Market Overview

The KSA Military Platforms market current size stands at around USD ~ million, reflecting sustained procurement activity across air, land, and naval domains supported by modernization initiatives. During the most recent period, cumulative platform inductions reached ~ systems, while active operational fleets crossed ~ units across key defense branches. Annual defense capital allocations exceeded USD ~ million, enabling delivery of ~ platforms focused on surveillance, mobility, and precision engagement. Sustained lifecycle spending above USD ~ million also underpinned upgrades and digital retrofits across legacy assets.

Market dominance is concentrated in Riyadh, Jeddah, and Dhahran, driven by proximity to defense command centers, airbases, and naval yards. These hubs benefit from dense clusters of maintenance depots, systems integration facilities, and training centers that support high deployment readiness. Demand concentration is reinforced by advanced logistics corridors, proximity to ports and airports, and mature industrial ecosystems aligned with localization mandates. Policy alignment and procurement centralization further strengthen these regions as the operational and commercial core of military platform development and deployment.

Market Segmentation

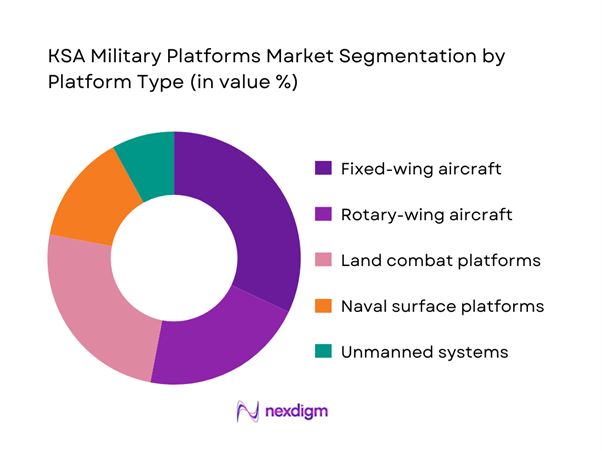

By Platform Type

The platform type segmentation is led by aerial and land combat systems due to sustained force modernization and rapid fleet renewal programs. Fixed-wing and rotary-wing assets dominate procurement cycles, supported by rising mission intensity and expanded patrol coverage. Land combat platforms follow closely, driven by border security reinforcement and rapid response requirements. Naval platforms maintain stable demand supported by coastal security priorities and fleet renewal mandates. Unmanned systems show accelerating traction as surveillance coverage expands across remote and high-risk zones, reinforcing the diversification of the platform mix and reshaping long-term acquisition strategies across defense branches.

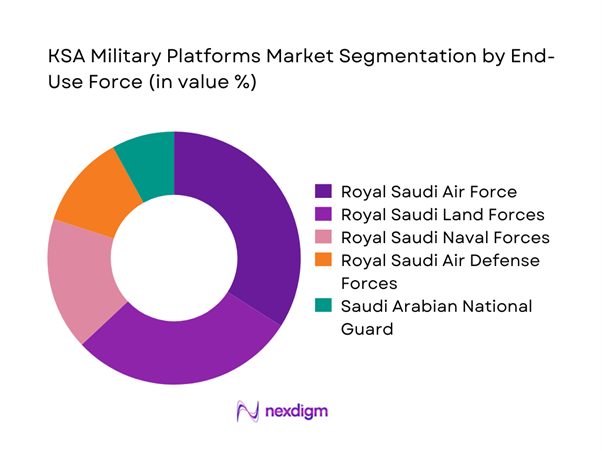

By End-Use Force

End-use force segmentation is dominated by the air force and land forces due to their central role in national defense readiness and rapid deployment missions. Air force demand is driven by fleet modernization and expanded airspace surveillance, while land forces sustain high acquisition volumes for armored mobility and tactical support. Naval forces follow with steady investments tied to maritime security imperatives. Air defense units maintain focused procurement linked to missile defense architecture upgrades. The national guard sustains selective acquisitions aligned with internal security mandates, ensuring balanced demand across the defense ecosystem.

Competitive Landscape

The KSA Military Platforms market reflects a moderately concentrated structure, shaped by long-term government contracts and strategic partnerships with global defense manufacturers and domestic integrators. Competitive intensity is influenced by localization requirements, technology transfer commitments, and lifecycle service capabilities, creating a landscape where established players coexist with emerging national champions focused on indigenous production and system integration.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Saudi Arabian Military Industries | 2017 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence and Space | 2014 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| RTX | 1922 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Military Platforms Market Analysis

Growth Drivers

Rising defense budget aligned with Vision 2030 localization goals

Sustained capital allocation has positioned the KSA Military Platforms market for accelerated modernization, with recent annual defense outlays exceeding USD ~ million dedicated to fleet renewal and domestic manufacturing. Over the last two cycles, localized production programs enabled the delivery of ~ systems across air and land segments, reducing external dependency. Investments of USD ~ million in industrial zones supported the establishment of ~ facilities focused on assembly and integration. These financial commitments expanded the operational fleet by ~ units while enabling lifecycle upgrades for ~ platforms, reinforcing long-term capability enhancement through domestic capacity building.

Escalating regional security threats and border protection needs

Heightened security dynamics have driven increased deployment intensity, with border surveillance missions supported by the induction of ~ aerial and ground platforms in recent periods. Operational command units expanded coverage across ~ km of sensitive zones, requiring sustained procurement of ISR-enabled systems. Annual allocations exceeding USD ~ million supported the activation of ~ new operational squadrons and patrol units. The deployment of ~ systems across coastal and desert regions strengthened rapid response readiness, ensuring continuous modernization cycles aligned with evolving threat scenarios.

Challenges

High capital intensity and long procurement cycles

The KSA Military Platforms market faces structural pressure from extended acquisition timelines, with major platform programs spanning ~ months from tender issuance to deployment. Capital commitments per program often exceed USD ~ million, constraining flexibility in rapid fleet expansion. Over recent periods, delayed deliveries affected the activation of ~ units, while deferred upgrade schedules impacted ~ operational platforms. Budget phasing across multi-year cycles tied up USD ~ million in committed but undelivered assets, highlighting the financial and operational implications of long lead times and complex approval structures.

Dependence on foreign technology and export controls

Despite localization initiatives, advanced avionics, propulsion systems, and sensor suites remain sourced externally, affecting deployment timelines for ~ platforms in recent cycles. Export clearance delays extended delivery schedules by ~ months for critical subsystems, impacting the readiness of ~ operational units. Annual technology import expenditures exceeded USD ~ million, underscoring ongoing reliance on foreign supply chains. These constraints limited rapid scalability for ~ programs and reinforced the strategic importance of accelerating domestic capability development to mitigate external dependency risks.

Opportunities

Localization partnerships with global OEMs under SAMI initiatives

Strategic joint ventures have unlocked significant industrial capacity, with recent collaborations enabling the localized assembly of ~ platforms and subsystems. Investments of USD ~ million in shared facilities supported the creation of ~ production lines dedicated to air and land systems. These partnerships facilitated the transfer of ~ technology modules and training for ~ personnel, strengthening national integration capabilities. The resulting output of ~ systems over recent periods reduced lead times and improved supply security, positioning localization as a critical growth lever for sustained market expansion.

Development of indigenous unmanned and loitering munition platforms

The unmanned segment presents strong expansion potential, supported by the deployment of ~ indigenous aerial and ground systems across surveillance and tactical roles. Development programs backed by USD ~ million in funding enabled the prototyping of ~ autonomous platforms, with ~ units already operational in border and maritime missions. These initiatives reduced acquisition costs by USD ~ million compared to imported alternatives and expanded fleet availability by ~ systems, reinforcing national self-reliance while addressing evolving operational requirements.

Future Outlook

The KSA Military Platforms market is set to advance through sustained modernization aligned with Vision 2030 defense industrialization goals. Emphasis on indigenous manufacturing, unmanned systems expansion, and digital battlefield integration will reshape procurement priorities. Strategic partnerships and technology transfer frameworks are expected to deepen, strengthening domestic capabilities. Over the coming decade, the market will transition toward network-centric and multi-domain platforms supporting enhanced operational agility and long-term defense resilience.

Major Players

- Saudi Arabian Military Industries

- Lockheed Martin

- Boeing Defense, Space and Security

- Airbus Defence and Space

- BAE Systems

- RTX

- Northrop Grumman

- General Dynamics

- Leonardo

- Thales Group

- Saab AB

- Rheinmetall

- Kongsberg Defence and Aerospace

- Navantia

- Oshkosh Defense

Key Target Audience

- Defense procurement authorities within the Ministry of Defense

- Saudi Arabian Military Industries and affiliated subsidiaries

- Armed forces acquisition and logistics commands

- Government and regulatory bodies such as the General Authority for Military Industries

- Defense system integrators and prime contractors

- Component suppliers and MRO service providers

- Investments and venture capital firms focused on defense technologies

- Strategic technology partners and offset program participants

Research Methodology

Step 1: Identification of Key Variables

Key demand drivers, platform categories, and procurement cycles were mapped using defense planning frameworks. Core variables included fleet age profiles, deployment intensity, and localization targets. These inputs formed the foundation for modeling acquisition and replacement dynamics.

Step 2: Market Analysis and Construction

Data sets covering procurement volumes, operational fleets, and capital allocations were consolidated. Scenario-based modeling was applied to assess modernization pathways and industrial capacity expansion under varying policy conditions.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through structured consultations with defense industry specialists and former procurement officials. Feedback loops refined assumptions on technology transfer, delivery timelines, and sustainment economics.

Step 4: Research Synthesis and Final Output

All qualitative and quantitative insights were integrated into a unified analytical framework. The final output was structured to support strategic planning, investment evaluation, and long-term capability development.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military platform taxonomy across air land and naval systems, market sizing logic by force structure modernization cycles and procurement timelines, revenue attribution across acquisitions upgrades and MRO services, primary interview program with defense operators OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational deployment pathways

- Ecosystem structure

- Supply chain and local content framework

- Regulatory and defense procurement environment

- Growth Drivers

Rising defense budget aligned with Vision 2030 localization goals

Escalating regional security threats and border protection needs

Modernization of aging air, land, and naval fleets

Expansion of indigenous manufacturing and MRO capabilities

Increasing adoption of unmanned and autonomous systems

Integration of advanced C4ISR and cyber-resilient platforms - Challenges

High capital intensity and long procurement cycles

Dependence on foreign technology and export controls

Complex technology transfer and IP protection constraints

Skills gap in advanced systems engineering and integration

Program delays due to regulatory and offset compliance

Lifecycle cost escalation and sustainment complexity - Opportunities

Localization partnerships with global OEMs under SAMI initiatives

Development of indigenous unmanned and loitering munition platforms

Upgrading legacy fleets with digital and network-centric capabilities

Expansion of regional export potential to GCC and MENA allies

Growth of integrated logistics support and MRO services

Adoption of AI-driven command and control platforms - Trends

Shift toward multi-domain operations and joint force platforms

Increasing emphasis on modular and upgradeable architectures

Rising deployment of autonomous ground and aerial systems

Greater focus on cyber resilience and electronic warfare

Expansion of naval platforms for Red Sea and Gulf security

Acceleration of defense industrialization and local content mandates - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Platforms, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land combat platforms

Fixed-wing aircraft

Rotary-wing aircraft

Naval surface combatants

Unmanned systems - By Application (in Value %)

Border security and territorial defense

Air defense and missile protection

Maritime security and coastal surveillance

Intelligence, surveillance, and reconnaissance

Strike and precision attack

Logistics and force mobility - By Technology Architecture (in Value %)

Conventional manned platforms

Unmanned and autonomous systems

Network-centric warfare platforms

AI-enabled combat systems

Modular open systems architecture platforms - By End-Use Industry (in Value %)

Royal Saudi Land Forces

Royal Saudi Air Force

Royal Saudi Naval Forces

Royal Saudi Air Defense Forces

Saudi Arabian National Guard - By Connectivity Type (in Value %)

Standalone operational platforms

Tactical data link–enabled platforms

Satellite communications–enabled platforms

Integrated C4ISR-connected platforms

5G-enabled battlefield networks - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (platform portfolio breadth, local content level, technology transfer depth, lifecycle support footprint, cost competitiveness, delivery timelines, combat-proven track record, cyber and systems integration capability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Saudi Arabian Military Industries (SAMI)

Lockheed Martin

Boeing Defense, Space & Security

Airbus Defence and Space

BAE Systems

RTX (Raytheon)

Northrop Grumman

General Dynamics

Leonardo

Thales Group

Saab AB

Rheinmetall

Kongsberg Defence & Aerospace

Navantia

Oshkosh Defense

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Platforms, 2026–2035

- By Average Selling Price, 2026–2035