Market Overview

The KSA Military Sensors market current size stands at around USD ~ million, reflecting steady expansion driven by modernization priorities and multi-domain defense programs. Recent spending on advanced sensing platforms has crossed USD ~ million, while annual deployment of new systems has reached ~ systems across land, air, and naval forces. Installed base upgrades now exceed ~ platforms, indicating a shift toward digital battlefield readiness and integrated situational awareness across operational theaters nationwide.

The market is dominated by defense clusters in Riyadh, Dhahran, and Jeddah, where command centers, air bases, and naval facilities concentrate demand for advanced sensing technologies. These regions benefit from mature defense ecosystems, localized manufacturing initiatives, and proximity to major procurement authorities. Strong infrastructure, secure logistics corridors, and favorable industrial policies further reinforce their leadership in hosting sensor integration, testing, and lifecycle support activities.

Market Segmentation

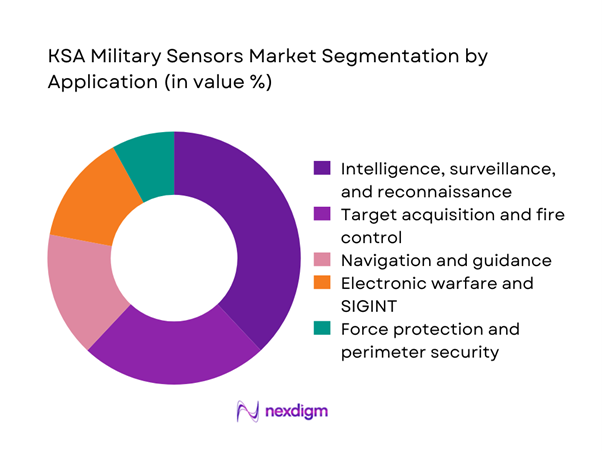

By Application

The intelligence, surveillance, and reconnaissance segment dominates the KSA Military Sensors market, driven by persistent border security requirements and multi-layered threat monitoring across land, sea, and air domains. Growing deployment of unmanned systems and network-centric warfare platforms has accelerated demand for persistent sensing solutions, particularly in electro-optical, infrared, and radar-based systems. Target acquisition and fire control applications follow closely, supported by upgrades in armored vehicles, air defense platforms, and naval combat systems. Navigation and guidance sensors also maintain strong traction due to modernization of aircraft fleets and missile systems. Together, these applications define a market landscape shaped by real-time data needs, force protection priorities, and command-and-control integration requirements.

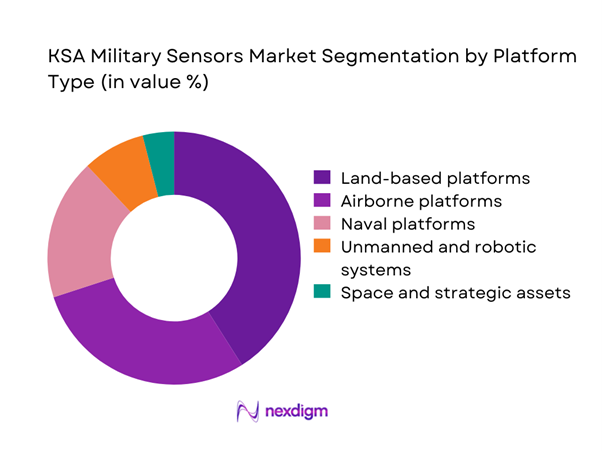

By Platform Type

Land-based platforms account for the largest share of sensor deployment in Saudi Arabia, supported by continuous upgrades to armored vehicles, artillery systems, and border surveillance infrastructure. Airborne platforms follow, reflecting sustained investments in fighter aircraft, airborne early warning systems, and unmanned aerial vehicles. Naval platforms maintain steady demand as coastal defense, maritime surveillance, and fleet protection programs expand across the Red Sea and Arabian Gulf. Space and strategic surveillance assets are emerging as a high-impact segment, driven by growing interest in satellite-based sensing and long-range threat monitoring. Together, platform diversification underscores a shift toward multi-domain defense architectures requiring interoperable and resilient sensor ecosystems.

Competitive Landscape

The KSA Military Sensors market is moderately concentrated, characterized by a mix of global defense technology leaders and a growing base of localized defense electronics firms. Strategic partnerships, offset programs, and long-term service agreements shape competitive positioning, while localization mandates increasingly influence contract awards and ecosystem participation.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Saudi Arabian Military Industries | 2017 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Advanced Electronics Company | 1988 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Military Sensors Market Analysis

Growth Drivers

Rising defense modernization and Vision ~ localization mandates

Accelerated defense transformation has driven sustained procurement of advanced sensing platforms, with modernization programs channeling USD ~ million toward digital battlefield technologies. Platform upgrades across ~ systems in land and air forces have increased demand for integrated radar, electro-optical, and signals intelligence sensors. Localization mandates further amplify this momentum, with domestic production initiatives targeting ~ facilities and ~ assembly lines. These efforts are reshaping procurement models, encouraging technology transfer, and expanding long-term maintenance ecosystems. As modernization spending remains a priority, sensor adoption continues to scale across command, surveillance, and force protection applications.

Expansion of ISR and border surveillance programs

Persistent regional security dynamics have led to the deployment of ~ surveillance systems across critical border zones and maritime corridors. Investments exceeding USD ~ million in integrated ISR networks now support continuous monitoring of ~ kilometers of strategic frontiers. Multi-layer sensing architectures combining radar, infrared, and acoustic systems have increased operational coverage by ~ installations nationwide. These programs reinforce the centrality of sensors in national defense planning, driving consistent procurement cycles and long-term service contracts that sustain market growth across multiple defense agencies.

Challenges

High dependence on foreign technology and export controls

A significant share of advanced military sensors remains sourced from international suppliers, with imports accounting for ~ systems deployed annually. This dependence exposes procurement timelines to export licensing constraints affecting ~ programs and delaying ~ upgrades. Compliance requirements linked to sensitive technologies also elevate integration costs beyond USD ~ million in several major contracts. Such constraints limit rapid capability expansion and complicate lifecycle management, highlighting the urgency of localization strategies to mitigate geopolitical and supply chain risks.

Lengthy defense procurement and qualification cycles

Defense acquisition processes typically span ~ months from tender issuance to contract execution, slowing the deployment of critical sensor systems. Qualification and testing phases alone can involve ~ trials across multiple platforms, extending program timelines and escalating administrative overheads exceeding USD ~ million. These prolonged cycles reduce vendor agility, delay operational readiness, and constrain the pace of technological refresh. As a result, both suppliers and end users face challenges in aligning fast-evolving sensor innovations with rigid procurement frameworks.

Opportunities

Localization of sensor manufacturing under GAMI and SAMI initiatives

National defense industrialization programs have earmarked USD ~ million to establish ~ localized production and integration facilities for military electronics. These initiatives target the assembly of ~ sensor systems annually, strengthening domestic supply chains and reducing reliance on imports. Localization also enables faster customization for platform-specific requirements, improves lifecycle support efficiency, and builds indigenous engineering capabilities. Over time, these programs are expected to reposition Saudi Arabia as a regional hub for defense sensor manufacturing and system integration.

Development of AI-enabled and edge-processing sensor solutions

Growing operational complexity has created demand for ~ AI-driven sensor platforms capable of real-time data fusion and autonomous threat recognition. Investments of USD ~ million in defense digitalization are accelerating deployment of ~ edge-compute enabled systems across ISR and force protection roles. These solutions reduce latency, enhance decision-making speed, and lower data transmission burdens. As adoption expands, AI-integrated sensors are poised to become a defining feature of next-generation defense architectures in the kingdom.

Future Outlook

The KSA Military Sensors market is set to evolve toward highly integrated, software-defined, and AI-enabled ecosystems through the coming decade. Continued emphasis on localization, multi-domain operations, and autonomous platforms will reshape procurement strategies and supplier partnerships. As defense modernization remains a strategic priority beyond ~, sensor technologies will play an increasingly central role in national security and regional defense collaboration frameworks.

Major Players

- Saudi Arabian Military Industries

- Advanced Electronics Company

- Saudi Arabian Defense Electronics Company

- Thales Group

- Leonardo

- RTX

- Lockheed Martin

- Northrop Grumman

- BAE Systems

- L3Harris Technologies

- Elbit Systems

- Saab AB

- Hensoldt

- Teledyne FLIR

- Rohde & Schwarz

Key Target Audience

- Ministry of Defense of Saudi Arabia

- General Authority for Military Industries

- Saudi Arabian Military Industries procurement teams

- Royal Saudi Air Force systems integration units

- Royal Saudi Naval Forces acquisition departments

- Border Guard and internal security agencies

- Defense-focused investments and venture capital firms

- National cybersecurity and communications regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Defense spending patterns, platform upgrade cycles, and sensor adoption rates were mapped across major military branches. Supply chain structures and localization initiatives were analyzed to assess production dynamics. Regulatory frameworks and procurement pathways were evaluated to understand market entry conditions.

Step 2: Market Analysis and Construction

Historical deployment trends and system replacement cycles were reviewed to build baseline demand scenarios. Platform-level integration requirements were examined to estimate technology mix evolution. Ecosystem mapping supported assessment of supplier and partner roles.

Step 3: Hypothesis Validation and Expert Consultation

Operational assumptions were validated through structured discussions with defense procurement and engineering stakeholders. Scenario testing helped refine demand drivers and risk factors. Feedback loops ensured alignment with real-world deployment practices.

Step 4: Research Synthesis and Final Output

Quantitative and qualitative insights were consolidated into a coherent market narrative. Strategic implications were evaluated for suppliers and policymakers. Final outputs were structured to support investment, localization, and capability planning decisions.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military sensor taxonomy across electro optical radar and acoustic systems, market sizing logic by platform deployment and upgrade cycles, revenue attribution across equipment sales spares and support services, primary interview program with defense operators OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and scope

- Market evolution

- Operational and mission usage pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and defense procurement environment

- Growth Drivers

Rising defense modernization and Vision 2030 localization mandates

Expansion of ISR and border surveillance programs

Increased procurement of unmanned and autonomous platforms

Growing focus on electronic warfare and spectrum dominance

Heightened regional security threats and force readiness needs

Acceleration of digital battlefield and network-centric warfare adoption - Challenges

High dependence on foreign technology and export controls

Lengthy defense procurement and qualification cycles

Complex integration with legacy platforms

Budget prioritization across multi-domain programs

Cybersecurity risks in connected sensor networks

Shortage of specialized local engineering talent - Opportunities

Localization of sensor manufacturing under GAMI and SAMI initiatives

Development of AI-enabled and edge-processing sensor solutions

Retrofit and upgrade of existing platforms with advanced sensing

Growth in space-based and high-altitude surveillance programs

Public-private partnerships for defense R&D and testing

Export potential to allied GCC and MENA defense markets - Trends

Shift toward multi-sensor fusion and integrated situational awareness

Adoption of software-defined and modular sensor architectures

Increased use of AI and machine learning in target recognition

Expansion of passive and low-probability-of-intercept sensing

Growing emphasis on cyber-resilient and secure-by-design systems

Rising deployment of sensors in unmanned and autonomous missions - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land forces platforms

Naval vessels and coastal defense assets

Air force aircraft and air defense systems

Unmanned systems and robotics

Space and strategic surveillance assets - By Application (in Value %)

Intelligence, surveillance, and reconnaissance

Target acquisition and fire control

Navigation and guidance

Electronic warfare and signals intelligence

Force protection and perimeter security

Command, control, and situational awareness - By Technology Architecture (in Value %)

Radar and RF sensing systems

Electro-optical and infrared sensors

Sonar and underwater acoustic sensors

LiDAR and laser-based sensors

Signals intelligence and spectrum monitoring sensors

Multispectral and hyperspectral imaging systems - By End-Use Industry (in Value %)

Royal Saudi Land Forces

Royal Saudi Air Force

Royal Saudi Naval Forces

Saudi Arabian National Guard

Border Guard and internal security forces

Defense research, testing, and evaluation units - By Connectivity Type (in Value %)

Hardwired and platform-integrated systems

Tactical data link enabled sensors

Satellite communication enabled sensors

Secure mesh network connected sensors

Edge-compute and AI-enabled autonomous sensors - By Region (in Value %)

Central region defense installations

Western region naval and air bases

Eastern region critical infrastructure protection

Northern border security zones

Southern border and counter-threat zones

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (sensor portfolio breadth, platform integration capability, localization and offset compliance, cybersecurity and data protection standards, pricing competitiveness, aftersales and MRO support, R&D and innovation intensity, program execution track record)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Saudi Arabian Military Industries

Advanced Electronics Company

Saudi Arabian Defense Electronics Company

Thales Group

Leonardo

RTX (Raytheon)

Lockheed Martin

Northrop Grumman

BAE Systems

L3Harris Technologies

Elbit Systems

Saab AB

Hensoldt

Teledyne FLIR

Rohde & Schwarz

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035