Market Overview

The KSA Military Power Solutions market current size stands at around USD ~ million, reflecting steady expansion driven by defense modernization and infrastructure upgrades. Over the last two years, procurement spending reached nearly USD ~ million annually, supporting deployment of ~ systems across land, air, and naval platforms. Energy resilience programs contributed to installation of ~ mobile power units and ~ hybrid power modules, while base operations invested close to USD ~ million in smart power management technologies to improve reliability, efficiency, and operational readiness.

The market is geographically anchored in Riyadh, Jeddah, and Dhahran, where defense command centers, naval yards, and aerospace clusters create concentrated demand. These cities benefit from mature industrial ecosystems, advanced logistics corridors, and strong government backing for localization initiatives. Proximity to key military bases and research hubs has enabled faster deployment of advanced power solutions, supported by integrated supply chains and streamlined procurement channels aligned with national defense and industrial policies.

Market Segmentation

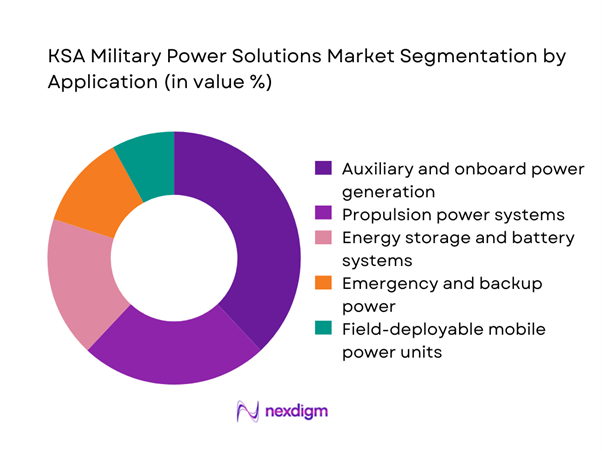

By Application

Auxiliary and onboard power generation dominates the KSA Military Power Solutions market due to its critical role across combat vehicles, naval vessels, and air platforms. Over the past two years, procurement contracts valued at USD ~ million focused on upgrading onboard systems for enhanced mission endurance and survivability. Demand has been driven by the installation of ~ power modules across armored fleets and ~ backup systems in naval assets. The growing complexity of electronic warfare suites and sensor arrays has further elevated requirements for reliable auxiliary power, encouraging adoption of hybrid and smart power technologies. These dynamics continue to reinforce the dominance of this segment across defense modernization programs.

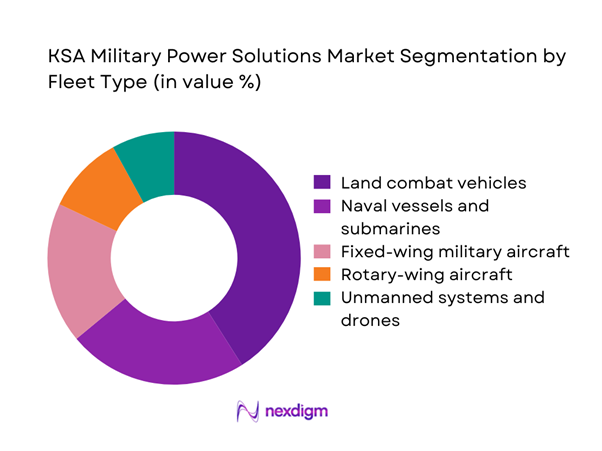

By Fleet Type

Land combat vehicles represent the leading fleet type segment, supported by large-scale modernization of armored brigades and border security units. In the last two years, acquisition programs allocated close to USD ~ million for integrating advanced power solutions into ~ vehicles, enhancing mobility and operational endurance. The segment benefits from sustained replacement cycles and upgrades to legacy platforms, driving continuous demand for compact, high-density power systems. Additionally, increased deployment of unmanned ground platforms has contributed to installation of ~ auxiliary power systems, reinforcing the dominance of land fleets in overall market value and technology adoption.

Competitive Landscape

The KSA Military Power Solutions market is moderately concentrated, with a mix of domestic defense manufacturers and global aerospace and defense firms shaping competitive dynamics. Localization mandates and technology transfer requirements have strengthened the position of regional players, while international companies maintain influence through long-term defense contracts and strategic partnerships with government entities.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Saudi Arabian Military Industries | 2017 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Advanced Electronics Company | 1988 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Military Power Solutions Market Analysis

Growth Drivers

Rising defense modernization programs under Vision 2030

Over the last two years, defense modernization initiatives supported procurement spending of nearly USD ~ million toward advanced power solutions for land, air, and naval platforms. These programs enabled deployment of ~ systems across combat fleets, including ~ hybrid power modules and ~ smart energy management units for base operations. Investments in next-generation armored vehicles and naval assets accelerated integration of high-density power architectures, increasing average system value to around USD ~ million per platform. The scale of modernization across ~ military facilities has strengthened long-term demand, reinforcing this driver as a foundational growth catalyst for the market.

Expansion of indigenous military manufacturing and localization mandates

Localization mandates have driven allocation of approximately USD ~ million into domestic manufacturing capabilities over the past two years, supporting establishment of ~ production lines for power electronics and energy storage systems. This shift enabled assembly of ~ systems locally, reducing reliance on imports and shortening supply cycles. Government-backed programs facilitated technology transfer agreements covering ~ hybrid modules and ~ battery platforms, elevating domestic value addition. As local firms expand capacity, annual output of military-grade power solutions reached ~ units, reinforcing supply security and stimulating sustained market growth through indigenous capability building.

Challenges

High capital expenditure and long procurement cycles

Deployment of advanced military power systems typically involves capital commitments of USD ~ million per program, creating budgetary pressure across defense portfolios. Over the last two years, approval timelines averaged ~ months for major contracts, delaying installation of ~ systems across multiple platforms. Extended testing and certification cycles further increased carrying costs by nearly USD ~ million annually. These financial and procedural constraints limit rapid scaling of new technologies, slowing replacement of legacy power infrastructure and restraining near-term market acceleration despite strong underlying demand.

Dependence on foreign technology and export controls

Despite localization efforts, nearly ~ critical components in high-performance military power solutions remain sourced from overseas suppliers, exposing procurement to export control restrictions. In the past two years, delayed clearances affected delivery of ~ systems, valued at approximately USD ~ million. These dependencies increased project timelines by ~ months and raised integration costs by close to USD ~ million per program. The reliance on foreign intellectual property also constrains customization for local operational needs, presenting a structural challenge to achieving full supply chain autonomy.

Opportunities

Development of indigenous power electronics and energy storage capabilities

Strategic focus on domestic innovation has opened opportunities for investments of nearly USD ~ million in power electronics and advanced battery technologies over the last two years. Pilot programs supported development of ~ locally engineered modules, enabling deployment of ~ systems across armored vehicles and base operations. These initiatives reduced unit dependency costs by around USD ~ million annually and created pathways for exporting ~ solutions to regional defense markets. Expanding indigenous R&D capacity positions the market to capture higher value segments and enhance long-term competitiveness.

Expansion of hybrid and microgrid solutions for base operations

Military base modernization programs allocated close to USD ~ million toward hybrid and microgrid deployments in the past two years, supporting installation of ~ integrated power systems across ~ facilities. These solutions improved energy resilience by enabling backup capacity of ~ megawatt-equivalent output while reducing reliance on conventional generators. Operational savings reached nearly USD ~ million annually, strengthening the business case for broader adoption. As infrastructure upgrades continue, this segment offers significant growth potential across fixed defense installations and remote operational zones.

Future Outlook

The KSA Military Power Solutions market is expected to evolve in line with long-term defense modernization and industrial localization strategies. Continued emphasis on energy resilience, smart power management, and hybrid architectures will shape procurement priorities. Strategic partnerships and technology transfer initiatives are likely to deepen domestic capabilities, while regional security dynamics will sustain investment momentum. Over the coming decade, the market is positioned for stable expansion supported by infrastructure upgrades and operational efficiency goals.

Major Players

- Saudi Arabian Military Industries

- Advanced Electronics Company

- Lockheed Martin

- RTX

- BAE Systems

- Northrop Grumman

- Boeing Defense, Space & Security

- Thales Group

- Leonardo S.p.A.

- Saab AB

- Rheinmetall AG

- General Dynamics

- Elbit Systems

- L3Harris Technologies

- Honeywell Aerospace

Key Target Audience

- Ministry of Defense of Saudi Arabia

- Saudi Arabian Military Industries procurement teams

- General Authority for Military Industries regulatory divisions

- Defense infrastructure operators and base commanders

- Investments and venture capital firms focused on defense technologies

- Energy and power system integrators serving military projects

- Government agencies overseeing localization and industrial policy

- Strategic partners and system integrators in the defense ecosystem

Research Methodology

Step 1: Identification of Key Variables

Core demand indicators, procurement cycles, and platform deployment data were identified to establish the scope of the market. Key technology segments and end-user groups were mapped to determine primary revenue drivers. Policy frameworks and localization mandates were incorporated to define structural influences. This step created a baseline for quantitative and qualitative assessment.

Step 2: Market Analysis and Construction

Data points were synthesized to build market estimates using deployment volumes and contract values. Historical trends in defense spending and infrastructure upgrades were analyzed to identify growth patterns. Segmentation frameworks were constructed around application and fleet types. The outcome was a structured view of current market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were tested through structured interactions with industry stakeholders and defense procurement experts. Assumptions regarding technology adoption and localization impact were refined. Scenario-based validation ensured alignment with operational realities. This process strengthened the reliability of growth and opportunity assessments.

Step 4: Research Synthesis and Final Output

All insights were consolidated into a coherent analytical framework. Quantitative estimates were aligned with qualitative trends to ensure consistency. Strategic implications were distilled for stakeholders across the value chain. The final output reflects an integrated perspective of market performance and future direction.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military power solution taxonomy across onboard and deployable energy systems, market sizing logic by platform deployment and modernization cycles, revenue attribution across equipment upgrades spares and support services, primary interview program with defense operators OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational usage pathways across defense platforms

- Ecosystem structure and key stakeholders

- Supply chain and channel structure

- Regulatory and defense procurement environment

- Growth Drivers

Rising defense modernization programs under Vision 2030

Expansion of indigenous military manufacturing and localization mandates

Increasing deployment of advanced combat platforms requiring higher power density

Growing emphasis on energy resilience for forward bases and critical assets

Adoption of smart and hybrid power technologies to improve operational efficiency

Heightened geopolitical tensions driving sustained defense spending - Challenges

High capital expenditure and long procurement cycles

Dependence on foreign technology and export controls

Integration complexity across legacy and next-generation platforms

Cybersecurity risks in networked power systems

Stringent military certification and compliance requirements

Supply chain vulnerabilities for critical components - Opportunities

Development of indigenous power electronics and energy storage capabilities

Expansion of hybrid and microgrid solutions for base operations

Strategic partnerships with global defense OEMs for technology transfer

Growth in unmanned systems increasing demand for compact power solutions

Lifecycle services, maintenance, and upgrade programs

Export potential to other Middle East and allied defense markets - Trends

Shift toward hybrid-electric military platforms

Rising adoption of lithium-ion and next-generation batteries

Integration of AI-enabled power management systems

Increased focus on sustainability and fuel efficiency in defense operations

Growth of mobile and rapidly deployable power solutions

Localization of manufacturing and MRO capabilities - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land combat vehicles

Naval vessels and submarines

Fixed-wing military aircraft

Rotary-wing aircraft

Unmanned systems and drones

Forward operating base infrastructure - By Application (in Value %)

Propulsion power systems

Auxiliary and onboard power generation

Energy storage and battery systems

Power management and distribution

Emergency and backup power

Field-deployable mobile power units - By Technology Architecture (in Value %)

Conventional diesel-based power systems

Hybrid-electric power solutions

Fully electric power architectures

Fuel cell-based power systems

Microgrid and smart power management platforms - By End-Use Industry (in Value %)

Army and land forces

Navy and coastal defense

Air force and aerospace command

Joint operations and special forces

Defense infrastructure and base operations - By Connectivity Type (in Value %)

Standalone power systems

Networked power management systems

IoT-enabled smart power solutions

Secure tactical communication-integrated systems - By Region (in Value %)

Central Region

Eastern Region

Western Region

Southern Region

Northern Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (local manufacturing footprint, defense certification portfolio, power density performance, lifecycle support capability, technology transfer readiness, cybersecurity compliance, cost competitiveness, regional partnerships)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Saudi Arabian Military Industries (SAMI)

Advanced Electronics Company (AEC)

Lockheed Martin

RTX (Raytheon Technologies)

BAE Systems

Northrop Grumman

Boeing Defense, Space & Security

Thales Group

Leonardo S.p.A.

Saab AB

Rheinmetall AG

General Dynamics

Elbit Systems

L3Harris Technologies

Honeywell Aerospace

- Demand and utilization drivers across defense services

- Procurement and tender dynamics within the Ministry of Defense

- Buying criteria and vendor selection processes

- Budget allocation and financing preferences

- Implementation barriers and operational risk factors

- Post-purchase service, training, and lifecycle support expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035