Market Overview

The KSA Military Lighting Market market current size stands at around USD ~ million, reflecting steady procurement across air, land, and naval defense platforms. In the latest assessment cycles, defense lighting programs recorded allocations of nearly USD ~ million in the most recent fiscal year, with system deployments reaching ~ systems across operational bases and fleets. Recent modernization phases have also driven replacement demand of ~ units for cockpit, deck, and perimeter lighting, strengthening lifecycle-driven revenue continuity.

Market dominance is concentrated in Riyadh, Jeddah, and the Eastern Province, where the majority of defense headquarters, airbases, naval ports, and industrial clusters are located. These regions benefit from superior logistics access, mature defense supply chains, and proximity to major procurement authorities. Strong policy alignment with localization programs and the presence of certified maintenance and overhaul facilities further reinforce regional leadership in adoption, integration, and long-term servicing of military-grade lighting systems.

Market Segmentation

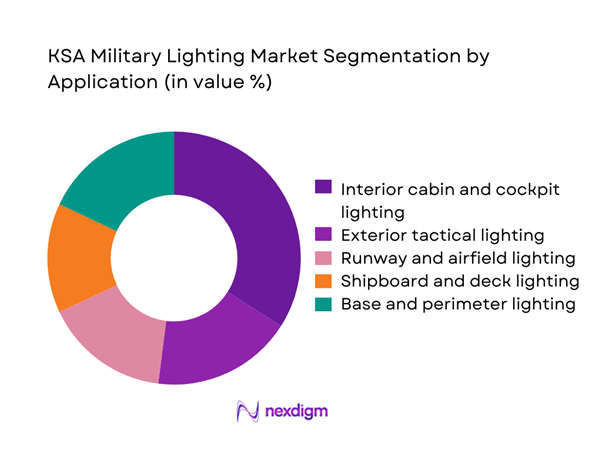

By Application

Interior cabin and cockpit lighting dominates this segmentation due to its mission-critical role across aircraft, armored vehicles, and naval command centers. High deployment density of these systems across fleets results in consistent replacement cycles and technology upgrades. The growing emphasis on night operations and low-visibility missions has strengthened demand for NVG-compatible and adaptive brightness solutions. Base and perimeter lighting follows closely, driven by expanding military infrastructure projects and heightened focus on force protection. Together, these applications account for the majority of procurement activity, supported by standardization under military specifications and integration with digital control systems that enhance operational efficiency and safety.

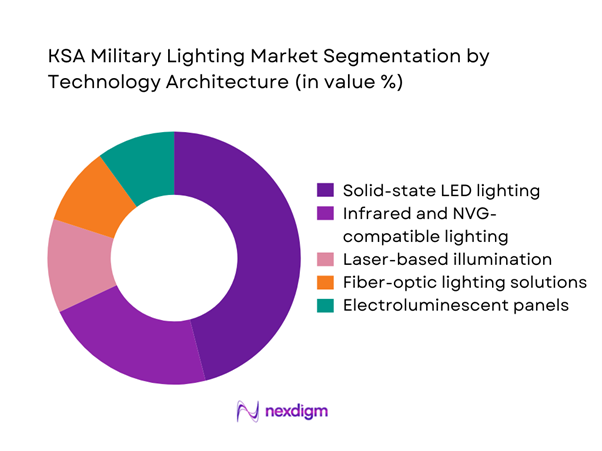

By Technology Architecture

Solid-state LED lighting leads the technology architecture landscape owing to its durability, low power consumption, and extended lifecycle under extreme operating conditions. Defense forces increasingly prioritize LEDs to reduce maintenance burdens and improve system reliability across harsh desert and maritime environments. Infrared and NVG-compatible systems represent the fastest-growing niche, aligned with the rising intensity of night-time operations and stealth requirements. Laser-based and fiber-optic lighting retain specialized roles in aerospace and naval platforms where precision illumination and electromagnetic compatibility are critical. This segmentation reflects a gradual but steady transition from legacy halogen systems toward intelligent, digitally controlled lighting architectures.

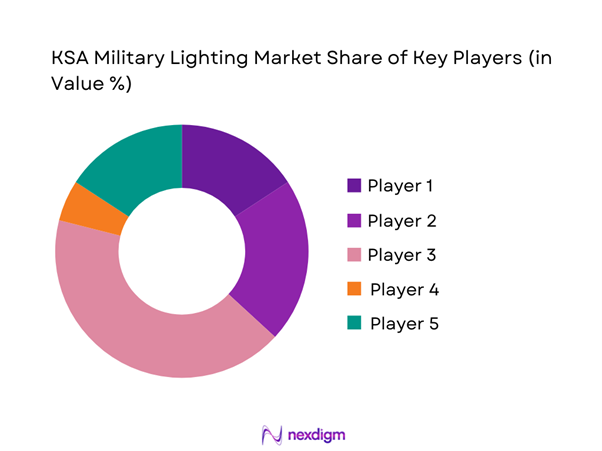

Competitive Landscape

The KSA Military Lighting Market is moderately concentrated, with a mix of global defense technology leaders and specialized aerospace lighting suppliers dominating high-value contracts. Market structure is shaped by stringent certification requirements and long-term framework agreements, which limit frequent entry of new vendors. Competitive differentiation centers on compliance with military standards, local partnership depth, and the ability to support lifecycle maintenance within Saudi Arabia.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Signify | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| OSRAM | 1919 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 1895 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Military Lighting Market Analysis

Growth Drivers

Rising defense modernization programs under Vision 2030

Defense modernization initiatives under Vision 2030 have resulted in annual platform upgrade programs covering ~ aircraft, ~ naval vessels, and ~ armored vehicles during recent cycles. These programs have driven cumulative lighting system retrofits valued at USD ~ million across airbases and naval ports. Between recent procurement phases, more than ~ systems were integrated with advanced control units to support night operations and energy efficiency mandates. Infrastructure expansion involving ~ bases and ~ training centers has further amplified demand for perimeter and runway lighting, reinforcing the central role of modernization in sustaining market growth.

Expansion of domestic defense manufacturing and localization mandates

Localization policies have accelerated the establishment of ~ assembly lines and ~ certified service centers for military electronics, including lighting subsystems. Over the past procurement cycles, localization-linked contracts accounted for investments of nearly USD ~ million in production tooling and workforce training. The shift toward domestic integration has supported deployment of ~ units annually through local partners, reducing dependence on imported components. This structural transition has strengthened supply chain resilience while enabling faster turnaround for maintenance and spares, positioning localization as a key growth catalyst for sustained market expansion.

Challenges

High qualification and certification requirements for military-grade lighting

Military lighting systems must comply with ~ distinct qualification protocols covering vibration, electromagnetic compatibility, and extreme temperature endurance. These certification processes extend development timelines by ~ months and increase pre-production costs by USD ~ million per product line. For suppliers entering the market, the need to validate ~ test parameters across multiple platforms often delays commercial deployment. Such high technical thresholds restrict rapid innovation cycles and limit the number of qualified vendors, creating barriers that slow the pace of technology refresh despite rising operational demand.

Lengthy procurement cycles and tender-based purchasing

Defense procurement frameworks typically involve tender cycles spanning ~ months from specification issuance to contract award. During recent acquisition phases, lighting system contracts valued at USD ~ million experienced multiple evaluation rounds, delaying fleet-wide deployment schedules. These extended timelines create revenue visibility challenges for suppliers and complicate production planning for ~ units annually. For end users, the lag between requirement identification and system delivery can hinder rapid capability upgrades, particularly in fast-evolving operational environments.

Opportunities

Localization of lighting system assembly and integration in KSA

The establishment of localized assembly operations presents opportunities to capture incremental value across ~ stages of the supply chain. Recent defense industrial initiatives have earmarked USD ~ million for expanding electronics integration capacity, with lighting systems positioned as a priority segment. Local assembly can support annual output of ~ units for land, air, and naval platforms, enabling faster customization and compliance with national content requirements. This shift also enhances after-sales responsiveness, opening long-term service contracts valued at USD ~ million across military bases and fleet depots.

Development of smart and adaptive lighting for next-generation platforms

Next-generation combat platforms increasingly require adaptive lighting systems capable of responding to mission profiles in real time. Recent pilot programs have deployed ~ smart lighting modules integrated with command systems across ~ test platforms. These initiatives involved development budgets nearing USD ~ million for sensor-enabled illumination and automated dimming solutions. As future fleets scale, the potential installation base of ~ systems creates a strong opportunity for suppliers specializing in digital and software-driven lighting architectures, expanding value beyond hardware into system intelligence.

Future Outlook

The KSA Military Lighting Market is expected to evolve in line with broader defense modernization and localization strategies through the next decade. Increasing emphasis on smart bases, autonomous platforms, and integrated command systems will reshape lighting requirements toward adaptive, networked solutions. Policy alignment with domestic manufacturing will further deepen local value creation, while rising operational complexity will sustain demand for high-reliability, certified systems across all defense domains.

Major Players

- Signify

- OSRAM

- GE Current

- L3Harris Technologies

- Collins Aerospace

- Astronics Corporation

- Hella GmbH & Co. KGaA

- Stanley Electric

- Elbit Systems

- Rafael Advanced Defense Systems

- Saab AB

- Thales Group

- Honeywell Aerospace

- Oxley Group

- STG Aerospace

Key Target Audience

- Saudi Arabian Military Industries procurement divisions

- Ministry of Defense acquisition and lifecycle management units

- Royal Saudi Air Force logistics and engineering departments

- Royal Saudi Naval Forces infrastructure and systems teams

- Saudi Border Guard and homeland security agencies

- Public Investment Fund defense and industrial programs

- Defense-focused investments and venture capital firms

- General Authority for Military Industries regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Assessment of platform upgrade programs, base expansion plans, and fleet modernization cycles. Mapping of lighting technology adoption trends across air, land, and naval forces. Identification of regulatory and certification frameworks shaping procurement decisions.

Step 2: Market Analysis and Construction

Compilation of procurement patterns from recent defense tenders and framework agreements. Evaluation of supply chain structures including local integration and service capabilities. Construction of demand scenarios based on infrastructure and fleet renewal pipelines.

Step 3: Hypothesis Validation and Expert Consultation

Engagement with defense logistics planners and technical specialists to validate assumptions. Cross-verification of deployment patterns across different operational commands. Refinement of market dynamics through structured expert feedback loops.

Step 4: Research Synthesis and Final Output

Integration of quantitative indicators with strategic and policy-driven insights. Development of coherent narratives linking modernization, localization, and technology trends. Final validation to ensure consistency, accuracy, and consulting-grade presentation.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military lighting system taxonomy across aircraft vehicle and soldier borne applications, market sizing logic by platform modernization programs and unit deployment, revenue attribution across equipment upgrades spares and support services, primary interview program with defense operators OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational usage pathways across defense platforms

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and standards environment

- Growth Drivers

Rising defense modernization programs under Vision 2030

Expansion of domestic defense manufacturing and localization mandates

Increased demand for NVG-compatible and stealth lighting solutions

Upgrades of airbases, naval ports, and military installations

Growing adoption of LED and energy-efficient lighting technologies

Enhanced focus on soldier safety and mission effectiveness - Challenges

High qualification and certification requirements for military-grade lighting

Lengthy procurement cycles and tender-based purchasing

Dependence on imported high-end lighting components

Integration complexity with legacy military platforms

Budget constraints and competing defense priorities

Harsh operating environments affecting system reliability - Opportunities

Localization of lighting system assembly and integration in KSA

Development of smart and adaptive lighting for next-generation platforms

Retrofit opportunities for aging aircraft and armored fleets

Expansion of military infrastructure projects and giga defense zones

Strategic partnerships between global OEMs and Saudi defense firms

Export potential to regional GCC and MENA defense markets - Trends

Shift toward fully solid-state and digital lighting architectures

Growing deployment of infrared and multispectral lighting systems

Integration of lighting with battlefield management and C2 systems

Increased use of lightweight and ruggedized materials

Adoption of predictive maintenance for lighting systems

Standardization around NATO and MIL-STD lighting specifications - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land forces vehicles and armored platforms

Naval vessels and submarines

Military aircraft and helicopters

Unmanned aerial systems

Special operations and tactical mobility platforms - By Application (in Value %)

Interior cabin and cockpit lighting

Exterior tactical and formation lighting

Runway and airfield lighting

Shipboard and maritime deck lighting

Perimeter, base, and security lighting

Portable and expeditionary lighting systems - By Technology Architecture (in Value %)

Solid-state LED lighting

Infrared and NVG-compatible lighting

Laser-based illumination systems

Fiber-optic lighting solutions

Electroluminescent panels - By End-Use Industry (in Value %)

Army and ground forces

Navy and maritime defense

Air force and aerospace defense

Homeland security and border protection

Defense manufacturing and MRO services - By Connectivity Type (in Value %)

Wired lighting systems

Wireless lighting control

Hybrid connectivity systems

Networked lighting management platforms

Standalone lighting units - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product ruggedization level, NVG compatibility, certification compliance, local content ratio, system integration capability, lifecycle support coverage, pricing flexibility, delivery lead time)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Signify (Philips Lighting)

OSRAM

GE Current

L3Harris Technologies

Collins Aerospace

Astronics Corporation

Hella GmbH & Co. KGaA

Stanley Electric

Elbit Systems

Rafael Advanced Defense Systems

Saab AB

Thales Group

Honeywell Aerospace

Oxley Group

STG Aerospace

- Demand and utilization drivers across defense platforms

- Procurement and tender dynamics within Saudi armed forces

- Buying criteria and vendor selection processes

- Budget allocation and lifecycle cost considerations

- Implementation barriers and operational risk factors

- Post-purchase service, training, and support expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035