Market Overview

The KSA Military Helicopter MRO Market market current size stands at around USD ~ million, supported by sustained defense readiness programs and expanding fleet sustainment requirements. In the most recent period, service revenues reached nearly USD ~ million while maintenance throughput exceeded ~ units across multiple rotary-wing platforms. Engine overhaul and avionics upgrades together accounted for more than ~ service engagements annually. Rising mission availability targets have pushed annual depot-level maintenance activity beyond ~ systems, strengthening the overall lifecycle support ecosystem.

The market is primarily concentrated in Riyadh, Jeddah, and Dhahran due to the presence of major air bases, centralized defense procurement offices, and growing in-kingdom aerospace clusters. These cities benefit from advanced hangar infrastructure, proximity to command centers, and a maturing supplier network of OEM-authorized service providers. Strong government backing for localization, combined with integrated logistics corridors and defense industrial zones, continues to reinforce these regions as hubs for helicopter maintenance, repair, and overhaul activities.

Market Segmentation

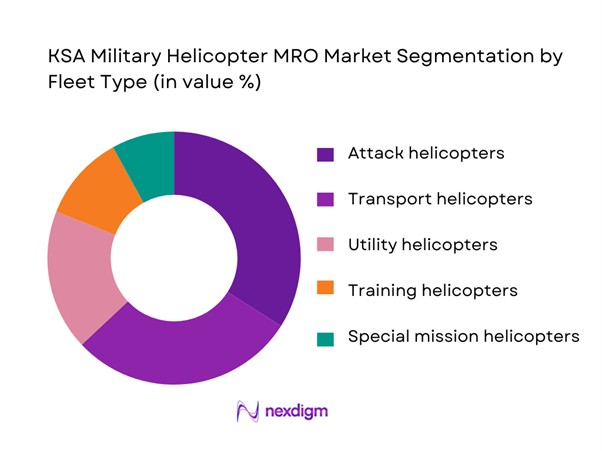

By Fleet Type

Attack and transport helicopters dominate the KSA Military Helicopter MRO Market due to their intensive operational cycles and higher maintenance complexity. These fleets undergo frequent engine inspections, avionics recalibration, and structural integrity checks, driving consistent demand for depot-level services. Utility and special mission helicopters contribute steadily, supported by border surveillance and internal security operations. Training helicopters generate stable baseline demand, especially for scheduled inspections and component replacements. The overall segmentation reflects a maintenance ecosystem shaped by mission-critical usage patterns rather than sheer fleet size, reinforcing the importance of readiness-driven MRO spending across core combat and logistics platforms.

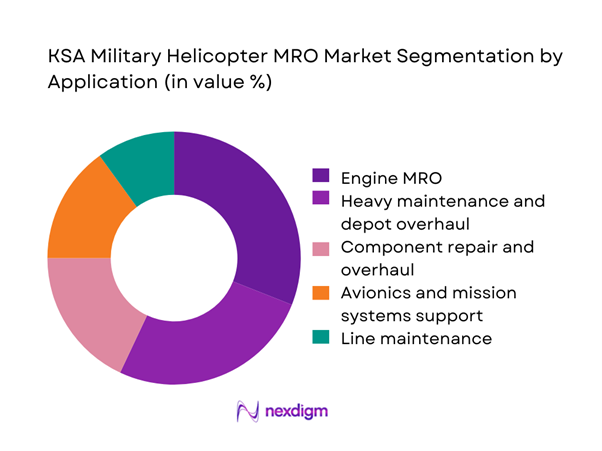

By Application

Engine MRO and heavy maintenance account for the largest share of service demand, reflecting the operational intensity of frontline rotary-wing fleets. Component repair and avionics support follow closely, driven by modernization programs and increasing reliance on digital mission systems. Line maintenance remains essential for daily readiness but contributes a smaller share of total value due to lower service complexity. Structural repair and modification services are gaining traction as fleet life-extension initiatives accelerate. This application-based segmentation highlights a market increasingly oriented toward high-value technical services rather than routine maintenance alone.

Competitive Landscape

The KSA Military Helicopter MRO Market is moderately concentrated, with a mix of global OEM service arms and rapidly expanding local defense aerospace entities. Market structure is shaped by long-term sustainment contracts, strict certification requirements, and increasing localization mandates, which together limit the number of qualified service providers.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Airbus Helicopters | 1992 | Marignane, France | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin Sikorsky | 1923 | Stratford, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo Helicopters | 1948 | Rome, Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Bell Textron | 1935 | Fort Worth, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Saudi Arabian Military Industries Aerospace | 2017 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Military Helicopter MRO Market Analysis

Growth Drivers

Fleet modernization under Vision 2030 defense localization

Fleet renewal programs have accelerated maintenance demand as more than ~ platforms transition to advanced avionics and digital mission systems. Localization policies have driven over ~ maintenance contracts toward in-kingdom providers, creating sustained workloads for heavy overhaul and component repair facilities. Annual investments of USD ~ million in aerospace infrastructure have expanded hangar capacity and tooling depth, enabling support for ~ additional helicopters each year. These shifts are reshaping the sustainment model from reliance on overseas depots to a domestically anchored MRO ecosystem.

Rising operational tempo and readiness requirements

Operational deployments have increased flight hours beyond ~ hours annually across key helicopter units, intensifying wear on engines, transmissions, and rotor systems. This has translated into more than ~ additional shop visits each cycle and higher demand for predictive maintenance technologies. Maintenance scheduling systems now manage over ~ work orders per year, ensuring availability targets are met. The sustained tempo has elevated the strategic importance of rapid turnaround times, making MRO capacity expansion a core defense readiness priority.

Challenges

High dependence on foreign OEM certifications

More than ~ critical maintenance procedures still require foreign technical approvals, slowing turnaround times and increasing service costs by USD ~ million annually. Limited access to proprietary diagnostic software restricts local facilities from independently handling ~ high-value repairs. This dependency creates bottlenecks during peak operational periods, with aircraft awaiting certification clearance for ~ days on average. Reducing this reliance remains complex due to intellectual property constraints and strict defense export control regimes.

Skilled workforce shortages in advanced avionics and engines

The sector faces a shortfall of nearly ~ certified technicians in engine overhaul and mission system diagnostics, limiting annual service throughput by ~ helicopters. Training programs currently graduate only ~ specialists per cycle, well below operational needs. As a result, overtime costs have risen to USD ~ million annually to sustain readiness levels. This skills gap constrains the pace of localization and slows the transfer of complex maintenance capabilities to domestic providers.

Opportunities

Localization of heavy maintenance and depot-level overhaul

Establishing additional in-kingdom depots could shift over ~ major overhaul events annually from overseas facilities, retaining service revenues of USD ~ million within the domestic defense economy. New hangar complexes are projected to support ~ additional aircraft per year, improving fleet availability and reducing turnaround times by ~ days. This localization drive aligns with broader industrialization goals and positions Saudi Arabia as a regional hub for military helicopter sustainment.

Public–private partnerships for MRO infrastructure

Joint ventures between defense authorities and aerospace firms are enabling the development of ~ new maintenance centers equipped for engine testing, composite repair, and digital diagnostics. These partnerships have already mobilized investments of USD ~ million, expanding service capacity for ~ helicopter fleets. Shared-risk models accelerate technology transfer while ensuring compliance with national security standards, creating a scalable framework for long-term MRO capability growth.

Future Outlook

The KSA Military Helicopter MRO Market is set to evolve into a strategically autonomous sustainment ecosystem over the coming decade. Continued localization, digital maintenance adoption, and workforce development will strengthen in-kingdom capabilities while reducing external dependencies. As fleet modernization progresses, demand will increasingly shift toward advanced avionics support and predictive maintenance models. This trajectory positions Saudi Arabia not only to meet domestic readiness goals but also to emerge as a regional center for military helicopter lifecycle services.

Major Players

- Airbus Helicopters

- Lockheed Martin Sikorsky

- Leonardo Helicopters

- Bell Textron

- Saudi Arabian Military Industries Aerospace

- Saudi Aerospace Engineering Industries

- Alsalam Aerospace Industries

- Boeing Global Services

- Safran Helicopter Engines

- Pratt & Whitney Canada

- Rolls-Royce

- StandardAero

- AAR Corp

- Lufthansa Technik

- HAECO

Key Target Audience

- Ministry of Defense of Saudi Arabia

- General Authority for Military Industries

- Royal Saudi Air Force logistics command

- Saudi Arabian Military Industries procurement teams

- Defense-focused private MRO providers

- Aerospace component manufacturers and suppliers

- Investments and venture capital firms

- Saudi Arabian Standards Organization and related regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Assessment of fleet composition, maintenance cycles, and overhaul frequency. Mapping of in-kingdom versus overseas service dependencies. Identification of regulatory and security compliance requirements.

Step 2: Market Analysis and Construction

Compilation of service demand patterns across major helicopter platforms. Evaluation of capacity across line, base, and depot maintenance levels. Structuring of value chains from spares supply to heavy overhaul.

Step 3: Hypothesis Validation and Expert Consultation

Validation of demand drivers with defense aviation specialists. Review of workforce capability gaps and training pipelines. Cross-checking of localization impact assumptions.

Step 4: Research Synthesis and Final Output

Integration of quantitative indicators with strategic insights. Development of scenario-based outlooks for sustainment demand. Finalization of competitive and ecosystem assessments.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military helicopter MRO taxonomy across airframe engine and avionics maintenance, market sizing logic by fleet size flight hours and overhaul cycles, revenue attribution across scheduled maintenance spares and depot level services, primary interview program with defense operators MRO providers and OEMs, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Maintenance and sustainment pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and defense compliance environment

- Growth Drivers

Fleet modernization under Vision 2030 defense localization

Rising operational tempo and readiness requirements

Expansion of in-kingdom MRO capabilities

Long-term sustainment contracts with OEMs and primes

Growing adoption of predictive maintenance technologies

Increased defense budgets for lifecycle support - Challenges

High dependence on foreign OEM certifications

Skilled workforce shortages in advanced avionics and engines

Complexity of multi-OEM fleet sustainment

Supply chain risks for critical spares

Cybersecurity and data sovereignty constraints

Lengthy approval cycles for defense procurement - Opportunities

Localization of heavy maintenance and depot-level overhaul

Public–private partnerships for MRO infrastructure

Expansion of component repair and parts manufacturing

Digital transformation of fleet management systems

Regional MRO hub potential for GCC militaries

Lifecycle extension programs for legacy fleets - Trends

Shift toward performance-based logistics contracts

Rising use of HUMS and predictive analytics

Integration of additive manufacturing for spares

Increased outsourcing to in-kingdom private MROs

Greater alignment with NATO and international standards

Focus on sustainability and efficiency in maintenance operations - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Revenue per Aircraft, 2020–2025

- By Fleet Type (in Value %)

Attack helicopters

Transport helicopters

Utility helicopters

Training helicopters

Special mission helicopters - By Application (in Value %)

Line maintenance

Heavy maintenance and depot overhaul

Component repair and overhaul

Engine MRO

Avionics and mission systems support

Structural repair and modification - By Technology Architecture (in Value %)

Conventional maintenance programs

Predictive and condition-based maintenance

Digital twins and fleet analytics

Additive manufacturing for spares

Advanced diagnostics and HUMS integration - By End-Use Industry (in Value %)

Royal Saudi Air Force

Royal Saudi Land Forces Aviation Command

Royal Saudi Naval Forces Aviation

Ministry of Interior aviation units

National Guard aviation units - By Connectivity Type (in Value %)

Offline maintenance management systems

On-premise connected MRO platforms

Secure defense cloud-based MRO solutions

Hybrid connectivity environments - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (localization depth, certification portfolio, fleet coverage, turnaround time, cost competitiveness, digital MRO capability, security compliance, partnership ecosystem)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Airbus Helicopters

Boeing Global Services

Lockheed Martin Sikorsky

Leonardo Helicopters

Bell Textron

Saudi Arabian Military Industries Aerospace

Saudi Aerospace Engineering Industries

Alsalam Aerospace Industries

AAR Corp

StandardAero

HAECO

Lufthansa Technik

Safran Helicopter Engines

Pratt & Whitney Canada

Rolls-Royce

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Revenue per Aircraft, 2026–2035