Market Overview

The KSA Military Truck market current size stands at around USD ~ million, reflecting sustained procurement activity and fleet modernization momentum. Demand has remained stable across 2024 and 2025, supported by ongoing defense modernization programs, vehicle replacement cycles, and operational mobility requirements. Procurement volumes have remained consistent, supported by multi-year defense allocations and localized assembly initiatives. The market continues to be characterized by long acquisition cycles, strict technical standards, and platform standardization aligned with military logistics doctrines.

The market is geographically concentrated around major military hubs including Riyadh, Eastern Province, and Western operational zones, where logistics and deployment intensity remains highest. Infrastructure maturity, proximity to maintenance depots, and access to military bases shape regional demand distribution. The presence of defense industrial clusters and government-backed localization programs further reinforces regional concentration. Policy-driven localization mandates and national security priorities strongly influence procurement flows and supplier engagement.

Market Segmentation

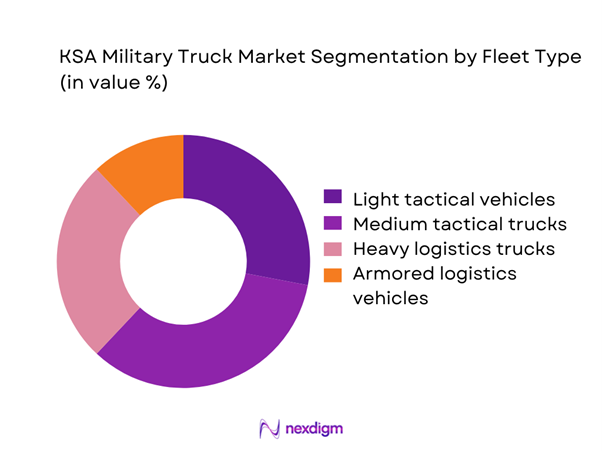

By Fleet Type

The fleet type segmentation is dominated by medium and heavy tactical trucks due to their versatility in logistics, troop transport, and equipment movement. Light tactical vehicles maintain relevance for reconnaissance and rapid deployment, while armored logistics platforms are increasingly adopted for border and high-risk operations. Fleet composition is influenced by terrain adaptability, payload capacity, and integration compatibility with existing military systems. Lifecycle replacement cycles and mission-specific configurations continue to shape procurement preferences, with standardization becoming increasingly important to reduce maintenance complexity.

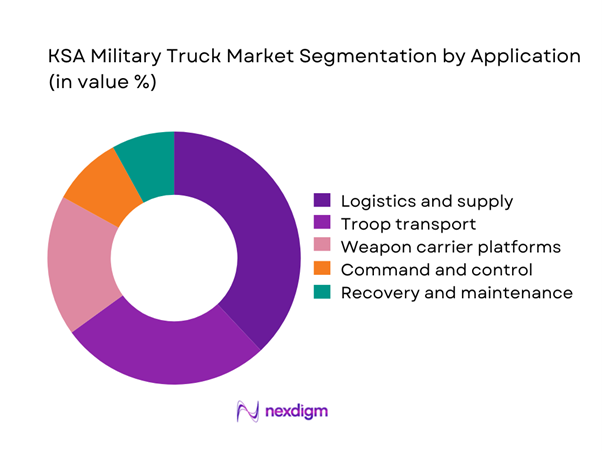

By Application

Application-based segmentation is led by logistics and supply operations, driven by sustained troop mobility and equipment transportation requirements. Troop transport remains a core application, supported by fleet modernization initiatives. Command and control and recovery vehicles form smaller but critical segments, reflecting increased emphasis on operational readiness. Application demand is closely linked to defense deployment patterns, infrastructure development, and evolving battlefield mobility doctrines across land forces.

Competitive Landscape

The competitive landscape is characterized by a mix of international defense manufacturers and regional integrators operating under localization and offset frameworks. Market participants compete on platform reliability, customization capability, lifecycle support, and compliance with defense procurement standards. Strategic partnerships, local assembly agreements, and long-term service contracts shape competitive positioning across the value chain.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Oshkosh Defense | 1917 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall MAN Military Vehicles | 2010 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Arquus | 2018 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Saudi Arabian Military Industries | 2017 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Iveco Defence Vehicles | 1975 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Military Truck Market Analysis

Growth Drivers

Modernization of Saudi land forces under Vision 2030

Saudi defense modernization allocated over 75% of land systems funding toward mobility platforms between 2023 and 2025. The Ministry of Defense approved multiple vehicle upgrade programs covering more than 20 operational brigades nationwide. Fleet renewal targets include replacing vehicles older than 25 years across logistics and transport units. Standardization initiatives reduced platform variety by approximately 30% to improve maintenance efficiency. Defense industrial localization policies mandate increased domestic assembly content exceeding 50%. Operational readiness benchmarks require higher vehicle availability ratios exceeding 85%. Increased training intensity led to higher utilization cycles across support vehicles. Regional security developments reinforced demand for enhanced tactical mobility. Logistics automation programs expanded deployment requirements across desert and border terrains. Government procurement frameworks emphasize long-term fleet sustainability over short-term acquisition volume.

Rising defense logistics and mobility requirements

Land force mobility requirements increased following expanded border monitoring operations exceeding 1,300 kilometers. Military logistics throughput rose by over 20% between 2023 and 2025 due to expanded exercises. Deployment cycles shortened by nearly 15% requiring more reliable transport platforms. Equipment rotation rates increased across armored and logistics divisions. Interoperability requirements with allied forces drove platform standardization. Infrastructure upgrades expanded operational coverage into remote regions. Transport efficiency metrics became a core performance indicator for procurement evaluation. Increased troop movement frequency drove demand for higher-capacity vehicles. Logistics digitization initiatives increased dependency on fleet reliability. Defense readiness evaluations emphasized rapid deployment capabilities across multiple theaters.

Challenges

High capital cost and long procurement cycles

Defense vehicle procurement cycles typically exceed 36 months due to testing and compliance requirements. Capital allocation processes require multi-year approvals tied to national budgeting cycles. Contract structuring complexity delays deployment schedules across multiple programs. Localization mandates increase upfront investment requirements for suppliers. Integration testing timelines extend platform delivery by over 12 months. Procurement transparency requirements increase administrative processing duration. Vendor qualification standards limit eligible suppliers significantly. Customization requirements reduce production scalability. Budget reallocation risks emerge during fiscal reprioritization periods. Long lifecycle costs complicate total ownership evaluation.

Dependence on foreign OEMs and technology transfer

Over 65% of advanced military vehicle components remain imported under licensing agreements. Technology transfer frameworks impose strict intellectual property controls. Localization targets require gradual capability buildup extending beyond five years. Skilled labor availability remains constrained in specialized manufacturing domains. Supply chain dependencies expose procurement timelines to geopolitical disruptions. Export control regulations affect component availability and integration schedules. Certification processes for localized production remain time-intensive. Knowledge transfer limitations slow indigenous design development. Maintenance dependency persists for advanced drivetrain and protection systems. Offset compliance monitoring increases administrative complexity.

Opportunities

Local manufacturing and MRO partnerships

Government incentives support establishment of domestic assembly facilities across multiple industrial zones. Localization programs target over 50% local content across defense platforms. MRO demand is expanding due to growing installed fleet volumes. Public–private partnerships enable technology absorption and workforce development. Maintenance localization reduces lifecycle costs and operational downtime. Skilled labor training initiatives support industrial capacity expansion. Defense industrial clusters improve supply chain integration efficiency. Offset programs encourage long-term supplier investment commitments. Component manufacturing localization strengthens resilience against import disruptions. Regional export potential improves viability of localized production.

Integration of autonomous and smart mobility features

Defense digitization initiatives prioritize autonomous convoy and fleet monitoring technologies. Sensor integration enhances operational safety across logistics operations. Data-driven fleet management improves utilization efficiency. Telematics deployment supports predictive maintenance strategies. Autonomous testing programs expanded within controlled military zones. AI-based diagnostics reduce vehicle downtime and maintenance costs. Command systems increasingly integrate vehicle telemetry data. Cybersecurity frameworks enhance vehicle network resilience. Smart mobility solutions improve mission planning accuracy. Technology integration aligns with broader defense digital transformation goals.

Future Outlook

The KSA military truck market is expected to maintain steady development driven by sustained defense modernization and localization initiatives. Continued emphasis on mobility, fleet readiness, and industrial self-reliance will shape procurement strategies. Integration of advanced technologies and local manufacturing capabilities is expected to strengthen long-term operational resilience. Strategic partnerships and policy alignment will remain central to market evolution.

Major Players

- BAE Systems

- Rheinmetall MAN Military Vehicles

- Oshkosh Defense

- Navistar Defense

- Iveco Defence Vehicles

- Tatra Trucks

- Arquus

- Mercedes-Benz Special Trucks

- AM General

- Nexter Systems

- General Dynamics Land Systems

- Streit Group

- Saudi Arabian Military Industries

- Advanced Electronics Company

- Ashok Leyland Defence Systems

Key Target Audience

- Ministry of Defense, Saudi Arabia

- General Authority for Military Industries

- Saudi Arabian Military Industries

- Land Forces Procurement Divisions

- Defense Logistics and Supply Chain Authorities

- Military Vehicle Integrators and OEMs

- Maintenance, Repair, and Overhaul Providers

- Investment and Venture Capital Firms

Research Methodology

Step 1: Identification of Key Variables

Market boundaries were defined through platform classification, operational usage, and procurement frameworks. Defense mobility requirements and fleet composition parameters were identified. Data inputs were aligned with defense planning structures.

Step 2: Market Analysis and Construction

Demand indicators were mapped against procurement cycles and fleet replacement timelines. Policy directives and localization mandates were integrated into analytical models.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through defense industry experts and procurement specialists. Assumptions were refined using institutional data and operational benchmarks.

Step 4: Research Synthesis and Final Output

Findings were consolidated into structured insights aligned with strategic decision-making needs. Data consistency and analytical coherence were ensured throughout the study.

- Executive Summary

- Research Methodology (Market Definitions and military vehicle classification framework, KSA defense fleet segmentation and platform taxonomy, Bottom-up fleet sizing and replacement cycle modeling, Defense budget mapping and procurement value attribution, Primary interviews with MoD officials OEMs and integrators, Triangulation using SIPRI customs data and contract disclosures, Assumptions on localization content and lifecycle utilization)

- Definition and scope

- Market evolution and defense modernization context

- Operational usage across army and joint forces

- Ecosystem structure and OEM–integrator relationships

- Supply chain localization and offset programs

- Regulatory and defense procurement environment

- Growth Drivers

Modernization of Saudi land forces under Vision 2030

Rising defense logistics and mobility requirements

Increased localization and local assembly mandates

Expansion of border security and rapid deployment needs

Replacement of aging tactical vehicle fleets - Challenges

High capital cost and long procurement cycles

Dependence on foreign OEMs and technology transfer

Stringent military certification requirements

Complex maintenance and lifecycle management

Budget fluctuations linked to oil revenue - Opportunities

Local manufacturing and MRO partnerships

Growth in armored and multi-role vehicle demand

Integration of autonomous and smart mobility features

Export potential through regional defense cooperation

Aftermarket services and fleet modernization programs - Trends

Shift toward modular and multi-mission platforms

Rising adoption of armored logistics vehicles

Digital fleet management and telematics integration

Increased localization under GAMI regulations

Emphasis on survivability and mobility enhancement - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Light tactical vehicles

Medium tactical trucks

Heavy logistics trucks

Armored logistics vehicles

Special purpose and recovery vehicles - By Application (in Value %)

Troop transport

Logistics and supply

Weapon carrier platforms

Command and control

Maintenance and recovery - By Technology Architecture (in Value %)

Conventional diesel platforms

Hybrid military vehicles

Armored mobility platforms

Modular mission-configurable platforms - By End-Use Industry (in Value %)

Saudi Land Forces

National Guard

Royal Saudi Air Force logistics units

Border Guard and internal security forces - By Connectivity Type (in Value %)

Non-connected platforms

Telematics-enabled vehicles

C4ISR-integrated vehicles - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio breadth, localization capability, contract value share, technological integration level, aftersales support strength, pricing competitiveness, defense certifications, regional partnerships)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

BAE Systems

Rheinmetall MAN Military Vehicles

Oshkosh Defense

Navistar Defense

IVECO Defence Vehicles

Tatra Trucks

Arquus

Mercedes-Benz Special Trucks

AM General

Nexter Systems

General Dynamics Land Systems

Streit Group

Saudi Arabian Military Industries

Advanced Electronics Company

Ashok Leyland Defence Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035