Market Overview

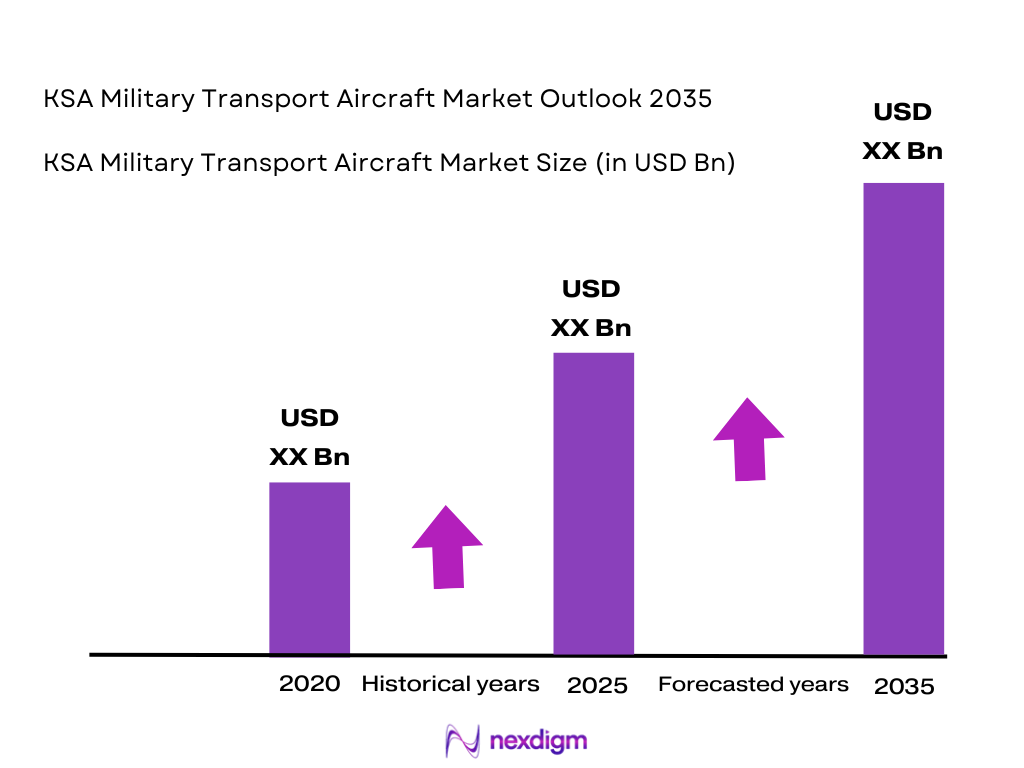

The KSA Military Transport Market is valued at USD ~ billion, based on historical analysis of defense procurement trends and government spending on military infrastructure. The market is driven by the Kingdom’s Vision 2030, which prioritizes the modernization of defense capabilities, especially military logistics and transport infrastructure. Investments in military technology and the increasing demand for efficient mobility solutions are key factors propelling this market forward.

Saudi Arabia dominates the military transport market in the Middle East due to its strategic location, large defense budget, and strong military-industrial base. The country’s significant defense expenditure, coupled with its geopolitical interests, positions it as the leader in the region. Moreover, collaborations with international defense contractors further enhance its market position, allowing for continuous innovation in military transport systems.

Market Segmentation

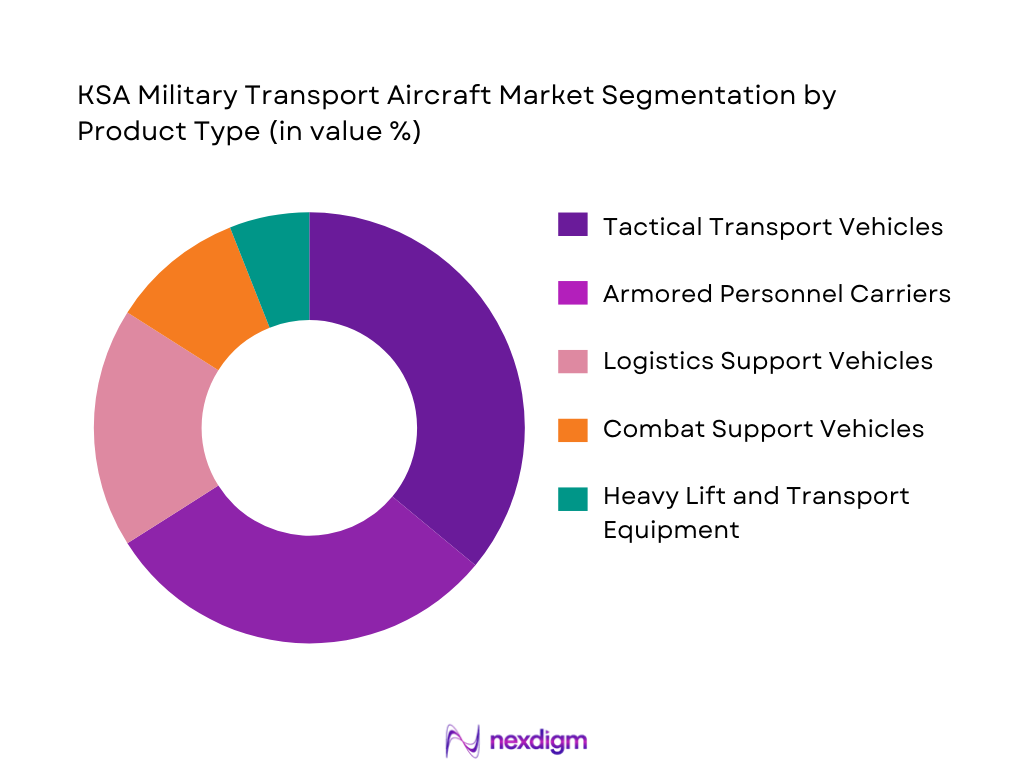

By Product Type

The KSA Military Transport Market is segmented into tactical transport vehicles, armored personnel carriers (APCs), logistics support vehicles, combat support vehicles, and heavy lift and transport equipment. The tactical transport vehicles segment is currently leading the market due to the increasing demand for versatile, mobile solutions that can operate in diverse terrains. These vehicles are a cornerstone for rapid deployment, essential for the Kingdom’s defense and humanitarian missions.

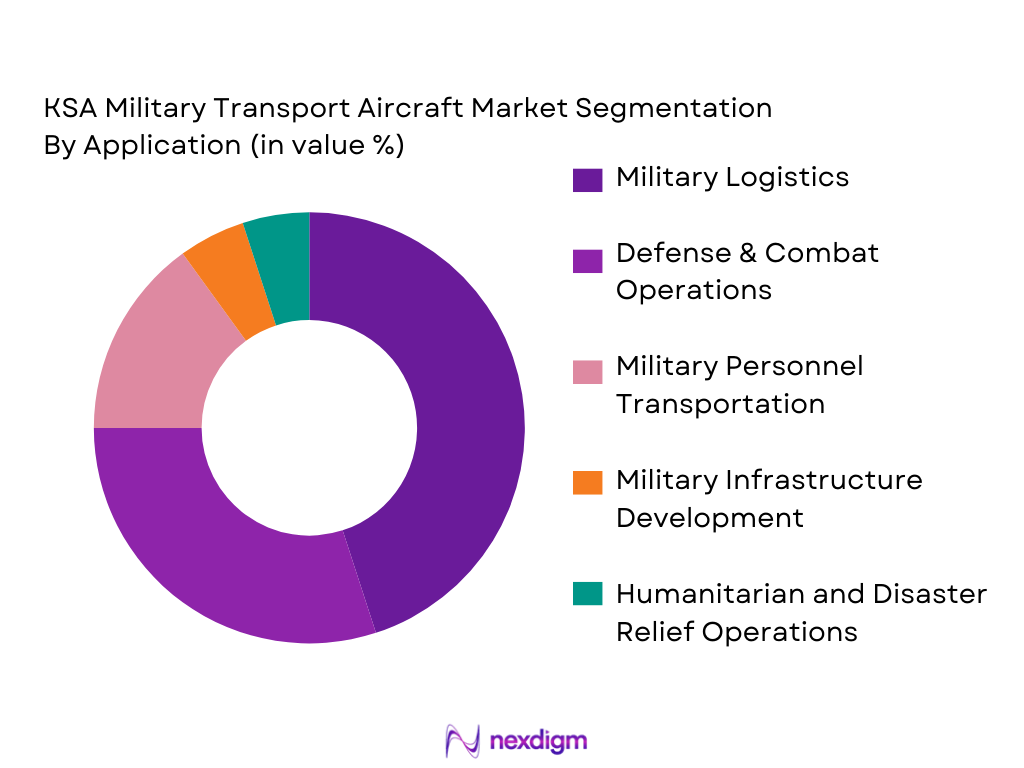

By Application

The military transport market is segmented by its applications, including military logistics, defense and combat operations, military personnel transportation, military infrastructure development, and humanitarian and disaster relief operations. The military logistics segment holds the largest share, driven by Saudi Arabia’s strategic military operations and the need for efficient, secure supply chains. Logistics solutions are crucial for the rapid deployment of troops and military assets, supporting both domestic and international operations.

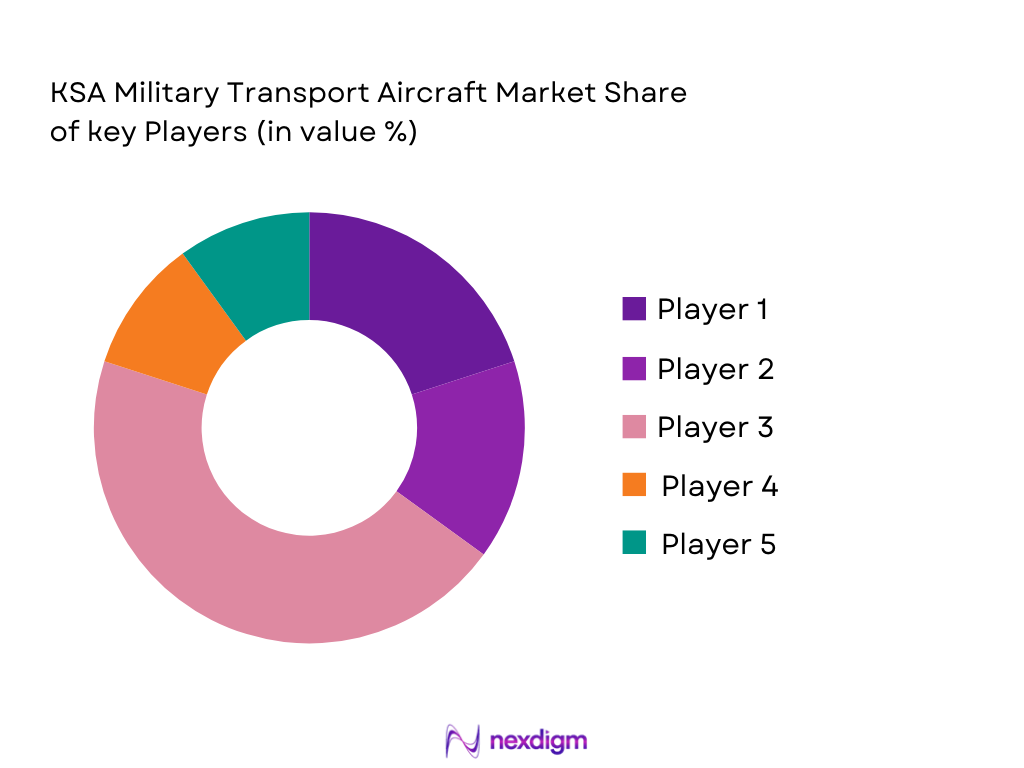

Competitive Landscape

The KSA Military Transport Market is dominated by a few key players, including global defense contractors and local manufacturers. Major international players, such as Lockheed Martin and Oshkosh Defense, hold a significant portion of the market due to their advanced technology and strong relationships with the Saudi government. The presence of local manufacturers like the Advanced Defense Technologies (ADT) also adds to the competitive landscape, as they provide tailored solutions for the Kingdom’s defense needs.

| Company | Establishment Year | Headquarters | Product Portfolio Breadth | Defense Expertise | Market Reach | R&D Investment |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ |

| Oshkosh Defense | 1917 | USA | ~ | ~ | ~ | ~ |

| Advanced Defense Technologies | 1999 | Riyadh, KSA | ~ | ~ | ~ | ~ |

| General Dynamics | 1899 | USA | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ |

KSA Military Transport Market Analysis

Growth Drivers

Increasing Defense Budget Allocations

Saudi Arabia’s defense budget is one of the highest in the Middle East, consistently allocating significant resources towards strengthening its military infrastructure. In recent years, the Kingdom has increased its defense spending to modernize its military capabilities, particularly in military transport. This commitment is part of the broader Vision 2030 agenda, which aims to diversify the economy and enhance the country’s defense technology. The increased funding is directed toward upgrading and expanding the military fleet, including investments in new, advanced military transport vehicles. These allocations ensure that the Saudi military can maintain a competitive edge in the region, addressing both current defense needs and future strategic objectives. Furthermore, defense spending is bolstered by the Kingdom’s geopolitical positioning, necessitating robust military mobility and logistics systems to secure its borders and support regional operations.

Focus on Modernization of Military Fleet

The modernization of the Saudi military fleet is a critical driver of the military transport market. With an evolving security landscape, Saudi Arabia is focused on replacing aging military vehicles with state-of-the-art, versatile transport systems capable of performing in diverse operational environments. The Saudi government’s investments prioritize increasing the mobility, durability, and efficiency of military fleets. These modernized transport vehicles are equipped with the latest technology, including advanced armor, improved fuel efficiency, and enhanced communication systems. The ongoing fleet modernization strategy is also in line with the Kingdom’s desire to integrate more advanced technologies such as autonomous and electric vehicles into its military logistics infrastructure. As the focus shifts from maintaining older models to introducing next-gen equipment, the demand for new military transport systems is expected to continue growing.

Market Challenges

Supply Chain Disruptions

One of the major challenges facing the KSA Military Transport Market is supply chain disruptions, which are largely due to global geopolitical tensions and trade restrictions. The defense industry relies heavily on a complex network of suppliers, many of which are international. Disruptions in this network—due to political instability, natural disasters, or sanctions—can delay the procurement of critical components for military vehicles. The challenges are exacerbated by logistical hurdles related to the transportation of large and sensitive military equipment. In some cases, even delays in parts or raw materials can lead to extended production times for military transport vehicles, causing setbacks in fleet readiness. The KSA government must continue to manage these risks through robust supply chain strategies, including partnerships with local manufacturers and diversification of procurement sources.

Compliance with International Standards and Certifications

Compliance with international standards and certifications is another significant challenge in the KSA Military Transport Market. The Kingdom’s defense procurement process requires strict adherence to both domestic and international regulations, particularly when integrating foreign-built transport systems. Manufacturers must meet standards related to environmental impact, safety, interoperability with other systems, and specific military certifications. Navigating these regulatory requirements can slow down the development and deployment of new military vehicles. Additionally, the Kingdom must ensure that these systems are compatible with NATO or other international coalition forces’ standards, as Saudi Arabia participates in various multinational defense agreements. The cost and complexity of compliance often present obstacles to the smooth and timely integration of advanced military transport solutions.

Opportunities

Development of Green Transport Solutions

As environmental sustainability becomes increasingly important across industries, the KSA Military Transport Market is witnessing a growing interest in the development of green transport solutions. The Saudi government has shown interest in reducing the carbon footprint of its defense operations, which aligns with Vision 2030’s broader goals of economic diversification and environmental responsibility. The integration of hybrid and electric technologies into military transport vehicles presents a significant opportunity for the Kingdom. These green solutions offer reduced fuel consumption, lower emissions, and a smaller environmental impact, while also improving the operational efficiency of military fleets. With global pressure on nations to adopt cleaner technologies, Saudi Arabia’s investment in green military transport options could not only contribute to environmental goals but also enhance the Kingdom’s image as a leader in innovative defense solutions.

Integration of AI and Automation in Military Transport Vehicles

The integration of artificial intelligence (AI) and automation in military transport vehicles is another promising opportunity in the KSA Military Transport Market. As military strategies increasingly prioritize speed, precision, and efficiency, AI-driven autonomous vehicles can revolutionize the way Saudi Arabia’s military conducts logistics and transport operations. These systems can help optimize route planning, reduce human error, and improve the safety and reliability of transport missions. The Kingdom’s ongoing modernization efforts, combined with its substantial defense budget, make it well-positioned to adopt autonomous military transport vehicles. Additionally, these advancements can lead to more agile and responsive fleets, capable of performing a wide variety of missions, from combat support to logistics and personnel transportation. The integration of AI also offers long-term cost savings, enhancing the operational readiness of Saudi Arabia’s armed forces.

Future Outlook

The KSA Military Transport Market is expected to experience significant growth over the next several years, driven by Saudi Arabia’s commitment to enhancing its defense capabilities and infrastructure. The Kingdom’s Vision 2030, which emphasizes modernization and the development of high-tech military assets, will play a crucial role in expanding the market for military transport solutions. Increasing regional tensions and Saudi Arabia’s desire to maintain its position as a leading military power in the Middle East are expected to further stimulate market growth.

Major Players

- Lockheed Martin

- Oshkosh Defense

- Advanced Defense Technologies

- General Dynamics

- BAE Systems

- Rheinmetall AG

- Thales Group

- Leonardo S.p.A

- MBDA

- Northrop Grumman

- Airbus Defense and Space

- Saab Group

- L3 Technologies

- ST Engineering

- Textron

Key Target Audience

- Saudi Ministry of Defense (MOD)

- Saudi Arabian National Guard (SANG)

- Saudi Royal Air Force (RAF)

- Saudi Arabian Military Industries (SAMI)

- Investments and venture capitalist firms

- Government and regulatory bodies (e.g., Saudi Defense Procurement Office)

- Armed Forces Logistics Units

- Military Equipment Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the major variables affecting the KSA Military Transport Market. This process includes gathering data from both secondary and proprietary sources, such as government defense reports, industry publications, and financial reports from leading defense contractors. The goal is to map out the factors that influence the market, such as defense budgets, procurement policies, and geopolitical trends.

Step 2: Market Analysis and Construction

The second step involves constructing a detailed market model based on historical data. This will include an in-depth analysis of military transport expenditures, historical procurement patterns, and supply chain structures. Additionally, we will analyze market dynamics such as demand for specific vehicle types and technological advancements.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, we validate market assumptions by consulting industry experts through structured interviews. These consultations will focus on verifying key trends, challenges, and opportunities in the KSA Military Transport Market. Experts will provide insight into the future direction of defense procurement and military mobility solutions.

Step 4: Research Synthesis and Final Output

The final step synthesizes all collected data and expert insights to produce a comprehensive, validated report. This step involves combining quantitative data with qualitative expert opinions to ensure a robust understanding of market dynamics. A final review ensures that the report provides an accurate and reliable forecast for the KSA Military Transport Market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Defense Budget Allocations

Focus on Modernization of Military Fleet

Regional Geopolitical Instability Driving Defense Spending

- Market Challenges

Supply Chain Disruptions

Compliance with International Standards and Certifications

Cost of Technological Integration

- Opportunities

Development of Green Transport Solutions

Integration of AI and Automation in Military Transport Vehicles

Collaborations with International Defense Suppliers

- Trends

Shift Towards Autonomous and Hybrid Military Transport Systems

Increase in Military Vehicle Upgrades and Retrofitting Programs

Focus on Multi-Role Platforms

- Government Regulation

Defense Procurement Policies

Environmental and Safety Standards for Military Transport

- SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- Competition Ecosystem

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Product Type (In Value %)

Tactical Transport Vehicles

Armored Personnel Carriers (APCs)

Logistics Support Vehicles

Combat Support Vehicles

Heavy Lift and Transport Equipment - By Application (In Value %)

Military Logistics

Defense & Combat Operations

Military Personnel Transportation

Military Infrastructure Development

Humanitarian and Disaster Relief Operations - By End User (In Value %)

Ministry of Defense

Armed Forces

Private Contractors

Military Equipment Manufacturers

Logistics Providers - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region - By Technology (In Value %)

Electric and Hybrid Military Vehicles

Autonomous Military Transport Systems

Advanced Armor Technology

Communication Systems for Military Transport

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by Product Type - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Product Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players in KSA Military Transport Market

- Detailed Profiles of Major Companies

Al-Jazira Heavy Transport

Al-Fahd Military Industries

National Industrialization Company (Tasnee)

Gulf Transport Solutions

Hassan Ali Trading Company

Advanced Defense Technologies

International Military Transport Corporation

Thales Group

Rheinmetall AG

Oshkosh Defense

General Dynamics

Lockheed Martin

BAE Systems

Saab Group

Leonardo S.p.A

MBDA

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035