Market Overview

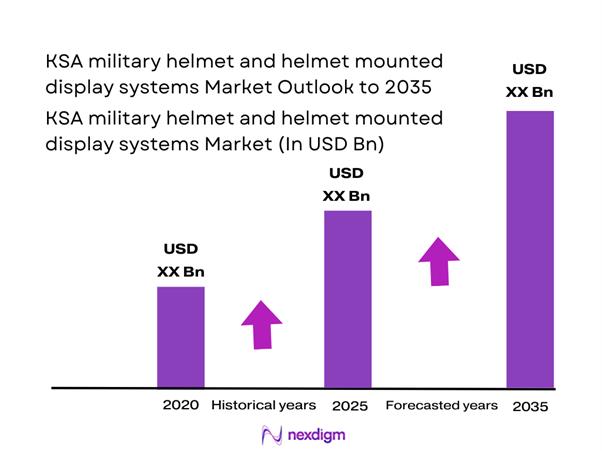

The KSA military helmet and helmet mounted display systems Market market current size stands at around USD ~ million, reflecting steady expansion driven by modernization programs and elevated operational readiness requirements. Over the most recent reporting periods, market value advanced from approximately USD ~ million to nearly USD ~ million, supported by rising procurement of advanced pilot and infantry headborne systems. Annual deployment volumes reached close to ~ units, while active system counts exceeded ~ systems across air and land forces. Ongoing platform upgrades continue to sustain demand momentum.

Saudi Arabia’s market leadership is concentrated in Riyadh, Dhahran, and Jeddah, where defense procurement agencies, air bases, and integration centers are clustered. These hubs benefit from advanced military infrastructure, high operational tempo, and proximity to prime contractors and system integrators. The presence of specialized training facilities and testing ranges further strengthens ecosystem maturity. A supportive policy environment emphasizing defense localization and technology transfer has accelerated adoption, positioning these regions as the core demand and innovation centers.

Market Segmentation

By Application

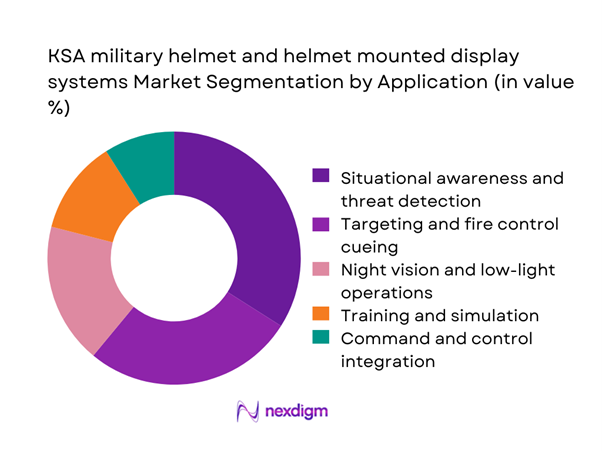

Situational awareness and targeting applications dominate this market as armed forces increasingly prioritize real-time battlefield intelligence and pilot survivability. Helmet mounted displays integrated with sensors, night vision, and weapon cueing systems are becoming standard across fighter, rotary wing, and special operations units. The dominance of this segment is reinforced by ongoing upgrades of legacy platforms and the need to improve mission effectiveness in complex operational theaters. Training and simulation use cases are also expanding, but combat-centric applications remain the primary growth engine due to their direct impact on operational outcomes and force readiness.

By End-Use Industry

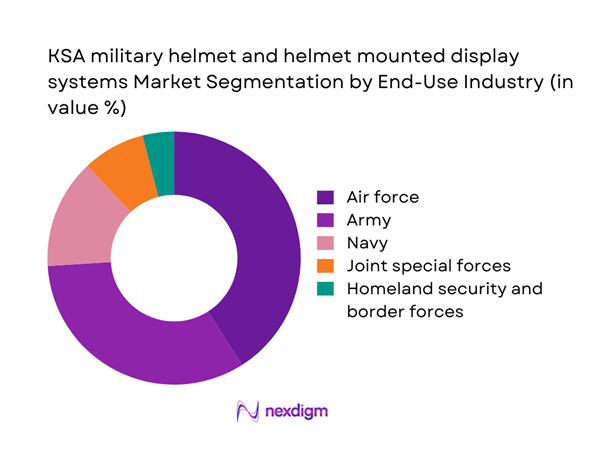

The air force segment leads market demand due to the extensive deployment of helmet mounted display systems in fighter and rotary wing fleets. Advanced aviation helmets with integrated cueing and augmented overlays are critical for modern air combat, driving higher per-unit value and faster replacement cycles. The army follows closely, particularly within special operations and mechanized units that require enhanced situational awareness. Naval aviation and homeland security forces represent emerging demand pockets as maritime surveillance and border protection missions increasingly rely on wearable digital systems for operational efficiency.

Competitive Landscape

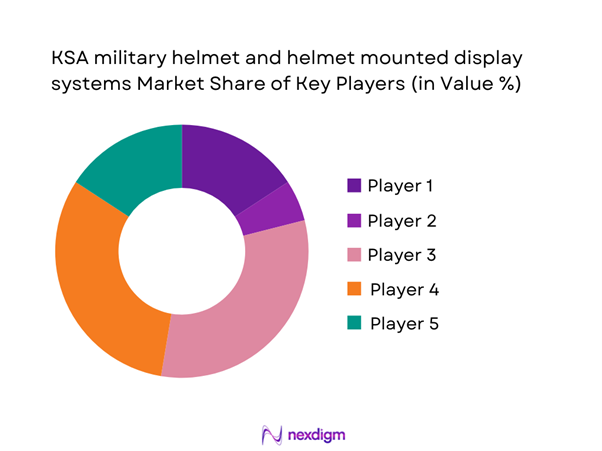

The market is moderately concentrated, with a limited number of global defense electronics firms dominating high-end helmet and display technologies. Competitive intensity is shaped by long-term defense contracts, platform-specific certifications, and localization partnerships that influence vendor positioning within Saudi Arabia’s procurement ecosystem.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Gentex Corporation | 1894 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Advanced Electronics Company | 1988 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

KSA military helmet and helmet mounted display systems Market Analysis

Growth Drivers

Modernization of Saudi armed forces under Vision 2030 defense localization strategy

Defense modernization programs have accelerated procurement cycles, with annual allocations for soldier systems and avionics upgrades reaching USD ~ million in recent budget cycles. Over the last few years, more than ~ platforms underwent mid-life upgrades that required advanced helmet and display integrations. Localization initiatives supported the establishment of ~ facilities focused on assembly and lifecycle support, increasing domestic system availability. These efforts have driven deployment volumes beyond ~ units annually, reinforcing sustained demand for technologically advanced headborne systems across air and land forces.

Rising investments in pilot survivability and mission effectiveness systems

Operational readiness priorities have led to sustained spending of nearly USD ~ million on pilot survivability technologies, including helmet mounted displays and integrated cueing systems. Recent fleet enhancement programs covered over ~ aircraft, each requiring ~ systems for primary and backup aircrew. Training squadrons alone absorbed close to ~ units to support advanced simulation and live-fly integration. These investments directly correlate with higher mission effectiveness metrics and reduced operational risk, positioning survivability-focused helmet systems as a core procurement category.

Challenges

High unit cost of advanced helmet mounted display technologies

Advanced helmet systems incorporating augmented overlays and sensor fusion often carry acquisition values approaching USD ~ million per program batch, limiting large-scale rollouts. In recent procurement cycles, fewer than ~ units were acquired annually for frontline squadrons due to budget trade-offs with higher-priority platforms. Lifecycle support contracts also represent recurring expenditures of nearly USD ~ million, constraining expansion into secondary units. These cost pressures slow penetration rates, particularly within training and reserve formations.

Dependence on foreign suppliers for critical optics and avionics components

Despite localization efforts, over ~ components within advanced helmet and display systems remain sourced from overseas suppliers. Annual import values for optical modules and micro-displays exceed USD ~ million, exposing procurement schedules to geopolitical and logistics risks. Delays affecting as many as ~ deliveries in recent periods highlighted vulnerabilities in supply continuity. This dependence challenges rapid scaling of domestic production and complicates long-term sustainment planning for mission-critical equipment.

Opportunities

Local manufacturing and MRO partnerships under Saudi localization mandates

Localization mandates have opened pathways for establishing ~ assembly and maintenance centers dedicated to helmet and display systems. Initial investment commitments surpass USD ~ million, enabling domestic production capacity of approximately ~ units per year. These partnerships reduce lead times, enhance system availability, and strengthen sovereign capability. As local content thresholds rise, suppliers with in-country manufacturing footprints are positioned to capture a growing share of defense procurement aligned with national industrialization objectives.

Upgrading legacy fleets with retrofit HMD solutions

A significant portion of operational aircraft and armored platforms still rely on analog or early-generation helmet systems, representing an upgrade base of over ~ platforms. Retrofit programs valued near USD ~ million are enabling incremental modernization without full platform replacement. Recent pilot projects covered ~ units, demonstrating measurable gains in situational awareness and mission efficiency. This upgrade-driven demand offers a scalable pathway for expanding market penetration across both frontline and support units.

Future Outlook

Looking ahead to the period through 2035, the KSA military helmet and helmet mounted display systems Market is set to benefit from sustained defense modernization and deeper localization of advanced soldier technologies. Continued integration of digital warfare concepts, combined with rising emphasis on pilot and infantry survivability, will keep demand resilient. Strategic partnerships and in-country manufacturing are expected to reshape competitive dynamics while strengthening supply security. Overall, the market trajectory remains firmly aligned with long-term national defense and industrial development goals.

Major Players

- Gentex Corporation

- Thales Group

- Elbit Systems

- Collins Aerospace

- BAE Systems

- Leonardo

- Safran Electronics and Defense

- L3Harris Technologies

- Rheinmetall Defence

- Hensoldt

- Saab

- Teledyne FLIR

- ASELSAN

- Advanced Electronics Company

- Saudi Arabian Military Industries

Key Target Audience

- Ministry of Defense of Saudi Arabia

- Saudi Arabian Military Industries procurement divisions

- Royal Saudi Air Force acquisition units

- Royal Saudi Land Forces modernization teams

- General Authority for Military Industries

- Public Investment Fund defense and aerospace investment arm

- Regional defense-focused private equity and venture capital firms

- Homeland security and border forces technology procurement agencies

Research Methodology

Step 1: Identification of Key Variables

Assessment of operational requirements, platform compatibility, and technology adoption trends across air and land forces. Mapping of procurement cycles, localization mandates, and sustainment needs influencing demand. Compilation of system categories and application priorities shaping market scope.

Step 2: Market Analysis and Construction

Evaluation of historical procurement patterns and deployment trends to construct baseline demand. Analysis of modernization programs and fleet upgrade pipelines impacting near-term volumes. Development of market sizing logic aligned with defense budget structures.

Step 3: Hypothesis Validation and Expert Consultation

Validation of demand drivers and constraints through consultations with defense program managers and system integrators. Refinement of assumptions on localization impact and technology transition timelines. Cross-checking of deployment and upgrade estimates with operational planners.

Step 4: Research Synthesis and Final Output

Integration of quantitative insights with strategic context on national defense priorities. Structuring of competitive and segmentation analysis to reflect procurement realities. Final consolidation into a consulting-grade narrative supporting decision-making.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military helmet and HMD system taxonomy across pilot and ground soldier applications, market sizing logic by force modernization programs and unit deployment, revenue attribution across equipment upgrades spares and support services, primary interview program with defense operators OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational usage pathways

- Ecosystem structure

- Supply chain and integration architecture

- Regulatory and military standards environment

- Growth Drivers

Modernization of Saudi armed forces under Vision 2030 defense localization strategy

Rising investments in pilot survivability and mission effectiveness systems

Expansion of special operations and counter-terror capabilities

Increasing adoption of network-centric warfare concepts

Demand for advanced situational awareness in asymmetric warfare environments

Lifecycle replacement of legacy helmets and analog HMD platforms - Challenges

High unit cost of advanced helmet mounted display technologies

Dependence on foreign suppliers for critical optics and avionics components

Integration complexity with diverse aircraft and weapon platforms

Stringent military certification and testing timelines

Budget prioritization toward platforms over soldier systems

Cybersecurity and data integrity risks in connected helmet systems - Opportunities

Local manufacturing and MRO partnerships under Saudi localization mandates

Upgrading legacy fleets with retrofit HMD solutions

Growing requirement for training and simulation helmets

Development of lightweight composite and modular helmet designs

Integration of AI-based threat cueing and decision support

Expansion into export programs through joint ventures - Trends

Shift toward fully digital helmet mounted display ecosystems

Increasing use of augmented reality overlays in combat aviation

Miniaturization of sensors and power systems

Adoption of modular open system architectures

Emphasis on soldier-worn networked systems

Rising role of predictive maintenance and health monitoring - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land forces infantry and special operations units

Air force fast jet pilots

Rotary wing aircrew

Naval aviation crews

Unmanned systems operators - By Application (in Value %)

Situational awareness and threat detection

Targeting and fire control cueing

Night vision and low-light operations

Training and simulation

Command and control integration - By Technology Architecture (in Value %)

Standalone ballistic helmets

Helmet integrated night vision systems

Helmet mounted display systems

Augmented reality enabled helmets

Sensor fused smart helmets - By End-Use Industry (in Value %)

Army

Air force

Navy

Joint special forces

Homeland security and border forces - By Connectivity Type (in Value %)

Wired systems

Wireless RF linked systems

Encrypted tactical data link systems

Hybrid connectivity systems - By Region (in Value %)

Central Region

Western Region

Eastern Region

Northern Region

Southern Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio depth, technology integration capability, platform compatibility, local manufacturing presence, lifecycle support strength, pricing competitiveness, defense offset participation, cybersecurity compliance)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Gentex Corporation

Thales Group

Elbit Systems

Collins Aerospace

BAE Systems

Leonardo

Safran Electronics and Defense

L3Harris Technologies

Rheinmetall Defence

Hensoldt

Saab

Teledyne FLIR

ASELSAN

Advanced Electronics Company

Saudi Arabian Military Industries

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems Installed Base, 2026–2035

- By Average Selling Price, 2026–2035