Market Overview

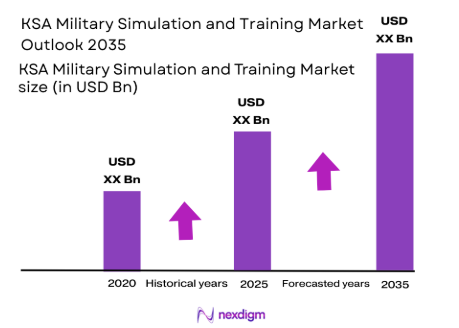

The KSA military simulation and training market is poised for significant growth, driven by substantial government defense investments and technological advancements. The market size is expected to expand rapidly as Saudi Arabia prioritizes modernizing its armed forces, improving readiness, and integrating sophisticated simulation technologies into military training. The government’s commitment to enhancing defense capabilities is reflected in increased spending, with total defense expenditure set to surpass USD ~billion. Technological improvements in training simulators, including virtual and live systems, contribute to the market’s expansion by offering cost-effective and efficient training solutions.

The Kingdom of Saudi Arabia’s dominance in the military simulation and training market is attributed to a combination of factors, including its strategic location, advanced defense infrastructure, and significant defense budget. As one of the largest military spenders globally, KSA has built a strong foundation for developing cutting-edge simulation technologies. Major cities such as Riyadh, Jeddah, and Dhahran host a majority of military installations and training centres, enabling quick adoption of these technologies. The growing need for effective military training, alongside the Kingdom’s vision to bolster national security and defense preparedness, positions KSA as a leader in the market.

Market Segmentation

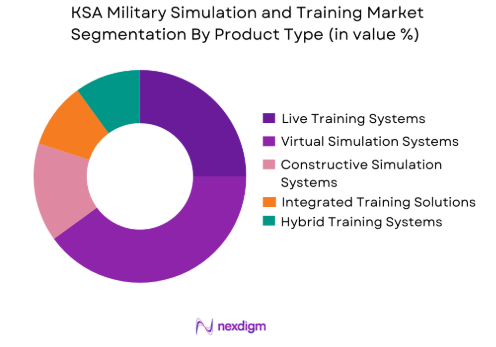

By Product Type

The KSA military simulation and training market is segmented by product type into live training systems, virtual simulation systems, constructive simulation systems, integrated training solutions, and hybrid training systems. Recently, virtual simulation systems have a dominant market share due to their ability to provide immersive, cost-effective, and scalable training options. These systems enable highly realistic training scenarios while reducing the operational cost and logistics associated with live training. Moreover, the growing adoption of advanced simulation technologies to train military personnel in a variety of environments has been a key driver of this segment’s dominance.

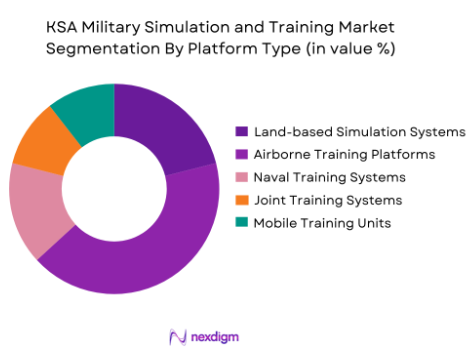

By Platform Type

The market is also segmented by platform type, including land-based simulation systems, airborne training platforms, naval training systems, joint training systems, and mobile training units. Airborne training platforms hold a dominant market share due to the increasing demand for air force training systems that replicate real-life aerial combat scenarios. These platforms simulate combat environments for pilots, offering essential hands-on experience in a controlled and safe environment. The growing focus on enhancing the capabilities of air forces to handle modern warfare has spurred this sub-segment’s growth.

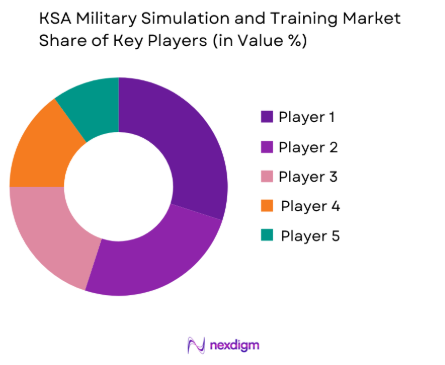

Competitive Landscape

The KSA military simulation and training market is competitive, characterized by the presence of both international and domestic players. Key players are focusing on technological innovation, strategic partnerships, and acquisitions to consolidate their positions in the market. These players leverage their strong R&D capabilities and vast experience in the defense sector to create cutting-edge training systems that meet the evolving needs of the Saudi armed forces. The market’s competitiveness is driven by the demand for customized training solutions that enhance military readiness and operational efficiency.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Lockheed Martin | 1912 | Bethesda, USA | Simulation Technologies | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | Virtual Reality, AI-driven Training | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | Cybersecurity, Simulation | ~ | ~ | ~ | ~ |

| L3 Technologies | 2016 | New York, USA | Simulation & Training Systems | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | Defense Simulation | ~ | ~ | ~ | ~ |

KSA Military Simulation and Training Market Analysis

Growth Drivers

Increasing Defense Expenditure

The primary growth driver in the KSA military simulation and training market is the significant increase in defense expenditure. Saudi Arabia has been increasing its defense budget year-on-year, and with an allocation of over USD 61 billion in the recent budget, the Kingdom remains one of the top spenders globally. This robust defense spending not only fuels the procurement of advanced military equipment but also drives investments in modernizing training infrastructure. As part of its Vision 2030 objectives, Saudi Arabia is focusing on enhancing the capabilities of its armed forces by integrating advanced technology, such as simulation systems, to better prepare personnel for modern warfare scenarios. The growing demand for realistic, cost-effective training solutions further bolsters the adoption of simulation technologies, which is vital for air, land, and sea-based operations.

Technological Advancements in Simulation Systems

The growing importance of technology in defense training is another key driver of the market. Simulation technologies have evolved rapidly, incorporating artificial intelligence (AI), virtual reality (VR), and augmented reality (AR) to create realistic, immersive training environments. These innovations allow military personnel to engage in scenarios that replicate real-life combat situations without the associated risks. Saudi Arabia’s focus on adopting these cutting-edge technologies to modernize its military is driving the demand for advanced training systems. Additionally, the ability to simulate complex environments such as air and naval operations has become a cornerstone of military readiness, providing personnel with hands-on experience in handling sophisticated equipment and complex missions. These advancements enable cost-effective training by reducing the need for physical resources and live combat scenarios.

Market Challenges

High Costs of Advanced Simulation Systems

One of the primary challenges faced by the KSA military simulation and training market is the high upfront cost associated with acquiring and implementing advanced simulation systems. These systems are often highly complex, requiring significant investments in infrastructure, software, and hardware. While the long-term benefits of simulation training in terms of operational readiness and reduced logistical costs are clear, the initial capital required to deploy such systems can be a deterrent. Many organizations within the military sector are hesitant to allocate significant portions of their budgets to simulation systems when faced with the need to purchase other essential equipment. As a result, the challenge lies in striking a balance between acquiring cutting-edge simulation systems and meeting other operational needs.

Integration with Legacy Systems

Another significant challenge is the integration of modern simulation systems with existing, often outdated, military platforms. Saudi Arabia’s military infrastructure comprises both advanced and legacy systems and adapting simulation solutions to these varying technologies can be technically challenging. Integrating these systems requires not only technological expertise but also extensive testing and adaptation to ensure compatibility and effective performance. The complexity of training personnel on such diverse systems, coupled with the need for consistent updates, adds a layer of operational difficulty. Therefore, achieving seamless integration without disrupting ongoing training or operations is a key challenge that Saudi Arabia’s defense sector must address to fully leverage simulation technologies.

Opportunities

Collaboration with International Defense Contractors

One of the most promising opportunities in the KSA military simulation and training market lies in collaboration with leading international defense contractors. With its growing defense budget and focus on modernization, Saudi Arabia has the potential to form strategic partnerships with global players to develop customized simulation solutions that meet its specific training requirements. These partnerships can also involve joint ventures and technology transfer agreements, which will not only improve the capabilities of Saudi Arabia’s military but also foster long-term cooperation in defense manufacturing and innovation. Collaborating with internationally renowned firms brings the added advantage of incorporating the latest technological advancements and expertise into Saudi military training programs.

Adoption of Hybrid and Virtual Training Platforms

The increasing demand for hybrid and virtual training platforms presents a significant opportunity for the KSA military simulation and training market. Hybrid systems that combine live, virtual, and constructive simulation offer enhanced flexibility and scalability, making them ideal for training large numbers of personnel across diverse scenarios. These platforms reduce logistical and operational costs by providing a mix of virtual and live training modules, making them more accessible and cost-effective for defense forces. Additionally, the global trend towards virtual training, bolstered by advancements in VR and AR, creates opportunities for the development and adoption of immersive training experiences. As Saudi Arabia continues to focus on high-tech solutions, the shift towards hybrid training systems presents a favorable market opportunity.

Future Outlook

The future outlook of the KSA military simulation and training market is optimistic, with expected growth driven by technological advancements, increasing defense expenditure, and the growing emphasis on modernizing training systems. Over the next five years, the demand for simulation systems will continue to rise, particularly in sectors like airborne training platforms and virtual simulation systems. As Saudi Arabia’s military enhances its readiness and operational capabilities, there will be a heightened focus on integrating AI, VR, and AR into training platforms. Additionally, continued collaboration with international defense contractors and the expansion of hybrid training systems will further accelerate market growth.

Major Players

- Lockheed Martin

- BAE Systems

- Northrop Grumman

- L3 Technologies

- Raytheon Technologies

- Saab Group

- Elbit Systems

- Leonardo

- Group

- Cubic Corporation

- Rockwell Collins

- Simi Gossow Simulation Systems

- Textron Systems

- CAE Inc.

- General Dynamics

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military personnel training organizations

- Aerospace and defense equipment suppliers

- Military technology developers

- Security agencies

- National defense ministries

Research Methodology

Step 1: Identification of Key Variables

The identification of key variables involves recognizing the critical factors that influence market trends, including defense expenditure, technological advancements, and training system requirements. These variables form the foundation for market analysis.

Step 2: Market Analysis and Construction

Market analysis is conducted by gathering data from credible sources, including industry reports, market surveys, and expert interviews. A comprehensive understanding of the KSA military simulation and training sector is built through this process.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts, government bodies, and defense contractors are conducted to validate hypotheses and obtain accurate market projections.

Step 4: Research Synthesis and Final Output

The final research output synthesizes data, trends, and expert insights to create a comprehensive market report, offering actionable insights for stakeholders and decision-makers.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budgets in Saudi Arabia

Technological advancements in simulation technologies

Rising demand for advanced training systems in military operations - Market Challenges

High costs associated with advanced simulation systems

Complexity in integrating new systems with legacy platforms

Regulatory and certification challenges in the defense sector - Market Opportunities

Collaborations with international defense contractors

Development of cost-effective and scalable training solutions

Expanding focus on hybrid training systems and virtual platforms - Trends

Shift toward AI-powered simulation training

Integration of virtual and live training environments

Increasing adoption of mobile and modular training solutions

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Live Training Systems

Virtual Simulation Systems

Constructive Simulation Systems

Integrated Training Solutions

Hybrid Training Systems - By Platform Type (In Value%)

Land-based Simulation Systems

Airborne Training Platforms

Naval Training Systems

Joint Training Systems

Mobile Training Units - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Upgraded Systems

Custom Fitment

Aftermarket Fitment - By End User Segment (In Value%)

Defense Ministries

Armed Forces

Private Defense Contractors

Training and Simulation Providers

Military Educational Institutions - By Procurement Channel (In Value%)

Government Procurement

Private Procurement

Direct Sales

Third-party Procurement

Public-Private Partnerships

- Market Share Analysis

- Cross Comparison Parameters (Technology adoption rate, Government defense expenditure, Integration challenges, Regional defense collaboration, Procurement policies)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

BAE Systems

Northrop Grumman

L3 Technologies

General Dynamics

Raytheon Technologies

Saab Group

Elbit Systems

Leonardo

Thales Group

Cubic Corporation

Rockwell Collins

Simi Gossow Simulation Systems

Textron Systems

CAE Inc.

- Adoption of simulation and training systems in the Saudi military

- Role of private contractors in enhancing military training capabilities

- Growing importance of multi-domain training for joint forces

- Rising focus on custom-designed training systems for specialized units

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035