Market Overview

The KSA military unmanned ground vehicle market is valued at USD ~ million, supported by an increase from USD ~ million in the prior year, based on Grand View Research’s Saudi Arabia UGV revenue series. Demand is driven by land-force modernization, border security automation, and safer standoff operations for reconnaissance and explosive-ordnance disposal, which shift spending toward teleoperated platforms, rugged mobility kits, ISR payloads, and secure command-and-control integration aligned to local defense procurement priorities.

Riyadh is the primary demand center due to concentration of defense procurement, program management, and system-integration activity, while Eastern Province logistics corridors and large training areas increase fielding and sustainment needs for UGV fleets. Internationally, the United States, United Kingdom, Turkey, and Israel influence the ecosystem through mature autonomy stacks, mission payloads, and combat-proven platforms that are widely integrated into NATO-aligned architectures, accelerating qualification cycles and interoperability for imported or co-developed systems deployed in desert operating conditions.

Market Segmentation

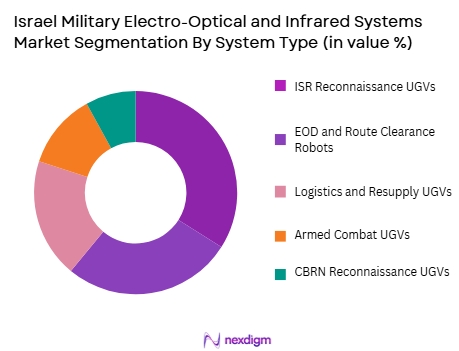

By System Type:

KSA military unmanned ground vehicle market is segmented by system type into ISR reconnaissance UGVs, EOD and route-clearance robots, logistics and resupply UGVs, armed combat UGVs, and CBRN reconnaissance UGVs. Recently, ISR reconnaissance UGVs have a dominant market share in KSA under the system type segmentation, due to persistent border and facility surveillance requirements, demand for standoff observation in high-risk corridors, and faster procurement cycles compared with weaponized platforms. ISR UGVs also field more easily across multiple end users, because payloads such as EO IR cameras, mast sensors, radar cueing, and secure datalinks can be scaled across light and medium chassis. Their dominance is reinforced by high utilization rates in training and operations, simpler rules-of-engagement constraints versus armed variants, and stronger compatibility with command posts and base security networks.

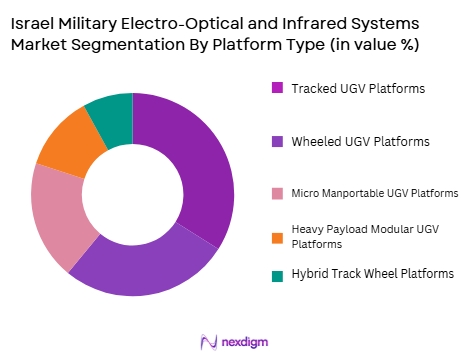

By Platform Type:

KSA military unmanned ground vehicle market is segmented by platform type into tracked UGV platforms, wheeled UGV platforms, hybrid track wheel platforms, micro man portable UGV platforms, and heavy payload modular UGV platforms. Recently, tracked UGV platforms have a dominant market share in KSA under the platform type segmentation, as they deliver superior mobility in sand, loose gravel, and uneven desert terrain while maintaining stability for sensor masts and EOD manipulators. Tracked designs also distribute weight better for heavier payloads, enabling longer endurance with auxiliary power units and improved thermal management. In addition, many defense-grade UGV families are fielded first in tracked configurations for route-clearance and reconnaissance roles, making them a default choice for programs that prioritize survivability, traction, and mission continuity in harsh climates.

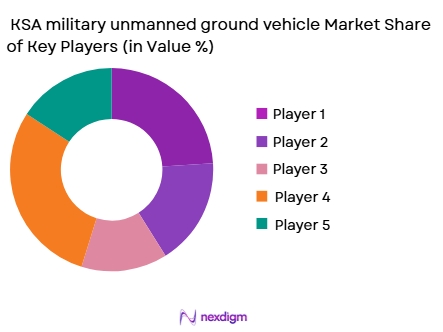

Competitive Landscape

The KSA military unmanned ground vehicle market is shaped by a mix of domestic defense-industrial entities and international UGV specialists, with procurement frequently influenced by integration capability, desert hardening, secure communications compliance, and local support readiness. The landscape is moderately concentrated around platforms that have proven reliability in EOD, reconnaissance, and perimeter security roles, while new entrants compete through autonomy software, modular payload ecosystems, and localization partnerships that align with KSA defense industrialization and sustainment objectives.

| Company | Establishment Year | Headquarters | Core UGV Portfolio Fit | Autonomy Software Depth | Payload Modularity | Desertization & Thermal Hardening | Secure C2 / Cyber Readiness | Local Partnership / Offset Readiness | Lifecycle Support & MRO Strength |

| Saudi Arabian Military Industries (SAMI) | 2017 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Advanced Electronics Company (AEC) | 1988 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| QinetiQ | 2001 | Farnborough, UK | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall | 1889 | Düsseldorf, Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Milrem Robotics | 2013 | Tallinn, Estonia | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

KSA military unmanned ground vehicle Market Analysis

Growth Drivers

Technological Advancements in Robotics:

The continuous advancements in robotics and artificial intelligence have significantly boosted the adoption of unmanned ground vehicles in the defense sector. The development of more reliable and efficient autonomous systems has made unmanned ground vehicles an essential part of military operations, especially high-risk and challenging tasks. These technologies enable unmanned vehicles to perform complex missions, such as surveillance, logistics, and reconnaissance, with minimal human intervention, reducing the risks associated with traditional military operations.

High Development and Maintenance Costs:

The development, procurement, and maintenance of military unmanned ground vehicles present significant financial challenges. These vehicles require advanced technologies, which demand high initial capital investment for both design and production. Moreover, the maintenance of such sophisticated systems involves continuous updates and repairs, which add to the cost burden. Military contractors and governments need to balance these high expenses with the overall strategic benefits that unmanned systems provide, making cost a critical consideration in decision-making.

Market Challenges

High Development and Maintenance Costs:

The development, procurement, and maintenance of military unmanned ground vehicles present significant financial challenges. These vehicles require advanced technologies, which demand high initial capital investment for both design and production. Moreover, the maintenance of such sophisticated systems involves continuous updates and repairs, which add to the cost burden. Military contractors and governments need to balance these high expenses with the overall strategic benefits that unmanned systems provide, making cost a critical consideration in decision-making.

Regulatory and Ethical Challenges:

Regulatory concerns and ethical considerations also present barriers to the broader deployment of unmanned ground vehicles in military applications. There are complex international laws and regulations governing the use of autonomous systems in warfare, particularly concerning the deployment of machines capable of making life-and-death decisions.

Opportunities

Collaboration with Technology Innovators:

One of the most significant opportunities in the KSA military unmanned ground vehicle market is the potential for collaboration between defense contractors and technology innovators. As unmanned systems evolve, military forces require increasingly sophisticated technology, such as enhanced sensors, AI-driven decision-making, and real-time data analytics.

Growing Demand for Remote Combat Systems:

As geopolitical tensions and security challenges increase in the Middle East, there is a growing demand for remote combat systems that can reduce the need for human personnel on the battlefield. Military unmanned ground vehicles provide an opportunity to conduct high-risk operations, such as bomb disposal, surveillance, and reconnaissance, without endangering soldiers’ lives. The increasing emphasis on force protection and reducing military casualties is leading to a greater focus on unmanned systems for combat operations.

Future Outlook

Over the next decade, the KSA military unmanned ground vehicle market is expected to expand as land-force modernization, border security automation, and safer standoff operations remain procurement priorities. Program design is likely to favor modular platforms that can switch between ISR, logistics, and EOD payloads while meeting cybersecurity and interoperability requirements. Based on Grand View Research’s Saudi Arabia UGV growth benchmark, the market’s expansion profile supports a low double-digit trajectory, anchored by a ~CAGR indicator over the country forecast window. The global UGV market’s 2026–2035 CAGR reference point is also tracked at ~ by Expert Market Research, which provides an external benchmark for long-range demand normalization as the category matures.

Market Players

- Lockheed Martin

- Boeing Defense

- Northrop Grumman

- General Dynamics

- Thales Group

- Rheinmetall Defence

- Textron Systems

- BAE Systems

- Elbit Systems

- Oshkosh Defense

- Saab Group

- Leonardo S.p.A.

- Kongsberg Gruppen

- IAI – Israel Aerospace Industries

- MBDA

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Military Contractors

- Defense Manufacturers

- Public Safety Authorities

- International Defense Organizations

- Military Research and Development Agencies

- Military Equipment Distributors

Research Methodology

Step 1: Identification of Key Variables

The initial phase maps the KSA military unmanned ground vehicle ecosystem across OEMs, integrators, payload suppliers, and end users. Desk research is conducted using defense procurement releases, company disclosures, and credible market databases to define variables such as platform classes, mission roles, integration stack, and sustainment requirements. The objective is to establish the market boundary and the key demand indicators.

Step 2: Market Analysis and Construction

This phase compiles historical market evidence across revenue indicators, program activity, and platform deliveries where disclosed. The analysis structures demand by mission role, platform type, and integration complexity, linking procurement cycles to operational drivers such as border security, base protection, and EOD readiness. Assumptions are standardized to ensure consistency across segmented market sizing.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through structured expert discussions with stakeholders across OEMs, integrators, and defense-aligned suppliers. Interviews focus on qualification timelines, localization feasibility, thermal and mobility constraints, and secure C2 requirements. The objective is to reconcile secondary findings with operational realities and refine segment-level dominance logic.

Step 4: Research Synthesis and Final Output

The final phase triangulates findings from secondary datasets, expert inputs, and competitive benchmarking to finalize market sizing, segmentation shares, and outlook narratives. Cross-checks are applied to ensure internal consistency across segments and to validate that drivers, constraints, and trends align with procurement practices and deployment conditions in KSA.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Border security reinforcement and persistent surveillance requirements across remote frontiers

Force protection focus driving demand for standoff reconnaissance and IED risk reduction

Localization and defense industrialization policies accelerating domestic assembly and integration - Market Challenges

Technology transfer constraints and export control limits on autonomy stacks sensors and comms

Harsh desert operating environment impacting mobility endurance thermal management and sustainment

Complex certification for weaponization cyber hardening and secure command and control integration - Market Opportunities

Hybrid powertrains and extended endurance packages tailored for long patrol cycles and overwatch

Co development with local integrators for modular payloads EW ISR and counter drone

applications

Lifecycle support training and depot level MRO opportunities under local content frameworks - Trends

Shift toward multi mission modular UGV families with interchangeable payload bays

Rising adoption of autonomy assisted navigation obstacle avoidance and leader follower convoying

Integration of secure mesh networking and manned unmanned teaming concepts for land operations - Government regulations

SDAIA data governance and AI guidance impacting autonomy data handling and model lifecycle

controls

NCA ECC compliance requirements shaping cybersecurity baselines for connected defense

platforms

GAMI defense procurement governance and local content compliance influencing contracting and offsets - SWOT analysis

- Porters 5 forces

By Market Value,2020-2025

By Installed Units,2020-2025

By Average System Price,2020-2025

By System Complexity Tier,2020-2025

- By System Type (In Value%)

Combat UGVs with Remote Weapon Stations

ISR Reconnaissance UGVs

EOD and Route Clearance Robots

Logistics and Resupply UGVs

CBRN Reconnaissance UGVs - By Platform Type (In Value%)

Tracked UGV Platforms

Wheeled UGV Platforms

Hybrid Track Wheel Convertible Platforms

Micro and Manportable UGV Platforms

Heavy Payload Modular UGV Platforms - By Fitment Type (In Value%)

New Procurement for Program of Record Platforms

Mission Kit Retrofit for Existing Vehicles

Modular Payload Plug and Play Fitments

Government Furnished Equipment Integration

OEM Integrated UGV Solutions - By EndUser Segment (In Value%)

Land Forces and Mechanized Units

Border Guard and Frontier Surveillance Units

Special Operations Forces

Military Police and Base Security Units

Civil Defense and Critical Infrastructure Protection Units - By Procurement Channel (In Value%)

Direct MoD Acquisition and Program Contracts

Local Defense Prime and System Integrator Awards

Offset and Localization Driven Procurement

Foreign Military Sales and Government to Government

Competitive Tenders via Defense Procurement Portals

- Cross Comparison Parameters (Autonomy maturity level, Payload modularity, Endurance and range, C2 and network security compliance, Desert hardening and reliability, Local assembly and support capability)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Saudi Arabian Military Industries

Advanced Electronics Company

Intra Defense Technologies

NAMI

Al Esnad

QinetiQ

Milrem Robotics

Rheinmetall

General Dynamics Land Systems

BAE Systems

Leonardo

Elbit Systems

Israel Aerospace Industries

Aselsan

EDGE Group

- Border and frontier units prioritize endurance sensors and autonomous patrol behaviors for

persistent coverage - Mechanized brigades emphasize manned unmanned teaming and route reconnaissance ahead of convoys

- Special operations units focus on low signature manportable UGVs for ISR and EOD in confined areas

- Base security users favor networked perimeter robots with remote monitoring and rapid response

payloads

Future Size,2026-2035

Forecast Market Value,2026-2035

Forecast Installed Units,2026-2035

Price Forecast by System Tier,2026-2035

Future Demand by Platform,2026-2035