Market Overview

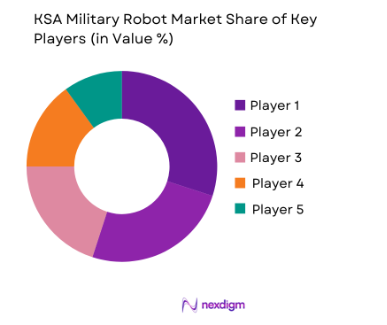

The KSA Military Robot market is valued at USD~ billion in 2025, with expectations to continue its robust growth in 2025, reaching approximately USD ~billion. The market is primarily driven by advancements in robotics and automation technologies, which have significantly enhanced the operational capabilities of the Saudi military. Government investments in defense innovation, under the framework of Vision 2035, have further contributed to the growth of this market. Automation in logistics, surveillance, and combat operations is expected to remain the key driver for growth in the coming years.

Countries like Saudi Arabia are leading the charge in the military robotics market due to their substantial defense budgets and the need for advanced defense technologies. The KSA government has prioritized enhancing military capabilities by investing heavily in robotics and automation. Additionally, global leaders like the US and Russia are also key players due to their superior technological innovations, but KSA’s significant investments in military modernization under Vision 2035 ensure its prominence in the market.

Market Segmentation

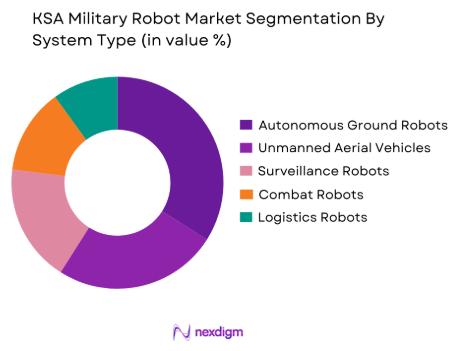

By System Type

The KSA Military Robot market is segmented by system type into autonomous ground robots, unmanned aerial vehicles (UAVs), surveillance robots, combat robots, and logistics robots. Among these, autonomous ground robots dominate the market share in 2025. This segment is driven by their versatile application in both tactical and logistical support in military operations. The use of ground robots for high-risk missions such as bomb disposal, mine clearance, and surveillance has gained momentum, pushing this sub-segment’s market share to the forefront.

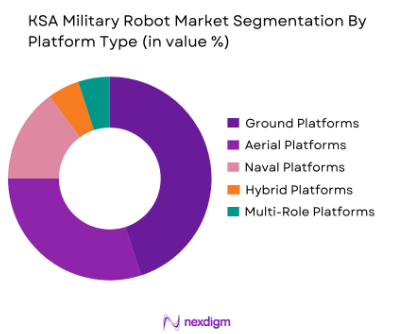

By Platform Type

The market is further segmented by platform type into ground platforms, aerial platforms, naval platforms, hybrid platforms, and multi-role platforms. Ground platforms lead the market in 2025. due to their critical role in surveillance and combat situations. These platforms, particularly unmanned ground vehicles (UGVs), are integral for reconnaissance and combat operations, which makes them indispensable for modern military applications, particularly in environments where human presence is a risk. Their effectiveness in both offensive and defensive operations makes this segment the dominant force in the market.

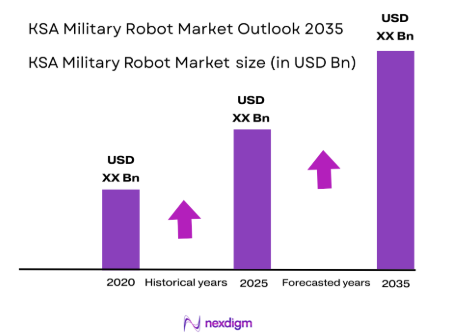

Competitive Landscape

The KSA Military Robot market is dominated by several key players, including global and regional firms. Companies like Lockheed Martin, BAE Systems, and Northrop Grumman are leading the charge with their cutting-edge robotic systems, catering to both local and international military needs. These companies benefit from their long-standing relationships with defense ministries and their advanced R&D capabilities, which enable them to lead in product innovation. Saudi Arabia’s ongoing investments in domestic defense capabilities are also boosting local players.

| Company Name | Establishment Year | Headquarters | Defense Robotics Expertise | R&D Capabilities | Market Integration | Service Network |

| Lockheed Martin | 1912 | USA | High | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | High | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | Very High | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | High | ~ | ~ | ~ |

| General Dynamics | 1952 | USA | High | ~ | ~ | ~ |

KSA Military Robot Market Analysis

Growth Drivers

Government Investments and Vision 2035 Initiatives

Saudi Arabia’s Vision 2035 has placed a strong emphasis on military modernization, including the adoption of advanced technologies like robotics and automation. The Saudi government is investing heavily in developing autonomous systems for various military operations such as surveillance, combat, and logistics. The increased defense budget, with a focus on innovation and local manufacturing, has accelerated the integration of military robots. These investments are driving the demand for autonomous systems in both offensive and defensive military strategies. As part of Vision 2035, the country is aiming to enhance its self-reliance in defense, leading to a surge in the adoption of military robots and related technologies, which is expected to propel the market’s growth in the coming years.

Technological Advancements in Robotics and AI

The continuous development in artificial intelligence (AI), machine learning, and robotics has become a significant growth driver for the military robot market in Saudi Arabia. AI-enabled systems enhance decision-making, enabling autonomous robots to perform complex tasks such as reconnaissance, surveillance, and combat operations. The integration of AI and robotics increases the efficiency and precision of military robots, making them crucial assets for modern defense operations. Technological advancements, including improved sensors, better mobility, and enhanced battlefield capabilities, have made military robots more reliable and versatile. These innovations are creating new opportunities for their deployment, particularly in high-risk environments where human presence is not ideal. With robotics and AI transforming military capabilities, the demand for such systems is rapidly increasing, further propelling the market’s growth.

Market Challenges

High Costs of Development and Integration

One of the major challenges facing the KSA Military Robot market is the high costs associated with the development and integration of advanced robotic systems. Military robots require significant investment in R&D, prototyping, and testing, particularly when incorporating complex technologies like AI, sensors, and autonomous navigation systems. Moreover, integrating these robots into existing military infrastructure presents additional costs in terms of both time and money. The sophisticated nature of these systems, along with the requirement for regular upgrades and maintenance, contributes to the overall high expenses. This financial burden may hinder some defense organizations from fully adopting military robotics, limiting the potential for growth in certain segments of the market.

Regulatory and Certification Challenges

Military robots in Saudi Arabia must comply with stringent regulatory standards and certification processes, which can be a barrier to rapid market growth. These robots need to meet specific military-grade standards related to security, reliability, and operational capability. The process of obtaining the necessary certifications for defense and military applications can be time-consuming and complex, delaying the entry of new products into the market. Moreover, the lack of standardized regulations for military robots can create inconsistencies across different platforms, further complicating the certification process. The challenges in meeting these regulatory requirements, coupled with the need for national and international approvals, slow down the adoption of robotic systems and increase the overall time to market.

Opportunities

Local Manufacturing and Technological Partnerships

As part of Saudi Arabia’s Vision 2035, the government is encouraging local manufacturing and technological partnerships in the defense sector. By partnering with international defense technology providers, Saudi Arabia aims to build a strong domestic robotics manufacturing base. This opportunity presents a significant advantage, as local production can reduce reliance on foreign imports, lower costs, and accelerate the development and deployment of military robots. Furthermore, technological partnerships between Saudi defense companies and global robotics firms can result in the transfer of knowledge and advanced technologies, leading to innovation and the enhancement of Saudi Arabia’s defense capabilities. This is likely to create a favorable environment for growth in the military robot market, as local production and technological advancements combine to boost competitiveness.

Increased Demand for Autonomous Military Systems

There is a growing global trend towards the adoption of autonomous systems in military operations, and Saudi Arabia is no exception. With the increasing demand for robots capable of performing critical tasks like surveillance, bomb disposal, logistics, and combat missions, the KSA military robot market is positioned to benefit from this trend. Autonomous systems not only reduce the risk to human life but also improve operational efficiency, allowing military forces to complete high-risk missions with greater precision. As Saudi Arabia focuses on modernizing its defense forces, there is a clear opportunity to develop and deploy more autonomous systems that can carry out complex tasks with minimal human intervention. The increasing demand for these systems is likely to provide significant growth opportunities for the military robot market in the region.

Future Outlook

Over the next 5 years, the KSA Military Robot market is expected to show significant growth driven by continuous government support, advancements in robotic technology, and increasing military expenditure under the Vision 2035 initiative. The Saudi Arabian government’s dedication to military modernization, combined with its focus on autonomous defense systems, will fuel demand for advanced robots. Furthermore, the integration of AI and robotics into military applications such as surveillance, combat, and logistics will accelerate the adoption of military robots.

Major Players

- Lockheed Martin

- BAE Systems

- Northrop Grumman

- Elbit Systems

- General Dynamics

- Leonardo DRS

- Thales Group

- Saab AB

- Kongsberg Gruppen

- Rheinmetall AG

- QinetiQ Group

- Textron Systems

- L3 Technologies

- Oshkosh Defense

- Mitsubishi Heavy Industries

Key Target Audience

- Investments and Venture Capitalist Firms

- Saudi Arabian Ministry of Defense

- Saudi Arabian General Authority for Military Industries

- Global Military Suppliers and Integrators

- National Security Agencies

- Regional Defense Contractors

- Manufacturers of Military Robotics

- Local Military Research and Development Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Military Robot Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data regarding KSA’s defense industry, military robotics adoption, and technological advancements will be compiled and analysed. This includes evaluating the penetration of robotic systems across various military operations and the related revenue generation. The goal is to assess the market’s size, trends, and growth prospects.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through consultations with industry experts. These experts will include government defense bodies, military technology manufacturers, and contractors. Expert insights will provide operational and financial data, which will be instrumental in refining market models.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with key defense suppliers in Saudi Arabia to acquire detailed insights into product segments, market trends, and the future outlook. This will ensure the reliability and accuracy of the market analysis and provide comprehensive findings for strategic decision-making.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for advanced security systems

Expansion of defense budgets for robotics and automation

Technological advancements in autonomous systems - Challenges

High initial development and deployment costs

Complexities in certification and regulatory compliance

Integration challenges with existing defense systems - Opportunities

Collaboration with international defense technology providers

Local manufacturing initiatives under KSA Vision 2030

Expanding demand for autonomous military applications - Trends

Increased adoption of AI in military robotics

Growing focus on swarm robotics for tactical operations

Enhancements in robot durability and environmental adaptability

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Autonomous Ground Robots

Unmanned Aerial Vehicles (UAVs)

Surveillance Robots

Combat Robots

Logistics Robots - By Platform Type (In Value%)

Ground Platforms

Aerial Platforms

Naval Platforms

Hybrid Platforms

Multi-Role Platforms - By Fitment Type (In Value%)

Onboard Systems

Remote Operated Systems

Fully Autonomous Systems

Semi-Autonomous Systems

Hybrid Systems - By End User Segment (In Value%)

Army

Air Force

Navy

Government & Defense Contractors

Private Security & Surveillance Agencies - By Procurement Channel (In Value%)

Government Procurement

Defense Contracts

Private Sector Procurement

International Procurement

Local Manufacturing

- Market Share Analysis

- Cross Comparison Parameters (Technological Integration, Market Penetration, Cost Structure, Product Innovation, Service Network)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Elbit Systems

Lockheed Martin

BAE Systems

Northrop Grumman

General Dynamics

Raytheon Technologies

Leonardo DRS

Thales Group

Saab AB

Oshkosh Defense

QinetiQ Group

Rheinmetall AG

Kongsberg Gruppen

Textron Systems

L3 Technologies

- Adoption of military robots by defense forces

- Emerging use of robots for peacekeeping and humanitarian missions

- Increased interest from private sector security companies

- Growing demand for robots in logistics and supply chain management

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035