Market Overview

The KSA military ground vehicle actuators market has experienced notable growth, driven by Saudi Arabia’s focus on modernizing its defense capabilities. Based on recent historical assessments, the market is valued at approximately USD ~ billion in 2024. This growth is primarily driven by the country’s defense spending, with a projected defense budget of USD ~ billion in 2024. A significant portion of this budget is allocated towards upgrading military vehicle fleets, including the adoption of advanced actuators to enhance vehicle performance, precision, and mobility. These actuators are critical for supporting the operations of armored vehicles, tactical platforms, and other defense systems, making them integral to Saudi Arabia’s military strategy. Additionally, the market is fueled by ongoing technological advancements in actuator systems, which are increasingly being integrated into the nation’s defense infrastructure.

Saudi Arabia’s military strategy is heavily influenced by its geopolitical position and security priorities, leading to a concentration of defense investments in major cities such as Riyadh, Jeddah, and Dammam. These regions are central to the development and deployment of advanced military systems, supported by local manufacturing initiatives. The country’s Vision 2030 emphasizes self-reliance in defense technology, pushing for increased domestic production of critical components such as actuators. This strategic push is designed to reduce dependence on foreign suppliers and support local industries. Consequently, the key regions driving this market are those with high concentrations of military activity and defense industry infrastructure, particularly those located in the country’s eastern and central zones. These areas are expected to see continued growth in actuator demand as Saudi Arabia continues to modernize its defense sector.

Market Segmentation

By Product Type

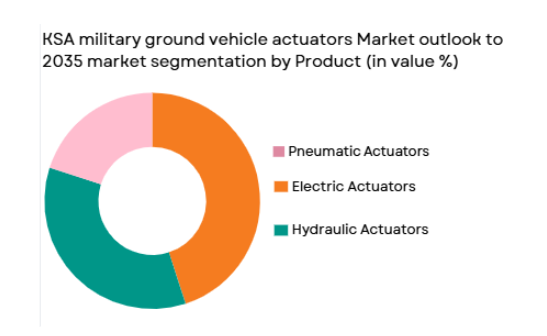

The KSA military ground vehicle actuators market is segmented by product type into electric actuators, hydraulic actuators, and pneumatic actuators. Recently, the electric actuators sub-segment has been dominating the market share due to advancements in electric mobility and energy efficiency in military vehicles. The rise in demand for electric actuators is driven by their higher precision, efficiency, and relatively lower maintenance costs compared to hydraulic and pneumatic alternatives. This technology’s growing preference is particularly notable in armored vehicles and advanced military systems, which are increasingly adopting electrified components to enhance performance and reliability.

By Vehicle Type

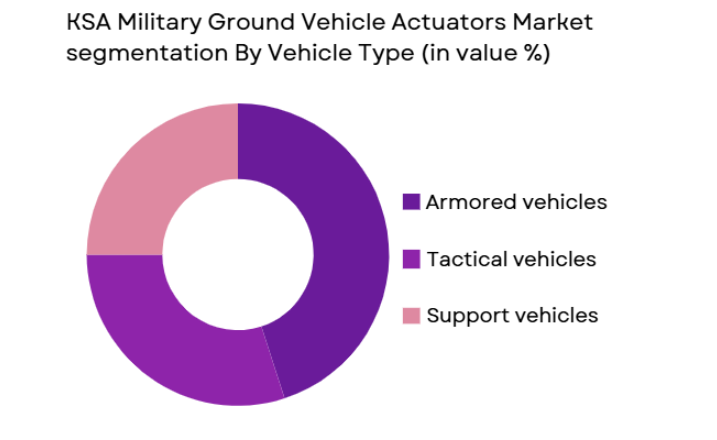

The KSA military ground vehicle actuators market is segmented by vehicle type into armored vehicles, tactical vehicles, and support vehicles. Among these, armored vehicles have dominated the market share due to their essential role in modern military operations and ongoing defense reforms. Armored vehicles are heavily reliant on robust actuator systems to ensure their mobility and operational capabilities under extreme conditions. The strategic importance of armored vehicles, coupled with increasing defense budgets allocated for upgrading military fleets, has resulted in their commanding position in the actuator market.

Competitive Landscape

The KSA military ground vehicle actuators market is characterized by a competitive landscape with a strong presence of global and regional players. Key players in the market are focused on enhancing their technological offerings and expanding their market reach to meet the growing demand for advanced military actuators. Companies are also investing in R&D and collaborating with local manufacturers to provide custom solutions for military applications.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-specific Parameter |

| General Dynamics | 1899 | USA | ~ | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| Parker Hannifin | 1917 | USA | ~ | ~ | ~ | ~ | ~ |

| Saudi Military Industries | 1977 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Eaton Corporation | 1911 | USA | ~ | ~ | ~ | ~ | ~ |

KSA military ground vehicle actuators Market Analysis

Growth Drivers

Increase in Military Modernization

The KSA military ground vehicle actuators market is experiencing substantial growth due to the country’s ongoing military modernization initiatives. As part of Saudi Arabia’s Vision 2030, the government has prioritized the enhancement of its defense capabilities, which includes substantial investments in upgrading and expanding its military vehicle fleets. This modernization drive is focused on improving the performance, mobility, and operational capabilities of military vehicles. Actuators play a vital role in these improvements by enabling precision movements and operational efficiency in armored vehicles, tactical vehicles, and other critical military systems. The military’s shift towards more technologically advanced platforms, including electric and autonomous vehicles, has further propelled the demand for actuators, which are essential for the efficient functioning of these vehicles. Moreover, with Saudi Arabia’s commitment to enhancing its self-reliance in defense manufacturing, local production of actuator systems has become a priority. As a result, the demand for high-performance actuators that can withstand the extreme operational environments of military vehicles is expected to remain strong. This push towards modernization, combined with increasing defense budgets, is expected to fuel significant growth in the market, as the country continues to prioritize the development of its defense infrastructure and capabilities.

Government Defense Initiatives

The Saudi government’s defense initiatives have a critical role in shaping the growth of the military ground vehicle actuators market. Over the past few years, Saudi Arabia has made significant strides in building its defense industry, reducing its reliance on foreign suppliers, and focusing on indigenous production. Government-backed programs, such as the establishment of defense manufacturing zones and the integration of advanced technologies into local defense systems, have created a conducive environment for the growth of actuator technologies in the country. These initiatives are geared towards bolstering national security and enhancing the capabilities of the military. With the government heavily investing in upgrading military vehicle fleets, the demand for actuators in the domestic market is rising, as these components are integral to the modernization of armored vehicles, tactical platforms, and other critical military systems. This shift toward local manufacturing and reliance on indigenous defense capabilities continues to support market expansion, as more businesses enter the actuator supply chain to meet the increasing needs of the Saudi Armed Forces.

Market Challenges

High Costs of Military Vehicle Upgrades

A major challenge faced by the KSA military ground vehicle actuators market is the high cost associated with upgrading existing vehicle fleets. While the Saudi government continues to allocate substantial budgets for defense, the integration of new technologies into aging military vehicles involves significant costs, particularly when it comes to upgrading complex actuator systems. The cost of retrofitting legacy systems with advanced actuators, especially hydraulic and electric actuators, is often higher than initially anticipated, which can delay the modernization of military fleets. Additionally, the complexity of these upgrades, coupled with the need for comprehensive testing and certification processes, further increases the overall expenditure. While the shift towards electric and autonomous vehicles presents an opportunity for growth, the initial cost of acquiring and integrating these systems remains a substantial barrier. This can lead to a slower adoption of advanced actuator technologies, particularly for vehicles that are not immediately prioritized for modernization. Given that a large portion of Saudi Arabia’s military vehicle fleet consists of older models, the cost of upgrades may hinder the speed of implementation and overall growth in the market, posing a significant challenge to manufacturers and defense planners alike.

Regulatory and Certification Hurdles

The regulatory environment and certification processes are another significant challenge for the KSA military ground vehicle actuators market. The need to comply with strict local and international standards related to safety, performance, and environmental impact presents a barrier to quick product development and market deployment. Actuator systems must undergo rigorous testing and validation to meet the required standards, which often results in extended timeframes before products can be integrated into military systems. Furthermore, the evolving nature of defense technology regulations, especially with the rise of autonomous and electric military vehicles, means that manufacturers must stay agile in their designs and ensure that they meet both current and future regulatory expectations. The complexity of the certification process, along with the frequent updates to regulatory frameworks, creates additional pressure on actuator producers, limiting their ability to scale quickly. This regulatory burden can delay the introduction of innovative actuator technologies into the Saudi military fleet and slow the pace of market growth.

Opportunities

Growing Demand for Autonomous Military Vehicles

One of the most promising opportunities in the KSA military ground vehicle actuators market is the growing demand for autonomous military vehicles. As part of Saudi Arabia’s Vision 2030 and its broader efforts to modernize its defense sector, there is a significant push towards incorporating autonomous capabilities into military platforms. These include unmanned ground vehicles (UGVs) and autonomous armored vehicles, which require advanced actuator systems to function effectively. The demand for high-performance actuators that can provide precise control over vehicle movements, weapon systems, and other critical functions is increasing as the country continues to invest in autonomous technology. Actuators are key to enabling the precision and reliability required in autonomous vehicles, especially in combat and reconnaissance missions. As Saudi Arabia moves towards more sophisticated defense technologies, the need for actuators that can withstand harsh operating conditions while offering enhanced control and operational efficiency will continue to rise. This presents a significant opportunity for actuator manufacturers to develop and supply specialized systems for autonomous military platforms, expanding their presence in the Saudi defense sector.

Shift Towards Electric Military Vehicles

Another major opportunity within the KSA military ground vehicle actuators market is the shift towards electric military vehicles. As global trends in sustainability and energy efficiency influence military vehicle development, Saudi Arabia is investing in electric vehicle (EV) technologies for its defense sector, in line with its Vision 2030 sustainability goals. Electric actuators, in particular, are gaining traction due to their efficiency, precision, and reduced maintenance costs compared to traditional hydraulic actuators. The growing demand for electric military vehicles, such as armored electric vehicles and electric tactical platforms, is expected to drive the adoption of electric actuators, which are more compatible with electric propulsion systems. As the KSA military fleet transitions toward cleaner, more energy-efficient vehicles, the demand for electric actuators that can provide seamless operation and integration with electric powertrains will continue to grow. This shift towards electrification presents an exciting opportunity for actuator manufacturers to develop and supply the specialized systems needed to support the next generation of military vehicles in Saudi Arabia.

Future Outlook

The KSA military ground vehicle actuators market is poised for steady growth over the next five years, fueled by significant advancements in military technology and increasing demand for sophisticated actuators. The future of the market is expected to be shaped by innovations in actuator systems, including enhanced energy efficiency, precision, and reliability. As Saudi Arabia’s defense infrastructure continues to modernize and expand, particularly with an emphasis on autonomous and electric military vehicles, the demand for high-performance actuators will intensify. Regulatory support and increased investments in domestic defense manufacturing will also contribute to the market’s positive outlook, ensuring robust growth in the coming years.

Major Players

- General Dynamics

- Honeywell International

- Parker Hannifin

- Saudi Military Industries

- Eaton Corporation

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- BAE Systems

- Leonardo S.p.A.

- Thales Group

- Rheinmetall AG

- Navistar Defense

- Oshkosh Defense

- IVECO Defence Vehicles

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military procurement agencies

- OEMs for military vehicles

- Defense technology developers

- Suppliers of military components

- System integrators for military vehicles

Research Methodology

Step 1: Identification of Key Variables

The first step in the research process involves identifying the key variables influencing the KSA military ground vehicle actuators market, including technological advancements, government policies, and market demand factors.

Step 2: Market Analysis and Construction

In this step, detailed market analysis is performed, including the segmentation of the market by product type and vehicle type, along with identifying major players and trends that influence the market.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted to validate the hypotheses and insights gathered during the market analysis. This helps refine the understanding of key trends and drivers.

Step 4: Research Synthesis and Final Output

The final research synthesis combines all the findings from previous steps, leading to a comprehensive report on the KSA military ground vehicle actuators market. The report is structured to provide actionable insights for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Defense Spending in KSA

Technological Advancements in Vehicle Actuation Systems

Upgraded Military Fleet Programs

Growing Focus on Autonomous and Remote-Controlled Systems

Rising Geopolitical Tensions in the Middle East - Market Challenges

High Cost of Actuator Development and Integration

Maintenance and Repair Challenges for Complex Systems

Availability of Skilled Workforce for Actuator Technologies

Compatibility Issues with Older Military Vehicles

Regulatory Hurdles for Advanced Technologies - Market Opportunities

Expanding Use of Smart Actuators in Autonomous Ground Vehicles

Collaborations with Global Defense Contractors for Technology Transfer

Increase in Joint Military Exercises with International Partners - Trends

Rise in Electric and Hybrid Actuation Systems

Growing Demand for Lightweight and Durable Materials

Shift Toward Digital and Smart Actuation Solutions

Development of Energy-Efficient Actuator Systems

Expansion of Military Vehicle Upgrades and Refurbishments - Government Regulations & Defense Policy

Tightening of Defense Procurement Policies

Increased Funding for Domestic Defense Technology Development

Implementation of Environmental Standards for Military Equipment - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Hydraulic Actuators

Electric Actuators

Pneumatic Actuators

Rotary Actuators

Linear Actuators - By Platform Type (In Value%)

Tracked Vehicles

Wheeled Vehicles

Amphibious Vehicles

Armored Personnel Carriers

Main Battle Tanks - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Replacement Parts

Upgrades

Retrofits - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Maintenance Facilities

Research & Development Organizations - By Procurement Channel (In Value%)

Direct Procurement

Distributors & Resellers

Government Contracts

E-commerce Platforms

B2B Platforms - By Material / Technology (in Value%)

Hydraulic Materials

Electric Actuator Components

Pneumatic Systems

Composite Materials

Smart Actuator Technologies

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Performance, Durability, Integration, Cost, Maintenance, Compatibility, Energy Efficiency, Lead Time, Availability, Innovation)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

Boeing

Thales Group

General Dynamics

Oshkosh Defense

Rheinmetall

BAE Systems

SAAB

Navistar Defense

Harris Corporation

Kongsberg Gruppen

Iveco Defence Vehicles

Elbit Systems

L3 Technologies

- Adaptation of Actuators in Modernized Military Vehicles

- Strategic Importance of Local Manufacturing

- Increased Focus on Defense Export Markets

- Role of R&D Institutions in Military Vehicle Actuator Development

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035