Market Overview

The KSA military helicopter MRO market has experienced steady growth, driven by the increasing demand for maintaining and upgrading military helicopter fleets to enhance operational readiness and extend their service life. The market size is projected to reach USD ~ billion, with demand primarily influenced by the need for specialized maintenance, repairs, and overhaul services. The market is expected to continue growing due to the rising geopolitical tensions and military modernization efforts, which further emphasize the importance of maintaining advanced aviation capabilities in Saudi Arabia’s defense forces.

Saudi Arabia, being the largest and most influential market in the region, drives the demand for military helicopter MRO services. The Kingdom’s strategic location, combined with its robust defense budget, makes it a hub for military operations and defense procurement. With continuous investments in upgrading military infrastructure and a focus on enhancing defense capabilities, Saudi Arabia has become a leader in military aviation in the Middle East, thereby driving the MRO market for military helicopters.

Market Segmentation

By Product Type

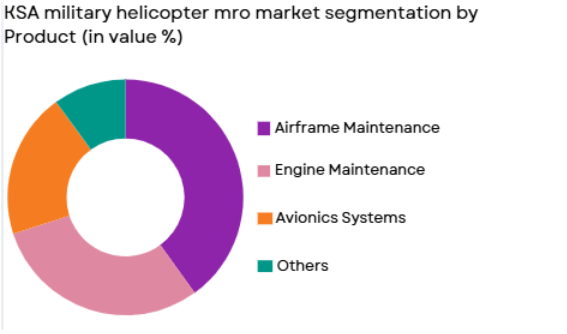

The KSA military helicopter MRO market is segmented by product type into airframe maintenance, engine maintenance, and avionics systems. The airframe maintenance sub-segment currently holds a dominant market share due to the increasing demand for structural repairs and the prolonged operational use of military helicopters. Airframe components require consistent attention to ensure safety and performance, making this sub-segment the primary area of focus. This demand is particularly driven by the need to extend the lifespan of helicopters in service, reducing overall fleet replacement costs.

By Platform Type

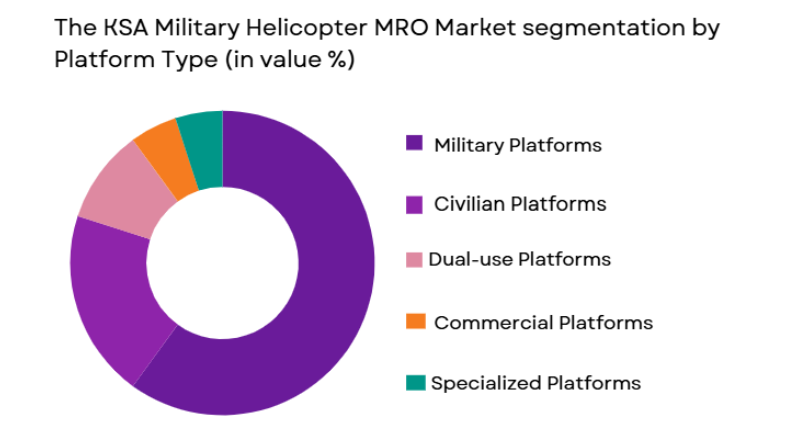

The KSA military helicopter MRO market is segmented by platform type into attack helicopters, transport helicopters, and utility helicopters. The attack helicopter sub-segment has the largest market share, as these helicopters require advanced maintenance and frequent upgrades to ensure they meet the operational standards for combat missions. Saudi Arabia’s substantial investment in defense and military modernization, particularly in attack helicopters, drives this demand. Attack helicopters are critical for border security, counterterrorism, and regional military operations, which necessitate regular MRO services to maintain operational readiness.

Competitive Landscape

The KSA military helicopter MRO market is highly competitive, with several global players consolidating their positions through strategic partnerships, acquisitions, and technology advancements. Major players dominate the market by offering a broad range of services, including routine maintenance, upgrades, and specialized repairs for advanced military helicopters. The presence of these companies in the region further strengthens the competition as they aim to meet the growing demand from Saudi Arabia’s defense sector. The continuous modernization of the country’s military capabilities also drives the expansion of the MRO sector, providing ample opportunities for industry players to increase their share.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD Billion) | Additional Parameter |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 2000 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| Bell Helicopter | 1935 | Fort Worth, USA | ~ | ~ | ~ | ~ | ~ |

KSA Military Helicopter MRO Market Analysis

Growth Drivers

Geopolitical Instability

Geopolitical instability in the Middle East, particularly along Saudi Arabia’s borders, has been a significant growth driver for the KSA military helicopter MRO market. The region has faced rising tensions and threats from both state and non-state actors, which has prompted Saudi Arabia to maintain a high level of military readiness, including keeping its helicopter fleet operational. The strategic importance of helicopters, especially in combat and surveillance operations, drives the demand for MRO services, ensuring that these machines are kept in top condition to respond quickly to any emerging security challenges. Additionally, Saudi Arabia’s defense spending has been increasing, which further accelerates the procurement and upkeep of military helicopters, ensuring sustained growth for the MRO market. As the security environment in the region remains volatile, there is a continual need for advanced helicopter MRO services to support the Kingdom’s defense operations. This ongoing geopolitical instability, combined with the importance of maintaining a modern and capable helicopter fleet, will continue to fuel demand for MRO services in the region over the coming years.

Technological Advancements in Helicopter Systems

Technological advancements in helicopter systems have also played a crucial role in driving the growth of the KSA military helicopter MRO market. As helicopters evolve to include more sophisticated avionics, communication systems, propulsion units, and weapons systems, the need for specialized maintenance and repair services has increased significantly. Newer models of military helicopters are equipped with cutting-edge technology that requires precise calibration, diagnostics, and frequent upgrades to maintain optimal performance. This trend has created a substantial opportunity for the MRO market, as more advanced tools and expertise are required to service these complex systems. Saudi Arabia’s investment in the latest military technology, including the procurement of new and more advanced helicopters, ensures that there will be a continuous demand for specialized MRO services to maintain these high-tech assets. As these technologies become more prevalent, the MRO market will need to adapt to meet the growing demand for such advanced maintenance services, contributing to the market’s expansion.

Market Challenges

High Maintenance Costs

One of the most significant challenges in the KSA military helicopter MRO market is the high cost associated with maintaining advanced military helicopters. These helicopters are equipped with state-of-the-art systems that require specialized care and expertise to keep them operational. The complexity of these systems increases the cost of labor, spare parts, and maintenance procedures. Moreover, the need for highly trained technicians and specialized equipment adds another layer of expense. While Saudi Arabia has prioritized military readiness and helicopter fleet management, the high costs associated with maintaining these assets can pose a challenge to ensuring that every helicopter receives the necessary upkeep. Despite efforts to streamline maintenance processes, the inherent complexity of modern military helicopters, coupled with rising inflation and the increasing cost of materials, makes helicopter MRO services a costly endeavor. This financial burden, coupled with budget constraints, can limit the frequency and scope of helicopter maintenance and potentially impact operational efficiency.

Supply Chain Constraints

Another challenge affecting the KSA military helicopter MRO market is supply chain constraints, particularly in the procurement of spare parts and specialized components. Helicopters require a steady supply of parts that are often highly specialized and sourced from international suppliers. Disruptions in the global supply chain, such as delays in shipping, production shortages, or logistical challenges, can lead to significant delays in maintenance schedules. Additionally, geopolitical tensions, trade restrictions, and embargoes can further complicate the supply chain, making it harder to obtain the required components. These delays not only increase maintenance costs but also extend downtime for critical helicopter assets, potentially impacting Saudi Arabia’s ability to maintain full operational readiness. The reliance on foreign suppliers for critical helicopter components, coupled with potential disruptions in global trade, continues to pose a risk to the efficiency of the MRO market. To mitigate these challenges, local manufacturing capabilities and supply chain diversification strategies may become essential in ensuring the sustainability of the MRO market.

Opportunities

Expansion of Helicopter Fleets

The expansion of Saudi Arabia’s military helicopter fleet presents a significant opportunity for the MRO market. As the Kingdom seeks to modernize and enhance its defense capabilities, the procurement of new helicopters, particularly attack and transport helicopters, will increase. This expansion will require a corresponding increase in MRO services to ensure the helicopters are kept in operational condition throughout their service lives. Additionally, as Saudi Arabia diversifies its fleet to include advanced and specialized helicopters, the complexity of maintenance services will also rise, creating a demand for more sophisticated MRO solutions. The growth of the fleet will necessitate both routine and emergency maintenance, providing a sustained demand for MRO service providers in the region. Moreover, the establishment of local maintenance hubs and regional partnerships to support this growing fleet will further bolster the MRO market. With an expanded helicopter fleet, the Kingdom will need more comprehensive and frequent MRO services, which presents a lucrative opportunity for companies in this sector to expand their offerings and solidify their market presence.

Technological Integration in MRO Services

Technological advancements within the MRO services sector present a unique opportunity for growth in the KSA military helicopter MRO market. The integration of predictive maintenance technologies, such as AI-powered diagnostic tools and data analytics platforms, is expected to revolutionize the way maintenance services are conducted. These technologies enable service providers to predict potential failures before they occur, reducing unplanned downtime and improving fleet management. Additionally, augmented reality (AR) and virtual reality (VR) are increasingly being used to enhance repair and training procedures, allowing technicians to visualize complex systems and diagnose issues more effectively. By adopting these advanced technologies, MRO providers can reduce costs, streamline operations, and improve service quality, leading to more efficient and cost-effective helicopter maintenance. Saudi Arabia’s push toward modernizing its defense infrastructure presents an ideal environment for the adoption of these technologies, creating an opportunity for MRO service providers to implement innovative solutions that will meet the future needs of the Kingdom’s military helicopter fleet. As these technologies become more integrated into maintenance practices, the demand for specialized MRO services is expected to rise, further boosting market growth.

Future Outlook

The future outlook for the KSA military helicopter MRO market appears positive, driven by the country’s strategic defense priorities and the ongoing need to maintain and upgrade military helicopter fleets. The market is expected to grow steadily, with continued investments in military infrastructure and modernization initiatives. Technological advancements in MRO tools and systems will improve the efficiency and quality of services, while demand for advanced helicopter MRO services will continue to rise. Regulatory support and the emphasis on operational readiness will further sustain the growth of the market, with opportunities for both domestic and international players to expand their presence in Saudi Arabia’s defense sector.

Major Players

- Lockheed Martin

- Boeing

- Raytheon Technologies

- Airbus Helicopters

- Bell Helicopter

- Leonardo

- Sikorsky

- Northrop Grumman

- General Electric

- Thales Group

- Rolls-Royce

- DynCorp International

- Saab AB

- Textron Aviation

- Collins Aerospace

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military and government procurement agencies

- Military logistics companies

- Aviation manufacturers

- MRO service providers

- Aerospace technology developers

Research Methodology

Step 1: Identification of Key Variables

The first step in the research methodology involves identifying the key variables that influence the KSA military helicopter MRO market. This includes understanding the market drivers, challenges, and factors influencing growth, such as technological advancements and government regulations.

Step 2: Market Analysis and Construction

Next, a detailed market analysis is conducted, which includes the examination of historical trends, current market conditions, and future projections. Data from reliable sources is gathered to construct a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

To validate hypotheses and assumptions, consultations with industry experts, stakeholders, and market analysts are conducted. This ensures that the market insights are accurate and grounded in real-world data.

Step 4: Research Synthesis and Final Output

Finally, all collected data, insights, and expert opinions are synthesized into the final market report, providing a comprehensive analysis of the KSA military helicopter MRO market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in defense budgets across the region

Advancements in helicopter technologies

Demand for modernization and upgrades

Strategic military alliances with global defense contractors

Focus on reducing operational costs and extending service life - Market Challenges

High cost of helicopter MRO services

Complexity of maintaining cutting-edge technologies

Fluctuations in government defense spending

Regional geopolitical tensions affecting defense investments

Logistical challenges in remote operational areas - Market Opportunities

Expansion of MRO capabilities for international markets

Growing demand for dual-use helicopters

Government incentives for local defense industry development - Trends

Increased use of digital technologies for predictive maintenance

Growth in public-private partnerships for defense MRO

Technological advancements in engine and rotor system maintenance

Integration of AI and machine learning for fault detection

Sustainability initiatives in MRO services - Government Regulations & Defense Policy

Stringent safety regulations for military aircraft

Policy changes driving investment in advanced helicopter technologies

Encouragement for local defense industry capabilities - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Rotary-Wing Helicopters

Light Utility Helicopters

Attack Helicopters

Transport Helicopters

Reconnaissance Helicopters - By Platform Type (In Value%)

Military Platforms

Commercial Platforms

Dual-use Platforms

Civilian Platforms

Specialized Platforms - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Upgraded Systems

Refurbished Systems

Custom-fit Systems - By EndUser Segment (In Value%)

Military Organizations

Private Sector Operators

Government Agencies

Defense Contractors

OEMs - By Procurement Channel (In Value%)

Direct Procurement

Government Auctions

Third-Party Procurement

Strategic Partnerships

Long-term Contracts - By Material / Technology (In Value%)

Composite Materials

Titanium Alloys

Advanced Propulsion Systems

Robust Control Systems

Aerodynamic Enhancements

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Cost-effectiveness, Technological expertise, Service speed, Global reach, Customer support, Contract flexibility, MRO service innovation, Fleet diversity, Industry partnerships, Regulatory compliance)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Boeing

Airbus

Leonardo

Sikorsky

Bell Helicopter

General Electric

Honeywell Aerospace

Rolls-Royce

Northrop Grumman

SAAB

Kawasaki Heavy Industries

Turbomeca

MTU Aero Engines

Safran Helicopter Engines

- Rising demand from the Saudi Arabian Ministry of Defense

- Increased focus on fleet readiness and efficiency

- Incorporation of advanced materials for maintenance

- Growing preference for aftermarket and service contract solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035