Market Overview

The KSA Military Navigation Systems Market market current size stands at around USD ~ million, reflecting sustained procurement activity across air, land, and naval forces. In the most recent assessment period, spending expanded from approximately USD ~ million to USD ~ million, driven by platform modernization and increasing emphasis on mission-critical positioning accuracy. Demand has also been supported by multi-domain operations that require resilient navigation in contested environments, reinforcing steady investment momentum across defense acquisition programs.

The market is dominated by activity centered in Riyadh, Jeddah, and the Eastern Province, where major defense command structures, air bases, and naval facilities are concentrated. These regions benefit from mature defense infrastructure, centralized procurement mechanisms, and proximity to maintenance and integration hubs. The presence of advanced training facilities and joint command centers further strengthens demand, while a supportive policy environment focused on defense localization continues to deepen ecosystem maturity.

Market Segmentation

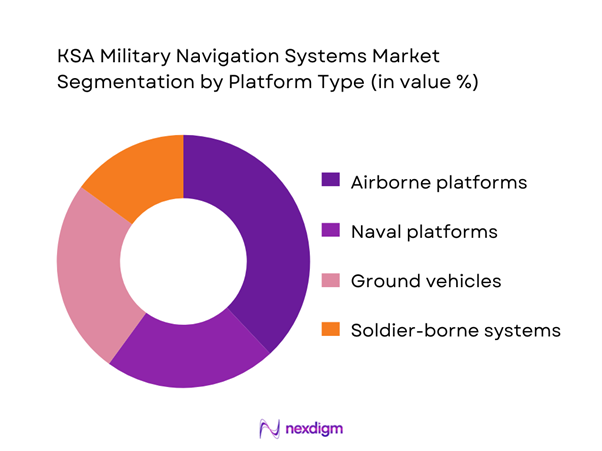

By Platform Type

Airborne platforms dominate the KSA Military Navigation Systems Market due to sustained modernization of fighter jets, transport aircraft, and unmanned aerial systems. High mission frequency and operational complexity in air defense create consistent demand for advanced inertial and hybrid navigation architectures. Naval and land platforms follow, supported by fleet upgrades and border security requirements. Soldier-borne systems remain a growing segment, driven by special forces modernization. Overall, procurement decisions prioritize platforms that operate in electronically contested environments, where navigation resilience directly influences mission success and survivability.

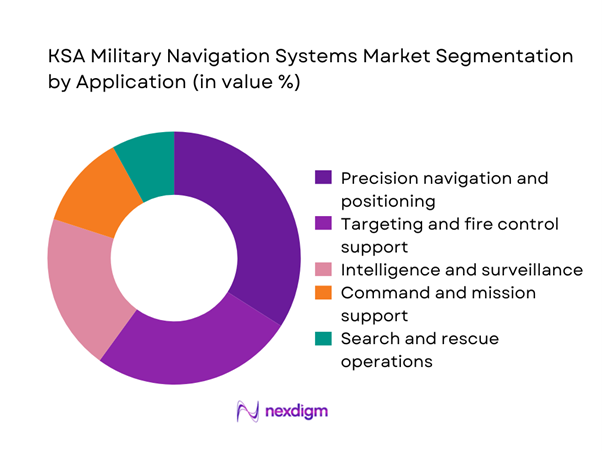

By Application

Precision navigation and positioning applications lead the market as they underpin nearly all combat and support missions. Targeting and fire control integration represents the second largest segment, reflecting the increasing reliance on network-centric warfare doctrines. Intelligence and surveillance applications continue to expand with UAV deployment, while command support and search operations maintain steady uptake. The overall application mix reflects the armed forces’ strategic focus on operational accuracy, rapid decision-making, and mission assurance in complex theaters.

Competitive Landscape

The KSA Military Navigation Systems Market is moderately concentrated, with a limited group of global defense technology providers supplying most high-end navigation solutions. Market structure is shaped by long procurement cycles, strict qualification requirements, and deep integration with broader C4ISR ecosystems. Competitive positioning depends heavily on system reliability, local partnership depth, and the ability to support lifecycle sustainment programs aligned with national defense objectives.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Electronics & Defense | 1924 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Military Navigation Systems Market Analysis

Growth Drivers

Rising defense modernization and Vision 2030 military localization programs

Modernization programs have expanded procurement volumes across air, land, and naval forces, with cumulative allocations reaching approximately USD ~ million in recent defense upgrade cycles. Localization initiatives have added further momentum by channeling nearly USD ~ million into domestic integration and sustainment capabilities. These investments have accelerated fleet refresh rates, increasing annual system deployments to around ~ systems across multiple platforms. The combined effect has been a structurally higher baseline demand for resilient navigation solutions that support long-term force readiness and industrial capability development.

Expansion of UAV and autonomous systems deployment

Unmanned and autonomous platforms have seen rapid operational integration, with fleet expansion adding roughly ~ systems over recent acquisition phases. Associated navigation and guidance packages account for spending of nearly USD ~ million, reflecting the complexity of multi-sensor fusion requirements. As mission profiles broaden from surveillance to strike and logistics, navigation performance has become a critical enabler. This shift has materially increased the volume of advanced navigation modules procured annually, strengthening a sustained growth trajectory for specialized military navigation technologies.

Challenges

High acquisition and lifecycle maintenance costs

Advanced military navigation systems require significant upfront investment, with program-level expenditures frequently exceeding USD ~ million for large fleet integrations. Ongoing calibration, software upgrades, and component replacement add annual sustainment costs of around USD ~ million, straining long-term defense budgets. These financial pressures often lead to phased procurement approaches, limiting the pace of full-scale deployment and extending upgrade cycles across platforms.

Dependence on foreign technology and export controls

A substantial share of high-end navigation components is sourced externally, with import volumes reaching approximately ~ systems in recent procurement cycles. This reliance exposes programs to export licensing delays that can postpone delivery timelines by several months. In parallel, technology access restrictions can elevate per-unit costs by USD ~ million equivalents across large orders, constraining rapid capability scaling and complicating strategic autonomy objectives.

Opportunities

Local manufacturing and technology transfer initiatives

Localization programs have opened opportunities for domestic assembly and subsystem production, supported by capital inflows of nearly USD ~ million into defense industrial zones. These initiatives are projected to enable annual output of around ~ systems within the country, reducing lead times and improving cost control. The development of local supply chains also enhances long-term sustainment efficiency and creates a foundation for export-oriented growth in specialized navigation components.

Development of indigenous resilient PNT solutions

Rising focus on navigation in GNSS-denied environments has driven research investments of approximately USD ~ million into indigenous resilient positioning technologies. Prototype deployments have already reached ~ systems across select platforms, demonstrating operational viability. Scaling these solutions presents a significant opportunity to strengthen national technological sovereignty while addressing emerging electronic warfare challenges that increasingly shape modern battlefields.

Future Outlook

The KSA Military Navigation Systems Market is set to evolve in line with broader defense transformation goals through 2035. Continued emphasis on localization, autonomy, and electronic warfare resilience will redefine procurement priorities across all service branches. As integration deepens with command and control architectures, navigation systems will move from standalone components to core enablers of multi-domain operations. This strategic shift is expected to sustain long-term demand and innovation momentum.

Major Players

- Honeywell Aerospace

- Northrop Grumman

- Collins Aerospace

- Thales Group

- Safran Electronics & Defense

- BAE Systems

- Leonardo

- Elbit Systems

- L3Harris Technologies

- Saab AB

- Garmin Defense

- Trimble Military and Aerospace

- NovAtel by Hexagon

- Kearfott Corporation

- KVH Industries

Key Target Audience

- Ministry of Defense of Saudi Arabia

- General Authority for Military Industries

- Royal Saudi Air Force procurement units

- Royal Saudi Naval Forces modernization offices

- Saudi Arabian Military Industries

- Defense system integrators and prime contractors

- Investments and venture capital firms focused on defense technology

- National cybersecurity and electronic warfare agencies

Research Methodology

Step 1: Identification of Key Variables

The study identifies core demand drivers, platform deployment patterns, and procurement structures influencing the KSA Military Navigation Systems Market. Key variables include fleet modernization cycles, localization policies, and operational readiness requirements. These factors form the foundation for subsequent analytical modeling.

Step 2: Market Analysis and Construction

Quantitative and qualitative inputs are synthesized to build a coherent market framework. Platform-level adoption trends, application demand patterns, and ecosystem capabilities are assessed to construct a comprehensive market baseline.

Step 3: Hypothesis Validation and Expert Consultation

Initial assumptions are validated through structured discussions with defense technology specialists and operational stakeholders. Feedback is used to refine demand estimates and ensure alignment with real-world procurement dynamics.

Step 4: Research Synthesis and Final Output

All insights are integrated into a unified analytical narrative. Findings are cross-checked for consistency and relevance before being structured into the final consulting-grade report.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military navigation system taxonomy across GPS INS and hybrid solutions, market sizing logic by platform deployment and upgrade cycles, revenue attribution across equipment upgrades spares and support services, primary interview program with defense operators OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational and mission usage pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and defense procurement environment

- Growth Drivers

Rising defense modernization and Vision 2030 military localization programs

Expansion of UAV and autonomous systems deployment

Increasing emphasis on GNSS-denied operational resilience

Growth in joint operations and network-centric warfare

Modernization of naval and air force platforms

Heightened border security and surveillance requirements - Challenges

High acquisition and lifecycle maintenance costs

Dependence on foreign technology and export controls

Cybersecurity and electronic warfare vulnerabilities

Integration complexity with legacy platforms

Lengthy procurement and approval cycles

Skilled workforce gaps in advanced navigation technologies - Opportunities

Local manufacturing and technology transfer initiatives

Development of indigenous resilient PNT solutions

Integration of AI and sensor fusion in navigation systems

Upgrade programs for legacy aircraft and vehicles

Expansion of training and simulation-based navigation solutions

Partnerships with global defense primes for co-development - Trends

Shift toward multi-sensor fusion navigation architectures

Growing adoption of anti-jam and anti-spoofing technologies

Increased use of software-defined navigation systems

Rising focus on autonomous and semi-autonomous platforms

Convergence of navigation with C4ISR ecosystems

Greater emphasis on lifecycle support and performance-based logistics - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Air force manned aircraft

Unmanned aerial vehicles

Naval surface vessels

Armored and tactical ground vehicles

Dismounted soldier and special forces systems - By Application (in Value %)

Precision navigation and positioning

Targeting and fire control support

Intelligence, surveillance, and reconnaissance

Mission planning and command support

Search and rescue and recovery operations - By Technology Architecture (in Value %)

Inertial navigation systems

GNSS-based navigation systems

Hybrid INS and GNSS systems

Terrain and vision-aided navigation

Resilient PNT for GNSS-denied environments - By End-Use Industry (in Value %)

Ministry of Defense central commands

Royal Saudi Air Force

Royal Saudi Naval Forces

Royal Saudi Land Forces

Saudi Arabian National Guard - By Connectivity Type (in Value %)

Standalone embedded systems

Networked command-and-control integrated systems

SATCOM-enabled navigation platforms

Tactical data link enabled systems - By Region (in Value %)

Central region military commands

Western region military commands

Eastern region military commands

Southern region military commands

Northern region military commands

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology maturity, GNSS-denied capability, local manufacturing presence, system integration capability, lifecycle support depth, cybersecurity resilience, pricing competitiveness, offset and localization commitments)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Honeywell Aerospace

Northrop Grumman

Collins Aerospace

Thales Group

Safran Electronics & Defense

BAE Systems

Leonardo

Elbit Systems

L3Harris Technologies

Saab AB

Garmin Defense

Trimble Military and Aerospace

NovAtel by Hexagon

Kearfott Corporation

KVH Industries

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection processes

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service and lifecycle support expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035