Market Overview

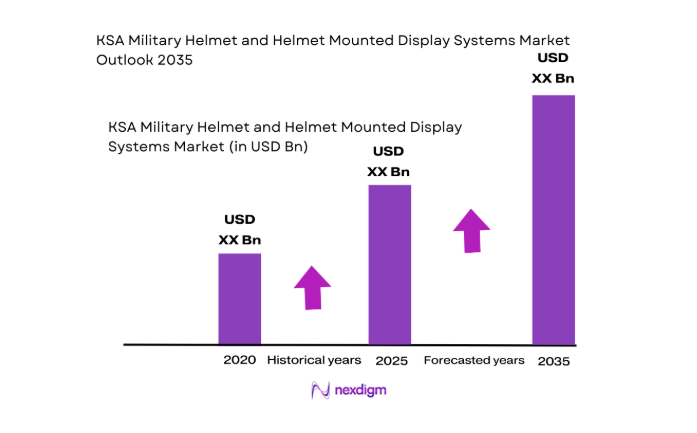

The KSA military helmet and helmet mounted display systems market is valued at approximately USD ~ in 2025, based on structured historical industry data from global market forecasts. This value reflects the combined revenue from advanced ballistic helmets and helmet mounted display systems integrated into modern soldier and aviation platforms. The size is driven by increasing modernization efforts across the Saudi Ministry of Defense, with procurement focused on digital battlefield situational awareness technology and upgraded force protection equipment.

Dominance in this market is influenced by defense expenditure and strategic operational requirements. Countries like the United States, United Kingdom, Israel, and Germany lead due to their extensive defense budgets, advanced aerospace industries, and long-established defense technology ecosystems. In the Middle East, Saudi Arabia and the UAE command regional focus because of geopolitical imperatives and ongoing modernization of ground and aviation forces. These nations leverage partnerships with global OEMs to integrate new helmet-based communication and display technologies for enhanced soldier effectiveness.

Market Segmentation

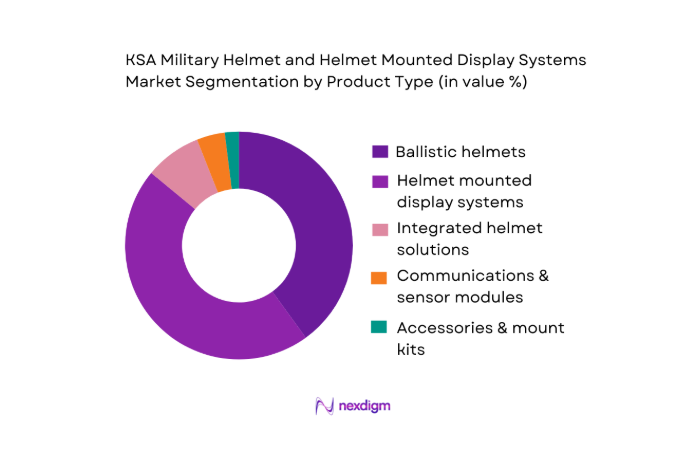

By Product Type

Within the product type segment, helmet mounted display systems account for the largest share of value in 2024. This dominance is due to their strategic role in improving soldier situational awareness, target identification, and communication integration across ground and air platforms. The rapid adoption of AR/augmented reality-enabled HMDs within advanced defense procurements, especially for aviation and special operations, has significantly increased their relative value contribution compared to traditional ballistic helmets. The vertical integration of HMDs with radios and sensor networks continues to drive procurement decisions, making this sub-segment the most valuable in the combined market.

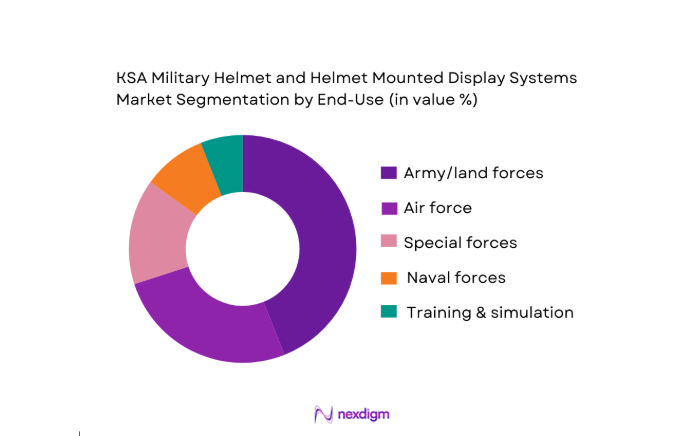

By End-Use

In the end-use segment, army/land forces dominate due to large deployment sizes and ongoing modernization programs. Army units require robust helmet systems that combine ballistic protection with integrated communication and display capabilities for dismounted operations. The frequency of replacements and upgrades, coupled with large unit sizes compared to smaller aviation or naval units, results in higher total procurement value. Programs such as digital soldier modernization and C4I (command, control, communication, computer and intelligence) integration further cement this segment’s dominance.

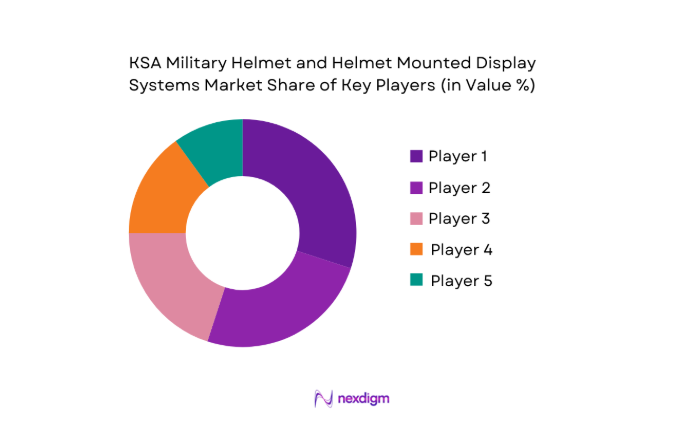

Competitive Landscape

The competitive environment in the military helmet and helmet mounted display systems market includes established global defense OEMs and specialized technology suppliers. The following overview provides insight into the major players shaping this market today.

The competitive landscape is characterized by a mix of large aerospace and defense conglomerates alongside specialized headborne system suppliers. This consolidation reflects high barriers to entry, strong IP portfolios, and long-term government contracts. Most major defense procurement programs involve prime contractors coordinating with sub-component specialists to deliver integrated helmet systems that meet stringent ballistic, avionics, and situational awareness performance standards.

| Company | Establishment Year | Headquarters | HMD Technology Portfolio | Ballistic Helmet Solutions | Army Integration Expertise | Aviation Helmet Programs | Global After-Sales Support |

| SAAB AB | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems Ltd. | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| BAE Systems plc | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

KSA military helmet and helmet mounted display systems Market Analysis

Growth Drivers

Modernization of soldier systems and battlefield digitization programs in KSA

Saudi Arabia’s push to digitize frontline operations is reinforced by a macro backdrop that sustains large-scale, multi-year modernization spending. The World Bank reports Saudi Arabia’s economy at USD ~ with GDP per capita of USD ~, supporting continued funding capacity for mission systems, personal protection, and networked soldier kits that increasingly require helmet-integrated mounts, power, and data interfaces. At the fiscal level, the Ministry of Finance projects total government expenditures of SAR ~ and public debt of SAR 1,300 billion for the budget year, reflecting an active spending posture where defense modernization typically competes strongly for allocations. Digitization also tracks broader state investment momentum: the same budget statement reports net FDI inflows of SAR ~ (H1) and 9,695 investment licenses granted through Q3—both of which expand the local ecosystem of electronics, integration, and advanced manufacturing partners relevant to helmet subcomponents (rails, comms cabling, rugged connectors, optical modules).

Investments in aviation readiness driving demand for advanced cueing and helmet display suites

Aviation readiness programs are a direct demand engine for high-end helmet mounted display and cueing suites because tactical aircraft and rotary platforms increasingly rely on head-tracked targeting and symbology to exploit sensors, guided munitions, and networked mission data. Macro conditions in Saudi Arabia remain supportive of sustained readiness investment: the World Bank reports USD ~ GDP (current) and USD ~ GDP per capita, providing a scale economy that can maintain complex sustainment and upgrade pipelines for flight equipment. Government financing capacity is further reflected in the Ministry of Finance’s projection of SAR ~ total expenditures for the budget year and reported SAMA government reserves of SAR ~ (bn SAR figures presented in the statement), which helps defend long-cycle programs that include flight helmet upgrades, spares, and depot-level support requirements. Financial system liquidity and procurement execution also matter for availability of supplier credit and contract performance: the same official budget statement reports total bank assets of SAR ~ (end of September) and bank credit growth of ~ (annual growth, end of September), creating a supportive environment for local integrators, licensed defense manufacturers, and tier-2 electronics suppliers that participate in helmet/HMD sustainment ecosystems.

Market Challenges

High certification and airworthiness qualification requirements for aviation helmet systems

Aviation helmet and HMD systems must clear demanding airworthiness and safety qualification pathways because the helmet becomes part of the flight critical ecosystem—interacting with life support, ejection survivability, cockpit lighting, and mission systems. That burden sits within a macro context where Saudi Arabia is funding broad public priorities: the government projects SAR ~ in total expenditures for the budget year and expects public debt of SAR ~, which can raise scrutiny on procurement timelines and compliance costs for specialized aviation equipment programs. Macro stability helps, but it doesn’t remove certification friction: the IMF lists consumer prices at 2.0 (projected) and real GDP change at 4.0 (projected), conditions that support long-cycle planning yet still require programs to absorb the time and documentation intensity of testing and qualification. On the industrial side, certification complexity expands the supplier set that must be validated (optics, microdisplay vendors, tracking sensors, helmet shells, cabling), increasing the workload of configuration control and traceability. Government-published data indicate 9,695 investment licenses were granted through Q3, reflecting ecosystem growth—but also implying a larger pool of vendors requiring vetting when they participate in defense and aerospace supply chains.

Integration complexity across radios, NVGs, sensors, and multiple legacy platforms

Helmet ecosystems increasingly need to interface with tactical radios, hearing protection, NVGs, weapon sights, ISR data links, and platform-specific mission computers—often across multiple legacy inventories with different connectors, power standards, and mounting geometries. This challenge is amplified in environments where procurement and sustainment must run continuously: the Ministry of Finance reports total bank assets of SAR ~ and bank credit growth of~ (annual, end of September), macro-financial conditions that enable ongoing procurement but also accelerate “fielding velocity,” making integration issues surface faster and at larger scale. From a macro anchor, the World Bank reports GDP of USD 1.24 trillion and GDP growth of 2.0, indicating an economy that can support modernization but also one where multiple competing investment priorities raise the bar for interoperability and standardization to avoid rework.

Opportunities

Localization of assembly and MRO under KSA local content and defense industrialization agendas

Localization is a practical growth opportunity for the helmet and HMD ecosystem because it reduces downtime, improves spares availability, and builds in-country competence for calibration, repair, and configuration control—especially for high-tempo units. Current fiscal and investment signals support that trajectory: the Ministry of Finance projects SAR ~ in total expenditures for the budget year and reports 9,695 investment licenses issued through Q3, indicating ongoing policy-driven industrial expansion that can be harnessed for defense electronics, composites, and precision assembly relevant to helmet subsystems. Macro anchors also favor industrial deepening: the World Bank reports USD ~ GDP and USD ~ GDP per capita, which underpins the domestic market scale needed to justify local lines for assembly, refurbishment, and test benches (battery packs, harnesses, mounts, visor mechanisms, and selected optics handling).

Upgrades for legacy fighter and rotary-wing fleets with next-generation cueing and symbology

Upgrade activity—rather than platform replacement—creates a durable opportunity because it pulls recurring demand for helmet cueing, tracking updates, display replacements, and integration kits as mission systems evolve. Current conditions show Saudi Arabia has the macro and operational runway to pursue these refresh cycles: the IMF projects real GDP change of 4.0 and consumer prices of 2.0, suggesting a stable planning environment for multi-year readiness initiatives that typically include avionics and pilot equipment improvements. Fiscal capacity is also visible in the government’s budget framework: the Ministry of Finance projects SAR ~ in total expenditures and reports government reserves at SAMA of SAR ~, which supports continuity for sustainment-heavy lines such as flight equipment spares, depot tooling, and upgrade integration activities. The same official publication reports SAR 21.2 billion net FDI inflows (H1) and a SAR ~ trade balance surplus over the cited period—both of which support the ecosystem required for complex upgrades, including access to imported subcomponents and the ability to structure local industrial participation through partnerships and licensed entities.

Future Outlook

Over the next decade (2026–2035), the KSA military helmet and helmet mounted display systems market is expected to grow steadily at approximately ~ CAGR, driven by continuous defense modernization, increased focus on enhanced soldier situational awareness, and integration of augmented reality within tactical systems. Partnerships with global OEMs for technology transfer and co-development will further strengthen local production and support capabilities. Advancements in lightweight composite materials and low-latency display technology will also accelerate adoption across land and air platforms, ensuring sustained market expansion throughout the forecast period.

Major Players

- Gentex Corporation

- Elbit Systems Ltd.

- Thales Group

- BAE Systems plc

- Honeywell Aerospace

- Rheinmetall AG

- Hensoldt AG

- Collins Aerospace

- L3Harris Technologies

- MSA Safety Incorporated

- Ceradyne Inc.

- Revision Military

- MKU Limited

- Leonardo S.p.A.

- Northrop Grumman

Key Target Audience

- Military procurement decision makers

- Defense equipment system integrators

- Global defense OEM program managers

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense technology suppliers and component manufacturers

- Aviation and airborne systems acquisition teams

- Special operations equipment planners

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a detailed ecosystem map of helmet and helmet mounted display systems, identifying factors influencing market dynamics such as procurement cycles, technology trends, and regional defense spending. This step uses extensive secondary research from credible industry databases and open-source defense reports.

Step 2: Market Analysis and Construction

Historical data from credible market research (including 2023 and 2024 figures) are compiled to analyze trends in revenue, unit adoption, and segment-specific growth. Price trends and unit shipment analyses support accurate revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through industry expert interviews with defense procurement specialists, OEM product managers, and system integrators, followed by cross-verification with primary research findings.

Step 4: Research Synthesis and Final Output

Final output synthesizes all data using bottom-up and top-down analytical models, ensuring accuracy in forecast projections and validating segment performance through comparison with external benchmarks from major industry sources.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Definition and Scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Modernization of soldier systems and battlefield digitization programs in KSA

Rising operational focus on night operations, ISR integration, and rapid target acquisition

Investments in aviation readiness driving demand for advanced cueing and helmet display suites - Market Challenges

High certification and airworthiness qualification requirements for aviation helmet systems

Integration complexity across radios, NVGs, sensors, and multiple legacy platforms

Supply chain constraints for optics, microdisplays, and ballistic materials under export controls - Opportunities

Localization of assembly and MRO under KSA local content and defense industrialization agendas

Upgrades for legacy fighter and rotary-wing fleets with next-generation cueing and symbology

Demand for lighter ballistic protection and modular mounts tailored to desert operational conditions - Trends

Shift toward modular helmet ecosystems with universal mounts, rails, and plug-and-play electronics

Growing adoption of augmented reality symbology and improved low-light sensor fusion for HMDs - Government Regulations

- SWOT Analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value%)

Ballistic combat helmets

Aviation flight helmets with integrated HMD

Helmet mounted display modules and optics

Helmet mounted cueing and tracking units

Power and interface units for helmet systems - By Platform Type (In Value%)

Land forces dismounted infantry

Armored and mechanized vehicle crews

Rotary-wing aviation

Fixed-wing fighter and trainer aircraft

Special operations units - By Fitment Type (In Value%)

New-build integrated helmet + HMD suites

Retrofit HMD kits for legacy helmets

Modular rail and shroud mounted accessories

Clip-on visor and monocular display fitments

Custom-fit helmet shells and liner systems - By EndUser Segment (In Value%)

Ministry of Defense ground forces

Royal Saudi Air Force

Royal Saudi Naval Forces and coastal units

National Guard tactical units

Interior security and counter-terror units - By Procurement Channel (In Value%)

Direct government-to-OEM contracting

Prime contractor system integration awards

Defense offset and local content partnerships

- Market Share Analysis

- Cross Comparison Parameters (Local content capability, Integration with NVG and comms, Ballistic protection level and weight, Display resolution and brightness, Tracking latency and accuracy, Lifecycle support and MRO presence)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Key Players

Gentex Corporation

Elbit Systems Ltd.

Thales Group

BAE Systems plc

Safran Electronics & Defense

Rheinmetall AG

Hensoldt AG

Collins Aerospace

Honeywell Aerospace

L3Harris Technologies

MSA Safety Incorporated

Ceradyne Inc.

Revision Military

MKU Limited

TECNOBIT Group

- Preference for interoperable helmet interfaces supporting NVG, comms, and C2 digital enablers

- Higher emphasis on aviation-grade reliability, weight balance, and crew comfort for long sorties

- Procurement evaluation increasingly weighted toward local content, training, and lifecycle support

- Specialized requirements for SOF including low-profile configurations and rapid reconfiguration kits

- By Market Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035