Market Overview

The KSA Military Training Aircraft Market is valued at USD ~ billion, with strong growth driven by the Kingdom’s ongoing defense and aviation modernization programs. Increased investments in local pilot training facilities and the expanding air force fleet are key factors propelling the market forward. In addition, the growing emphasis on reducing reliance on foreign pilot training has been a critical driver of the market’s expansion.

The market is dominated by countries with robust defense budgets and advanced aviation industries, notably the United States, Saudi Arabia, and European nations. These countries lead due to their strategic defense investments and established relationships with local and international OEMs. Saudi Arabia’s position is strengthened by the Vision 2030 defense modernization plan, which supports the domestic demand for training aircraft to support the Kingdom’s growing military and air defense capabilities.

Market Segmentation

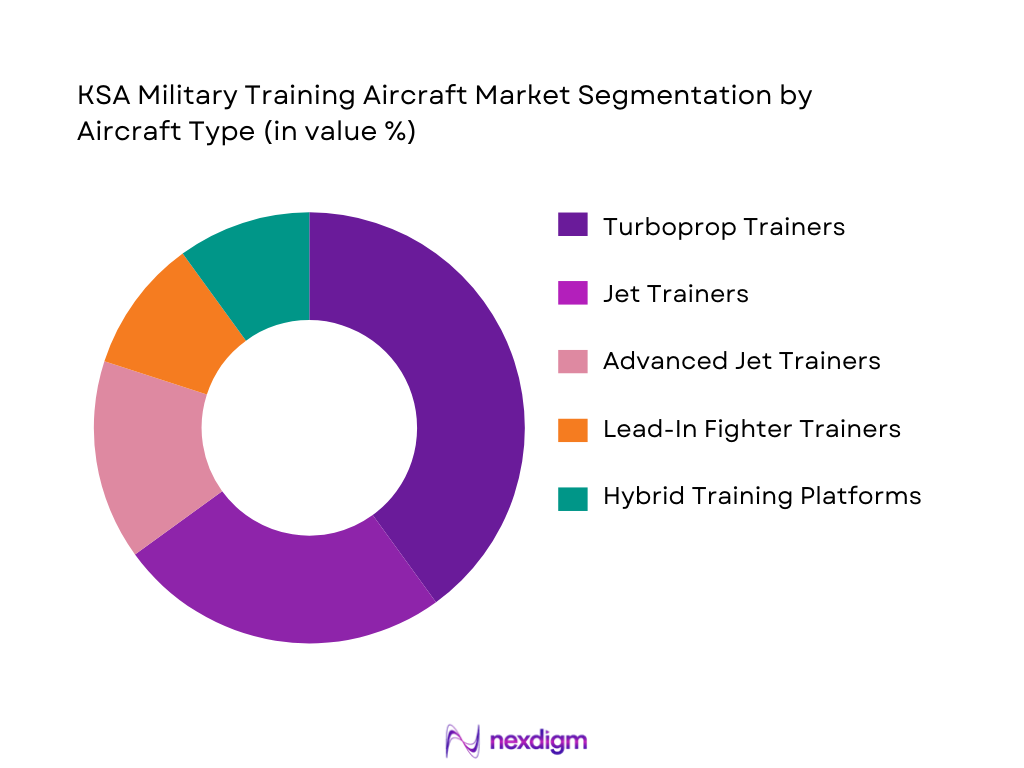

By Aircraft Type

The KSA Military Training Aircraft market is segmented into turboprop trainers, jet trainers, advanced jet trainers, lead-in fighter trainers, and hybrid training platforms. Turboprop trainers currently dominate the segment due to their cost-effectiveness and suitability for basic and intermediate pilot training. These platforms provide cost-efficient solutions for initial flight training, with a strong presence in the KSA Air Force.

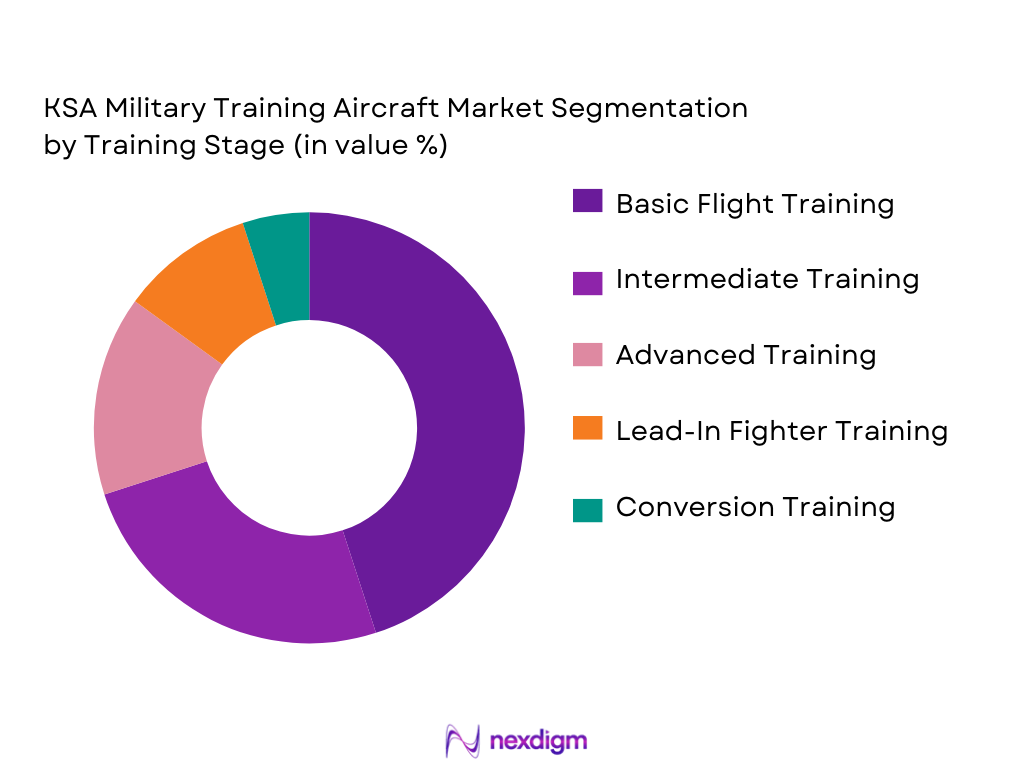

By Training Stage

The market is further segmented by training stage, including basic flight training, intermediate training, advanced training, lead-in fighter training, and conversion training. Basic flight training is the dominant segment, driven by the need for initial pilot training programs. This stage serves as the foundation for pilots in KSA, with many aircraft and flight schools dedicated to primary training, fostering the growth of this sub-segment.

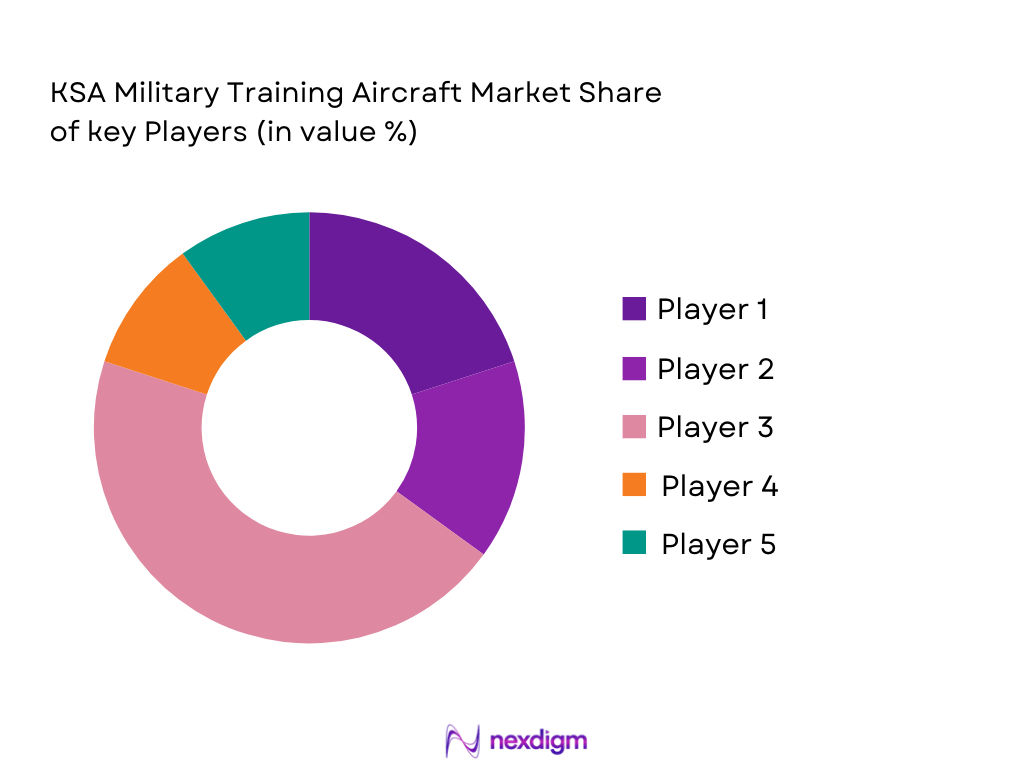

Competitive Landscape

The KSA Military Training Aircraft market is dominated by a few major players, including global aerospace manufacturers and local defense contractors. These companies have established a strong presence in the Kingdom through strategic collaborations with the Saudi government, leveraging the growing defense budget allocated to the country’s modernization efforts.

| Company | Establishment Year | Headquarters | Aircraft Expertise | Regional Footprint | Government Ties | MRO Capabilities |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ |

| Textron Aviation Defense | 1923 | USA | ~ | ~ | ~ | ~ |

KSA Military Training Aircraft Market Analysis

Growth Drivers

Air Force Fleet Expansion

The expansion of the Royal Saudi Air Force (RSAF) fleet is a significant driver of the KSA Military Training Aircraft market. As the Kingdom continues to modernize its military capabilities, there has been a steady increase in the acquisition of advanced fighter aircraft, such as the Eurofighter Typhoon, Boeing F-15, and the F-35. This modernization requires a corresponding increase in the number of pilots trained to operate these advanced platforms. To meet the demand for qualified pilots, the RSAF is investing heavily in upgrading its training aircraft fleet, both to provide initial basic training as well as transition to advanced jet training. The KSA is focusing on increasing the size and diversity of its air fleet to meet defense requirements, which directly correlates to the need for more training aircraft to prepare pilots for operational readiness. Furthermore, as the Kingdom develops more sophisticated defense capabilities, including more specialized military operations, the demand for advanced training aircraft with greater capabilities is expected to rise. This will include not only aircraft that provide basic flight training but also advanced trainers that simulate combat environments, ensuring that pilots are prepared for the realities of modern warfare. The fleet expansion also involves the replacement and modernization of outdated training aircraft, further increasing procurement. As a result, the Air Force fleet expansion is expected to drive significant demand for both basic and advanced training aircraft in the years to come.

Indigenous Pilot Training Capacity Development

Saudi Arabia’s increasing emphasis on self-reliance in defense matters has significantly impacted the demand for military training aircraft. Historically, the RSAF relied on foreign institutions for pilot training, but this reliance is shifting. Under Vision 2030, one of the key goals is to localize defense capabilities, including the training of military personnel. This involves establishing more in-country training academies and expanding the capacity of Saudi Arabian aviation institutions to handle basic, intermediate, and advanced flight training. As part of this initiative, the Kingdom is investing in indigenous pilot training facilities and local manufacturing of aircraft to serve both the domestic and regional markets. This drive to build a sustainable aviation workforce requires a large fleet of training aircraft, as these are essential in providing the various levels of instruction required by the growing number of pilots. The localization efforts will not only reduce reliance on foreign training systems but also ensure that KSA has complete control over its pilot training programs. Additionally, this development supports the Saudi government’s defense industrialization agenda, promoting collaboration between local suppliers and foreign OEMs to produce aircraft locally. As a result, indigenous capacity development will continue to expand the demand for training aircraft, driving long-term growth in this market segment.

Market Challenges

High Capital Acquisition Costs

The cost of acquiring military training aircraft represents a significant challenge for the Kingdom of Saudi Arabia, as well as for other nations with similar defense strategies. Training aircraft, particularly advanced jet trainers and lead-in fighter trainers, require high upfront capital investments. These costs cover the purchase of the aircraft, installation of high-tech avionics, integration of simulation systems, and the necessary support and training infrastructure. Additionally, the procurement of training aircraft often involves longer procurement cycles due to their complexity and the need for military-grade customization. This high cost burden can strain military budgets, especially when competing against other defense priorities such as combat aircraft acquisition, missile defense systems, and naval upgrades. Furthermore, maintenance and operational costs are recurring, requiring further investment over the life cycle of the aircraft. This presents a financial challenge for governments seeking to modernize their air forces while ensuring the sustainability of their training programs. To mitigate these challenges, KSA has turned to options like joint production agreements, leasing models, and foreign military sales, but the initial capital outlay remains a significant hurdle for the KSA Military Training Aircraft market.

Long Certification and Acceptance Cycles

The certification and acceptance processes for military aircraft, including training aircraft, can be lengthy and complex, especially for new and advanced systems. Certification involves rigorous testing to ensure that the aircraft meet all safety, operational, and combat-readiness standards set by national and international aviation bodies. For KSA, the military training aircraft must pass through stringent compliance checks mandated by both Saudi and international aviation authorities. Furthermore, the integration of advanced technology, such as avionics, simulation systems, and hybrid control mechanisms, can delay acceptance as these systems undergo extensive evaluations. In some cases, these processes may take years, thereby delaying the delivery and operational deployment of training platforms. This long certification cycle disrupts procurement schedules and can lead to cost overruns. Additionally, delays in training aircraft delivery can create gaps in pilot training, potentially leading to operational readiness issues for the air force. The length of time required for aircraft certification and acceptance can also affect the Kingdom’s ability to meet its defense objectives promptly, making this a significant challenge for the KSA Military Training Aircraft market.

Opportunities

Localization of Assembly and MRO

One of the key opportunities in the KSA Military Training Aircraft market is the increasing push toward localizing assembly and maintenance, repair, and overhaul (MRO) operations. The Kingdom’s Vision 2030 aims to strengthen the local defense and aviation industry by creating self-sufficiency and reducing dependence on foreign suppliers. Establishing local manufacturing and MRO capabilities would allow Saudi Arabia to not only reduce operational costs but also enhance the speed and efficiency of aircraft servicing and upgrades. With the growing fleet of training aircraft, the need for local support infrastructure is critical. By collaborating with global aerospace companies, Saudi Arabia can set up production facilities for training aircraft and specialized components, creating jobs and boosting the local economy. Furthermore, a localized MRO industry would ensure that training aircraft are maintained to the highest standards, reducing the downtime of the fleet and increasing its operational availability. Localizing these functions would also enable faster response times for maintenance and reduce the logistical challenges associated with transporting aircraft for repairs or upgrades. These factors position localization as a major opportunity, ensuring long-term sustainability and operational efficiency for Saudi Arabia’s military aviation infrastructure.

Integrated Live-Virtual-Constructive Training Ecosystems

Another exciting opportunity in the KSA Military Training Aircraft market lies in the development and implementation of Integrated Live-Virtual-Constructive (LVC) training ecosystems. This approach combines live flight training with virtual simulations and constructive environments to provide a comprehensive and immersive pilot training experience. LVC training systems allow pilots to experience real-world flying conditions while simultaneously interacting with simulated scenarios and enemy engagements, all without the logistical costs and risks associated with live missions. This integration of advanced simulation technologies into the training pipeline will enhance the effectiveness and safety of pilot training, especially for complex scenarios such as combat and tactical operations. The KSA has already been making strides in incorporating simulation into its military training, and the expansion of LVC systems is expected to increase the demand for advanced training aircraft that can interface seamlessly with these virtual environments. The integration of AI-driven simulators, synthetic environments, and real-time data analytics will further enhance the training process, allowing pilots to gain experience in a broader range of scenarios. As a result, the development of LVC ecosystems presents a significant opportunity for the KSA Military Training Aircraft market, driving innovation and improving the quality of pilot training in the Kingdom.

Future Outlook

Over the next several years, the KSA Military Training Aircraft market is poised for significant growth, driven by continued investments in defense capabilities, an emphasis on indigenous pilot training, and a growing need for modernized training systems. The Kingdom’s Vision 2030 will play a pivotal role in shaping the future of this market, with a greater focus on self-sufficiency, enhanced training technologies, and strategic defense partnerships. The increasing integration of advanced flight simulators and artificial intelligence into training platforms will further fuel market growth, positioning KSA as a regional leader in military aviation.

Major Players

- Lockheed Martin

- Boeing

- BAE Systems

- Leonardo

- Textron Aviation Defense

- Northrop Grumman

- Pilatus Aircraft

- Korea Aerospace Industries

- Embraer Defense & Security

- Turkish Aerospace Industries

- Hal

- Aero Vodochody

- Hindustan Aeronautics Limited

- Saab AB

- L3 Technologies

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Defense, KSA Air Force)

- Defense Procurement Agencies

- Military Aviation Manufacturers

- Air Force Training Commands

- OEM Partners and Tier-1 Suppliers

- Aviation and Military Research Organizations

- Defense Contractors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying critical factors impacting the KSA Military Training Aircraft Market. Desk research will provide a comprehensive understanding of market drivers, challenges, and competitive dynamics, helping to define key variables that influence growth and demand.

Step 2: Market Analysis and Construction

Historical data will be compiled and analyzed to assess market penetration, aircraft procurement strategies, and revenue generation. The analysis will include evaluating training systems and aircraft lifecycle costs to develop a holistic view of the market’s structure and dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through in-depth consultations with military experts, OEMs, and industry specialists. These expert consultations will help refine the assumptions and provide insights into the operational and strategic challenges facing the KSA market.

Step 4: Research Synthesis and Final Output

This phase will involve direct engagement with aviation manufacturers and military personnel to obtain insights into aircraft performance, training systems, and future procurement plans. The final research output will synthesize the gathered data into a comprehensive, actionable market report.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Defense Aviation Taxonomy, Abbreviations, Bottom-Up and Top-Down Market Sizing Logic, Procurement-Led Demand Modeling, Primary Interviews with Air Force and OEM Stakeholders, Validation Through Offset and Localization Data, Limitations and Assumptions)

- Market Definition and Scope

- Market Genesis and Evolution

- Military Training Aircraft Lifecycle Mapping

- Training Doctrine Alignment

- Supply Chain and Value Chain Analysis

- Growth Drivers

Air Force Fleet Expansion

Indigenous Pilot Training Capacity Development

Shift from Foreign Training Dependency - Market Challenges

High Capital Acquisition Costs

Long Certification and Acceptance Cycles - Opportunities

Localization of Assembly and MRO

Integrated Live-Virtual-Constructive Training Ecosystems - Technology Trends

Embedded Simulation

Digital Twin Aircraft

Advanced Flight Control Systems

Defense and Aviation Regulations

Airworthiness Certification

Military Flight Safety Standards

Export Control Compliance - Stakeholder Ecosystem

- Air Force Commands

- Defense Procurement Authorities

- OEMs

- Training Service Providers

- Porter’s Five Forces Analysis

- Competitive Intensity and Entry Barriers

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Aircraft Type (In Value %)

Turboprop Trainer

Jet Trainer

Advanced Jet Trainer

Lead-In Fighter Trainer

Hybrid Training Platforms

- By Training Stage (In Value %)

Basic Flight Training

Intermediate Training

Advanced Training

Lead-In Fighter Training

Conversion Training

- By Engine Configuration (In Value %)

Single Engine Trainer

Twin Engine Trainer

- By Avionics and Simulation Integration (In Value %)

Analog Cockpit

Glass Cockpit

Embedded Simulation

Networked Training Systems

AI-Enabled Training Suites

- By Procurement Model (In Value %)

Direct Government Procurement

Foreign Military Sales

Joint Production Programs

Leasing and Service-Based Training

Public-Private Partnership Models

- Market Share Assessment of Key Players

- Cross Comparison Parameters (Platform Performance Envelope, Training Stage Coverage, Localization Capability, Offset Compliance Depth, Avionics and Simulation Integration Level, MRO Footprint in KSA, Fleet Interoperability with Fighter Platforms, Upgrade and Scalability Roadmap)

- Strategic Positioning and Capability Mapping

- Pricing and Lifecycle Cost Benchmarking

- Company Profiles

Boeing Defense

Lockheed Martin

BAE Systems

Leonardo

Pilatus Aircraft

Korea Aerospace Industries

Turkish Aerospace Industries

Embraer Defense & Security

Textron Aviation Defense

Dassault Aviation

Saab AB

Aero Vodochody

HAL

Diamond Aircraft Industries

Northrop Grumman

- Air Force Training Command Requirements

- Procurement Budget Allocation Logic

- Decision-Making Framework

- Training Output and Utilization Metrics

- Operational Pain Points and Capability Gaps

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035