type

The KSA Military Gas Mask market is segmented by system type into full-face respirators, half-face respirators, powered air-purifying respirators (PAPR), escape respirators, and self-contained breathing apparatus (SCBA). Full-face respirators dominate the market due to their comprehensive protection against chemical, biological, radiological, and nuclear threats, covering both the respiratory and facial areas. These masks are integral to the personal protection gear of Saudi Arabian armed forces, ensuring that personnel are safeguarded from hazardous environments during combat and operations in hostile territories. The demand for full-face respirators continues to rise as the Saudi military modernizes its protective equipment, ensuring the safety of its personnel in high-risk operations.

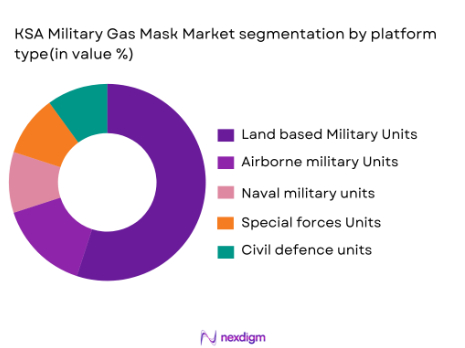

By Platform Type

The KSA Military Gas Mask market is segmented by platform type into land-based military units, airborne military units, naval military units, special forces & tactical units, and civil defense units. Land-based military units hold the largest share in the market due to the extensive deployment of ground forces in the Saudi Arabian military. These units, including infantry and armored divisions, require high-performance protective gear, such as gas masks, to ensure the safety of personnel during operations in CBRN-risk zones. The increasing demand for advanced land-based protective equipment is a key factor in the dominance of this segment in the KSA market.

Competitive Landscape

The KSA Military Gas Mask market is dominated by both international and domestic players who provide technologically advanced protective gear for military and defense forces. Major companies such as Honeywell International, 3M, and Drägerwerk AG have a strong presence in the market, supplying high-quality gas masks and CBRN protection systems. Saudi Arabia’s defense industry also works closely with local manufacturers to ensure the availability of these vital systems for the kingdom’s armed forces.

| Company Name | Establishment Year | Headquarters | Product Innovation | Market Focus | Export Reach | Technology Integration |

| Honeywell International | 1906 | USA | – | – | – | – |

| 3M | 1902 | USA | – | – | – | – |

| Drägerwerk AG | 1889 | Germany | – | – | – | – |

| Avon Protection | 1885 | UK | – | – | – | – |

| Israel Military Industries (IMI) | 1933 | Israel | – | – | – | – |

KSA Military Gas Mask Market Dynamics

Growth Drivers

Rising geopolitical tensions driving demand for enhanced protective gear

Rising geopolitical tensions in the Middle East have significantly contributed to the demand for advanced protective gear, including military gas masks. Saudi Arabia’s defense expenditure reached USD ~ billion in 2023, reflecting the kingdom’s strong focus on enhancing its military capabilities amid regional instability. The increased defense spending is aimed at improving the safety of Saudi personnel in high-risk operations, which includes the procurement of CBRN (chemical, biological, radiological, nuclear) protection systems. This ongoing concern about security threats, such as potential chemical warfare or terrorist attacks, fuels the demand for protective equipment like gas masks.

Ongoing development of chemical, biological, radiological, and nuclear (CBRN) defense capabilities

Saudi Arabia has significantly enhanced its CBRN defense capabilities, driving the demand for advanced protective gear such as military gas masks. In 2023, the country’s defense budget allocation for CBRN systems exceeded USD ~ billion. The government’s continued investment in upgrading military equipment to handle potential CBRN threats is fueling the market for military-grade gas masks. These masks are critical in ensuring the protection of Saudi personnel in high-risk environments, especially during military operations in hostile territories where chemical or biological weapons could be used. The kingdom’s commitment to modernizing its defense infrastructure is central to the growth of this market.

Market Challenges

High costs of advanced gas mask technologies and systems

The development and procurement of advanced military gas mask systems come with substantial costs. In 2023, Saudi Arabia’s procurement of CBRN protective gear, including gas masks, was valued at over USD ~ million. These high costs are driven by the incorporation of advanced filtration technologies and the need to meet military-grade standards. With the continuous advancement of gas mask systems, including enhanced air-purifying capabilities and durability, these costs have continued to rise. Moreover, the complexity of these systems increases their manufacturing and maintenance costs, presenting a financial challenge to defense procurement.

Supply chain disruptions for critical materials and components

Supply chain disruptions for essential materials like high-grade plastics, rubber, and advanced filtration components are significantly affecting the production of military gas masks in Saudi Arabia. In 2023, global supply chain issues, exacerbated by the COVID-19 pandemic and geopolitical tensions, caused delays in the procurement of key materials needed for gas mask production. This led to delays in fulfilling military contracts and also increased the cost of production. Saudi Arabia’s reliance on global suppliers for these specialized materials means that any disruptions, such as in the semiconductor or chemical industries, further complicate procurement and manufacturing timelines for critical protective gear.

Market Opportunities

Expansion of military contracts and international defense sales

The expansion of military contracts and international defense sales presents significant growth opportunities for Saudi Arabia’s military gas mask market. Saudi Arabia’s defense export market was valued at over USD ~ billion in 2024, with substantial orders for military-grade protection equipment. As the country continues to strengthen defense relations with countries in the Middle East and North Africa (MENA) region, the demand for high-quality protective gear, including gas masks, is expected to grow. The kingdom’s role in the Gulf Cooperation Council (GCC) and as a key player in the broader Middle Eastern defense ecosystem will further promote its defensive exports, creating a larger market for military-grade personal protective equipment.

Growing focus on integrating advanced filtration technologies in gas masks

The growing emphasis on integrating advanced filtration technologies into military gas masks offers a unique opportunity for market expansion. Saudi Arabia has been at the forefront of adopting the latest innovations in filtration technology for military use, allocating over USD ~ million in 2024 for research and development in this area. This includes improvements in chemical and biological agent filtration, as well as the integration of technologies like powered air-purifying respirators (PAPR). As the kingdom’s military forces continue to upgrade their protective gear, the market for highly sophisticated gas masks with advanced filtration systems is expected to expand.

Future Outlook

The KSA Military Gas Mask market is poised for steady growth in the coming years, driven by continued defense spending and the modernization of Saudi Arabia’s military forces. With a defense budget expected to remain robust in the coming years, Saudi Arabia will continue to invest in CBRN defense systems, including gas masks. This will be supported by technological advancements in filtration systems and protective gear, as the kingdom prioritizes the protection of its military personnel in high-risk operations. Additionally, Saudi Arabia’s strategic alliances with global defense contractors are likely to further bolster the market, ensuring the availability of advanced gas masks and other protective equipment for the kingdom’s armed forces.

Major Players

- Honeywell International

- 3M

- Drägerwerk AG

- Avon Protection

- Israel Military Industries (IMI)

- Rafael Advanced Defense Systems

- MSA Safety

- Scott Safety

- Cameron International

- Sundström Safety

- MedEng Systems

- Aearo Technologies

- Trelleborg AB

- Birnberg Medical

- Avon Rubber

Key Target Audience

- Defense Ministries

- Military Units

- Security Agencies

- CBRN Defense Contractors

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Emergency Response Units

Research Methodology

Step 1: Identification of Key Variables

In the first phase, we identify all key stakeholders in the KSA Military Gas Mask market, including manufacturers, government bodies, and defense agencies. This step involves using secondary research to identify variables such as defense spending, regional threats, and procurement requirements.

Step 2: Market Analysis and Construction

We analyze historical data related to defense budgets and military procurement in Saudi Arabia. This includes understanding the demand for protective gear, including gas masks, across different branches of the military and governmental agencies, focusing on penetration rates and product preferences.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including military procurement officers and gas mask manufacturers. These discussions provide insights into operational challenges, technological needs, and procurement practices.

Step 4: Research Synthesis and Final Output

The final phase involves working with multiple defense contractors to gather insights on product performance, market segmentation, and consumer preferences. This direct engagement ensures that the analysis is grounded in real-time market developments, providing a comprehensive view of the KSA Military Gas Mask market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising geopolitical tensions driving demand for enhanced protective gear

Ongoing development of chemical, biological, radiological, and nuclear (CBRN) defense capabilities - Market Challenges

High costs of advanced gas mask technologies and systems

Supply chain disruptions for critical materials and components

Market Opportunities

Expansion of military contracts and international defense sales

Growing focus on integrating advanced filtration technologies in gas masks - Trends

Shift towards lightweight, portable, and more efficient respiratory protection systems

Integration of smart technology and monitoring systems in gas masks

Increasing emphasis on multi-purpose protective gear for all military personnel

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Full-Face Respirators

Half-Face Respirators

Powered Air-Purifying Respirators (PAPR)

Escape Respirators

Self-Contained Breathing Apparatus (SCBA) - By Platform Type (In Value%)

Land-Based Military Units

Airborne Military Units

Naval Military Units

Special Forces & Tactical Units

Civil Defense Units - By Fitment Type (In Value%)

Standard Fitment

Custom Fitment

Replacement Filters and Accessories

Flexible Fitment

Modular Fitment - By End User Segment (In Value%)

Military Forces

Civilian Defense Agencies

Government & Security Agencies

International Defense Allies - By Procurement Channel (In Value%)

Direct Government Procurement

Military Contractors

OEM Manufacturers

Third-party Distributors

Collaborative Procurement

- Market Share Analysis

- Cross Comparison Parameters (Price, Technology Integration, Product Durability, Global Reach, Military Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Israel Military Industries (IMI)

Rafael Advanced Defense Systems

Honeywell International

3M

Avon Protection

Drägerwerk AG

MSA Safety

Scott Safety

Cameron International

Sundström Safety

MedEng Systems

Aearo Technologies

Trelleborg AB

Birnberg Medical

Avon Rubber

- Rising demand for advanced gas masks in international military alliances

- Growth in civilian defense procurement driven by regional threats

- Specialized needs of defense agencies for high-performance gas masks

- Investment in next-gen gas masks by KSA’s defense forces and allies

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035