Market Overview

The KSA Military Lighting Market is valued at USD ~ billion, based on a five-year historical analysis of Saudi Arabia’s broader defense and lighting infrastructure and is driven by heightened defense budget allocations toward modern base and platform lighting systems, LED adoption in tactical environments, airfield and perimeter lighting retrofits, and strategic infrastructure projects aligning with Vision 2030 energy efficiency goals. This valuation is anchored in documented Saudi Arabia lighting market data and defense spending trends that increasingly integrate advanced lighting subsegments into procurement programs.

Dominant markets for military lighting include Riyadh due to its status as the political and defense procurement hub where national projects are headquartered, and Jeddah as a major naval and commercial logistics center requiring extensive base and tactical lighting solutions. These urban centers lead because of concentrated defense modernization projects, large public-sector infrastructure investments, and proximity to global defense integrators and suppliers operating in the Kingdom.

Market Segmentation

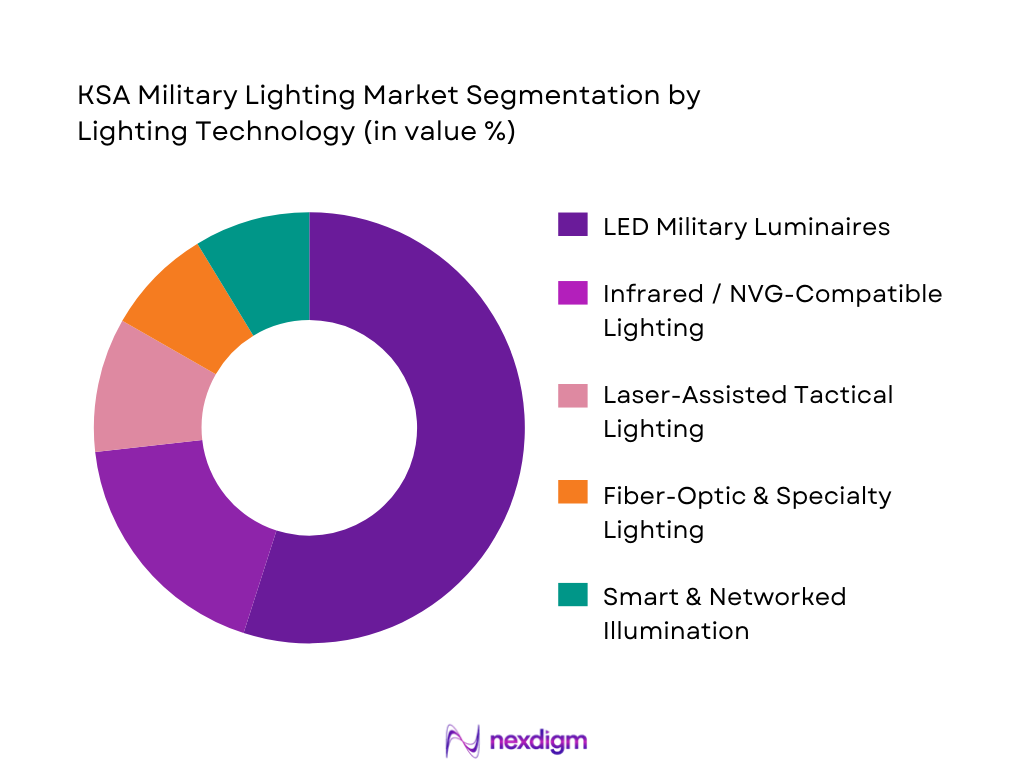

By Lighting Technology

By lighting technology, LED military luminaires dominate, primarily due to their durability, lower lifecycle cost, broad adoption across airfield, base, and tactical applications, and alignment with energy-efficient procurement policies. LED solutions provide reliable performance under harsh operational conditions, long MTBF (mean time between failure), and seamless integration with digital control systems that defense forces increasingly mandate for interoperability and maintenance efficiency.

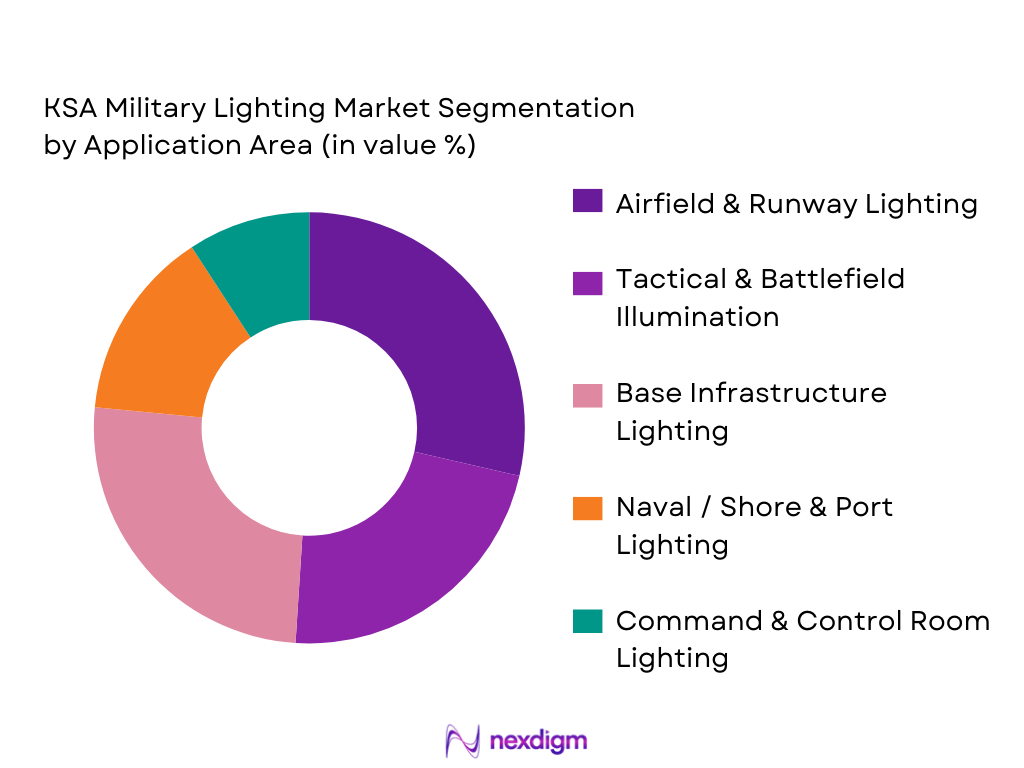

By Application Area

The Airfield & Runway segment leads as the largest application area due to continuous modernization of air force bases, stringent operational lighting requirements for 24/7 mission readiness, and upgrades to runway and support field lighting that improve safety and meet international runway visual-aid standards used by defense forces.

Competitive Landscape

The KSA Military Lighting competitive landscape is characterized by a mix of multinational defense contractors and regional manufacturers capable of meeting stringent military spec requirements for ruggedness, NVG compatibility, EMI/EMC compliance, and interoperability with base and C4ISR systems.

In the KSA Military Lighting Market, competition is led by a consolidated set of global primes and localized integrators that supply advanced LED and smart lighting solutions to defense programs. This consolidation underscores the importance of compliance expertise, long-term service contracts, and integration capability with tactical and infrastructure platforms.

| Company | Establishment Year | Headquarters | Product Portfolio Breadth | NVG / Tactical Certification | Local Defense Offset Status | Integration Capability | After-Sales & Field Support | Installed Project Base |

| Saudi Arabian Military Industries (SAMI) | 2017 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ | ~ |

| Advanced Electronics Company (AEC) | 1988 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ | ~ |

| Schréder Saudi Arabia | 2019 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ | ~ |

| Signify (Philips Defense Lighting) | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Eaton Military Lighting | 1911 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Military Lighting Market Analysis

Growth Drivers

Defense Budget Allocation to Infrastructure Lighting

Saudi Arabia’s sustained defense spending has placed strong emphasis on the modernization and expansion of military infrastructure, including airbases, naval ports, command centers, border installations, and training facilities. Lighting systems are a core operational requirement within these assets, supporting round-the-clock mission readiness, safe aircraft movement, secure perimeter control, and improved situational awareness. Unlike conventional infrastructure lighting, military-grade lighting must withstand extreme heat, dust, vibration, and operational stress, which drives demand for specialized, high-value solutions. As new bases are developed and existing facilities undergo phased upgrades, lighting is increasingly specified as an integrated system rather than a standalone component. This structural shift has elevated lighting procurement volumes and budgets, positioning it as a critical subsegment within defense infrastructure investment.

Vision 2030 Localization and IKTVA Mandates

Vision 2030 has fundamentally altered defense procurement dynamics by prioritizing localization, technology transfer, and domestic value creation. Under IKTVA and related offset frameworks, defense suppliers are required to increase local content, establish in-country operations, and develop Saudi supply chains. Military lighting manufacturers are responding by setting up assembly lines, testing facilities, and system-integration partnerships within the Kingdom. Localization improves delivery timelines, lifecycle support, and maintenance responsiveness, making locally produced lighting systems more attractive to defense buyers. Additionally, standardized lighting platforms designed for Saudi operational conditions reduce long-term costs and enhance procurement efficiency, further reinforcing demand growth.

Market Restraints

Extended Defense Procurement Cycles

Defense procurement in Saudi Arabia follows a highly structured and multi-tiered approval process. Military lighting projects are often bundled within larger infrastructure or platform programs, requiring technical evaluations, compliance audits, cybersecurity assessments, and financial approvals before contract award. These extended cycles delay project execution and revenue realization, increasing working capital requirements for suppliers. Smaller manufacturers and new entrants may find it difficult to sustain long bidding periods without guaranteed outcomes, limiting competitive diversity in the market.

Stringent MIL-STD and NVG Certification Requirements

Military lighting systems must comply with strict MIL-STD specifications related to durability, ingress protection, shock resistance, and electromagnetic compatibility. In addition, many applications require compatibility with night-vision goggles, demanding precise spectral control and advanced optical engineering. Certification processes involve extensive laboratory testing and field validation, significantly increasing development timelines and costs. These requirements create high entry barriers and restrict market participation to companies with proven defense-grade engineering and testing capabilities.

Opportunities

Local Manufacturing and Offset Programs

Localization policies present long-term opportunities for companies that align with Saudi defense industrial goals. Establishing local manufacturing or assembly facilities allows suppliers to meet offset obligations, reduce import dependency, and secure long-term framework agreements. These initiatives also enable technology transfer, workforce development, and positioning Saudi Arabia as a regional hub for military lighting production, opening future export potential.

Smart and Connected Military Lighting Systems

The evolution of smart military bases is creating demand for connected lighting solutions integrated with surveillance, perimeter security, and command systems. Smart lighting enables adaptive illumination based on threat levels, movement detection, or operational requirements while reducing energy consumption and maintenance costs. As defense infrastructure becomes more digitized, lighting systems are increasingly viewed as intelligent assets, creating opportunities for suppliers offering software-enabled platforms, system integration, and long-term service models.

Future Outlook

Looking ahead, the KSA Military Lighting Market is expected to exhibit consistent growth driven by continued defense modernization programs, increased allocation toward energy-efficient and rugged tactical lighting solutions, and integration of networked and smart illumination technologies that align with secure base and platform requirements. Expansion of smart military base initiatives under Vision 2030 and rising demand for NVG-capable, low thermal footprint systems will further fuel market momentum.

Major Players

- Saudi Arabian Military Industries (SAMI)

- Advanced Electronics Company (AEC)

- Schréder Saudi Arabia

- Signify (Philips) Defense Lighting

- Eaton Military Lighting

- Elbit Systems (Defense Lighting Division)

- Raytheon Technologies (Lighting Solutions)

- BAE Systems (Infrastructure Lighting)

- Hella KGaA Hueck & Co. (Defense Solutions)

- Honeywell Defense Systems

- Leonardo Defence Lighting

- Thales Group Lighting

- L3Harris Technologies Lighting Division

- Astronics Corporation (Defense Lighting)

Key Target Audience

- Defense procurement agencies (Ministry of Defense, Saudi Arabia)

- Royal Saudi Air Force procurement divisions

- Royal Saudi Naval Forces procurement divisions

- Royal Saudi Land Forces engineering and infrastructure divisions

- Investments and venture capitalist firms specializing in defense technology

- Government and regulatory bodies (SABER / SASO / GCC conformity authorities)

- Platform integrators and systems contractors for defense installations

- Defense supply chain and OEM partnerships (lighting & electronics)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing a comprehensive ecosystem map of stakeholders in the KSA Military Lighting Market, incorporating defense procurement frameworks, lighting technology categories, and military requirements. Secondary datasets and proprietary defense spending reports were leveraged to define critical market drivers.

Step 2: Market Analysis and Construction

This phase compiled historical data for broader Saudi lighting infrastructure and global military lighting trends. Lighting procurement patterns, technology adoption curves, and project pipelines were analyzed to derive a reliable market size estimate anchored on documented industry research.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through structured expert consultations with defense lighting integrators, military procurement advisors, and industry specialists. These insights refined assumptions on deployment cycles, technology adoption, and procurement behaviors.

Step 4: Research Synthesis and Final Output

Final synthesis involved engaging with defense contractors and integrating field insights to verify bottom-up projections and ensure coherence between supply-side technology trends and defense demand drivers, resulting in a validated KSA Military Lighting Market forecast.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Defense Lighting Taxonomy, Military-Grade Performance Benchmarks, Market Sizing Logic for Defense Procurement, Bottom-Up Spend Mapping via Defense Contracts, Top-Down Allocation from KSA Defense Budget, Primary Interviews with MoD Vendors & Integrators, Validation Through Offset & Localization Data, Limitations and Analyst Assumptions)

- Definition and Scope

- Overview Genesis

- Evolution of Military Lighting in KSA Defense Infrastructure

- Defense Modernization Context and Vision Alignment

- Military Lighting Supply Chain and Value Chain Analysis

- Stakeholder Mapping Across Defense Procurement Ecosystem

- Growth Drivers

Defense Budget Allocation to Infrastructure Lighting

Vision 2030 Localization and IKTVA Mandates

Energy-Efficient and Low-Maintenance Military Lighting Transition

Smart and Secure Military Base Expansion

Night Operations and Low-Visibility Mission Requirements - Market Restraints

Extended Defense Procurement Cycles

Stringent MIL-STD and NVG Certification Requirements

Dependence on Imported High-End Components

High Switching and Integration Costs

Cybersecurity and EMI/EMC Risks - Opportunities

Local Manufacturing and Offset Programs

Smart and Connected Military Lighting Systems

Integration with Surveillance and C4ISR Infrastructure

Export-Oriented Defense Manufacturing Potential

Dual-Use Technology Adaptation - Trends

NVG-Compatible and Spectrally Controlled Lighting

Human-Centric Lighting for Military Personnel

EMI/EMC Shielded Lighting Solutions

Modular and Rapid-Deployment Lighting Systems

AI-Enabled Adaptive Illumination - Regulatory & Compliance Landscape

Ministry of Defense Technical Standards

SASO and GCC Conformity Requirements

NATO STANAG Alignment

Cyber and Data Security Compliance - Environmental and Energy Efficiency Mandates

- SWOT Analysis

- Porter’s Five Forces Analysis

- Competition Ecosystem

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Lighting Technology (In Value %)

LED Luminaires

Infrared & Near-Infrared Lighting

OLED & Advanced Solid-State Lighting

Fiber Optic Lighting Systems

Laser-Based Tactical Illumination - By Application Area (In Value %)

Airfield & Runway Lighting

Naval Vessel & Port Lighting

Military Base & Barracks Lighting

Tactical & Battlefield Lighting

Command & Control Room Lighting - By Platform Type (In Value %)

Land-Based Installations

Naval Platforms

Airbases & Hangars

Mobile & Deployable Units

Underground & Hardened Facilities - By End User (In Value %)

Saudi Arabian Armed Forces

Royal Saudi Air Defense

Royal Saudi Naval Forces

Royal Saudi Air Force

Ministry of Interior Security Forces - By Installation Type (In Value %)

New Defense Infrastructure Projects

Retrofit & Modernization Programs

Temporary & Expeditionary Deployments

Smart Base Upgrades

Hardened Facility Installations

- Market Share Analysis by Value and Installed Base

- Cross Comparison Parameters (Localization Ratio & Offset Compliance, NVG Compatibility & Spectral Control, MIL-STD Certification Coverage, Energy Efficiency & Luminous Efficacy, System Integration Capability with C4ISR, Lifecycle Cost & MTBF, Environmental & EMI/EMC Resistance, After-Sales Support & Defense MRO Presence)

- SWOT Analysis of Key Players

- Detailed Profiles of Major Companies

Saudi Arabian Military Industries (SAMI)

Advanced Electronics Company (AEC)

Alfanar Lighting

Schréder Saudi Arabia

Signify (Philips) Defense Lighting

Eaton Lighting Systems

Hubbell Military & Aerospace

OSRAM Defense Solutions

L3Harris Technologies Lighting Division

Elbit Systems Night & Tactical Lighting

Thales Group Lighting Solutions

Leonardo Defence Systems Lighting

BAE Systems Infrastructure Lighting

Rohde & Schwarz Secure Lighting

Raytheon Technologies Base Infrastructure Lighting

- Procurement Behavior and Tendering Mechanisms

- Budget Allocation Patterns and CapEx vs OpEx Mix

- Decision-Making Hierarchy within Defense Contracts

- Operational Requirements and Performance Expectations

- Pain Point and Unmet Needs Assessment

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035