Market Overview

The KSA Military Simulation and Training market current size stands at around USD ~ million, reflecting steady expansion supported by defense modernization programs and rising adoption of synthetic training platforms. Recent annual spending levels have remained near USD ~ million in each of the last two periods, while active simulator deployments exceed ~ systems across air, land, and naval forces. Ongoing infrastructure investments of nearly USD ~ million annually continue to strengthen local training capacity and reduce dependence on overseas facilities.

The market is primarily concentrated in Riyadh, Dhahran, and Jeddah, where defense command centers, air bases, and naval training hubs create sustained demand for advanced simulation environments. These cities benefit from mature defense ecosystems, proximity to procurement authorities, and access to skilled technical workforces. Strong policy alignment with national defense localization goals further reinforces regional dominance, supported by expanding industrial clusters focused on digital defense solutions and mission-critical training technologies.

Market Segmentation

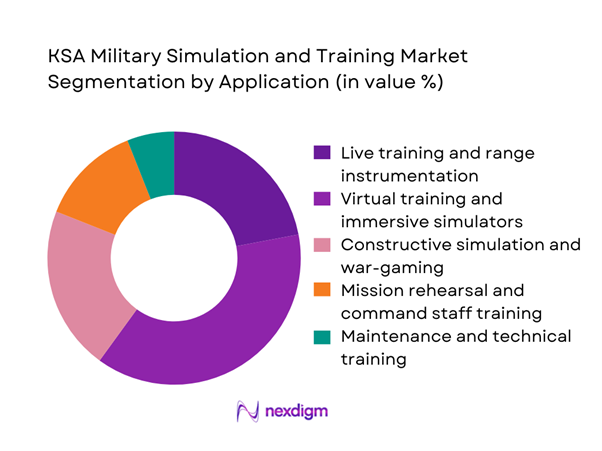

By Application

Virtual training and immersive simulators dominate the KSA Military Simulation and Training market, driven by the armed forces’ increasing reliance on cost-efficient and scalable alternatives to live exercises. Over ~ systems currently in operation are aligned with flight simulation, mission rehearsal, and tactical decision training. Annual deployment levels exceed ~ units, supported by infrastructure investments of nearly USD ~ million in centralized training hubs. These platforms offer consistent performance tracking, safer operational environments, and faster skill acquisition cycles, making them the preferred choice for both frontline units and specialized forces.

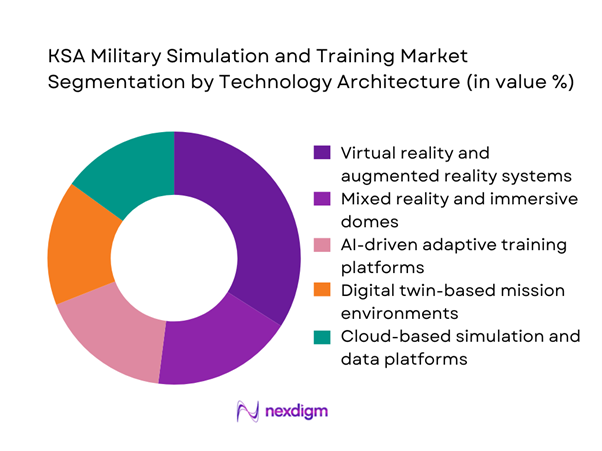

By Technology Architecture

Virtual reality and augmented reality systems represent the leading technology architecture in the market, supported by rapid adoption across air and land forces. More than ~ platforms are currently configured with immersive interfaces, while annual system upgrades average ~ units. Defense digitalization programs channel close to USD ~ million each cycle into advanced visualization and scenario modeling tools. These technologies enable realistic combat environments, reduce training downtime, and improve retention outcomes, positioning them as the cornerstone of next-generation military training strategies in the Kingdom.

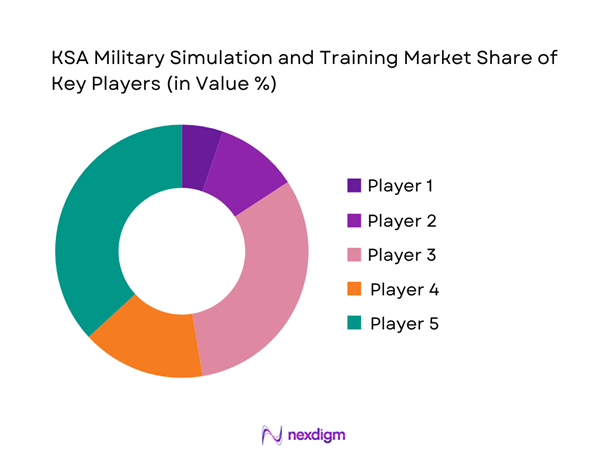

Competitive Landscape

The KSA Military Simulation and Training market shows moderate concentration, with a limited number of global defense technology leaders and regional champions controlling a large share of high-value contracts. Entry barriers remain high due to certification requirements, long procurement cycles, and the need for localized support capabilities. However, ongoing localization policies are gradually creating space for new partnerships and domestic system integrators.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| CAE | 1947 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Military Simulation and Training Market Analysis

Growth Drivers

Rising defense modernization under Vision 2030

Defense modernization programs have driven consistent capital allocation of nearly USD ~ million annually toward advanced training systems, with more than ~ platforms upgraded across air, land, and naval forces. The transition from legacy training tools to integrated digital environments has increased system deployments by over ~ units during the last two cycles. These investments support readiness benchmarks that require higher training throughput, pushing utilization levels to nearly ~ sessions per year across centralized academies and operational bases.

Increased focus on combat readiness and joint-force interoperability

Joint-force interoperability initiatives have accelerated the adoption of networked simulation systems, with over ~ systems now integrated across multiple service branches. Annual training volumes exceed ~ mission scenarios, supported by infrastructure upgrades worth USD ~ million. This focus ensures standardized operational doctrines, reduces coordination gaps, and improves response times during combined exercises, reinforcing simulation as a strategic enabler of national defense preparedness.

Challenges

High upfront capital costs of advanced simulation platforms

Advanced immersive simulators require initial investments of up to USD ~ million per deployment, creating budgetary pressure on training commands managing multiple bases. Installation programs often exceed ~ systems per phase, adding to lifecycle expenditure through maintenance and software upgrades. These cost structures can delay rollout schedules and limit rapid scaling, especially when procurement priorities shift toward frontline equipment acquisitions.

Lengthy defense procurement and approval cycles

Defense procurement timelines frequently extend beyond ~ months, slowing the adoption of newer simulation technologies. Approval workflows involve more than ~ stakeholder groups, increasing administrative complexity and project lead times. As a result, some training units continue operating ~ legacy systems longer than planned, constraining the pace of modernization and limiting access to next-generation training capabilities.

Opportunities

Localization and in-Kingdom manufacturing of simulators

Localization initiatives have opened opportunities for domestic production facilities capable of delivering ~ systems annually. Capital commitments nearing USD ~ million support the establishment of assembly lines, software labs, and maintenance hubs. These efforts reduce import dependence, improve response times, and create a sustainable ecosystem for long-term defense training innovation.

Public-private partnerships in defense training infrastructure

Public-private partnerships are enabling the development of multi-service training complexes, with infrastructure investments surpassing USD ~ million across recent projects. These facilities can host more than ~ trainees annually and support ~ concurrent simulation environments. Such models lower fiscal pressure on defense budgets while accelerating access to advanced training technologies and operational expertise.

Future Outlook

The KSA Military Simulation and Training market is expected to progress steadily through the next decade as defense digitalization, localization mandates, and multi-domain warfare requirements reshape training strategies. Greater integration of immersive technologies and data-driven performance management will define future procurement priorities. Partnerships between public entities and private defense technology providers are likely to expand, supporting scalable and resilient training ecosystems aligned with long-term national security objectives.

Major Players

- CAE

- Thales Group

- L3Harris Technologies

- Saab AB

- Leonardo S.p.A.

- Lockheed Martin

- BAE Systems

- Raytheon Technologies

- Boeing Defense, Space & Security

- Rheinmetall AG

- Indra Sistemas

- Cubic Corporation

- Elbit Systems

- QinetiQ

- Saudi Arabian Military Industries

Key Target Audience

- Saudi Ministry of Defense procurement departments

- General Authority for Military Industries

- Saudi Arabian Military Industries strategy teams

- Royal Saudi Air Force training command

- Saudi Arabian Army operational readiness units

- Royal Saudi Navy training and doctrine centers

- Investments and venture capital firms focused on defense technologies

- Government and regulatory bodies such as the Saudi Arabian Military Industries Authority

Research Methodology

Step 1: Identification of Key Variables

Key demand drivers, technology adoption patterns, and procurement cycles were mapped across air, land, and naval forces. Training infrastructure capacity, system deployment rates, and localization mandates were analyzed. Strategic defense priorities and operational readiness benchmarks were incorporated.

Step 2: Market Analysis and Construction

Segment-level demand was structured by application and technology architecture. Deployment volumes and investment flows were modeled across major defense regions. Policy frameworks and industrial participation goals were integrated into the analysis.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through structured discussions with defense training planners and system integrators. Assumptions on adoption speed and localization impact were stress-tested. Feedback loops refined the market development pathways.

Step 4: Research Synthesis and Final Output

All quantitative and qualitative inputs were consolidated into a unified framework. Strategic implications for stakeholders were assessed. Findings were translated into actionable market intelligence.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military simulation and training system taxonomy across live virtual and constructive solutions, market sizing logic by training seat demand and simulator deployment, revenue attribution across software licenses hardware platforms and support services, primary interview program with defense training commands OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Training and readiness pathways

- Ecosystem structure

- Supply chain and delivery models

- Regulatory and defense procurement environment

- Growth Drivers

Rising defense modernization under Vision 2030

Increased focus on combat readiness and joint-force interoperability

Shift toward cost-efficient synthetic training over live exercises

Expansion of domestic defense manufacturing and localization mandates

Growing complexity of modern warfare and multi-domain operations

Integration of advanced technologies such as AI and digital twins - Challenges

High upfront capital costs of advanced simulation platforms

Lengthy defense procurement and approval cycles

Cybersecurity and data sovereignty concerns

Interoperability issues across legacy and new systems

Limited local talent pool for advanced simulation engineering

Dependence on foreign technology providers for core platforms - Opportunities

Localization and in-Kingdom manufacturing of simulators

Public-private partnerships in defense training infrastructure

Export potential to GCC and allied regional forces

Development of indigenous software and content ecosystems

Integration of simulation with smart bases and digital command centers

Expansion into homeland security and critical infrastructure training - Trends

Adoption of immersive VR and mixed reality training environments

Use of AI for personalized and adaptive training scenarios

Convergence of live, virtual, and constructive training systems

Growth of networked and distributed simulation architectures

Increased use of data analytics for performance assessment

Shift toward modular and scalable simulation solutions - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land forces simulation platforms

Air forces flight and mission simulators

Naval and maritime training systems

Joint and combined forces training environments - By Application (in Value %)

Live training and range instrumentation

Virtual training and immersive simulators

Constructive simulation and war-gaming

Mission rehearsal and command staff training

Maintenance and technical training - By Technology Architecture (in Value %)

Virtual reality and augmented reality systems

Mixed reality and immersive domes

AI-driven adaptive training platforms

Digital twin-based mission environments

Cloud-based simulation and data platforms - By End-Use Industry (in Value %)

Saudi Arabian Army

Royal Saudi Air Force

Royal Saudi Navy

Special operations and homeland security forces

Defense academies and training institutes - By Connectivity Type (in Value %)

Standalone and offline systems

Networked on-premise simulators

Cloud-enabled training platforms

5G and edge-enabled simulation systems

Secure tactical network-integrated systems - By Region (in Value %)

Riyadh and Central Region

Eastern Province

Western Region

Southern Region

Northern Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology depth, localization capability, system interoperability, cybersecurity compliance, after-sales support, pricing flexibility, training content quality, integration with C4ISR systems)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

CAE

L3Harris Technologies

Thales Group

Lockheed Martin

Boeing Defense, Space & Security

Raytheon Technologies

BAE Systems

Saab AB

Rheinmetall AG

Leonardo S.p.A.

Indra Sistemas

Cubic Corporation

Elbit Systems

QinetiQ

Saudi Arabian Military Industries

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service and lifecycle support expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035