Market Overview

The KSA military multirole aircraft market current size stands at around USD ~ million, reflecting sustained procurement momentum driven by fleet renewal programs and mission capability expansion. Recent acquisitions and upgrade contracts together represent investment commitments of USD ~ million, while cumulative platform inductions stand near ~ aircraft across frontline and training squadrons. Ongoing modernization has also increased annual deployment cycles to ~ missions, supported by maintenance and upgrade spending of USD ~ million across air bases.

The market shows strong dominance across Riyadh, Dhahran, and Taif due to dense concentration of air bases, command infrastructure, and advanced maintenance facilities. These locations benefit from mature defense ecosystems, high availability of skilled aerospace personnel, and proximity to logistics corridors. Demand concentration is further reinforced by centralized procurement systems, robust testing and evaluation centers, and supportive industrial participation policies that favor long-term platform sustainment and technology localization.

Market Segmentation

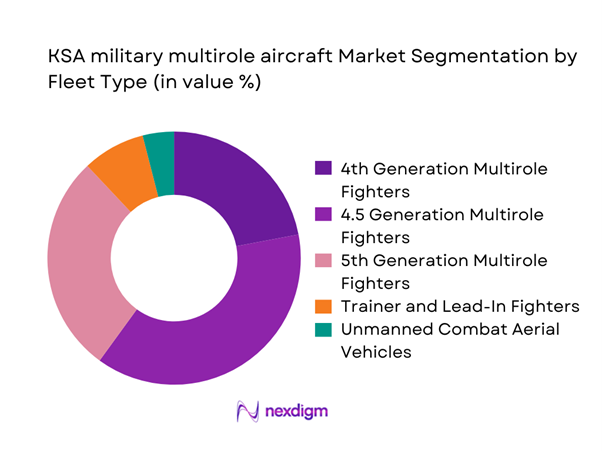

By Fleet Type

The market is dominated by advanced multirole fighters as the Royal Saudi Air Force prioritizes platforms capable of performing air superiority, strike, and reconnaissance roles within a single mission profile. Fleet renewal strategies emphasize replacing aging aircraft with technologically superior variants that offer extended range, improved survivability, and higher payload capacity. Investment levels of USD ~ million continue to be directed toward next-generation avionics and weapons integration, while fleet transition programs involve induction of ~ aircraft across multiple squadrons. The dominance of this segment is reinforced by long-term sustainment contracts, pilot retraining programs, and infrastructure upgrades that collectively enhance operational readiness and lifecycle value.

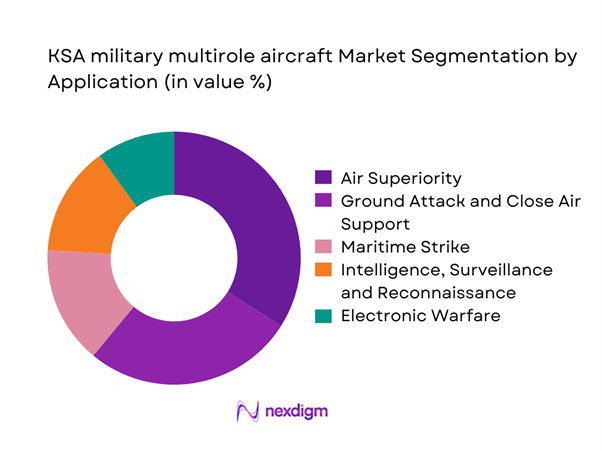

By Application

Combat and strike missions represent the largest application area, driven by the strategic emphasis on rapid response, deterrence, and coalition interoperability. Annual mission planning involves deployment of ~ aircraft across multiple operational theaters, supported by command systems investments of USD ~ million. The segment benefits from continuous upgrades in targeting accuracy, sensor fusion, and real-time data sharing, which significantly enhance mission success rates. Training and simulation also contribute to this dominance, with ~ simulators and digital training platforms improving pilot readiness and reducing operational risks. These structural advantages sustain long-term preference for combat-centric multirole aircraft deployments.

Competitive Landscape

The market exhibits a moderately concentrated structure dominated by a small group of global aerospace manufacturers that supply advanced platforms under long-term government-to-government agreements. Competitive positioning is shaped by technological depth, local partnership frameworks, and the ability to support full lifecycle services including training, upgrades, and maintenance.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Lockheed Martin | 1995 | Bethesda, United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Boeing Defense, Space & Security | 1916 | Arlington, United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence and Space | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Dassault Aviation | 1929 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ |

KSA military multirole aircraft Market Analysis

Growth Drivers

Modernization of Royal Saudi Air Force combat fleet

The ongoing modernization of the combat fleet continues to be a primary growth engine, with cumulative upgrade and replacement programs accounting for investments of USD ~ million. Fleet transition initiatives involve induction of ~ aircraft equipped with advanced avionics, leading to measurable increases in sortie generation rates of ~ missions annually. Infrastructure upgrades across ~ air bases further support this transformation, enabling higher maintenance throughput and reduced turnaround times. These quantitative improvements strengthen operational efficiency while extending platform service life, ensuring sustained demand for multirole aircraft across frontline and support squadrons.

Rising geopolitical tensions and regional security imperatives

Regional security dynamics have significantly elevated operational requirements, leading to expanded deployment cycles of ~ missions and increased readiness levels across ~ squadrons. Defense planning allocations have directed USD ~ million toward rapid response capabilities, including aerial refueling, precision strike, and networked command systems. These investments translate into higher fleet utilization rates and accelerated procurement timelines for mission-ready platforms. Quantitatively, the rise in operational tempo has driven the need for ~ additional aircraft to maintain force availability, reinforcing sustained market growth.

Challenges

High capital expenditure and lifecycle cost of advanced fighters

The financial burden associated with next-generation multirole aircraft remains a major constraint, with acquisition packages often exceeding USD ~ million per program and annual sustainment costs reaching USD ~ million. Lifecycle management demands involve maintenance of ~ components per aircraft and scheduled overhauls across ~ facilities, increasing pressure on defense budgets. These high cost structures limit procurement volumes to ~ aircraft per cycle, slowing fleet renewal despite operational needs. Budget optimization therefore remains a critical challenge in balancing modernization ambitions with fiscal sustainability.

Dependence on foreign OEMs and export control restrictions

Reliance on overseas suppliers introduces operational and financial risks, particularly when export controls affect delivery schedules and system upgrades. Delays in component supply chains have impacted maintenance cycles for ~ aircraft, while deferred software updates have postponed deployment of ~ mission systems. Contract renegotiations linked to compliance requirements can add USD ~ million in unplanned expenses, reducing procurement flexibility. This dependency constrains long-term planning and underscores the need for localized manufacturing and greater technology autonomy.

Opportunities

Fleet replacement of legacy 4th generation aircraft

The phased retirement of aging platforms presents a substantial opportunity, with ~ aircraft scheduled for decommissioning and replacement programs valued at USD ~ million. This transition enables the introduction of advanced mission systems that improve operational efficiency and reduce long-term maintenance costs by USD ~ million annually. Replacement cycles also stimulate investments in training infrastructure, including ~ simulators and digital mission planning tools, enhancing readiness levels across operational units. These quantifiable benefits position fleet renewal as a cornerstone opportunity for market expansion.

Co-production and technology transfer agreements

Strategic partnerships centered on co-production and technology transfer are opening new pathways for industrial growth, supported by agreements worth USD ~ million. Local assembly lines are projected to support production of ~ aircraft components annually, while skill development programs target training of ~ engineers and technicians. These initiatives reduce long-term dependency on foreign suppliers and improve supply chain resilience. Quantitatively, such arrangements can lower import costs by USD ~ million and accelerate maintenance turnaround times, strengthening the overall value proposition of localized aerospace manufacturing.

Future Outlook

The KSA military multirole aircraft market is expected to maintain steady momentum through the next decade, driven by continued fleet modernization and deeper integration of advanced combat technologies. Strategic emphasis on interoperability, digital warfare capabilities, and localized industrial participation will shape procurement priorities. Long-term partnerships and sustained investment in training and sustainment infrastructure will further reinforce market resilience and operational readiness.

Major Players

- Lockheed Martin

- Boeing Defense, Space & Security

- Airbus Defence and Space

- BAE Systems

- Dassault Aviation

- Saab

- Leonardo

- Northrop Grumman

- Embraer Defense & Security

- Korea Aerospace Industries

- Mitsubishi Heavy Industries

- Turkish Aerospace Industries

- Sukhoi

- RAC MiG

- Hindustan Aeronautics Limited

Key Target Audience

- Royal Saudi Air Force procurement and logistics divisions

- Ministry of Defense of Saudi Arabia

- General Authority for Military Industries

- Saudi Arabian Military Industries

- Defense systems integrators and maintenance providers

- Aviation training and simulation service providers

- Investments and venture capital firms focused on aerospace and defense

- Government and regulatory bodies including the Saudi Export Control Authority

Research Methodology

Step 1: Identification of Key Variables

Key variables related to fleet size, operational readiness, procurement cycles, and sustainment requirements were identified. Quantitative indicators such as investment flows of USD ~ million and platform deployment volumes of ~ aircraft were mapped to establish baseline market dynamics. Policy and industrial participation factors were also integrated to reflect local ecosystem conditions.

Step 2: Market Analysis and Construction

The market framework was constructed by analyzing procurement contracts, upgrade programs, and maintenance spending patterns totaling USD ~ million. Deployment intensity measured through ~ missions and infrastructure capacity across ~ air bases was used to assess operational demand. This approach enabled a structured view of current market performance.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary assumptions were validated through consultations with defense procurement specialists and aviation operations experts. Inputs focused on fleet renewal volumes of ~ aircraft and sustainment expenditures of USD ~ million, ensuring realistic assessment of demand drivers and constraints.

Step 4: Research Synthesis and Final Output

All findings were consolidated into a coherent analytical model linking procurement, operations, and industrial participation. Quantitative insights, including investment levels of USD ~ million and deployment metrics of ~ missions, were synthesized to deliver a comprehensive and actionable market outlook.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, multirole aircraft platform taxonomy across fighter and strike roles, market sizing logic by fleet strength procurement cycles and upgrade timelines, revenue attribution across aircraft acquisitions modernization and MRO services, primary interview program with defense operators OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational roles and mission profiles

- Ecosystem structure

- Supply chain and MRO framework

- Regulatory and defense procurement environment

- Growth Drivers

Modernization of Royal Saudi Air Force combat fleet

Rising geopolitical tensions and regional security imperatives

Increased defense spending under Vision 2030

Emphasis on air superiority and precision strike capabilities

Growing focus on interoperability with allied forces

Expansion of indigenous defense manufacturing and localization - Challenges

High capital expenditure and lifecycle cost of advanced fighters

Dependence on foreign OEMs and export control restrictions

Complex integration of next-generation avionics and weapons

Lengthy procurement cycles and bureaucratic tender processes

Skilled workforce constraints in advanced aerospace engineering

Maintenance, repair, and overhaul capacity limitations - Opportunities

Fleet replacement of legacy 4th generation aircraft

Co-production and technology transfer agreements

Development of local MRO and upgrade hubs

Integration of AI-enabled mission systems

Expansion of training and simulation ecosystems

Participation in multinational fighter development programs - Trends

Shift toward 4.5 and 5th generation multirole platforms

Increased adoption of network-centric warfare doctrines

Rising importance of electronic warfare and cyber resilience

Growth in long-range precision strike capabilities

Emphasis on sustainability and cost-efficient operations

Acceleration of digital twins and predictive maintenance - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Platforms, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

4th Generation Multirole Fighters

4.5 Generation Multirole Fighters

5th Generation Multirole Fighters

Trainer and Lead-In Fighter Aircraft

Unmanned Combat Aerial Vehicles - By Application (in Value %)

Air Superiority

Ground Attack and Close Air Support

Maritime Strike

Intelligence, Surveillance and Reconnaissance

Electronic Warfare - By Technology Architecture (in Value %)

Conventional Avionics Suites

Advanced AESA Radar Platforms

Sensor Fusion and Data Link Enabled Platforms

Stealth and Low Observable Architectures

Open Mission Systems - By End-Use Industry (in Value %)

Royal Saudi Air Force

Joint Forces and Coalition Operations

Homeland Security and Border Protection

Training and Test Squadrons

Defense Research and Evaluation Units - By Connectivity Type (in Value %)

Line-of-Sight Tactical Data Links

Beyond Line-of-Sight SATCOM

Network-Centric Warfare Integration

Secure Encrypted Communications

Interoperable NATO-Standard Links - By Region (in Value %)

Central Region Air Bases

Western Region Air Bases

Eastern Region Air Bases

Southern Region Air Bases

Northern Region Air Bases

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (aircraft generation, mission versatility, avionics sophistication, weapons integration, lifecycle cost, local content potential, interoperability standards, delivery lead time)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Lockheed Martin

Boeing Defense, Space & Security

Airbus Defence and Space

BAE Systems

Dassault Aviation

Saab

Leonardo

Northrop Grumman

Embraer Defense & Security

Korea Aerospace Industries

Mitsubishi Heavy Industries

Turkish Aerospace Industries

Sukhoi

RAC MiG

Hindustan Aeronautics Limited

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Platforms, 2026–2035

- By Average Selling Price, 2026–2035