Market Overview

The KSA Military Unmanned Aerial Vehicles (UAV) market is valued at USD ~ billion, based on recent historical assessments. This market is driven by the country’s growing demand for advanced defense capabilities, aimed at enhancing national security and maintaining regional dominance. The expansion is supported by government investments in defense modernization and strategic autonomy, including the procurement of sophisticated UAV platforms for intelligence, surveillance, reconnaissance, and combat operations. Additionally, increasing military spending, technological advancements, and strong defense partnerships are accelerating market growth.

Saudi Arabia is a dominant player in the KSA Military UAV market due to its significant defense budget and its strategic geopolitical position in the Middle East. The country’s investments in UAV technology are aligned with its Vision 2030 initiative, which aims to bolster national defense capabilities and reduce reliance on foreign military imports. Furthermore, the proximity to conflict zones such as Yemen has made UAVs an essential asset for border security, surveillance, and military operations, solidifying the nation’s leadership in the region.

Market Segmentation

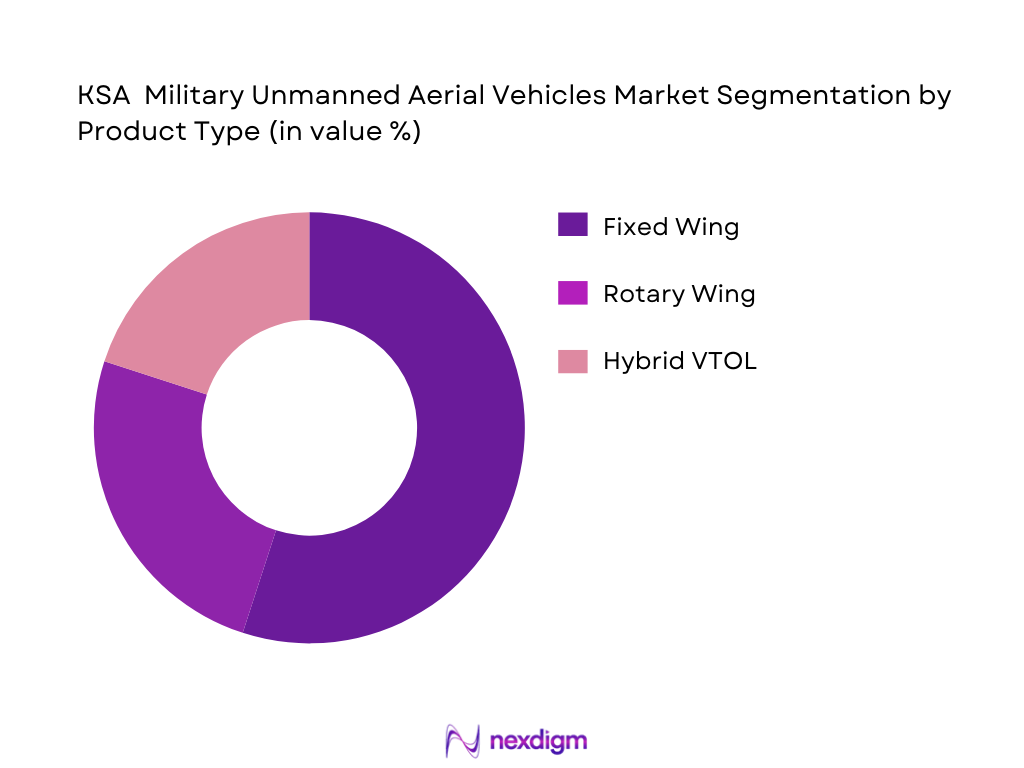

By Product Type

The KSA Military UAV market is segmented into fixed-wing, rotary-wing, and hybrid VTOL UAVs. The fixed-wing segment holds a dominant position due to its long endurance and high payload capacity, which are crucial for surveillance and reconnaissance missions. Fixed-wing UAVs are preferred for strategic missions requiring extended flight times and larger operational ranges. Additionally, hybrid VTOL UAVs are gaining traction as they offer the flexibility of vertical takeoff and landing, crucial for deployment in constrained environments.

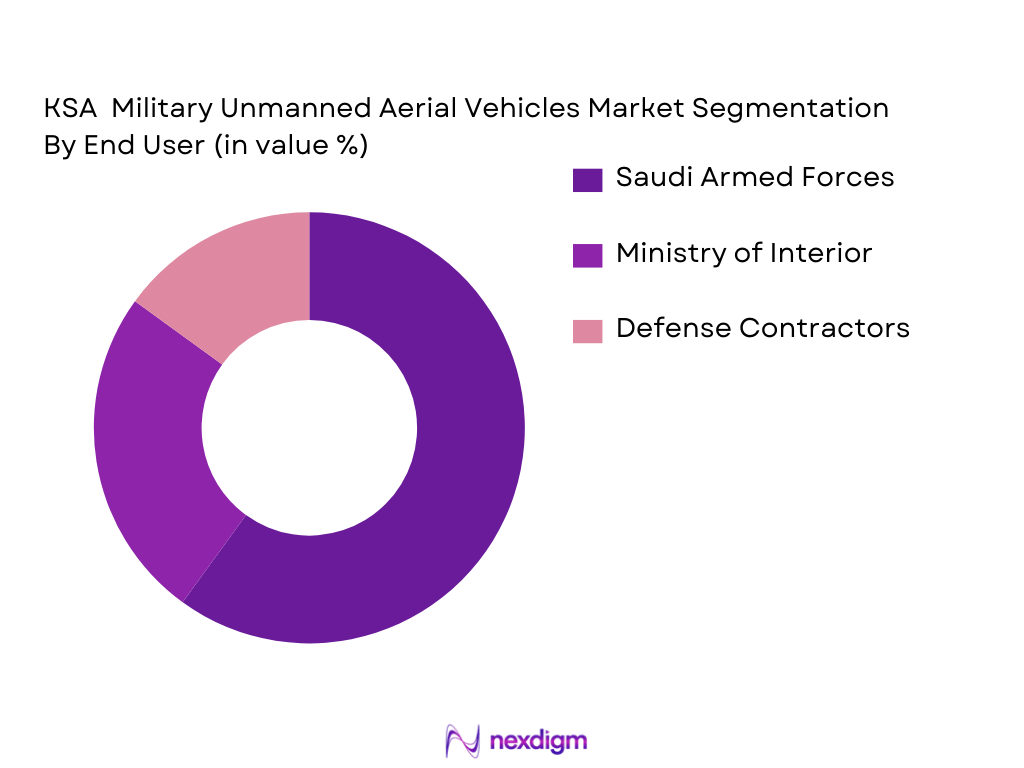

By End User

The market is segmented by end user into the Saudi Arabian Armed Forces, the Ministry of Interior, and defense contractors. The Saudi Arabian Armed Forces hold the majority market share, owing to the significant investments in defense technologies and large-scale UAV acquisitions for both combat and surveillance operations. The Ministry of Interior follows closely, utilizing UAVs for border security and internal surveillance, enhancing national security measures. The increasing collaboration between government entities and defense contractors also fuels market growth.

Competitive Landscape

The KSA Military UAV market is dominated by key global and local players, with international defense giants like Lockheed Martin, Boeing, and General Atomics leading the way. These companies provide a wide array of UAV platforms, ranging from strategic reconnaissance to tactical combat UAVs, and have established strong relationships with the Saudi government through defense contracts. Local players like Taqnia Aeronautics and Advanced Electronics Company are also pivotal, capitalizing on domestic production and assembly opportunities to meet the country’s Vision 2030 goals.

| Company | Establishment Year | Headquarters | Product Portfolio | UAV Types | Technology Innovation | Local Presence |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ |

| General Atomics | 1955 | USA | ~ | ~ | ~ | ~ |

| Taqnia Aeronautics | 2010 | Saudi Arabia | ~ | ~ | ~ | ~ |

| Advanced Electronics Company | 1988 | Saudi Arabia | ~ | ~ | ~ | ~ |

KSA Military Unmanned Aerial Vehicles Market Analysis

Growth Drivers

Defense Modernization and Strategic Autonomy (Localization Mandates, Offset Agreements)

The Saudi Arabian government is making significant strides in defense modernization to enhance national security and reduce reliance on foreign military suppliers. The defense modernization process is driven by the country’s Vision 2030 initiative, which emphasizes the need to build a self-reliant defense industry. Localization mandates and offset agreements play a crucial role in this process. Offset agreements stipulate that foreign defense contractors, in exchange for selling military equipment to the kingdom, must invest in local infrastructure, technology transfer, and manufacturing capabilities. These initiatives promote the growth of local defense industries and help establish a sustainable domestic UAV production ecosystem. By encouraging international partnerships and incentivizing local assembly and manufacturing, Saudi Arabia is positioning itself as a regional leader in UAV technology and capabilities. As a result, the demand for UAVs, especially domestically produced models, is expected to rise, further driving the growth of the market.

Regional Security Dynamics (GCC Cooperation, Yemen Border Operations)

The geopolitical environment in the Middle East is a major driver of the demand for military UAVs in Saudi Arabia. The ongoing conflict in Yemen has placed a significant strain on Saudi Arabia’s border security and defense capabilities. As a result, UAVs have become a critical asset for surveillance, reconnaissance, and targeted operations in conflict zones. Additionally, Saudi Arabia’s role in the Gulf Cooperation Council (GCC) underscores the strategic importance of advanced military technologies, including UAVs, to maintain security and regional dominance. The GCC’s collective defense initiatives and the evolving security threats in the region have necessitated the expansion of UAV deployment for border surveillance, intelligence gathering, and counterterrorism efforts. As these security dynamics continue to evolve, the demand for UAVs in Saudi Arabia is expected to rise to address the increasing need for real-time situational awareness and precision operations.

Market Challenges

Export and Import Controls (ITAR/EAR Impacts, Dual-Use Restrictions)

Saudi Arabia’s military UAV market faces challenges related to export and import controls, particularly those enforced by international arms regulations such as the International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR). These regulations govern the export of sensitive defense technologies, including UAV systems, and can create barriers for Saudi Arabia when attempting to procure advanced UAV technologies from foreign suppliers. ITAR and EAR restrictions, which are particularly stringent on dual-use technologies (those that have both military and civilian applications), can limit the access to cutting-edge UAV components and systems. As a result, Saudi Arabia may face delays in procurement or be forced to rely on less advanced or alternative technologies, which could hinder the operational efficiency and competitiveness of its UAV capabilities. Additionally, geopolitical tensions and arms embargoes may further complicate the country’s ability to acquire specific UAV technologies, forcing local manufacturers to focus on developing indigenous solutions, which may require significant investment in R&D.

Integration with Legacy Systems (Interoperability Risks)

Saudi Arabia’s military UAVs must integrate with a range of legacy systems currently in use by the Saudi Armed Forces. This presents a significant challenge, as UAVs require seamless communication with existing defense infrastructure, including radar systems, communication networks, and command centers. The integration of UAV platforms with legacy systems may face technical obstacles, such as mismatched data protocols, incompatible software, and hardware limitations. These interoperability risks can complicate the deployment of UAVs in existing operational theaters, requiring costly upgrades to current systems. Moreover, a lack of standardization across various defense platforms may lead to operational inefficiencies, which can undermine the full potential of UAV technology. To overcome these challenges, Saudi Arabia will need to prioritize investment in integrating UAV systems with its broader defense infrastructure while ensuring that future technology acquisitions align with existing military frameworks.

Market Opportunities

Local Manufacturing and Assembly (Offsets, In-Country Value Targets)

One of the most promising opportunities for the KSA Military UAV market lies in local manufacturing and assembly, which is aligned with the country’s Vision 2030 goal of building a self-sustaining defense industry. Offsets and in-country value (ICV) targets are mechanisms that drive foreign companies to set up local production facilities and invest in technology transfer to develop the local defense industry. By focusing on local manufacturing, Saudi Arabia aims to create a robust UAV supply chain that minimizes reliance on foreign imports while fostering job creation and technological innovation within the country. The local manufacturing initiative can also help reduce costs associated with long-term maintenance and repairs, as parts and services can be sourced domestically. Furthermore, such initiatives could make Saudi Arabia an exporter of UAV technologies in the long term, providing additional revenue streams and enhancing its geopolitical influence within the region.

Service and Maintenance Hubs (Sustainment Contracts, MRO Capabilities)

As the deployment of UAVs in Saudi Arabia increases, the demand for service and maintenance operations is expected to rise, offering a significant market opportunity. Maintenance, repair, and overhaul (MRO) services are critical for ensuring the operational readiness of UAVs, and as UAV fleets grow, so will the need for specialized services. Establishing regional MRO hubs within Saudi Arabia would not only provide operational continuity for the military but also serve as a lucrative service provider to neighboring countries in the Gulf region, where demand for UAVs is increasing. Through sustainment contracts and the establishment of robust MRO capabilities, Saudi Arabia can position itself as a leading regional hub for UAV service and maintenance. This not only helps ensure that UAVs remain operational for extended periods but also drives the development of technical expertise and skilled labor in the country. The ability to offer competitive and efficient MRO services could further bolster Saudi Arabia’s status as a major player in the UAV market, both locally and internationally.

Future Outlook

Over the next five years, the KSA Military UAV market is poised for significant growth driven by continuous investments in defense technologies, an expanding defense budget, and increasing demand for high-tech UAVs. The growing need for surveillance and border control capabilities, coupled with advancements in autonomy and AI integration, will further fuel the demand for UAVs across various mission applications. The strategic alliances with international defense companies and local manufacturers will ensure a steady supply of advanced UAV platforms, contributing to a robust market expansion.

Major Players

- Lockheed Martin

- Boeing

- General Atomics

- Taqnia Aeronautics

- Advanced Electronics Company

- Israel Aerospace Industries

- Northrop Grumman

- Elbit Systems

- Raytheon Technologies

- Thales Group

- Textron Systems

- SAAB

- L3 Harris Technologies

- Leonardo S.p.A

- UAV Factory

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (Saudi Arabian Ministry of Defense)

- Saudi Armed Forces

- Saudi Arabian Ministry of Interior

- Defense contractors (local and international)

- Military technology providers

- Border security agencies (Saudi Arabian Border Guard)

- UAV manufacturers and suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the critical market variables, including UAV types, mission applications, and end-user segments. This is achieved through secondary data research, gathering information from government procurement documents, defense industry reports, and previous market studies.

Step 2: Market Analysis and Construction

In this phase, we analyze historical market data to assess trends in UAV adoption, military expenditure, and defense procurements. Data is further supplemented by interviews with defense analysts and industry stakeholders to understand demand patterns.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on UAV demand and procurement cycles are validated through expert consultations and industry interviews. These insights provide deeper operational and financial perspectives to refine market data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the findings, validating them through expert insights, and preparing a comprehensive report on the KSA Military UAV market. This ensures the accuracy and relevance of all conclusions drawn from the research.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions (UAV Class Definitions,Platform Categorization, Operational Envelope), Abbreviations (ISR, UCAV, MTOW, LoS, BLOS), Market Sizing Approach (Procurement Value, Unit Deployment Counts, Service / Maintenance Valuation), Consolidated Research Approach (Primary Defense Stakeholder Interviews, Official, Procurement Data, Open Source Intelligence), Limitations and Quality Controls)

- Definition and Scope

- Overview Genesis

- Operational and Strategic Rationale in KSA (National Defense Strategy Alignment, Vision Sovereign Capabilities)

- KSA Defense Industrial Base and UAV Ecosystem

- Supply Chain and Value Chain Analysis (OEMs, Tier‑1 to Tier‑3 Suppliers, Integration Partners)

- Policy and Regulatory Landscape

- Growth Drivers

Defense Modernization and Strategic Autonomy (Localization Mandates, Offset Agreements)

Regional Security Dynamics (GCC Cooperation, Yemen Border Operations)

Budget Allocations and Procurement Programs (Defence Budget Prioritization, Procurement Cycles)

Technology Adoption (Autonomy, Secure Data Links, Sensor Miniaturization)

Industrial Partnerships and Joint Ventures (Transfer of Technology Terms, Local Assembly) - Market Challenges

Export and Import Controls (ITAR/EAR Impacts, Dual‑Use Restrictions)

Integration with Legacy Systems (Interoperability Risks)

Airspace Deconfliction and Command & Control Complexities

Sustainment and Lifecycle Costs (Spare Parts, Training Requirements)

Cybersecurity and Data Protection Risks - Market Opportunities

Local Manufacturing and Assembly (Offsets, In‑Country Value Targets)

Service and Maintenance Hubs (Sustainment Contracts, MRO Capabilities)

Advanced Autonomy and AI Modules (Mission Planning Efficiency)

Sensor and Payload Customization (Tiered Payload Packages for KSA Missions)

Training, Simulation, and Operator Certification Services - Market Trends

Shift to Collaborative UAV Swarms (Cooperative Engagement)

Growth in Hybrid VTOL Platforms (Operational Flexibility)

Increased Use of Secure BLOS Communications (Satellite Links)

Integration of Counter‑UAV and EW Suites

Sustainability in Power Systems (Fuel Cells, Hybrid Propulsion) - Government Regulation

Defense Procurement Policies (Tenders, MRU Integration Standards)

Airspace Operational Regulations (Military Flight Approval Processes)

Export Control Compliance (Technology Transfer Frameworks) - SWOT Analysis

- Ecosystem Stakeholders

Government

OEMs

Integrators

End Users

Service Providers - Porter’s Five Forces

Supplier Leverage

Buyer Power

Barriers to Entry

Substitutes

Competitive Rivalry

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Platform Type (In Value %)

Fixed Wing

Rotary Wing

Hybrid / VTOL

Mini/Micro UAV

High Altitude Long Endurance UAV - By End User (In Value %)

Royal Saudi Air Force

Ministry of Interior

Strategic Missile Forces

National Guard

Defense R&D Entities - By Mission Application (In Value %)

Intelligence, Surveillance and Reconnaissance

Combat / Strike

Electronic Warfare

Logistics / Resupply

Search and Rescue - By Payload Category (In Value %)

EO/IR Sensors

SAR/GMTI Radars

SIGINT

Directed Energy Payloads - By Technology Tier (In Value %)

AI‑Enabled Autonomy

Communications Systems

Cybersecurity Hardened Systems

- Market Share of Major Players (By Value, By Units Deployed)

- Cross Comparison Parameters (Company Overview, Product Portfolio Breadth , ISR Capability Levels , Strike Capability Integration, Autonomy and Software Features, After‑Sales Support Network , Local Presence/Assembly in KSA, Strategic Partnerships with KSA Entities)

- Detailed Profiles of Major Companies

General Atomics Aeronautical Systems

Lockheed Martin

Northrop Grumman

Boeing Defense

Baykar Technologies

Elbit Systems

Israel Aerospace Industries

CAE Inc.

Textron Systems

Leonardo S.p.A.

Thales Group

SAAB AB

Raksha Systems (Hypothetical/Tier‑1 Integrator)

Advanced Electronics Company (AEC)

Taqnia Aeronautics

- Operational Requirements and Deployment Patterns

- Budget Allocations and Procurement Timelines

- Training and Human Capital Requirements

- Decision‑Making Criteria and Acquisition Drivers

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035