Market Overview

The KSA military transport aircraft market is valued at approximately USD ~ billion, derived from consolidated procurement disclosures, budget execution statements of the Saudi Ministry of Defense, and platform-level contract values reported in official government releases and SIPRI defense acquisition datasets. The market is driven by sustained fleet expansion and replacement programs covering strategic airlifters, tactical transports, and multi-role tanker transport aircraft. Increased operational demand for rapid troop deployment, humanitarian assistance, regional force projection, and coalition interoperability continues to support procurement momentum. Defense budget allocations exceeding USD ~ billion across recent fiscal cycles reinforce long-term investment in air mobility assets.

The market is dominated by Saudi Arabia as the sole national buyer, with procurement influence extending to manufacturing and supplier hubs in the United States and Western Europe. Riyadh serves as the strategic command and procurement center, while Dhahran and Jeddah host key airbases supporting airlift operations. The United States dominates supply due to long-standing defense cooperation, Foreign Military Sales frameworks, and interoperability alignment, while European countries maintain relevance through tanker and medium transport platforms supported by offset and localization agreements under Vision 2030.

Market Segmentation

By Aircraft Type

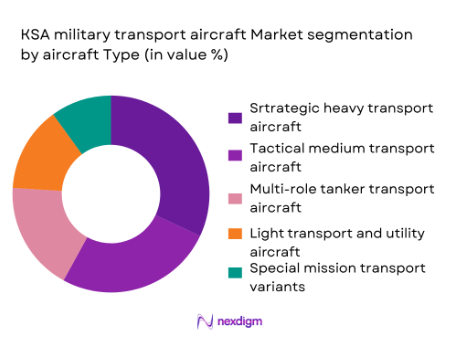

The KSA military transport aircraft market is segmented by aircraft type into strategic heavy transport aircraft, tactical medium transport aircraft, light transport and utility aircraft, multi-role tanker transport aircraft, and special mission transport variants.

Strategic heavy transport aircraft dominate this segmentation due to Saudi Arabia’s geographic scale, expeditionary doctrine, and reliance on long-range airlift for rapid force mobility. These aircraft support inter-theater troop movement, armored vehicle transport, and humanitarian missions across the Middle East, Africa, and beyond. Their high payload capacity, extended range, and compatibility with coalition logistics networks make them indispensable for national defense planning. The Kingdom’s emphasis on strategic autonomy and global reach reinforces sustained investment in this sub-segment.

By End-User type

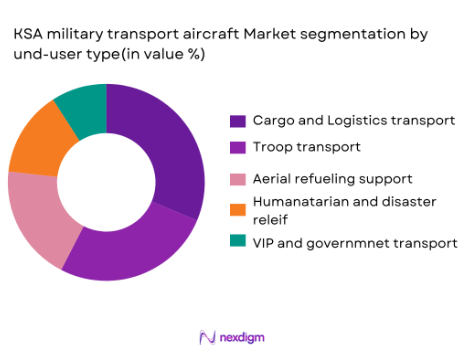

By end-use mission, the market is segmented into troop transport, cargo and logistics transport, aerial refueling support, humanitarian and disaster relief, and VIP/government transport.

Cargo and logistics transport represents the dominant sub-segment as the Saudi Armed Forces prioritize sustainment of large standing forces and forward-deployed units. Continuous movement of equipment, ammunition, and supplies between bases and operational theaters drives high utilization of transport fleets. This mission profile demands aircraft with flexible cargo configurations, rapid loading systems, and high sortie rates. Ongoing regional security commitments and domestic infrastructure protection further reinforce the dominance of logistics-focused airlift missions.

Competitive Landscape

The KSA military transport aircraft market is highly consolidated, dominated by a small group of global aerospace OEMs with deep experience in military airlift platforms and long-standing defense relationships with Saudi Arabia. This concentration reflects the high technical barriers, certification requirements, and strategic trust involved in supplying core air mobility assets.

| Company | Establishment Year | Headquarters | Platform Portfolio | Airlift Experience | Tanker Capability | Local Offset Engagement | MRO Support | Program Longevity |

| Lockheed Martin | 1995 | USA | – | – | – | – | – | – |

| Boeing Defense | 2002 | USA | – | – | – | – | – | – |

| Airbus Defence | 2000 | Europe | – | – | – | – | – | – |

| Embraer Defense | 1969 | Brazil | – | – | – | – | – | – |

| Leonardo Aircraft | 1948 | Italy | – | – | – | – | – | – |

KSA Military transport aircraft Market Analysis

Growth Drivers

Expansion of Expeditionary Logistics and Regional Deployment Readiness

Saudi Arabia’s focus on enhancing expeditionary logistics and regional deployment readiness is underpinned by sustained defense expenditure and improved national logistics metrics, which create a conducive environment for military transport aircraft operations. In 2024, military spending reached USD ~ billion, with allocations in the 2025 budget rising to USD ~ billion, indicating continued investment focus on defence infrastructure and capabilities appropriate for global and regional deployments. These expenditures account for approximately 21 % of total government spending and affirm priority accorded to defense logistics. The World Bank’s Logistics Performance Index (LPI) for Saudi Arabia shows material improvement in core logistics indicators such as transport infrastructure quality and shipment timeliness compared to prior periods, enabling greater throughput of military cargo and readiness of air logistics operations. Within the Saudi Air Force inventory, the Royal Saudi Air Force operates 33 C-130H Hercules tactical transport aircraft and a growing fleet of Airbus A330 MRTT tanker/transports, with recent orders intended to expand this fleet to 10 aircraft. These platforms support strategic lift, aerial refueling, and humanitarian logistics missions, distinctly enhancing regional deployment capabilities. The nation’s logistics infrastructure progression, coupled with robust defense outlays which exceed 7 % of GDP, provides a statistically backed rationale for continued emphasis on transport and air mobility assets. This synergy of macroeconomic stability in logistics performance and substantial defense investment supports growth in demand for sophisticated military transport aircraft capable of supporting expeditionary and rapid deployment missions across the Middle East and beyond.

Fleet Modernization Priorities for Airlift, Tanker, and Support Aircraft

Saudi Arabia’s military transport aircraft market is significantly driven by fleet modernization directives that reflect strategic needs for advanced airlift, tanker, and support platforms. Defence spending in 2024 was reported at USD 75.8 billion, with planned increases to USD 78 billion in the 2025 budget, demonstrating sustained fiscal commitment to upgrading military capabilities. Within this broader budget context, the Royal Saudi Air Force (RSAF) is modernizing its transport and aerial refuelling assets. The RSAF currently fields six Airbus A330 Multi Role Tanker Transports (MRTTs) for strategic airlift and refueling, and has placed orders for an additional four units, aiming for a fleet size of 10 aircraft making it one of the largest MRTT operators globally outside Europe. Complementing this, the RSAF’s tactical airlift arm comprises 33 Lockheed C-130H Hercules aircraft, a primary workhorse platform for heavy cargo movement that has been progressively maintained and upgraded to meet evolving operational demands. These modernization initiatives align with Saudi Arabia’s broader defence strategy, which integrates logistics infrastructure improvements indicated by the World Bank’s enhanced Logistics Performance Index metrics. Specifically, higher logistics quality improves the ability to sustain complex aircraft operations and ensures that physical and procedural supply chain aspects support modern air mobility requirements. The combination of high defence spending, strategic procurement of modern tanker/transport aircraft, and improved national logistics capacity form a quantifiable basis for the transport aircraft market’s expansion, directly tied to operational preparatory objectives of the Saudi armed forces.

Market Challenges

Long Delivery Lead Times and Constrained Global Production Slots

One of the pressing challenges in the KSA military transport aircraft market relates to global industrial capacity constraints that extend delivery lead times for large transport and tanker platforms, which can disrupt fleet modernization timelines and readiness planning. High-value defence procurement segments such as strategic airlifters and multi-role tanker transports are resource-intensive, leading manufacturers to allocate limited global production slots across competing international orders. Saudi Arabia’s defence spending, which reached USD 75.8 billion in 2024 and is budgeted at USD ~ billion for 2025, underscores the nation’s prioritization of military capabilities; however, it simultaneously places the Kingdom in competition for finite production resources. Orders such as the recent procurement of four additional Airbus A330 MRTT aircraft — intended to expand the Royal Saudi Air Force’s fleet to 10 units — face multi-year delivery schedules that extend into the latter half of the decade due to manufacturing backlogs and conversion requirements. These delivery timelines are exacerbated by global defence supply chain bottlenecks, including scarcity of specialized components and workforce constraints post-pandemic, which affect major aerospace OEMs. Furthermore, a typical strategic transport aircraft ordering process often includes long lead times for integration of mission systems, logistics support, and training packages, a factor that amplifies operational planning risks. In addition to aircraft production rates, lead times for maintenance, repair and overhaul (MRO) capacity are similarly constrained, complicating sustainment readiness in a market that demands both new platforms and continued airworthiness of existing fleets. This systemic constraint in production and sustainment slots highlights a structural market challenge that the KSA must mitigate through careful procurement planning and defense industrial cooperation.

Complex Certification for Defensive Aids, Comms, and Mission Systems

The integration of advanced defensive aids, secure communications, and customized mission systems into military transport aircraft presents a significant market challenge due to the complexity and time required for certification, testing, and interoperability validation. Military transport platforms such as the Airbus A330 MRTT and Lockheed C-130 variants are complex systems that must meet rigorous defence standards that differ fundamentally from civilian certifications. These platforms must be equipped with tactical defensive suites, encrypted communications, electronic warfare countermeasures, and mission-specific avionics, all of which require comprehensive testing and approval processes conducted under both Saudi and original equipment manufacturer regulatory frameworks. The inclusion of such mission systems adds layers of technical certification, often requiring iterative integration cycles and prolonged qualification periods. Given Saudi Arabia’s substantial defence outlays USD 75.8 billion in 2024 and USD 78 billion budgeted for 2025 the nation’s investment portfolio encompasses both cutting-edge airlift capabilities and the complex sensor suites needed for operational effectiveness. However, the certification process is prolonged, particularly for defensive aids and secure comms suites that must meet allied interoperability standards for coalition operations. This results in extended development cycles, higher integration costs, and potential delays in achieving full operational capability. Moreover, the need to align mission systems with both national defense protocols and supplier compliance requirements contributes to timeline uncertainties for entry into service. These certification complexities influence procurement planning, lifecycle support arrangements, and ultimately affect the pace at which modernized transport aircraft can be fielded and sustained within the Kingdom’s strategic force structure.

Market Opportunities

Localization of MRO, Component Overhaul, and Depot-Level Sustainment

A significant opportunity within the KSA military transport aircraft market lies in the localization of maintenance, repair, and overhaul (MRO), component overhaul, and depot-level sustainment services. Saudi Arabia’s Vision 2030 economic framework emphasizes the development of domestic capabilities across strategic industries, including defence, to reduce reliance on foreign support and circulate investment locally. The Kingdom’s defence budget, reported at USD ~ billion for 2024 with an increase to USD 78 billion allocated for 2025, creates a large potential base for in-country sustainment activities. Localization efforts not only align with national industrial diversification goals but also address logistical bottlenecks associated with MRO throughput and aircraft readiness. Establishing local MRO facilities for platforms such as C-130 tactical transports and A330 MRTT aircraft provides quantifiable operational benefits: reduced ground time for deployed aircraft, lower lifecycle sustainment costs, and improved turnaround for mission-critical modifications. Such initiatives would leverage Saudi Arabia’s improving logistics performance, as reflected in World Bank LPI data, which indicates elevated infrastructure and freight handling competencies that support complex maintenance workstreams. Secondary economic benefits include employment generation in highly skilled aerospace sectors and retention of technical value within the domestic economy.

Conversion and Upgrade Programs for Legacy Transports and Tankers

The conversion and upgrade of legacy transport and tanker aircraft represent an emerging opportunity in the Saudi military transport aircraft market, driven by the need to enhance existing airlift capabilities while managing budgetary and industrial constraints. The Royal Saudi Air Force operates a mixed fleet of legacy tactical transports and aerial tankers — including 33 C-130H Hercules airlifters and older KC-130 variants — which present opportunities for modernization through avionics upgrades, structural life-extension programs, and mission system enhancements that extend operational utility without full new-aircraft procurement. In parallel, the strategic decision to order four additional Airbus A330 MRTT aircraft, increasing the fleet to a planned 10 units, underscores continued demand for modernization and multi-mission capability. Legacy upgrade programs can capitalize on existing physical assets while integrating contemporary communications, defensive aids, and digital cockpit technologies, offering cost-effective interim solutions ahead of full fleet renewal.

Future Outlook

Over the coming decade, the KSA military transport aircraft market is expected to maintain steady expansion supported by defense modernization programs, Vision 2030 localization objectives, and growing emphasis on rapid mobility. Fleet replacement cycles, tanker expansion, and digital fleet management adoption will shape procurement strategies. Increased focus on local MRO capability and sustainment partnerships will further influence supplier selection. The forecasted CAGR for the 2026–2035 period is estimated at approximately 5.4%, reflecting stable long-term defense investment priorities.

Key Market Players

- Lockheed Martin

- Boeing Defense, Space & Security

- Airbus Defence and Space

- Embraer Defense & Security

- Leonardo Aircraft

- SAMI Aerospace

- Advanced Electronics Company

- L3Harris Technologies

- Raytheon Technologies

- Northrop Grumman

- Collins Aerospace

- Safran Electronics & Defense

- Thales Group

- ST Engineering Aerospace

- Saab Aeronautics

Key Target Audience

- Royal Saudi Air Force logistics and procurement divisions

- Saudi Ministry of Defense acquisition authorities

- Saudi Arabian Military Industries leadership

- Aerospace and defense OEMs and tier-one suppliers

- Defense-focused private equity groups

- Investments and venture capitalist firms

- Government and regulatory bodies

- MRO and sustainment service providers

Research Methodology

Step 1: Identification of Key Variables

The study begins with mapping the KSA military transport aircraft ecosystem, covering OEMs, suppliers, procurement bodies, and end users. Extensive secondary research using defense budgets, procurement records, and proprietary databases is conducted to define key market variables.

Step 2: Market Analysis and Construction

Historical fleet data, delivery schedules, and upgrade programs are analyzed to construct the market size. Platform utilization and mission profiles are evaluated to ensure accurate revenue attribution.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through structured interviews with aerospace executives, former military logistics officers, and maintenance specialists. These insights refine procurement timing and upgrade cycle assessments.

Step 4: Research Synthesis and Final Output

Data from bottom-up analysis is cross-verified with expert inputs and government disclosures. The final output integrates quantitative and qualitative findings into a validated market model.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of expeditionary logistics and regional deployment readiness

Fleet modernization priorities for airlift, tanker, and support aircraft

Rising requirement for protected air mobility and survivable transport - Market Challenges

Long delivery lead times and constrained global production slots

Complex certification for defensive aids, comms, and mission systems

Dependence on foreign OEM support and spares under export controls - Market Opportunities

Localization of MRO, component overhaul, and depot-level sustainment

Conversion and upgrade programs for legacy transports and tankers

Digital fleet management, predictive maintenance, and readiness analytics - Trends

Integration of defensive aids and DIRCM for contested air corridors

Modular missionization for medevac, disaster relief, and rapid logistics

Increased use of performance-based logistics and availability contracts

By Market Value 2020-2025

By Installed Units 2020-2025

By Average System Price 2020-2025

By System Complexity Tier 2020-2025

- By System Type (In Value%)

Strategic heavy airlifters and outsized cargo transports

Tactical medium airlifters for intra-theater logistics

Light transport and utility lift aircraft

Aerial refueling-capable tanker transports derived from airlifters

Special mission transport variants for medevac and VIP mobility - By Platform Type (In Value%)

Fixed-wing strategic transport aircraft

Fixed-wing tactical transport aircraft

Multi-role tanker transport aircraft

STOL-capable tactical lifters for austere runways

Converted commercial freighters for military logistics support - By Fitment Type (In Value%)

New-build aircraft acquisition from OEM production lines

Mid-life upgrade and avionics modernization packages

Cargo handling and aerial delivery system retrofits

Self-protection suite integration for contested airlift

Missionization kits for medevac, ISR support, and secure comms - By End User Segment (In Value%)

Royal Saudi Air Force air mobility command

Royal Saudi Land Forces logistics aviation support units

Saudi Arabian National Guard airlift and logistics elements

Ministry of Interior aviation for security logistics transport

Royal Court and government special air transport units - By Procurement Channel (In Value%)

Government-to-government acquisitions and FMS-style programs

Direct OEM contracts and long-term support agreements

Prime contractor-led integration and upgrade procurement

Local MRO and offset-driven acquisition packages

Emergency operational requirement and rapid procurement channel

- Market Share Analysis

- Cross Comparison Parameters (Payload and range performance, STOL capability and runway requirements, Defensive aids and survivability suite maturity, Missionization flexibility and cargo handling systems, MRO footprint and spares availability, Interoperability and certification compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Lockheed Martin

Boeing Defense, Space & Security

Airbus Defence and Space

Embraer Defense & Security

Leonardo AircraftSAMI Aerospace

Advanced Electronics Company

Saab Aeronautics

L3Harris Technologies

Raytheon Technologies

Northrop Grumman

Collins Aerospace

Safran Electronics & Defense

Thales Group

ST Engineering Aerospace

- High readiness emphasis for rapid troop and cargo movement across theaters

- Preference for multi-role platforms combining airlift and tanker missions

- Operational focus on interoperability with allied air mobility standards

- Growing demand for local sustainment, training, and depot capacity

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035